COSS 2025 Review: Everything You Need to Know

Executive Summary

COSS stands for Crypto One Stop Solution. It is an ambitious cryptocurrency exchange platform that positions itself as a comprehensive trading solution for digital asset enthusiasts. According to available user feedback data, COSS has achieved an 85/100 user rating, indicating generally positive reception among its user base. However, this coss review reveals that the platform faces significant challenges in transparency, particularly regarding regulatory compliance and detailed trading conditions.

The platform primarily targets small to medium-sized businesses. It offers a combination of cryptocurrency trading alongside various financial instruments. While COSS presents itself as a one-stop solution for crypto-related needs, the lack of comprehensive regulatory information and limited transparency in trading terms raises questions about its overall reliability. The platform's pricing evaluation scores only 5/10. This suggests potential concerns with cost competitiveness in the current market landscape.

For traders seeking a crypto-focused platform with integrated business solutions, COSS offers an interesting proposition. However, users should approach with caution given the limited regulatory disclosure and operational transparency currently available.

Important Disclaimers

Regional Entity Differences: COSS has not provided specific regulatory information across different jurisdictions. Users engaging in cross-border trading activities should independently research and understand applicable local laws and regulations before using the platform. The platform's compliance status may vary significantly across different regions.

Review Methodology: This evaluation is based on available user feedback data and publicly accessible information. The assessment does not cover all possible trading conditions, fees, or operational aspects that may affect individual trading experiences. Specific trading terms and conditions were not detailed in available sources. This limits the comprehensiveness of this analysis.

Rating Framework

Broker Overview

Company Background and Establishment

COSS was established in August 2017. It is a cryptocurrency exchange platform designed to provide comprehensive digital asset trading solutions. The platform's name stands for "Crypto One Stop Solution," which reflects its ambitious goal of creating an integrated ecosystem that addresses all cryptocurrency trading needs within a single platform environment. According to available information, COSS has positioned itself as more than just a traditional exchange. It aims to combine trading functionality with broader financial service offerings.

The platform has specifically focused its services toward small and medium-sized businesses. This recognizes this segment's growing need for accessible cryptocurrency trading solutions. This business model approach distinguishes COSS from many consumer-focused exchanges, though it also means the platform may not be optimally designed for individual retail traders seeking straightforward trading experiences.

Platform Structure and Asset Integration

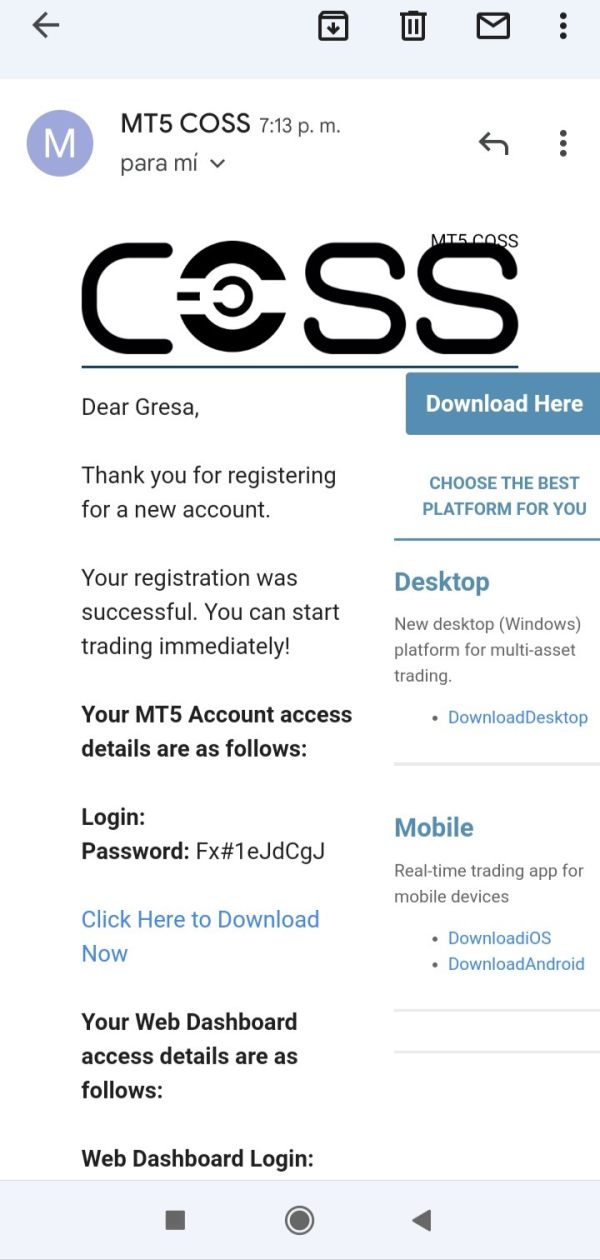

COSS operates as a comprehensive trading platform. It combines cryptocurrency trading with multiple financial instruments, though specific details about the range of available assets remain limited in publicly available information. The platform architecture supports desktop, mobile, and cloud-based access. This provides flexibility for users across different devices and operating environments. This coss review notes that while the platform promises comprehensive services, the actual scope of available trading instruments and financial products requires further clarification from official sources.

The exchange's approach to integrating various financial tools suggests an attempt to create a more holistic trading environment. However, the effectiveness of this integration and the quality of individual components remain areas where more detailed information would benefit potential users.

Regulatory Framework: Available sources do not provide specific information regarding COSS's regulatory status or oversight by financial authorities. This lack of regulatory transparency represents a significant concern for traders prioritizing compliance and legal protection.

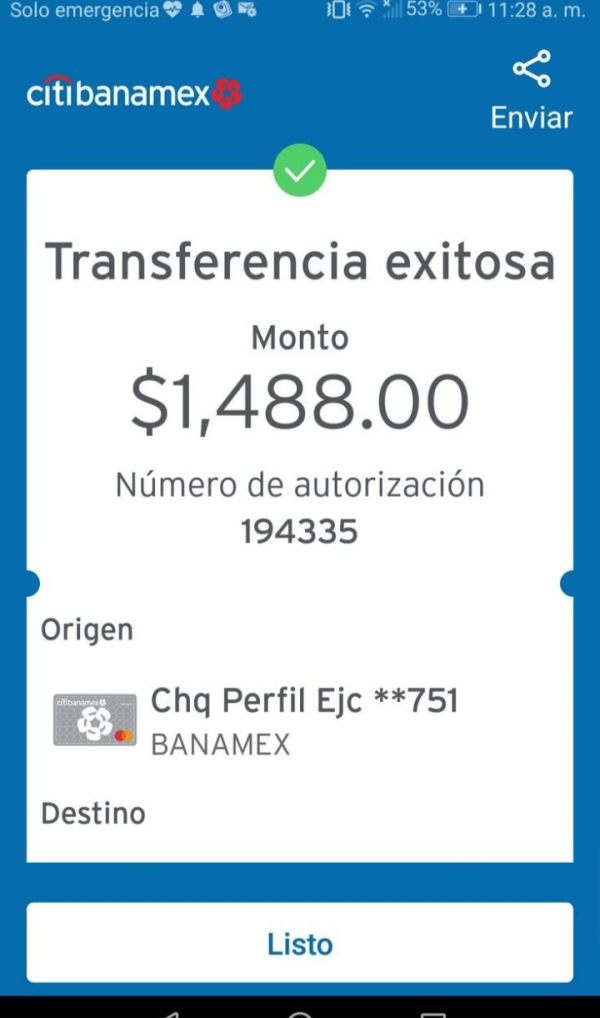

Deposit and Withdrawal Methods: Specific information about supported deposit and withdrawal methods is not detailed in available sources. Users should contact the platform directly for current payment processing options.

Minimum Deposit Requirements: Minimum deposit thresholds are not specified in available documentation. This requires direct inquiry with the platform for current account opening requirements.

Promotional Offers: Information regarding bonus structures or promotional campaigns is not available in current source materials.

Available Trading Assets: The platform indicates support for cryptocurrency trading combined with multiple financial instruments. However, specific asset listings and trading pairs are not detailed in available sources.

Cost Structure: Comprehensive fee schedules are not specified in available documentation. This includes trading commissions, spreads, and additional charges. This represents a significant transparency gap for potential users.

Leverage Options: Leverage ratios and margin trading capabilities are not detailed in current source materials.

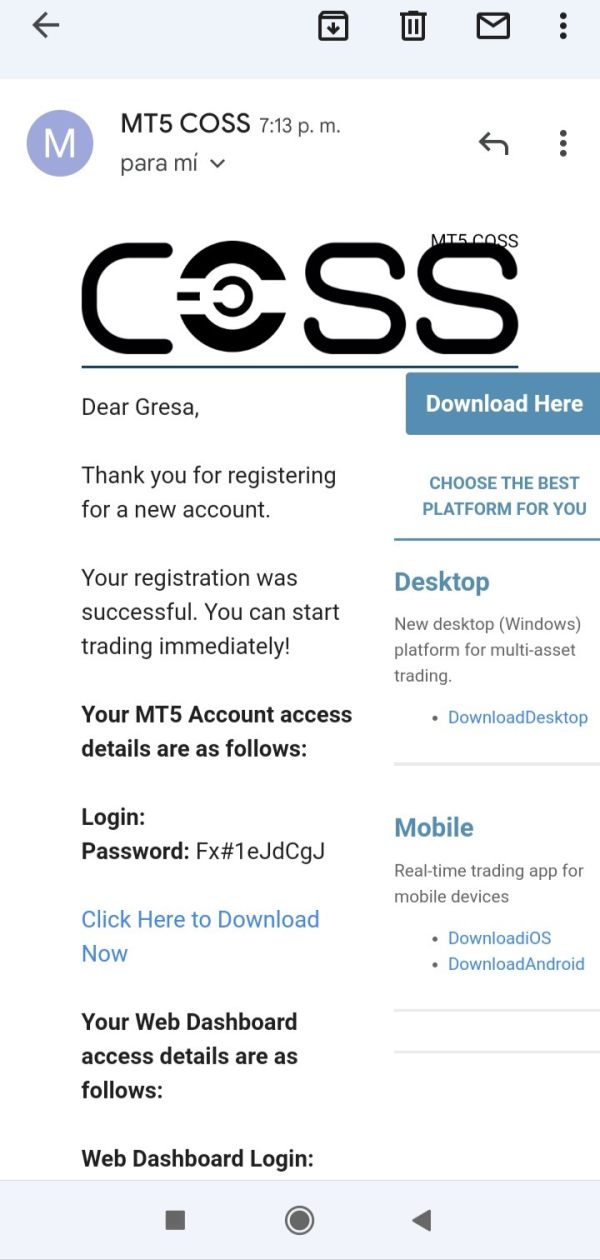

Platform Access: COSS supports multiple access methods. These include desktop applications, mobile platforms, and cloud-based trading interfaces. This provides flexibility across different user preferences and technical requirements.

Geographic Restrictions: Specific regional limitations or prohibited jurisdictions are not outlined in available sources.

Customer Support Languages: Language support options for customer service are not specified in current documentation. However, the platform appears to operate with English as a primary language.

This coss review emphasizes that the limited availability of detailed operational information represents a significant transparency challenge. Potential users should carefully consider this.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of COSS account conditions faces significant limitations. This is due to insufficient publicly available information. Standard account features such as account type varieties, specific minimum deposit requirements, and account opening procedures are not detailed in current source materials. This lack of transparency makes it challenging for potential users to understand what to expect when establishing an account with the platform.

Account opening processes and verification requirements remain unspecified. This is particularly concerning for a cryptocurrency platform where regulatory compliance and identity verification are typically crucial components. The absence of information about special account features, such as institutional accounts or specific business account types despite the platform's SMB focus, represents a notable gap in available documentation.

Without detailed account condition information, users cannot effectively compare COSS offerings against industry standards or competitor platforms. This coss review emphasizes that the platform would benefit significantly from providing comprehensive account documentation. This would build user confidence and enable informed decision-making.

The lack of account-related user feedback or testimonials in available sources further complicates the assessment. This affects the evaluation of account condition quality and user satisfaction with account management features.

Information regarding COSS trading tools and analytical resources is notably absent from available source materials. Standard trading platform features such as charting capabilities, technical analysis tools, market research resources, and educational materials are not documented in accessible information sources.

The platform's positioning as a comprehensive solution suggests the presence of various trading tools. However, without specific details about tool quality, functionality, or user interface design, it's impossible to assess whether COSS meets industry standards for trading resource provision. Advanced features such as automated trading support, API access, or algorithmic trading capabilities remain unspecified.

Educational resources are particularly important for the SMB market that COSS targets. However, these are not detailed in available documentation. This represents a significant oversight given that business clients often require comprehensive educational support to effectively utilize cryptocurrency trading platforms.

Research and analysis resources are not described in current source materials. This includes market data feeds, news integration, and analytical reports. Without these details, potential users cannot evaluate whether COSS provides adequate information resources to support informed trading decisions.

Customer Service and Support Analysis

Customer service information for COSS is not detailed in available source materials. This creates uncertainty about support quality and availability. Standard support metrics such as response times, available communication channels, and service quality indicators are not documented in accessible sources.

The absence of information about customer support hours, multilingual support capabilities, and problem resolution procedures represents a significant concern for potential users. This is particularly true for business clients who may require reliable support for operational continuity. Without documented support structures, users cannot assess whether COSS provides adequate assistance for technical issues, account problems, or trading-related queries.

User feedback regarding customer service experiences is not available in current source materials. This prevents assessment of actual support quality from user perspectives. This lack of service-related testimonials or reviews makes it impossible to evaluate whether COSS meets user expectations for customer support.

The platform's focus on SMB clients suggests a need for robust business-oriented support services. However, without detailed information about specialized business support offerings, potential commercial users cannot evaluate whether COSS provides appropriate service levels for their operational requirements.

Trading Experience Analysis

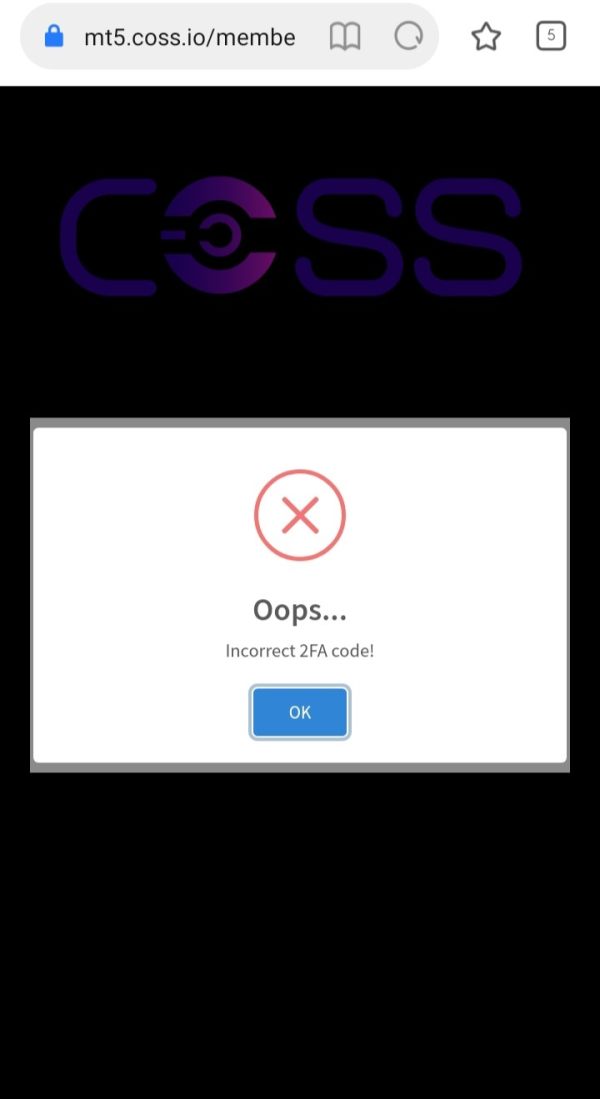

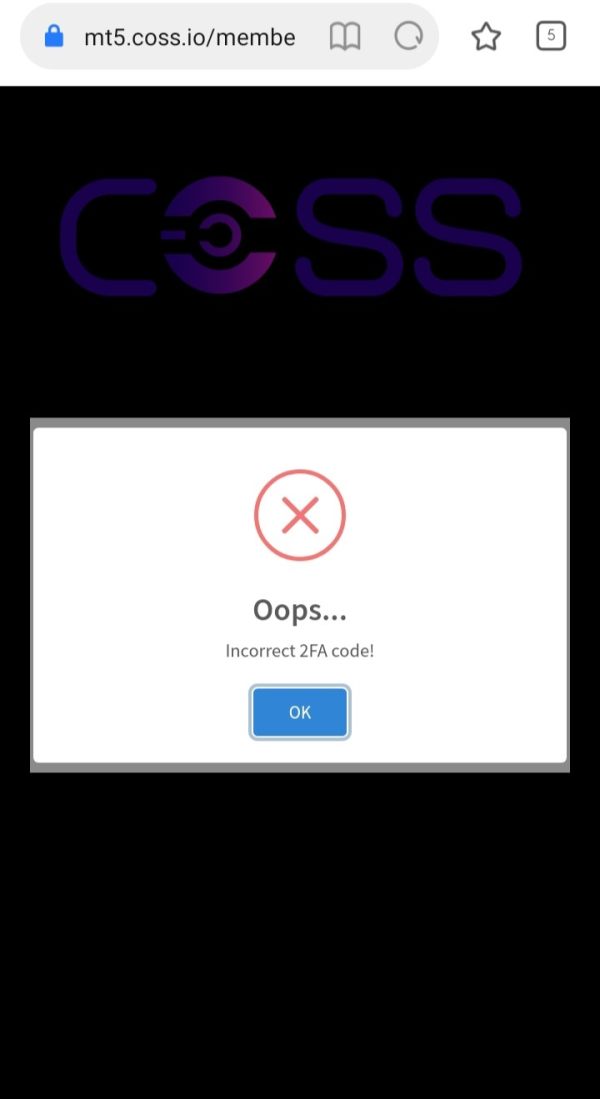

Specific information about COSS trading experience quality is not available in current source materials. Critical trading metrics such as platform stability, execution speed, order processing quality, and overall trading environment performance are not documented in accessible sources.

Platform functionality details remain unspecified. This includes order types, execution methods, and trading interface design. This lack of information makes it impossible to assess whether COSS provides a competitive trading experience compared to established cryptocurrency exchanges.

Mobile trading experience quality is not detailed in available documentation despite the platform's stated mobile support. Given the importance of mobile trading for modern cryptocurrency platforms, this represents a significant information gap for potential users who prioritize mobile trading capabilities.

Technical performance data are not provided in current source materials. This includes uptime statistics, latency measurements, and system reliability metrics. This coss review notes that without these fundamental performance indicators, users cannot evaluate whether COSS provides a reliable trading environment suitable for active trading strategies.

Trust and Regulation Analysis

Trust and regulatory compliance represent the most significant concerns identified in this evaluation. COSS has not provided specific regulatory information, licensing details, or oversight authority documentation in available sources. This lack of regulatory transparency creates substantial uncertainty about the platform's legal compliance status and user protection measures.

Fund security measures are not detailed in accessible documentation. This includes segregation policies, insurance coverage, and asset protection protocols. For a cryptocurrency platform handling user funds, this absence of security information represents a critical transparency gap that potential users should carefully consider.

Company transparency regarding operational structure, management team, financial backing, and business model details is limited in available sources. This lack of corporate transparency makes it difficult for users to assess the platform's stability and long-term viability.

Industry reputation and third-party evaluations are not extensively documented in current source materials. However, the 85/100 user rating suggests some level of user satisfaction. Without broader industry recognition or professional assessments, the platform's overall reputation remains difficult to evaluate comprehensively.

User Experience Analysis

User experience evaluation for COSS is limited by the scarcity of detailed user feedback and interface information in available sources. While the platform has achieved an 85/100 user rating, specific aspects of user satisfaction, interface design quality, and overall usability are not detailed in accessible documentation.

Registration and verification processes are not described in current source materials. This prevents assessment of user onboarding experience quality. For a platform targeting business clients, streamlined account setup procedures are typically crucial, but COSS has not provided detailed information about these processes.

Fund management experience remains unspecified in available sources. This includes deposit and withdrawal procedures, processing times, and user interface design for financial operations. This represents a significant information gap for users who prioritize efficient fund management capabilities.

Common user complaints or satisfaction areas are not documented in accessible sources. This makes it impossible to identify typical user experience strengths or weaknesses. Without detailed user feedback analysis, potential users cannot understand what to expect from actual platform usage or identify potential operational challenges they might encounter.

Conclusion

COSS presents an intriguing proposition as a cryptocurrency platform targeting small and medium-sized businesses with its comprehensive trading solution approach. The platform's 85/100 user rating suggests that existing users have generally positive experiences. This indicates that the platform delivers functional trading services to its current user base.

However, this coss review identifies significant transparency concerns that potential users should carefully consider. The lack of detailed regulatory information, unclear trading conditions, and limited operational documentation create substantial uncertainty about the platform's compliance status and operational standards. For traders prioritizing regulatory compliance and transparent operational practices, these limitations represent serious considerations.

COSS appears most suitable for users specifically interested in cryptocurrency trading who are comfortable with platforms that have limited regulatory disclosure. The platform's business focus may appeal to SMB clients seeking integrated cryptocurrency solutions. However, the lack of detailed service information makes it difficult to assess whether COSS truly meets business-grade requirements for reliability and compliance.