FXOTP 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive fxotp review evaluates FXOTP Ltd as an unregulated forex broker. It presents significant risks to potential investors. Based on available information and user feedback, FXOTP operates without proper regulatory oversight, which raises serious concerns about trader safety and fund security. The broker offers MT5 trading platform access and supports multiple asset classes including forex, indices, stocks, precious metals, and commodities. However, numerous red flags suggest this platform may not be suitable for most traders.

FXOTP targets investors seeking forex and multi-asset trading opportunities. The lack of regulatory protection and predominantly negative user reviews indicate substantial caution is warranted. According to regulatory information available, FXOTP does not hold valid forex trading licenses from recognized financial authorities. This positions it as a high-risk investment platform. The minimum deposit requirement of $300 may appear accessible, but the underlying risks significantly outweigh any potential benefits for retail traders.

Important Disclaimer

FXOTP is registered in Saint Lucia under relatively lenient regulatory frameworks. Users must understand the significant differences in investor protection compared to brokers regulated by major financial authorities like the FCA, CySEC, or ASIC. The regulatory environment in Saint Lucia provides minimal investor protection. Traders should be aware of the substantial risks involved.

This review is based on publicly available information, user feedback, and regulatory data available as of 2024. The assessment aims to provide potential investors with objective information to make informed decisions. Given the lack of comprehensive regulatory oversight and negative user experiences reported, this evaluation serves as a cautionary analysis rather than an endorsement.

Rating Framework

Broker Overview

FXOTP Ltd operates as an online investment platform specializing in forex trading services. Specific founding details remain unclear from available information. The company positions itself as a trading solutions provider in the competitive forex market, targeting individual traders seeking access to currency markets and other financial instruments. Despite marketing itself as a "trusted partner" in forex trading, the broker's operational transparency and regulatory compliance raise significant concerns among industry observers.

The broker's business model focuses on providing online trading services across multiple asset classes. It utilizes the popular MetaTrader 5 platform as its primary trading interface. FXOTP offers access to forex pairs, stock indices, individual stocks, precious metals, and commodity markets, appealing to traders seeking diversified investment opportunities. However, the lack of detailed information about the company's operational history, management team, and financial backing creates uncertainty about its long-term viability and commitment to client service.

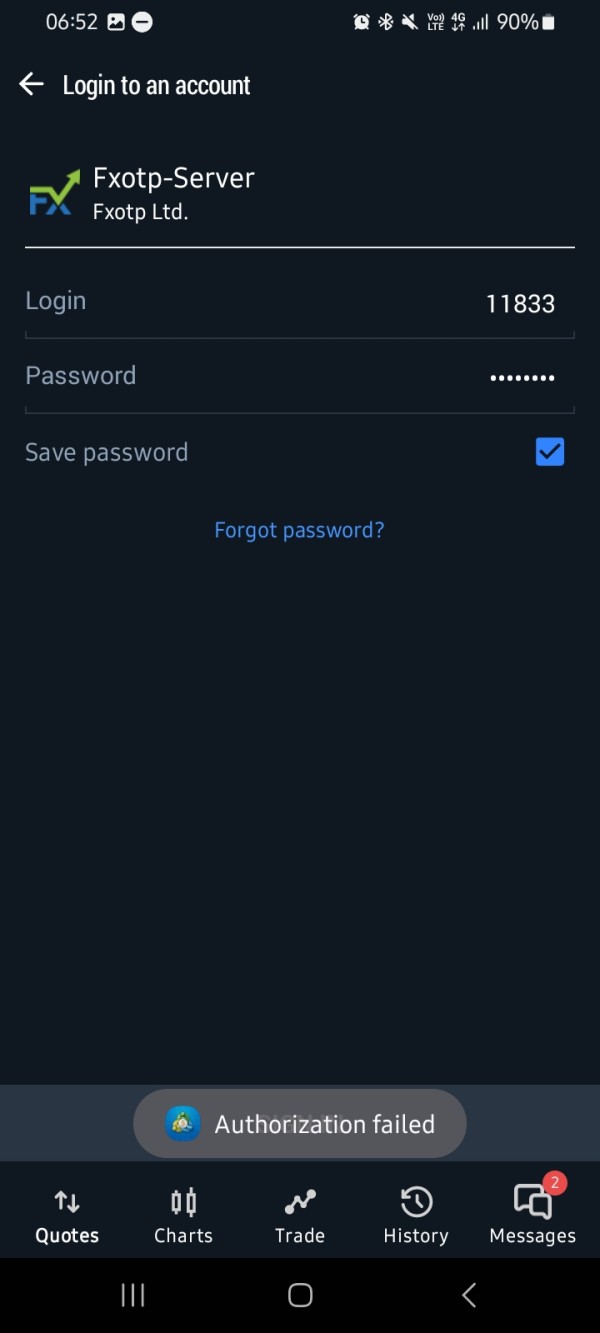

Regarding regulatory status, FXOTP is registered in Saint Lucia and claims oversight by the International Financial Centre. It critically lacks valid forex trading licenses from recognized regulatory authorities. This fxotp review emphasizes that the absence of proper regulatory authorization represents a fundamental risk factor that potential clients must carefully consider before engaging with this platform.

Regulatory Jurisdiction: FXOTP operates under Saint Lucia registration with claimed IFC oversight. It lacks valid forex trading licenses from established regulatory bodies, creating significant compliance concerns for potential traders.

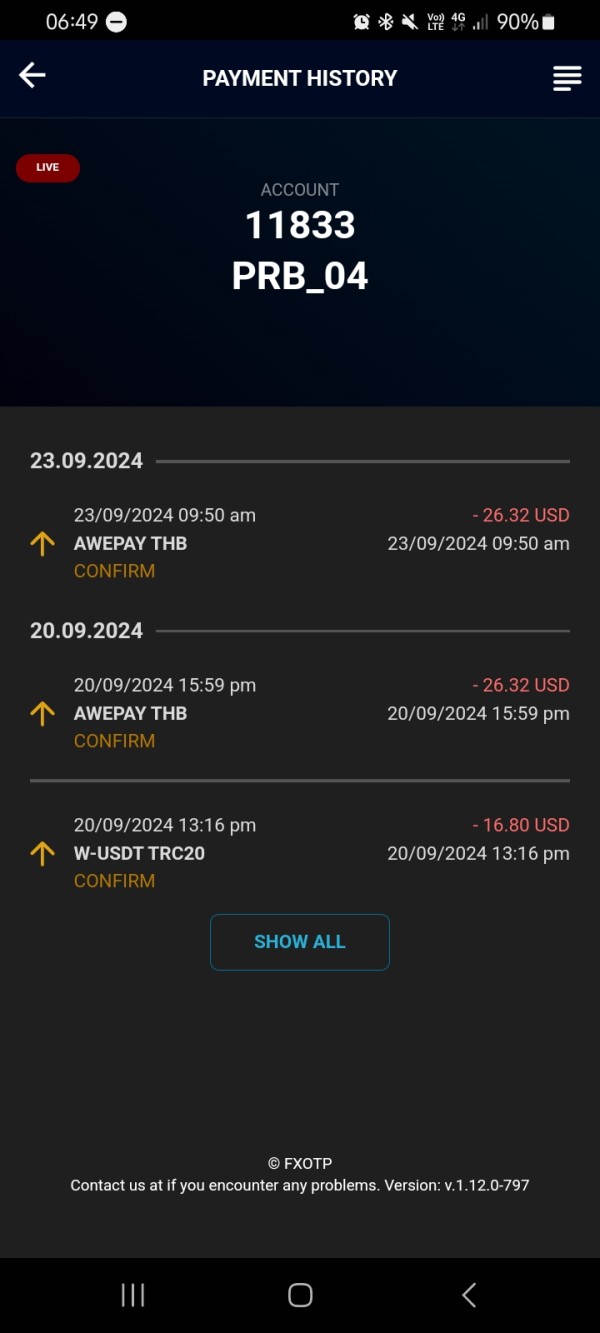

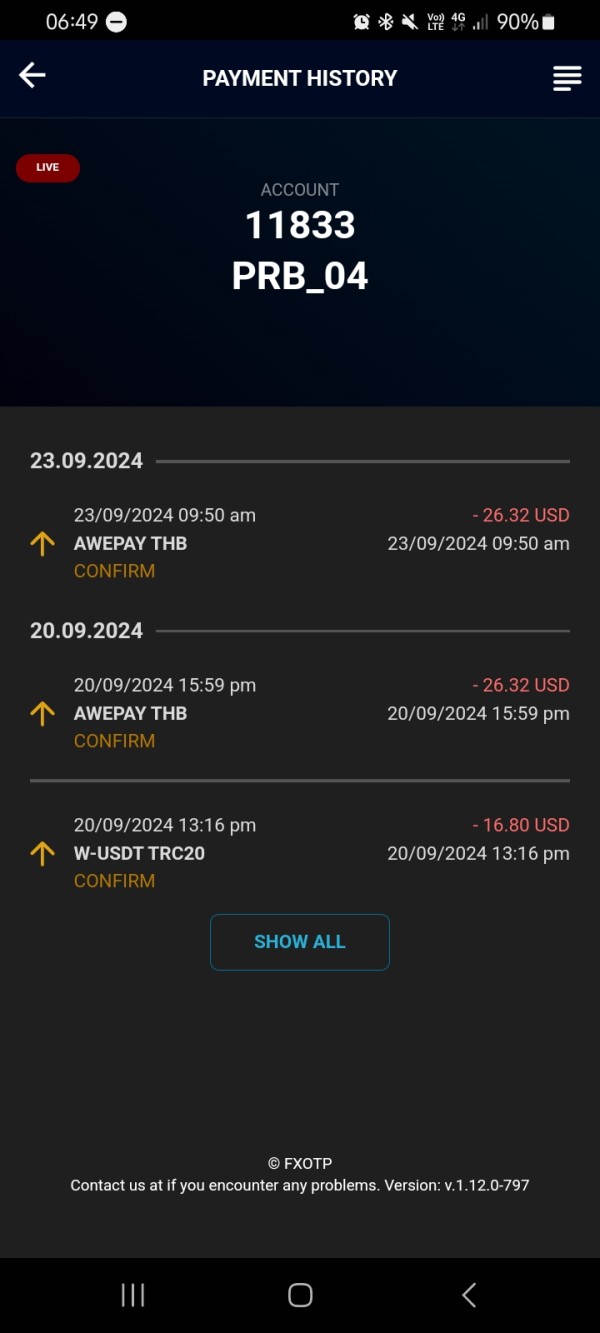

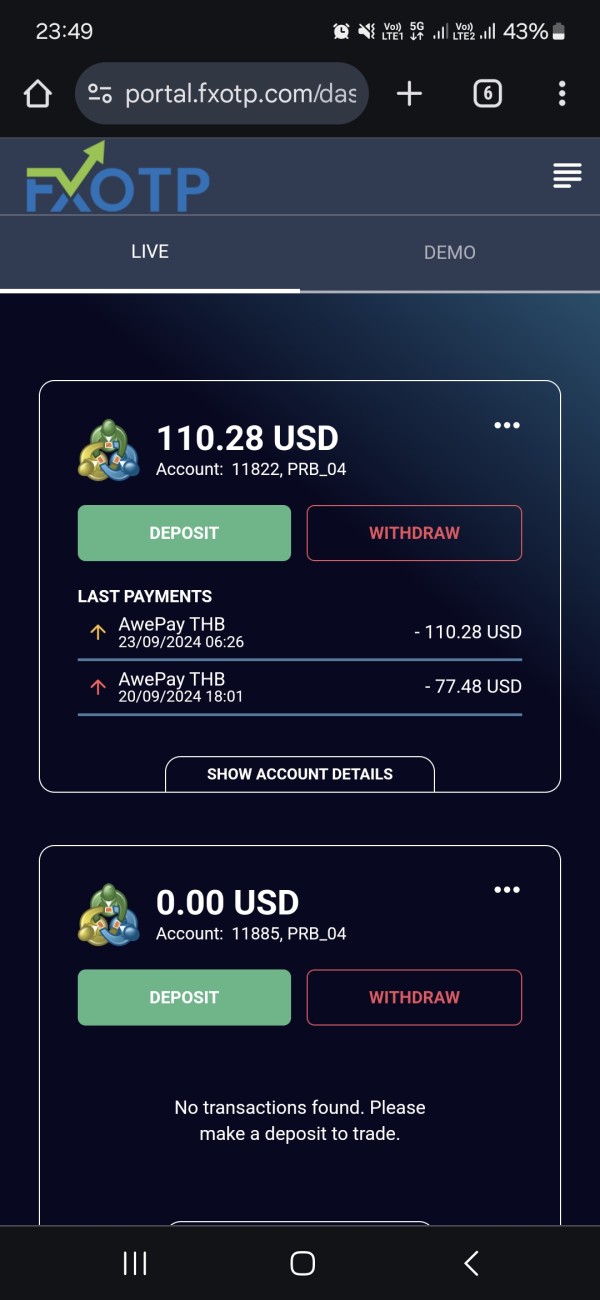

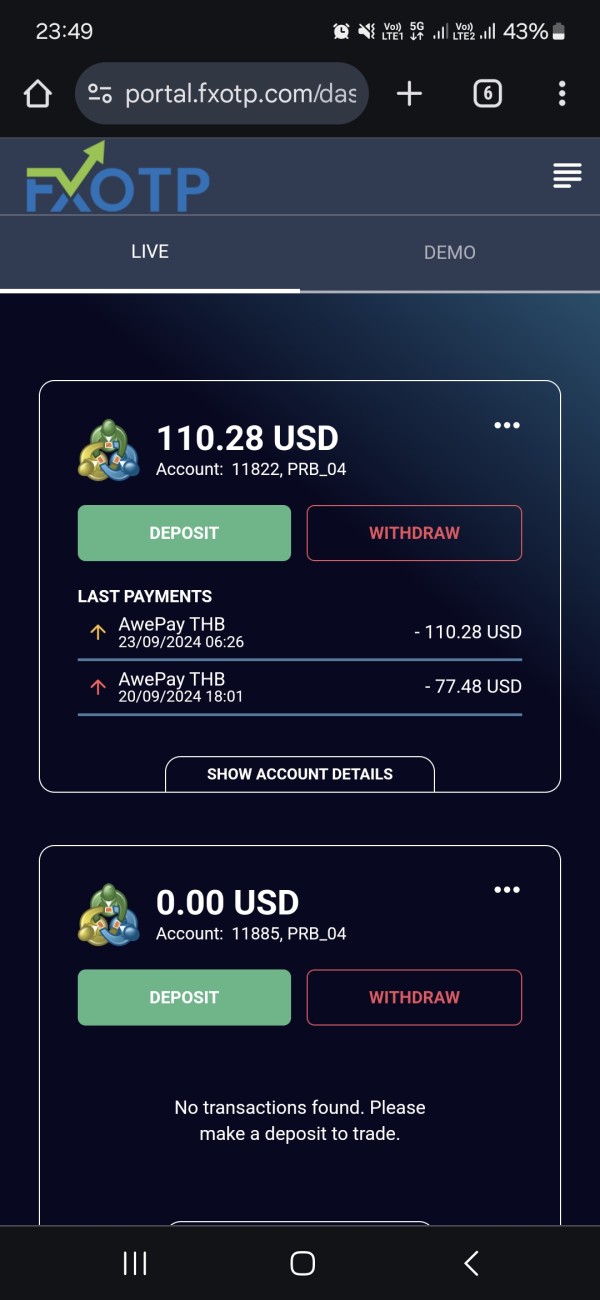

Deposit and Withdrawal Methods: Specific information regarding deposit and withdrawal options was not detailed in available materials. This represents a transparency gap that raises additional concerns about operational clarity.

Minimum Deposit Requirements: The platform requires a minimum deposit of $300. Some users consider this relatively high compared to regulated alternatives offering lower entry barriers.

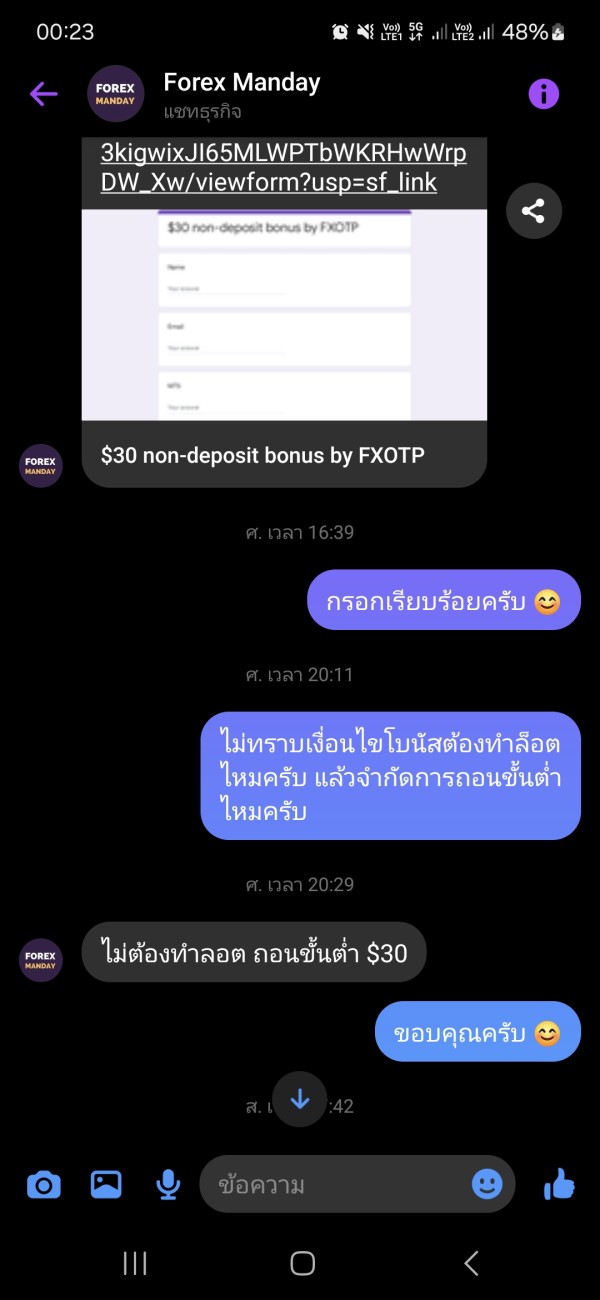

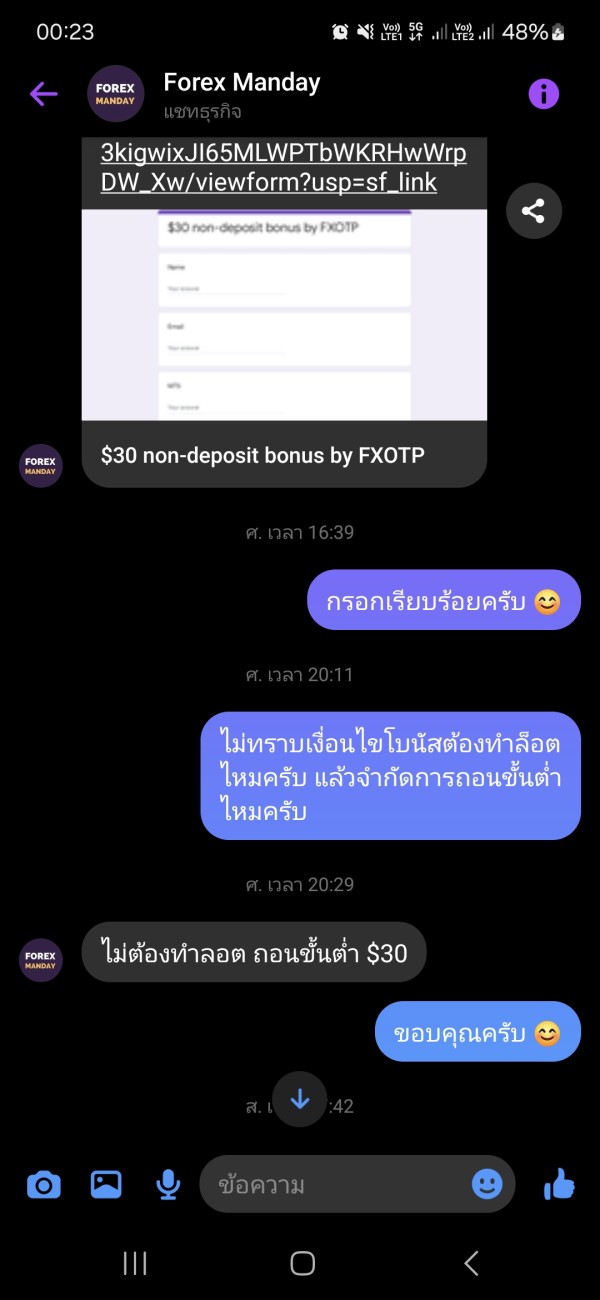

Bonus and Promotional Offers: Available information does not mention any bonus or promotional activities. This suggests either absence of such programs or lack of marketing transparency.

Tradeable Assets: FXOTP provides access to multiple asset categories including forex currency pairs, stock indices, individual equities, precious metals, and various commodity markets. It offers reasonable diversification options.

Cost Structure: Critical details regarding commission rates, spread levels, and leverage ratios remain unclear from available sources. This makes cost comparison with competitors impossible and raises transparency concerns.

Leverage Ratios: Specific leverage information was not provided in accessible materials. This represents another significant information gap for potential traders.

Platform Options: The broker offers MetaTrader 5 trading platform. It provides standard trading functionality and technical analysis tools familiar to most forex traders.

Geographic Restrictions: Information regarding regional trading restrictions was not specified in available documentation.

Customer Support Languages: Details about supported languages for customer service were not mentioned in accessible materials. This indicates potential communication limitations.

This fxotp review highlights that the numerous information gaps represent serious transparency issues. Regulated brokers typically address these comprehensively.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

FXOTP's account conditions present several concerning aspects that contributed to the poor rating in this category. The minimum deposit requirement of $300 is considered relatively high by industry standards. This is particularly true when compared to regulated brokers offering accounts with lower entry barriers. Available information does not specify different account types or tier structures, suggesting limited flexibility for traders with varying capital levels and experience.

The account opening process has received criticism from users who report complex and time-consuming procedures. They note these procedures lack clear justification for the additional requirements. Unlike regulated brokers that maintain streamlined verification processes while ensuring compliance, FXOTP appears to create unnecessary obstacles during registration without providing corresponding benefits or protections.

Special account features such as Islamic accounts, professional trader classifications, or institutional services were not mentioned in available materials. This lack of specialized offerings limits the broker's appeal to diverse trading communities. It suggests a basic service model that may not meet sophisticated trader requirements.

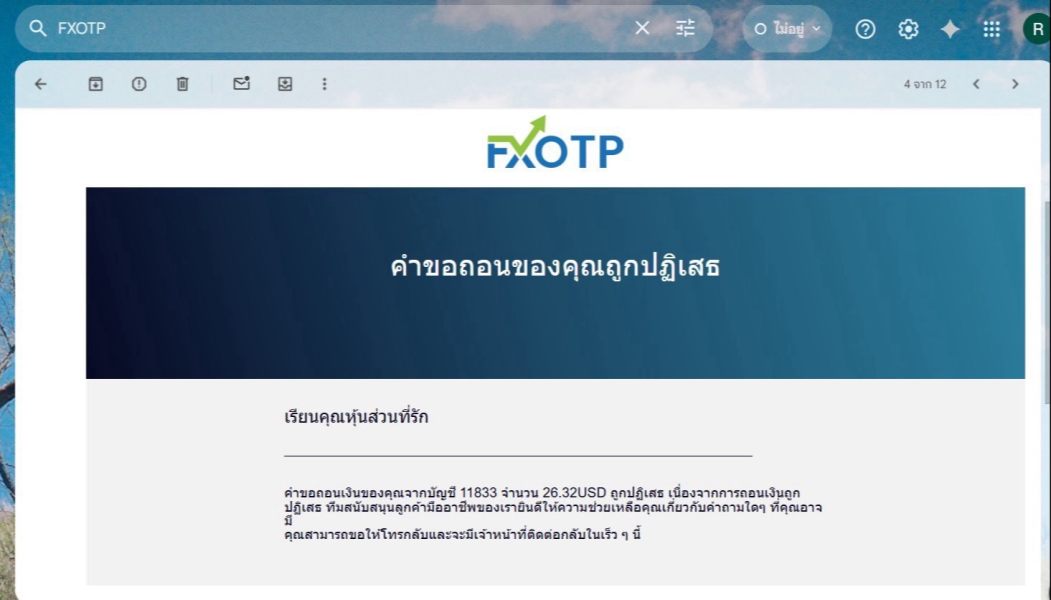

User feedback regarding account conditions has been predominantly negative. Complaints focus on unclear terms, unexpected restrictions, and poor communication during the account setup process. When compared to regulated alternatives offering transparent account structures and comprehensive client onboarding, FXOTP's approach appears inadequate and potentially problematic for serious traders seeking reliable trading partnerships.

This fxotp review emphasizes that account conditions represent a fundamental aspect of broker selection. FXOTP's performance in this area raises significant concerns about overall service quality.

FXOTP's tools and resources receive a moderate rating primarily due to the provision of the MetaTrader 5 platform. It offers standard trading functionality and technical analysis capabilities. MT5 provides essential charting tools, technical indicators, and automated trading support that most forex traders expect from modern trading platforms. However, the broker's overall resource offering appears limited compared to comprehensive alternatives.

Research and analysis resources were not detailed in available information. This suggests either absence of proprietary market analysis or poor communication about available research services. Professional traders typically require regular market commentary, economic calendar integration, and fundamental analysis support, which appear to be lacking or inadequately promoted by FXOTP.

Educational resources, including trading guides, webinars, and educational materials for new traders, were not mentioned in accessible documentation. This represents a significant gap for brokers targeting retail traders. These traders often require ongoing education and skill development support to succeed in forex markets.

Automated trading support through Expert Advisors and signal services was not specifically addressed. MT5 platform typically supports such functionality. However, without clear information about the broker's policies regarding automated trading and third-party signal integration, traders cannot assess the full scope of available tools.

User feedback regarding tools and resources has been limited. Most comments focus on platform stability rather than comprehensive resource evaluation. The moderate rating reflects the basic adequacy of MT5 provision while acknowledging significant gaps in comprehensive trader support services.

Customer Service Analysis (Score: 3/10)

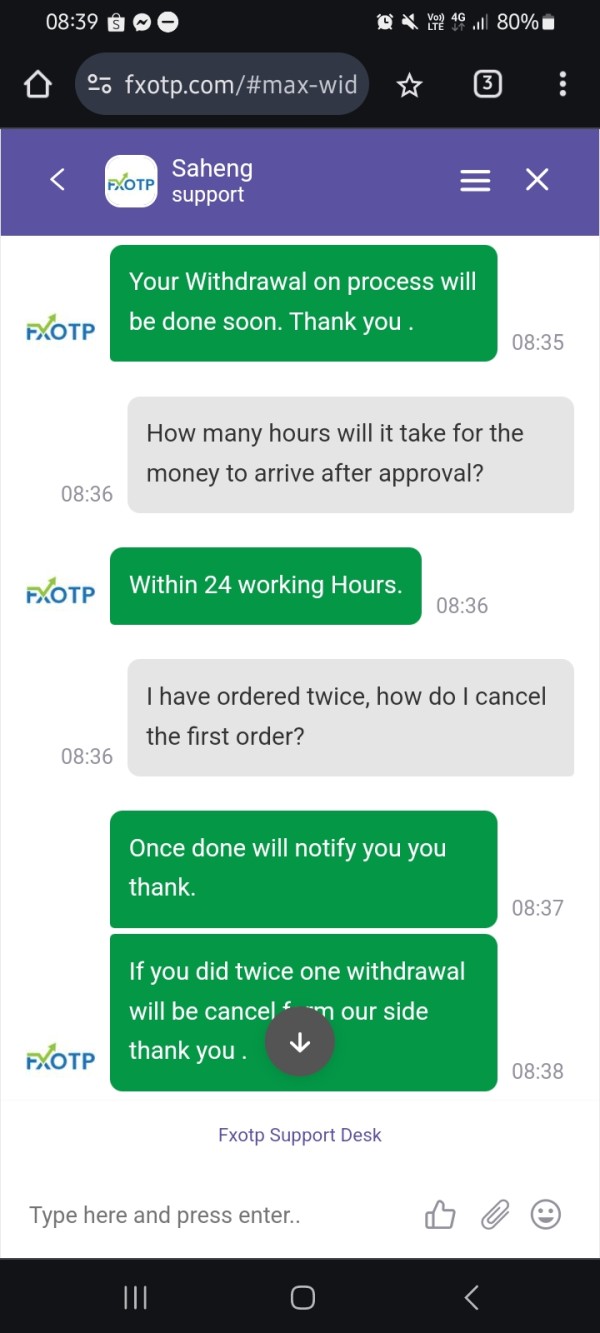

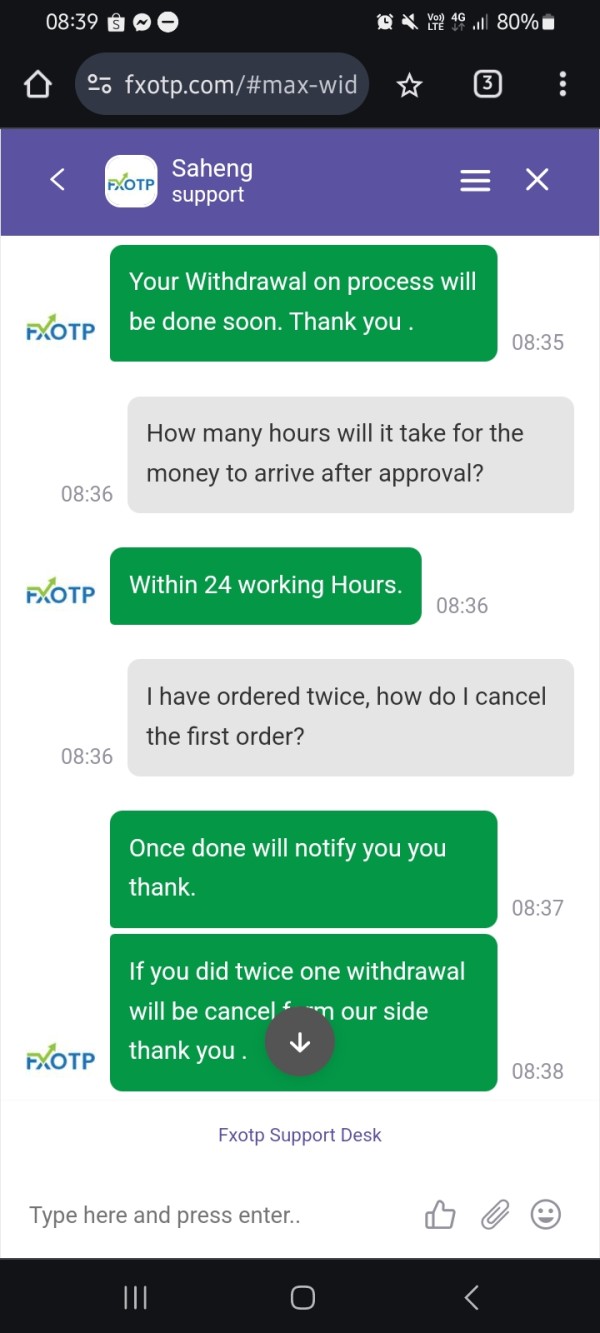

Customer service represents one of FXOTP's weakest areas. It earns a poor rating based on consistently negative user feedback and apparent service limitations. Available information does not specify customer support channels, operating hours, or response time commitments, creating uncertainty about support accessibility when traders need assistance.

User reports consistently highlight slow response times and inadequate problem resolution. Many clients express frustration about unresolved inquiries and poor communication quality. Professional trading requires reliable customer support, particularly during market volatility or technical issues, and FXOTP appears to fall short of industry standards in this critical area.

Service quality assessments from user feedback indicate widespread dissatisfaction with support effectiveness, knowledge levels, and problem-solving capabilities. Many users report feeling abandoned when encountering issues. Some describe customer service interactions as unhelpful or dismissive of legitimate concerns.

Multi-language support capabilities were not specified in available materials. This potentially limits service accessibility for international traders who require assistance in their native languages. Major regulated brokers typically provide comprehensive language support to serve global client bases effectively.

Customer service hours and availability were not clearly communicated. This raises questions about support accessibility during different market sessions and time zones. The poor rating reflects the combination of negative user experiences and lack of transparent service commitments that professional traders require.

Trading Experience Analysis (Score: 5/10)

FXOTP's trading experience receives a below-average rating due to mixed feedback and limited transparency about execution quality. While the MetaTrader 5 platform provides familiar functionality for experienced traders, concerns about overall trading conditions and execution reliability prevent a higher assessment.

Platform stability appears adequate based on limited user feedback. There are no widespread reports of system crashes or major technical failures. However, the absence of comprehensive performance data and limited user testimonials make it difficult to assess platform reliability during high-volatility periods or peak trading hours.

Order execution quality remains unclear due to lack of specific information about slippage rates, requote frequency, and execution speed metrics. Professional traders require transparent execution statistics to evaluate broker performance. FXOTP's failure to provide such data raises concerns about execution quality and transparency.

Platform functionality appears complete through MT5 integration. It offers standard charting, technical analysis, and order management capabilities. However, without detailed information about additional features, customization options, or platform enhancements, the trading environment appears basic compared to comprehensive alternatives.

Mobile trading experience was not specifically addressed in available materials. This represents a significant gap given the importance of mobile access for modern traders. The below-average rating reflects adequate basic functionality combined with transparency concerns and limited performance validation.

This fxotp review notes that trading experience encompasses multiple factors beyond platform provision. FXOTP's limited transparency in this area raises important questions about overall service quality.

Trust and Reliability Analysis (Score: 2/10)

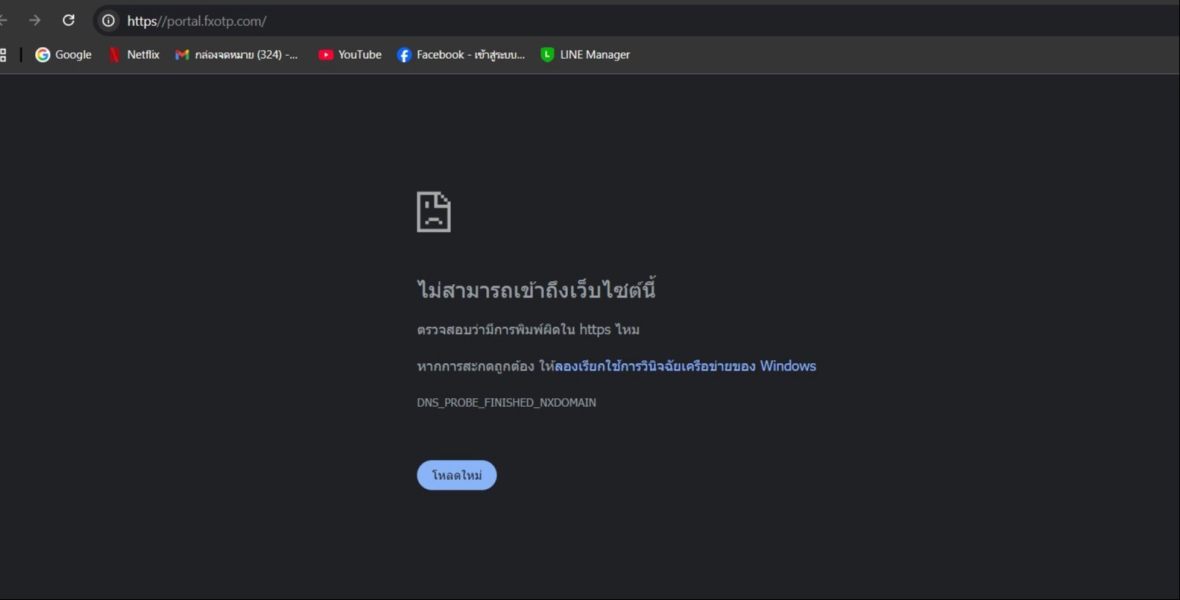

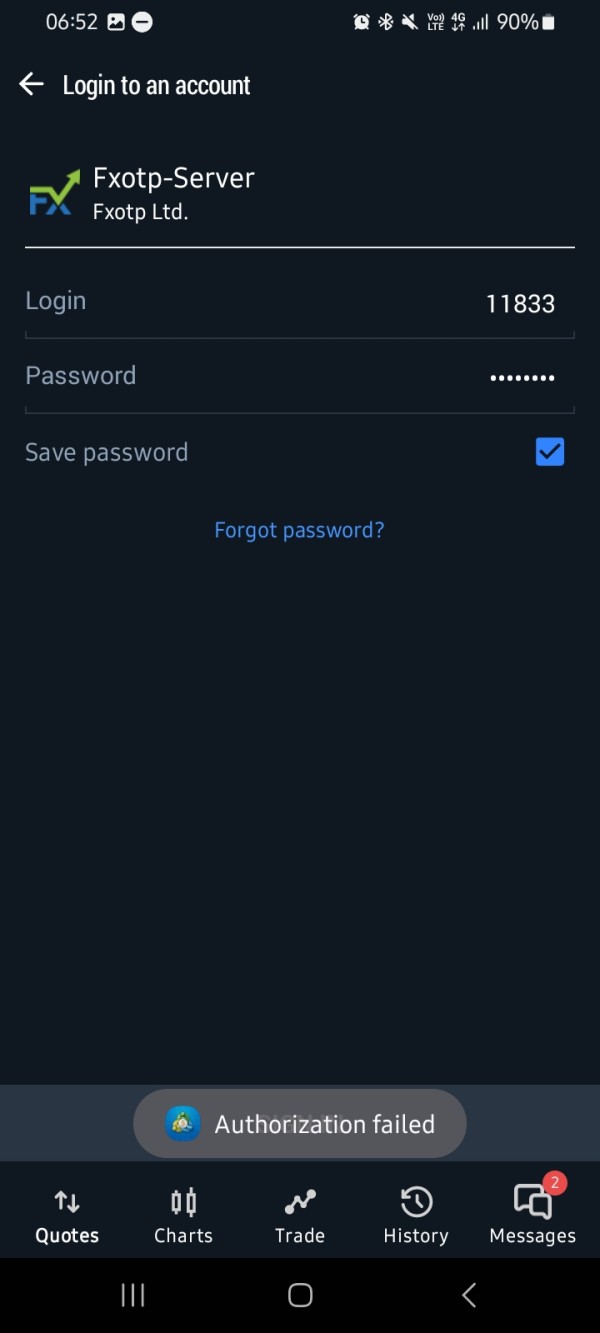

Trust and reliability represent FXOTP's most concerning weakness. It earns a very poor rating due to fundamental regulatory and transparency issues. The broker's registration in Saint Lucia with claimed IFC oversight does not constitute proper forex trading regulation, leaving clients without meaningful investor protection or regulatory recourse.

The absence of valid forex trading licenses from recognized regulatory authorities such as the FCA, CySEC, ASIC, or other major financial regulators represents a critical trust deficit. Regulated brokers must maintain segregated client funds, submit to regular audits, and provide compensation schemes. These protections appear unavailable through FXOTP.

Fund safety measures were not detailed in available information. This creates uncertainty about client money protection, segregation practices, and institutional safeguards. Professional traders require clear understanding of how their funds are protected, and FXOTP's lack of transparency in this area raises serious concerns about financial security.

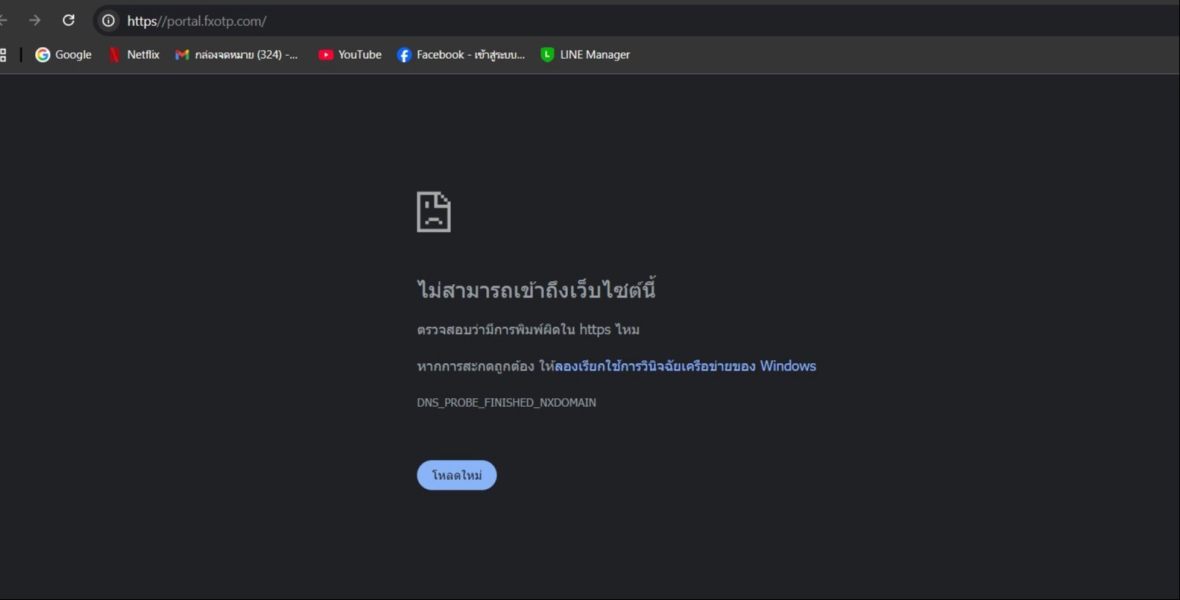

Company transparency receives poor assessment due to limited information about management, financial backing, operational history, and business practices. Unlike regulated brokers that must disclose comprehensive company information, FXOTP maintains opacity that prevents proper due diligence by potential clients.

Industry reputation appears problematic based on available user feedback and warning notices from trading communities. The very poor rating reflects the combination of regulatory deficiencies, transparency gaps, and negative community sentiment that collectively undermine broker trustworthiness.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with FXOTP appears consistently low based on available feedback and review patterns. Users report various frustrations with service quality, communication, and overall platform experience. These contribute to poor satisfaction ratings across multiple evaluation criteria.

Interface design and platform usability receive limited specific feedback. MT5 integration suggests adequate basic functionality. However, user comments focus more on service issues and reliability concerns rather than positive interface experiences, indicating that platform design alone cannot compensate for broader service deficiencies.

Registration and verification processes have received particular criticism from users who describe unnecessarily complex and time-consuming procedures. These lack clear justification. Professional brokers typically maintain efficient onboarding while ensuring compliance, but FXOTP appears to create obstacles without corresponding benefits or protection.

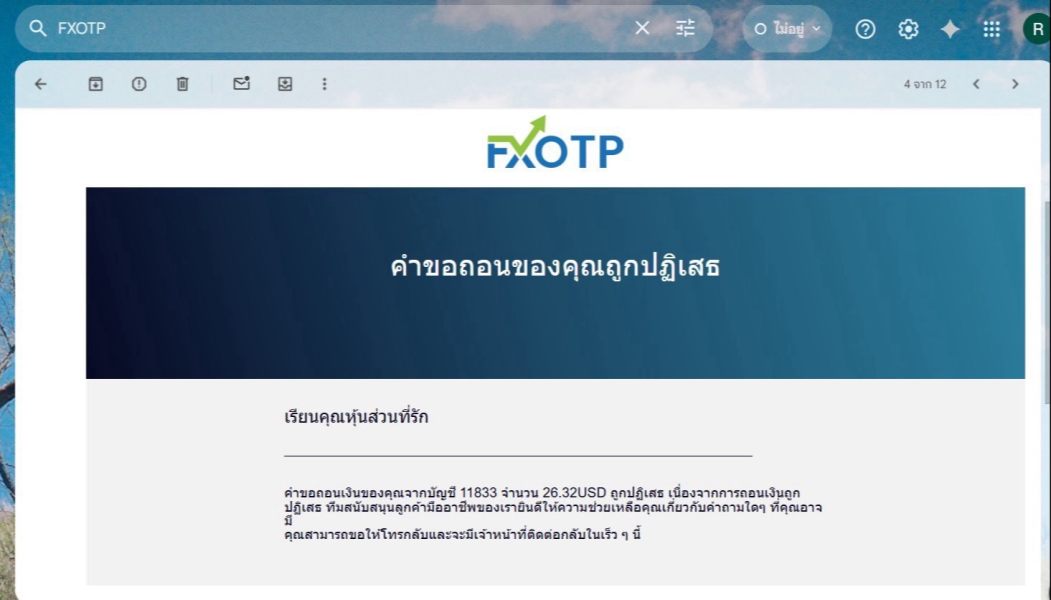

Fund operation experiences were not specifically detailed in available user feedback. General negative sentiment suggests potential issues with deposit and withdrawal processes. Reliable fund operations represent a fundamental requirement for trading platforms, and any concerns in this area significantly impact user experience.

Common user complaints center on customer service quality, transparency issues, and general reliability concerns. The pattern of negative feedback across multiple service areas suggests systematic issues rather than isolated problems. This contributes to the poor user experience rating.

The analysis indicates that FXOTP may be suitable only for highly risk-tolerant traders willing to accept significant uncertainties. Such users would likely be better served by regulated alternatives offering similar services with proper oversight and protection.

Conclusion

This comprehensive fxotp review concludes that FXOTP Ltd presents significant risks that outweigh any potential benefits for most traders. As an unregulated broker lacking proper forex trading licenses, FXOTP fails to meet basic safety and reliability standards expected in the modern forex industry. The combination of regulatory deficiencies, transparency gaps, and consistently negative user feedback creates a risk profile unsuitable for serious traders.

While the broker offers MetaTrader 5 platform access and multi-asset trading opportunities, these basic features cannot compensate for fundamental trust and reliability concerns. Experienced traders seeking such services would be better served by regulated alternatives providing similar offerings with proper investor protection and regulatory oversight.

The broker's poor performance across most evaluation criteria, particularly in trust, customer service, and user experience, suggests systematic operational issues rather than isolated problems. New traders should definitely avoid FXOTP due to the lack of educational resources and regulatory protection. Experienced traders should consider the substantial risks involved in dealing with an unregulated entity. The overall assessment recommends seeking regulated alternatives that provide similar services with proper oversight and investor protection.