Is FXOTP safe?

Business

License

Is FXOTP Safe or Scam?

Introduction

FXOTP is an online trading platform that claims to provide access to various financial markets, including forex and cryptocurrencies. With promises of high returns and a user-friendly interface, FXOTP positions itself as a viable option for traders of all experience levels. However, the forex market is rife with scams and unreliable brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article investigates the legitimacy of FXOTP, examining its regulatory status, company background, trading conditions, customer safety, user experiences, and overall risk factors. The investigation is based on a comprehensive analysis of various online sources, user testimonials, and expert reviews.

Regulatory Status and Legitimacy

Understanding the regulatory framework surrounding a trading platform is crucial for assessing its safety. A regulated broker is subject to oversight by financial authorities, which helps ensure compliance with industry standards and protects investor funds. In the case of FXOTP, there is a notable absence of regulation from recognized financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight raises significant red flags. FXOTP does not provide any verifiable licensing information, and it operates outside the jurisdiction of major regulatory bodies such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). This absence of regulation often correlates with increased risks for traders, as unregulated brokers can engage in questionable practices without accountability. The quality of regulation is paramount; it not only protects investor funds but also ensures that brokers adhere to ethical business practices. Without a regulatory body overseeing its operations, FXOTP poses a considerable risk to potential investors.

Company Background Investigation

FXOTP claims to be a global trading platform with a registered address in Saint Lucia. However, the details surrounding its ownership and management remain opaque. The company does not provide sufficient information regarding its history, development, or the backgrounds of its management team.

The absence of transparency in a trading platform's operations is concerning. Legitimate brokers typically disclose their ownership structure, management experience, and regulatory affiliations. In FXOTP's case, the lack of such information raises questions about its credibility and trustworthiness. Potential investors should be wary of platforms that do not provide clear details about their operations, as this can be a tactic used by fraudulent brokers to evade accountability.

Trading Conditions Analysis

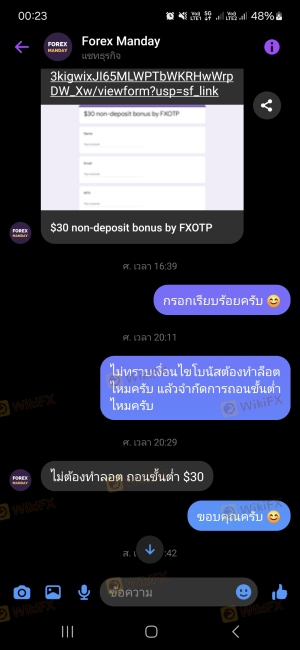

Understanding the trading conditions offered by FXOTP is critical for evaluating its overall value proposition. The platform advertises competitive trading fees, but user reviews suggest otherwise. Traders have reported issues with withdrawal processes and unexpected fees, which can significantly affect profitability.

| Fee Type | FXOTP | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Varies | Varies |

| Overnight Interest Range | High | Moderate |

The fees associated with FXOTP appear to be higher than industry averages, particularly regarding spreads. Additionally, the commission structure remains unclear, with reports of hidden fees that can erode trading profits. Such discrepancies between advertised and actual trading costs are often indicative of unreliable brokers. It is crucial for traders to understand the fee structure before opening an account, as unexpected costs can lead to significant financial losses.

Customer Funds Safety

The safety of customer funds is a primary concern when evaluating any trading platform. FXOTP's approach to fund security is questionable, as it lacks proper measures to protect investor assets. The absence of fund segregation, investor protection schemes, and negative balance protection policies raises alarms about the safety of client funds.

Traders should always prioritize platforms that implement stringent safety measures to safeguard their investments. Without these protections, investors are left vulnerable to potential fraud and mismanagement of their funds. Historical issues related to fund security can also be a warning sign; if a broker has faced allegations of mishandling client funds, it is prudent to exercise caution.

Customer Experience and Complaints

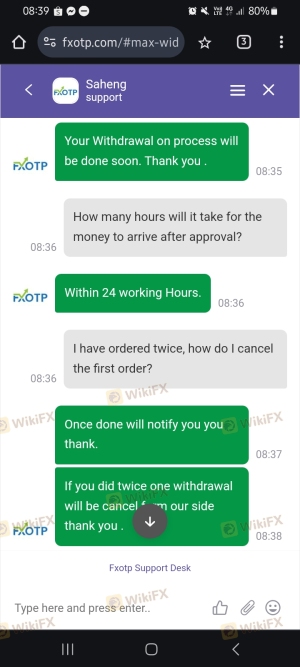

User experiences with FXOTP have been overwhelmingly negative. Many clients report difficulties with withdrawals, lack of responsive customer support, and high-pressure sales tactics aimed at encouraging additional deposits.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Non-responsive |

| Misleading Promises | High | No resolution |

Common complaints include delayed or denied withdrawal requests, which are often associated with fraudulent practices. The company's response to these issues has been largely inadequate, leaving customers frustrated and without recourse. Such patterns of behavior are characteristic of unreliable brokers and should raise concerns for potential investors.

Platform and Execution Quality

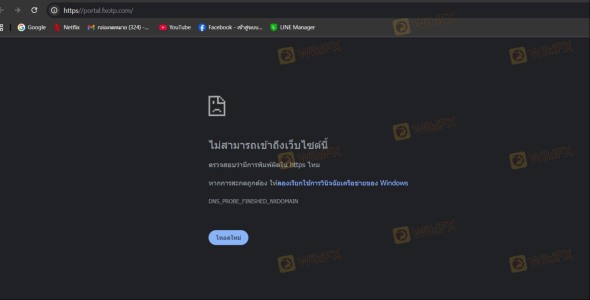

The trading platform offered by FXOTP has been criticized for its performance and user experience. Users report slow loading times, frequent outages, and issues with order execution, including slippage and rejected orders.

A reliable trading platform should provide seamless execution and minimal downtime. The presence of technical issues can hinder trading performance and lead to missed opportunities. Furthermore, any signs of potential market manipulation, such as unusual price movements or execution delays, should be scrutinized closely.

Risk Assessment

Engaging with FXOTP entails several risks that traders must consider. The lack of regulation, questionable trading conditions, and poor customer feedback contribute to an overall high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status |

| Financial Risk | High | High fees and withdrawal issues |

| Operational Risk | Medium | Platform performance issues |

To mitigate these risks, traders should conduct thorough research before committing funds and consider using regulated platforms with proven track records.

Conclusion and Recommendations

In conclusion, the evidence suggests that FXOTP exhibits multiple signs of being a potentially fraudulent broker. The absence of regulatory oversight, coupled with numerous user complaints and questionable trading conditions, raises significant concerns about its legitimacy. Is FXOTP safe? The overwhelming consensus among reviews indicates that it is not a secure platform for trading.

For traders seeking reliable options, it is advisable to consider well-regulated brokers that prioritize customer safety and transparency. Platforms with clear regulatory oversight, reasonable fees, and positive user feedback should be the focus for those looking to invest in the forex market. Avoiding FXOTP may be a prudent decision to safeguard your investments and ensure a more secure trading experience.

Is FXOTP a scam, or is it legit?

The latest exposure and evaluation content of FXOTP brokers.

FXOTP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FXOTP latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.