XO 2025 Review: Everything You Need to Know

Executive Summary

This xo review presents a comprehensive analysis of XO, a broker that has raised significant concerns within the trading community. While XO was established in 1995, its entry into the forex market as a new participant in 2018 has been marked by controversy and red flags that traders should know about. The broker operates without proper regulatory oversight. It has been flagged as a potential scam by various industry watchdogs who monitor suspicious trading companies. Despite targeting both novice and experienced traders, XO's unregulated status and extremely high minimum deposit requirement of $100,000 make it an unsuitable choice for most retail traders who want safe and affordable trading options. The lack of transparency regarding trading platforms, asset offerings, and basic operational details further compounds the concerns. With minimal user feedback available and no regulatory protection for client funds, XO presents substantial risks that far outweigh any potential benefits that traders might hope to find. This review aims to provide traders with the essential information needed to make an informed decision about this controversial broker.

Important Notice

This xo review is based on available public information and limited user feedback. Due to XO's unregulated status, traders should exercise extreme caution when considering this broker for their trading needs. The absence of regulatory oversight means that client protections typically afforded by licensed brokers are not available to users. Different jurisdictions may have varying legal frameworks regarding unregulated brokers, and traders should consult local financial authorities before engaging with such entities that operate without proper oversight. Our evaluation methodology relies on publicly accessible data, industry standards, and available user testimonials to provide an objective assessment of XO's services and reliability.

Rating Framework

Broker Overview

XO presents a complex profile within the financial services industry. Originally established in 1995, the company entered the forex trading market much later in 2018, positioning itself as a service provider for both novice and experienced traders who want to trade currencies and other financial instruments. Based on available information, XO is registered in Malaysia, though specific details about its corporate structure and operational headquarters remain limited and unclear. The broker's business model focuses primarily on forex and Contract for Difference trading, attempting to capture market share in the competitive retail trading sector.

The company's late entry into the forex market coincides with a period of increased regulatory scrutiny across the industry. However, XO operates without regulatory oversight from recognized financial authorities, which immediately raises red flags for potential clients who value safety and security. This xo review finds that the broker's approach to market entry appears to prioritize rapid customer acquisition over establishing proper regulatory compliance and transparent operational practices.

According to available data, XO's target demographic includes traders across the experience spectrum, from beginners seeking their first trading platform to seasoned professionals looking for advanced trading capabilities. However, the broker's actual service delivery and platform offerings remain poorly documented, with limited public information about specific trading tools, educational resources, or market analysis capabilities that would typically attract and retain serious traders who demand quality services.

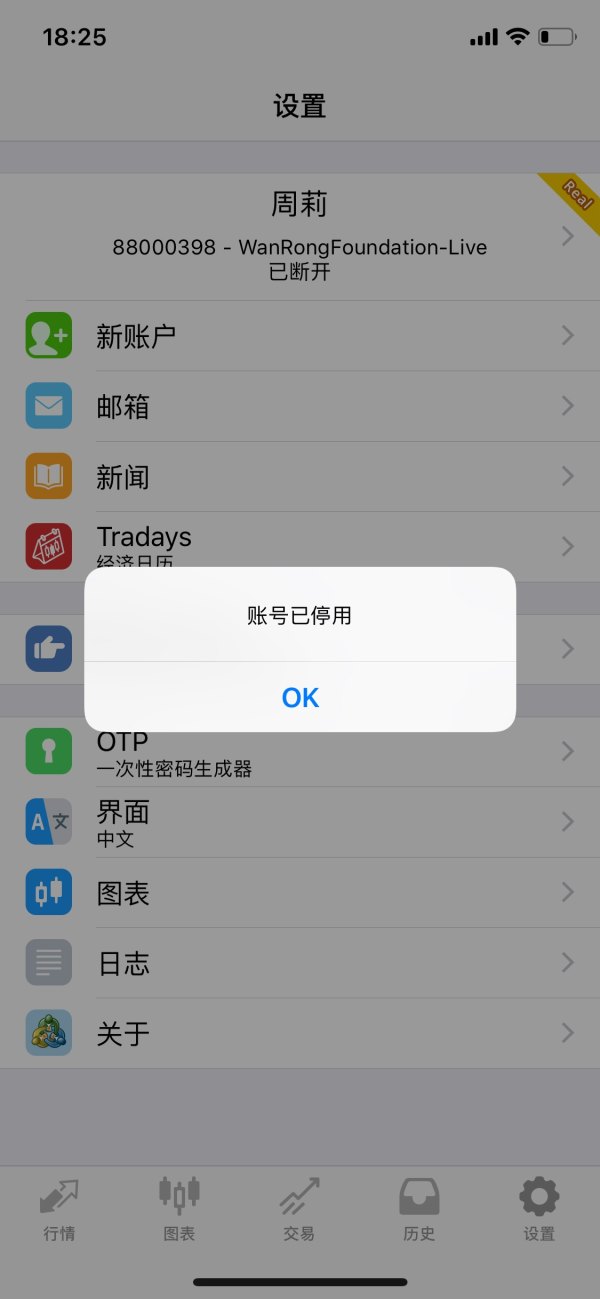

Regulatory Status: XO operates as an unregulated broker, meaning it lacks oversight from recognized financial regulatory authorities. This status significantly impacts client protection and fund security for all users.

Deposit and Withdrawal Methods: Specific information about available deposit and withdrawal methods is not detailed in available documentation. This raises concerns about operational transparency and user convenience.

Minimum Deposit Requirement: XO requires a substantial minimum deposit of $100,000, which the company claims is refundable. This amount is significantly higher than industry standards and may exclude most retail traders from using their services.

Bonus and Promotions: No information is available regarding promotional offers, welcome bonuses, or ongoing incentive programs for new or existing clients. This lack of promotional activity is unusual in the competitive trading industry.

Tradeable Assets: The broker focuses on forex and CFD trading, though specific currency pairs, commodities, indices, or other financial instruments available for trading are not clearly specified in public documentation. This makes it difficult for traders to assess whether the broker meets their trading needs.

Cost Structure: Details about spreads, commissions, overnight fees, and other trading costs are not provided in available materials. This makes it impossible for potential clients to assess the true cost of trading with XO.

Leverage Options: Information about maximum leverage ratios available to clients is not specified in accessible documentation. This is crucial information that traders need to manage their risk properly.

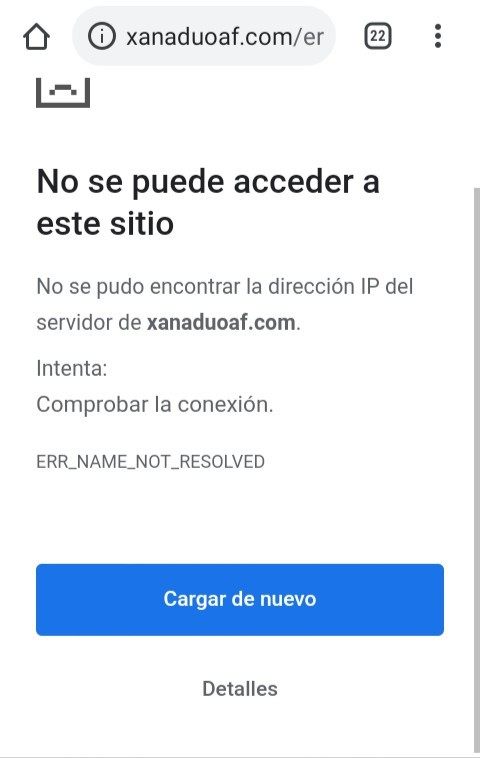

Platform Selection: This xo review finds no specific information about trading platforms offered by XO, whether proprietary or third-party solutions like MetaTrader. This lack of platform information makes it difficult to evaluate the trading experience.

Geographic Restrictions: Specific countries or regions where XO's services are restricted or prohibited are not clearly outlined in available materials. This information is important for international traders.

Customer Service Languages: The languages supported by XO's customer service team are not specified in public documentation. This could be a barrier for non-English speaking traders.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

XO's account conditions present significant barriers for most potential traders. The most striking aspect is the minimum deposit requirement of $100,000, which places this broker far outside the reach of typical retail traders who usually start with much smaller amounts. While the company claims this deposit is refundable, the lack of regulatory oversight raises serious questions about fund security and the actual refund process that clients might face. No information is available about different account types, tiered service levels, or special features that might justify such a high entry barrier.

The account opening process remains undocumented in publicly available materials. This leaves potential clients without clear guidance on verification requirements, documentation needed, or processing timeframes that they should expect. This xo review notes the absence of information about Islamic accounts, professional trading accounts, or other specialized account types that are standard offerings among legitimate brokers. The lack of transparency regarding account terms and conditions, including any restrictions on trading strategies or withdrawal policies, further diminishes the attractiveness of XO's account offerings.

Compared to regulated brokers that typically offer account minimums ranging from $10 to $500, XO's requirements appear designed to target high-net-worth individuals exclusively. However, sophisticated traders with substantial capital typically prefer regulated environments that offer comprehensive investor protections and transparent operational frameworks that protect their investments.

The availability of trading tools and resources at XO is poorly documented. This suggests a significant deficiency in this critical area that modern traders depend on for success. No information is available about charting packages, technical analysis tools, or market scanning capabilities that modern traders expect from their brokers. The absence of details about research and analysis resources indicates that XO may not provide the market insights, economic calendars, or expert commentary that help traders make informed decisions.

Educational resources appear to be non-existent based on available information. Legitimate brokers typically offer comprehensive educational programs including webinars, trading courses, market analysis tutorials, and strategy guides that help traders improve their skills. The lack of such resources suggests that XO may not be genuinely committed to supporting trader development and success. This is particularly concerning given their stated target market of both novice and experienced traders.

Automated trading support and algorithmic trading capabilities are not mentioned in available documentation. Modern trading environments increasingly rely on automated solutions, expert advisors, and API access for sophisticated trading strategies that can help traders manage risk and execute trades more efficiently. The absence of information about such capabilities suggests that XO may not offer the technological infrastructure expected by serious traders. Without proper tools and resources, traders are left to rely on external solutions, which can be costly and inefficient.

Customer Service and Support Analysis (Score: 2/10)

Customer service information for XO is notably absent from available documentation. This raises significant concerns about the broker's commitment to client support and satisfaction. No details are provided about available contact methods, whether through phone, email, live chat, or other communication channels. The lack of specified customer service hours means potential clients cannot determine when support would be available, particularly important for traders operating across different time zones.

Response time commitments and service quality standards are not documented. This leaves clients without expectations for problem resolution when issues arise. The absence of multilingual support information is particularly concerning for a broker claiming to serve an international client base. Professional brokers typically provide detailed information about their support infrastructure, including dedicated account managers, technical support teams, and complaint resolution procedures.

This xo review finds no evidence of customer service quality through user testimonials or third-party reviews. The lack of documented support procedures for common issues like deposit problems, withdrawal delays, or technical difficulties suggests that clients may face significant challenges when requiring assistance. Without proper customer service infrastructure, traders risk being left without recourse when problems arise, particularly problematic given XO's unregulated status.

Trading Experience Analysis (Score: 2/10)

The trading experience offered by XO remains largely unknown due to insufficient documentation about platform capabilities and performance. No information is available about platform stability, execution speeds, or server uptime statistics that would indicate the quality of the trading environment. The absence of details about order execution methods, whether market maker or ECN, leaves traders without crucial information about how their orders will be processed.

Platform functionality and features are not described in available materials. This makes it impossible to assess whether XO provides the tools necessary for effective trading. Modern traders expect features like one-click trading, advanced order types, risk management tools, and mobile accessibility. The lack of information about these capabilities suggests that XO may not offer a competitive trading environment.

Mobile trading experience, increasingly important for active traders, is not addressed in available documentation. This xo review finds no evidence of mobile applications, responsive web platforms, or other mobile-friendly solutions. Without proper mobile access, traders cannot effectively monitor and manage their positions when away from their computers, a significant limitation in today's fast-paced trading environment. The overall lack of transparency about the trading experience raises serious questions about XO's commitment to providing professional-grade trading services.

Trustworthiness Analysis (Score: 1/10)

XO's trustworthiness is severely compromised by its unregulated status and the fact that it has been flagged as a potential scam by industry watchdogs. Operating without regulatory oversight means that client funds are not protected by investor compensation schemes or segregated account requirements that are standard in regulated environments. This represents the most significant risk factor for potential clients considering XO's services.

The lack of regulatory compliance indicates that XO is not subject to regular audits, capital adequacy requirements, or operational standards that regulated brokers must maintain. This absence of oversight creates an environment where client interests may not be protected, and there is no regulatory recourse available if problems arise. The company's transparency regarding its operations, financial health, and business practices is minimal, with little public information available about its corporate structure or management team.

Industry reputation appears to be negative based on the scam warnings associated with XO. Legitimate brokers typically maintain positive relationships with industry organizations, participate in regulatory initiatives, and demonstrate commitment to best practices. The absence of such indicators, combined with active warnings about the broker's legitimacy, creates a highly concerning trust profile. This xo review strongly advises potential clients to consider these trust factors carefully before engaging with XO's services.

User Experience Analysis (Score: 2/10)

User experience with XO is difficult to assess due to limited user feedback and testimonials available in public forums. The absence of substantial user reviews suggests either a very small client base or potential issues with client retention. Legitimate brokers typically generate significant user discussion and feedback across trading forums and review platforms, which is notably absent for XO.

Interface design and platform usability cannot be evaluated due to lack of accessible information about XO's trading platforms. Modern traders expect intuitive interfaces, customizable layouts, and user-friendly navigation. Without demonstration accounts or publicly available platform information, potential clients cannot assess whether XO meets basic usability standards. The registration and verification process is not documented, leaving potential clients without clear expectations about account opening procedures.

Fund management experience, including deposit and withdrawal processes, is not detailed in available materials. This represents a significant gap in user experience information, as smooth and transparent fund operations are crucial for trader satisfaction. The absence of user testimonials about withdrawal experiences is particularly concerning given the broker's unregulated status. Overall user satisfaction metrics are not available, making it impossible to gauge whether XO successfully meets client expectations or addresses common user concerns effectively.

Conclusion

This xo review concludes that XO presents substantial risks that make it unsuitable for most traders. The broker's unregulated status, combined with scam warnings from industry sources, creates an environment where client funds and interests are not adequately protected. The extremely high minimum deposit requirement of $100,000, while claimed to be refundable, represents a significant barrier that excludes most retail traders and raises questions about the broker's target market and business model.

The lack of transparency regarding essential operational details, including trading platforms, customer service infrastructure, and basic account terms, further compounds the concerns about XO's legitimacy and professional standards. Both novice and experienced traders would be better served by choosing regulated brokers that offer comprehensive client protections, transparent operations, and established track records in the industry. The minimal advantages, such as the company's long establishment history, are far outweighed by the significant risks and operational deficiencies identified in this analysis.