Is FNB safe?

Business

License

Is FNB Safe or Scam?

Introduction

In the dynamic landscape of the foreign exchange market, First National Bank (FNB) has positioned itself as a significant player, particularly within South Africa. Established in 1838, FNB offers a variety of financial services, including forex trading, which attracts both novice and experienced traders. However, the rise of online trading has also led to an increase in scams and fraudulent activities, making it imperative for traders to carefully evaluate the reliability and safety of their chosen brokers. This article aims to explore whether FNB is a safe trading option or a potential scam. Our investigation is based on a thorough analysis of available online resources, including regulatory information, customer feedback, and the bank's operational history.

Regulation and Legitimacy

One of the foremost aspects of assessing any forex broker's credibility is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to stringent operational standards and ethical practices. In FNB's case, it is essential to note that while it operates under the auspices of Firstrand Bank Limited, it lacks regulation from major financial authorities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | South Africa | Not Regulated |

The absence of regulation raises significant concerns regarding the safety of funds and the potential for unethical practices. Without oversight from a recognized authority, traders may find it challenging to seek recourse in the event of disputes or financial discrepancies. Furthermore, the lack of regulatory history makes it difficult to assess FNB's compliance with industry standards, which is a critical factor in determining the overall safety of the trading environment.

Company Background Investigation

FNB has a long and storied history, having been established in 1838, making it one of the oldest banks in South Africa. It operates as a division of Firstrand Limited, which is a well-known financial services group that includes various banking and investment services. Despite its long-standing presence, the bank's recent foray into forex trading raises questions about its operational transparency and commitment to regulatory compliance.

The management team at FNB comprises experienced professionals with backgrounds in finance and banking. However, the lack of publicly available information regarding their specific qualifications and track records in forex trading is concerning. Transparency in management is crucial for building trust with clients, and FNB's limited disclosure on this front may deter potential traders.

Moreover, the bank's ownership structure does not provide any indication of potential conflicts of interest, but the absence of regulatory oversight further complicates the evaluation of its legitimacy. As such, potential investors should exercise caution when considering FNB as their forex broker, particularly given its lack of regulatory backing.

Trading Conditions Analysis

When it comes to trading conditions, FNB presents a mixed picture. While the bank offers a range of financial products, including forex trading, the overall fee structure is a critical consideration for traders. FNB's trading fees are generally competitive, but the absence of transparency regarding certain charges can be a red flag.

| Fee Type | FNB | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | N/A | 0.1% - 0.5% |

| Overnight Interest Range | 0.5% - 2% | 0.5% - 1.5% |

The variable spread on major currency pairs can be advantageous for traders, but the lack of a clear commission structure raises concerns. Without a defined fee model, traders may face unexpected costs, which could significantly impact their profitability. Additionally, the overnight interest rates seem higher than the industry average, which could deter long-term positions.

Client Fund Safety

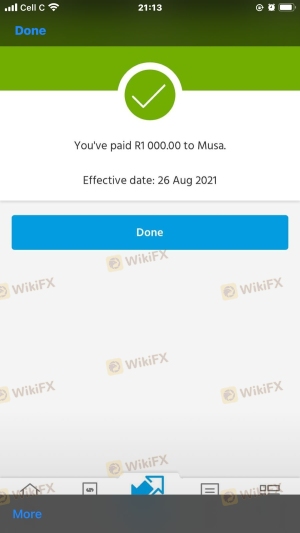

The safety of client funds is paramount when evaluating any forex broker. FNB claims to implement various measures to protect client funds, including segregated accounts and security protocols. However, the absence of a regulatory framework means that traders have limited recourse if issues arise.

FNB does not provide detailed information about its investor protection policies, which is a significant concern. The lack of negative balance protection means that traders could potentially lose more than their initial investment, exposing them to higher risks. Furthermore, the historical context surrounding FNB's financial practices raises questions about its commitment to safeguarding client assets.

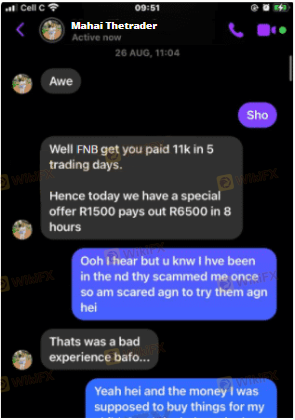

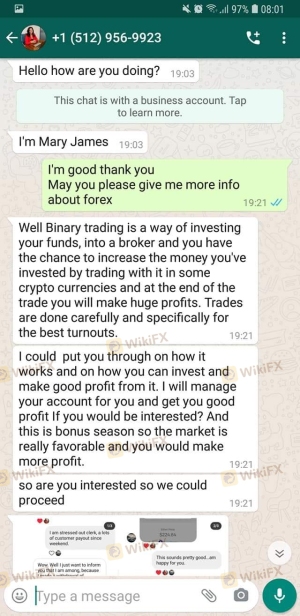

Customer Experience and Complaints

Customer feedback is an essential component of assessing a broker's reliability. Reviews of FNB indicate a mixed bag of experiences, with some clients praising the bank's banking services while others express dissatisfaction with its trading platform.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| High Fees | Medium | Limited Clarification |

| Poor Customer Support | High | Inconsistent |

Common complaints include difficulties in withdrawing funds and high fees, which have led to frustration among users. The bank's response to these complaints has been criticized for its lack of timeliness and effectiveness, further eroding trust among potential traders. Specific cases highlight the challenges faced by clients attempting to access their funds, raising concerns about the overall reliability of FNB as a trading platform.

Platform and Execution

FNB's trading platform is integrated with its banking services, which may provide convenience for existing customers. However, the platform's performance, stability, and user experience are vital factors for successful trading. Feedback suggests that users experience issues with order execution, including slippage and rejected orders.

The lack of advanced trading tools and features may also hinder traders who rely on technical analysis and sophisticated strategies. Given the competitive nature of the forex market, a reliable and efficient trading platform is crucial for success, and FNB appears to fall short in this area.

Risk Assessment

Using FNB as a forex broker presents several risks that potential traders should consider. The absence of regulatory oversight, combined with reported issues regarding fund withdrawals and customer service, contributes to a higher risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety Risk | High | Lack of protection measures may expose clients to financial losses. |

| Customer Service Risk | Medium | Inconsistent response to complaints can lead to unresolved issues. |

To mitigate these risks, traders should conduct thorough research and consider diversifying their trading accounts across multiple regulated brokers. This approach can help safeguard their investments and provide a more secure trading environment.

Conclusion and Recommendations

In conclusion, the evidence suggests that FNB presents several red flags that warrant caution. The lack of regulatory oversight, coupled with customer complaints regarding fund withdrawals and service quality, raises concerns about its safety as a forex broker. While FNB may offer a range of financial services, traders should be wary of potential pitfalls.

For those considering forex trading, it may be prudent to explore alternative brokers that are regulated by reputable authorities and offer transparent fee structures. Brokers such as AvaTrade and IG Markets are often recommended for their robust regulatory frameworks and positive customer feedback.

Ultimately, while FNB has a long-standing history in the banking sector, its foray into forex trading may not provide the level of security and reliability that traders seek. Therefore, it is essential to weigh the risks carefully and consider safer alternatives when choosing a broker.

Is FNB a scam, or is it legit?

The latest exposure and evaluation content of FNB brokers.

FNB Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FNB latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.