FXGT Review 69

I have been losing money with this broker for a long time. I just made my first profit. I withdrew my money but they refused to withdraw it. They stole my money.

Once you deposit funds, withdrawals are impossible. They constantly pressure you to deposit more under various pretexts, but withdrawals are never allowed. Currently, $57,000 is locked up. I requested a $27,000 withdrawal on October 28th, but it's still pending review.

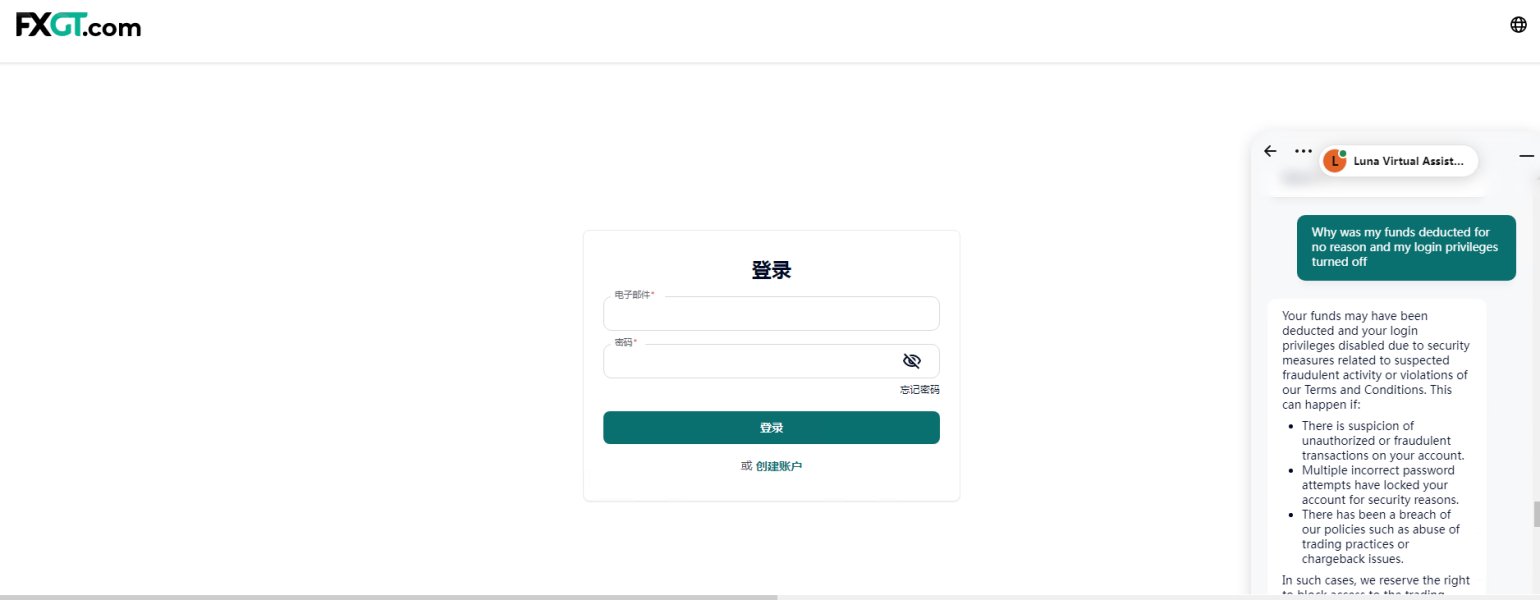

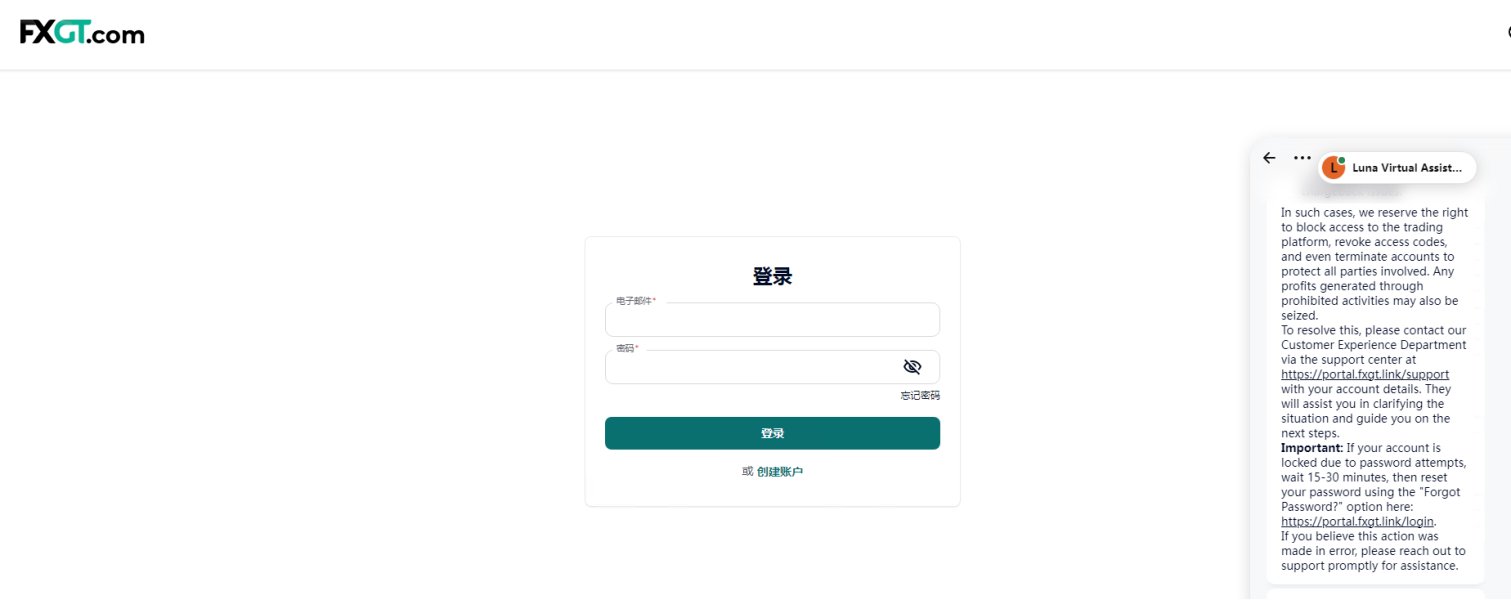

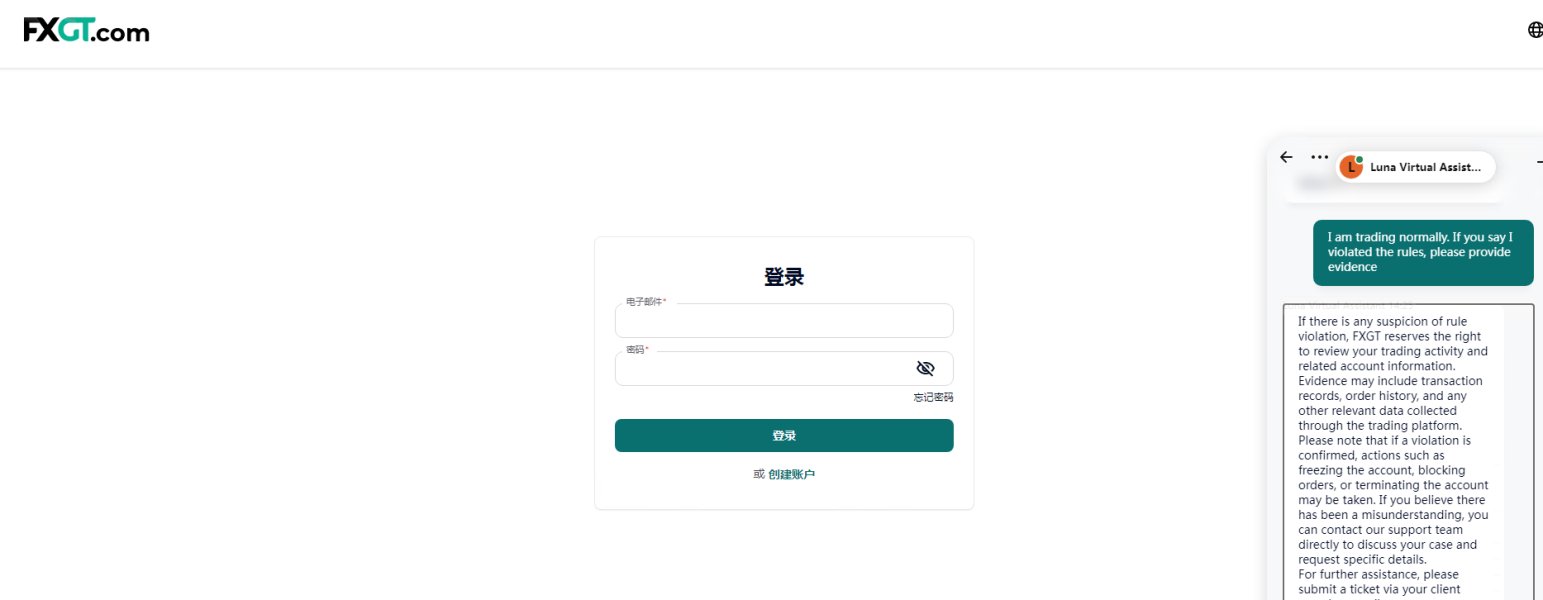

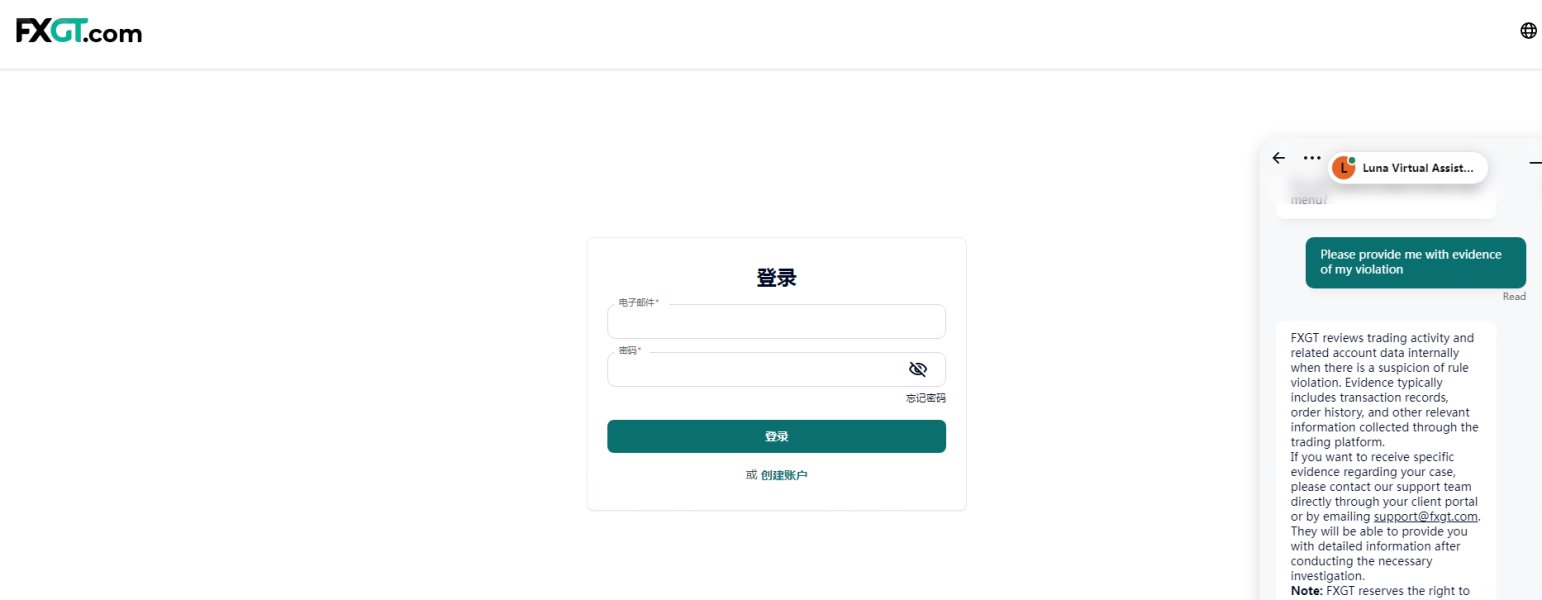

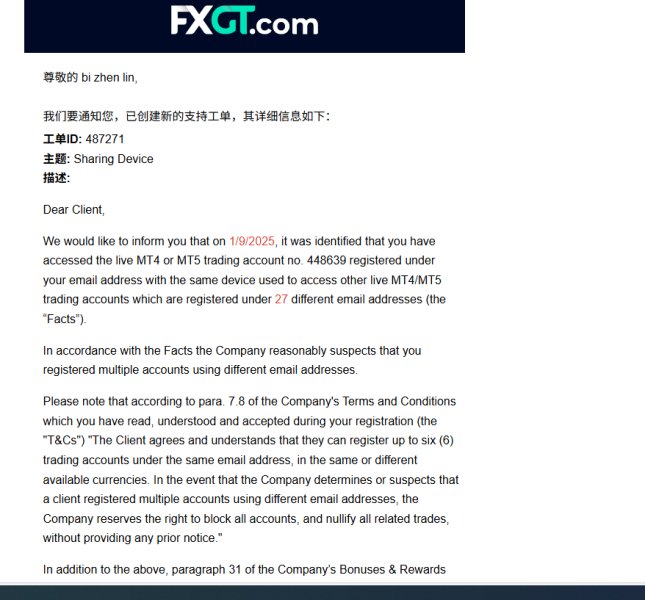

I am a registered user of your FXGT platform, my account is: [448639]. I have long been a loyal user of your platform, always adhering to the rules. This complaint is mainly against two associated serious issues: One, the platform unreasonably rejects my legal withdrawal request without any reasonable explanation or evidence. The origin of the fund is completely legal and compliant. However, after submitting the withdrawal request, it was not transferred in time as before, but was rejected by the platform. I immediately contacted online customer service for the reason, and the response was perfunctory, claiming a violation of terms and conditions. When I asked the customer service to specify: 1. Which platform rule was violated? 2. What does the so-called violation refer to? Please provide solid evidence. For the above critical issues, customer service could not give a direct, specific reply, but shirked the issue with "this is a system judgment, we cannot intervene". This groundless rejection is essentially an unreasonable encroachment on my legal property rights by the platform. Two, the platform unilaterally and compulsorily restores my account login permission, trying to "cold deal" with the issue without resolving the withdrawal issue. After the withdrawal was rejected, my account was temporarily unable to log in or function limited. But what is infuriating is that the platform unilaterally closed my account login permission without any communication and without any solution to the withdrawal problem. My demands are: 1. Immediate unfreeze of funds: Require the platform to immediately lift the freeze on the funds (1957.11) in my account, and complete the withdrawal operation, allowing the funds to successfully reach my binding account. 2. Provide written explanation: Request the platform to provide an official, credible written explanation for this "unreasonable refusal to withdraw" and "abnormal account control" incident, explaining the specific and true reason for the initial determination of account abnormalities. 3. Formal apology: Require the platform to formally apologize for the time cost, mental distress, and rights damage caused by this incident. This incident has severely damaged my trust in your platform, and it has caused me to seriously doubt your platform's fund security and user rights protection mechanism. I will have to take the following measures to protect my rights: • Report to the State Market Supervisory Administration, the China Internet Finance Association, and other related departments. • Expose this issue through the Consumer Association, media, and other channels. I look forward to your serious handling and prompt reply.

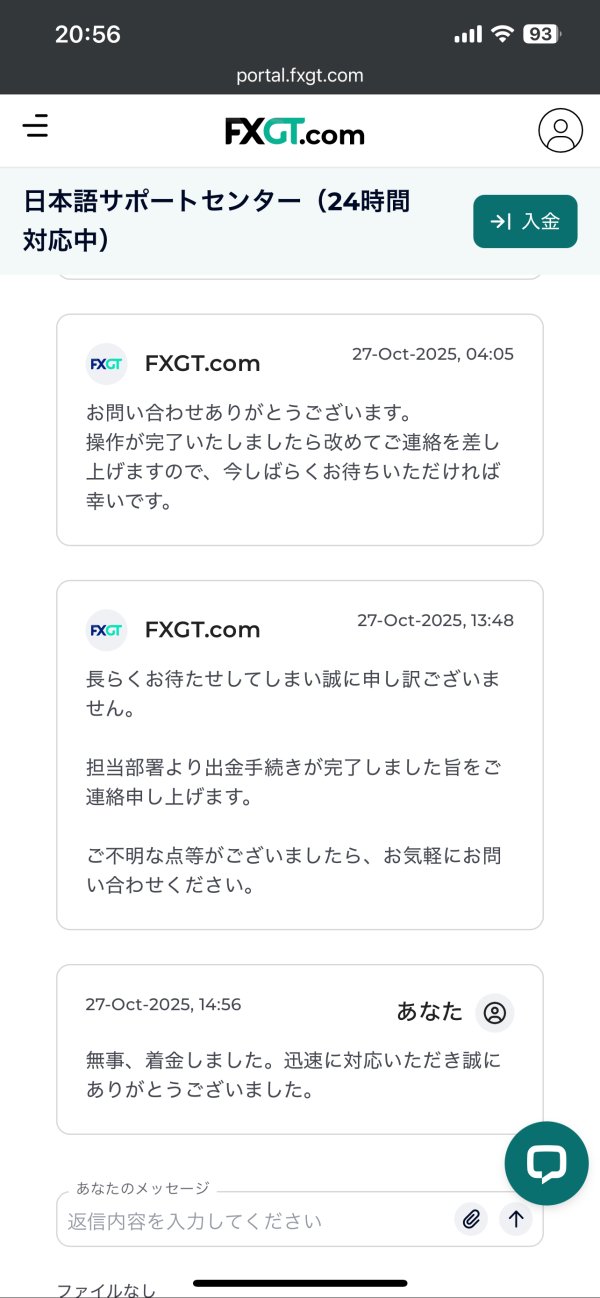

It was a high-value withdrawal, but it was processed within 24 hours. I had no concerns about the procedure.

This broker is a scam. I can imagine they make a lot from slippage as commision. Their slippage is really severe at ond time that my account got blown few minutes after I opened a XAU/USD trade. I was so devasted as it has never happened before. My trading career took a hit from that event. Newbies, stay away from FXGT with every power you have. You will end up losing money my friend.

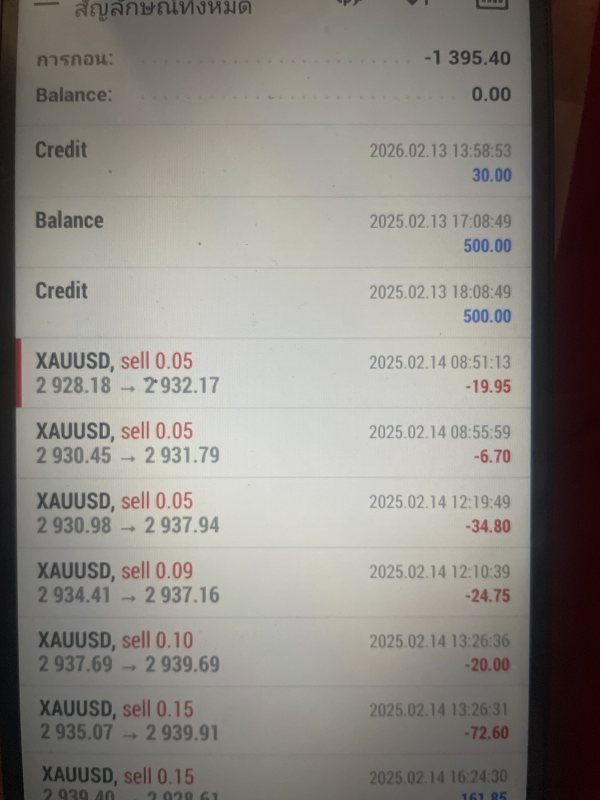

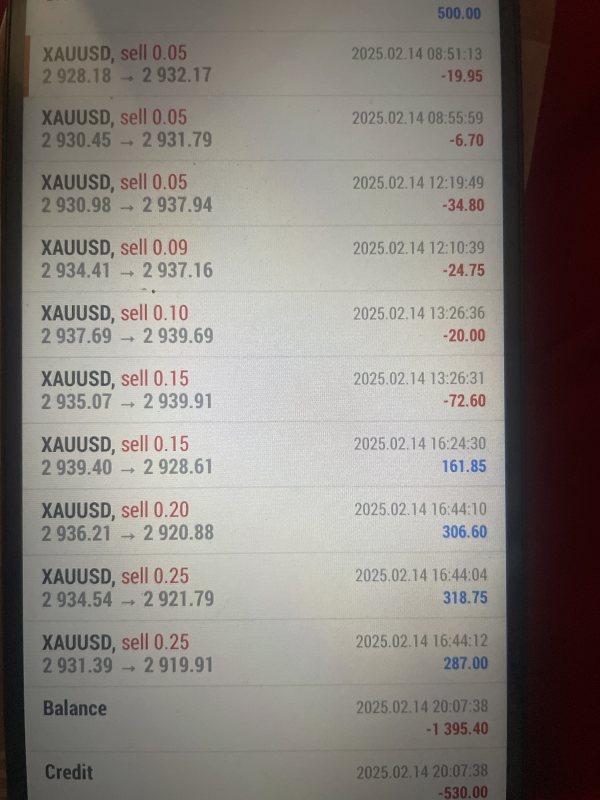

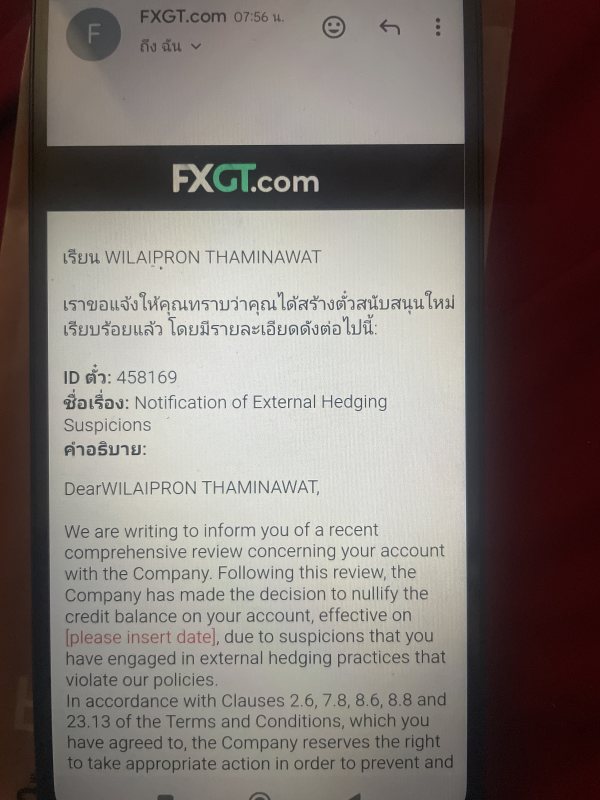

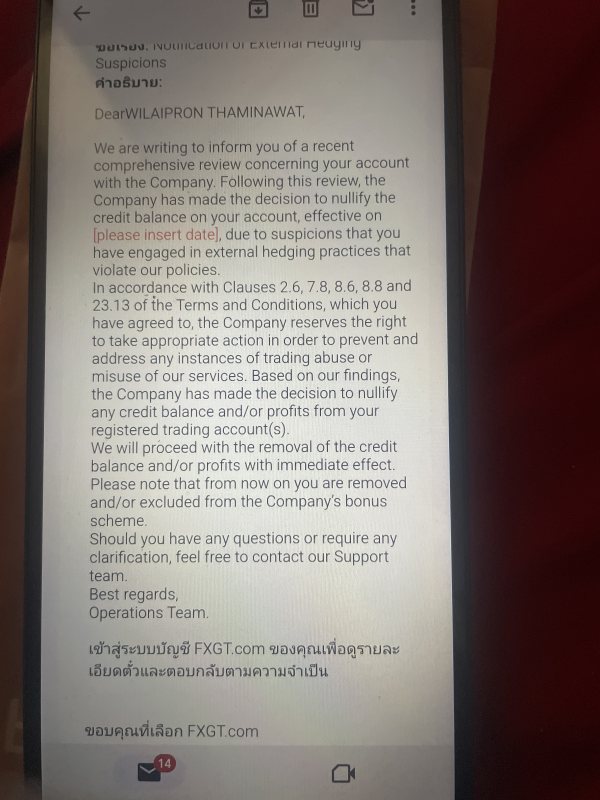

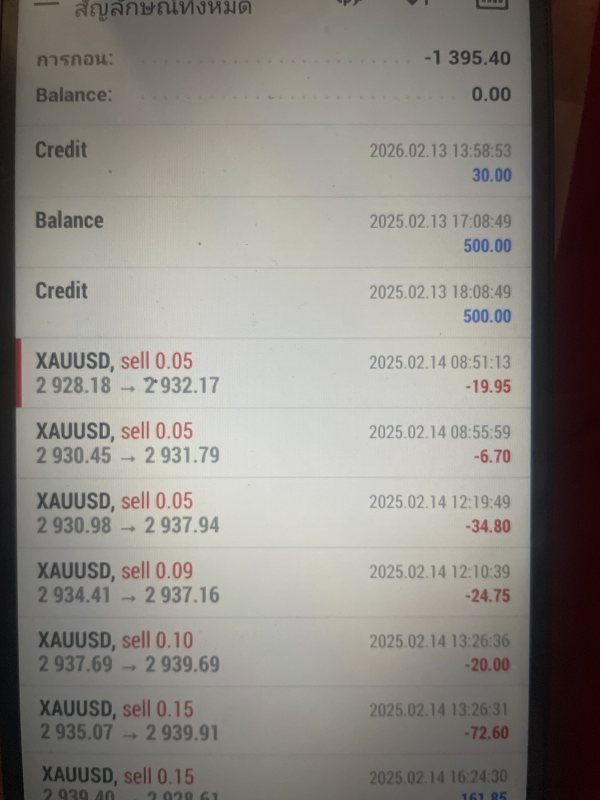

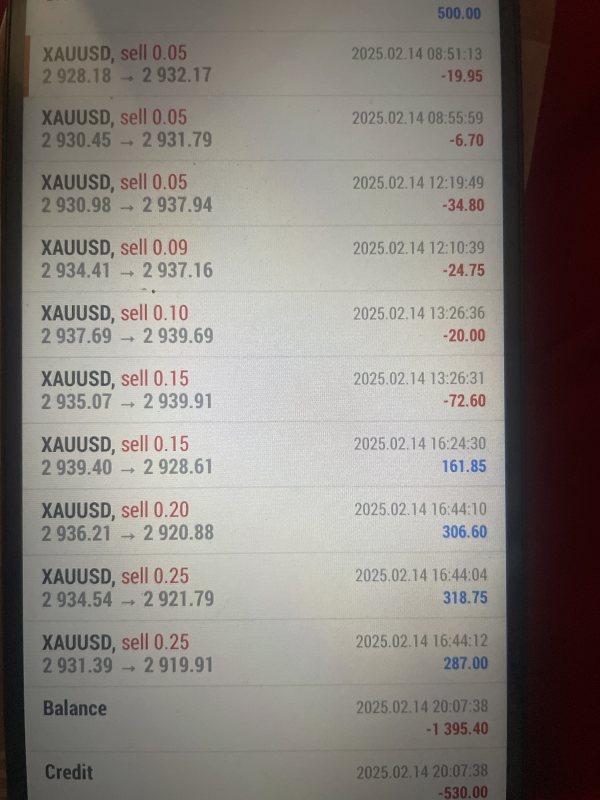

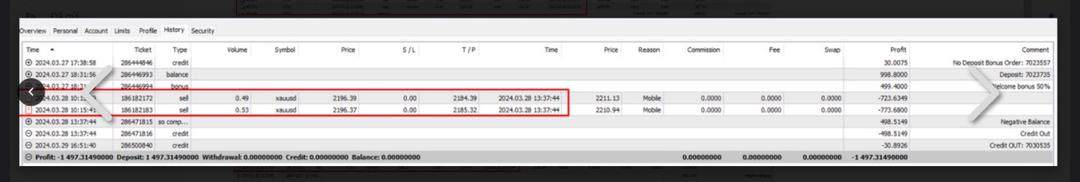

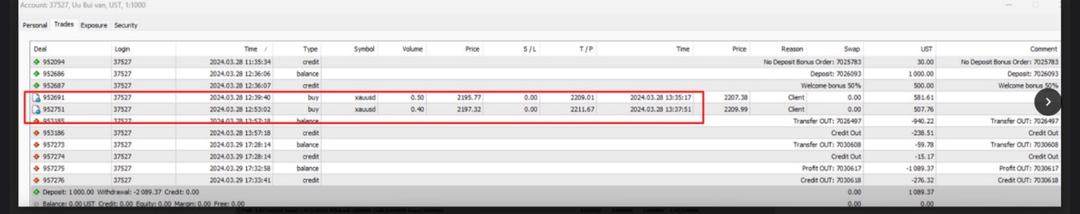

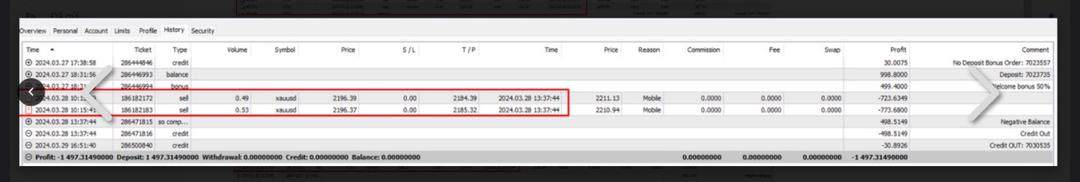

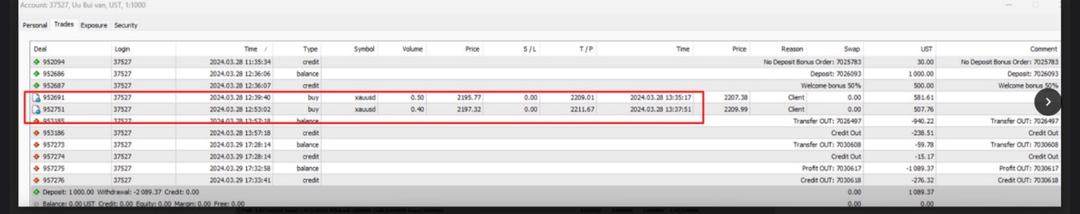

I entered 0.9 lots of gold and got a profit of 1089.37$ but then FXGT called me in violation because I was trading with another account. They placed an order of 1.02 lots and got negative 1400$ and revoked my profit. The order entry time is different, the profits and negative numbers are different but they say it's the same person, which is absurd.

Deposit Experience ★★★ Trade Execution ★★ Customer Service ★★ Withdrawal Smoothness ★ Platform Stability ★★ Tools & Product Support ★★★ Compliance & Security ★★ Multilingual Support ★★ Educational Resources ★★★ Customer Satisfaction ★

Does not pay