Windsor Brokers Ltd has been operating since 1988, solidifying its presence in the brokerage industry for over three decades. Registered in Cyprus and regulated by CySEC, it has adapted well to market demands, providing trading services globally. The firm positions itself as a reliable broker, rooted in stability and regulatory adherence, appealing to both novice and experienced traders.

Windsor Brokers provides a range of financial services, showcasing various asset classes, including:

The broker utilizes the MT4 trading platform, with complementary offerings of educational resources designed for user enhancement.

Windsor Brokers prides itself on regulation by multiple authorities, including CySEC, FSC, and FSA. However, the inconsistencies in user experiences regarding fund safety raise alarm bells. Some users have reportedly experienced issues around withdrawals, which compromises trust.

- Check website registration: Verify the brokers status on CySEC's official website.

- Look for compliance notifications: Any regulatory warnings or actions against the broker should be noted.

- Review user experiences: Gather insights from various trading forums and reviews.

- Assess available protections: Verify if the broker offers negative balance protection and segregated accounts.

Industry Reputation and Summary

Despite its regulatory framework, Windsor Brokers is subject to critique. Many users express concerns about withdrawal difficulties, prompting a comprehensive analysis of the broker's operational integrity.

Trading Costs Analysis

Advantages in Commissions

Windsor Brokers offers competitive commission rates, with commissions on forex CFDs typically being free. Furthermore, spreads begin as low as 0.2 pips for prominent currency pairs, making it appealing for low-cost trading.

The "Traps" of Non-Trading Fees

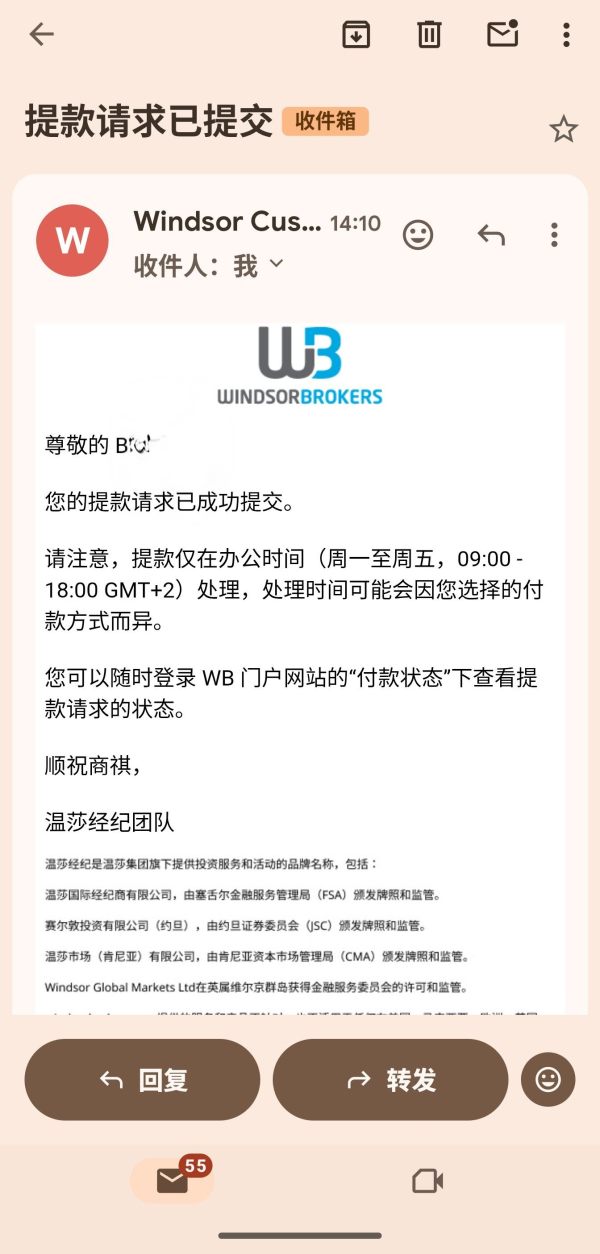

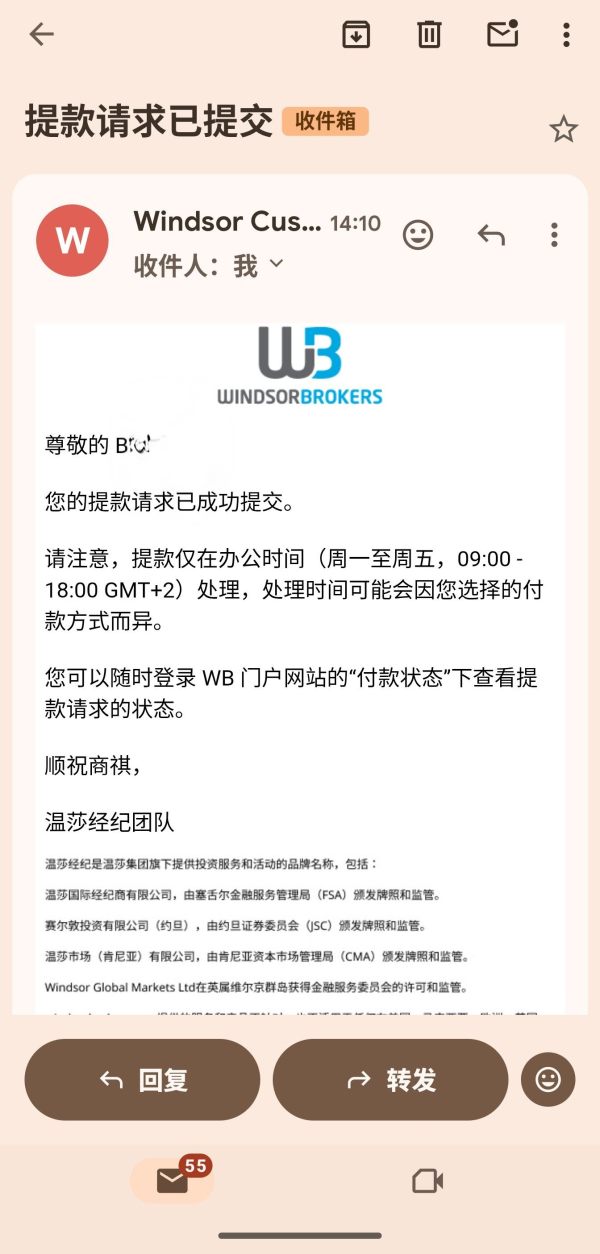

While trading fees are attractive, user complaints highlight potential hidden fees during withdrawal processes. Users have raised concerns about having to pay withdrawal fees of $3 per transaction, with some variability based on the method used.

"I was charged multiple withdrawal fees without prior notice, which made the process cumbersome." - User Review Highlight.

Cost Structure Summary

Competitive spreads and commission-free trading on specific instruments positions Windsor Brokers favorably against other brokers, despite potential hidden costs. Traders need to consider their individual trading styles and account preferences.

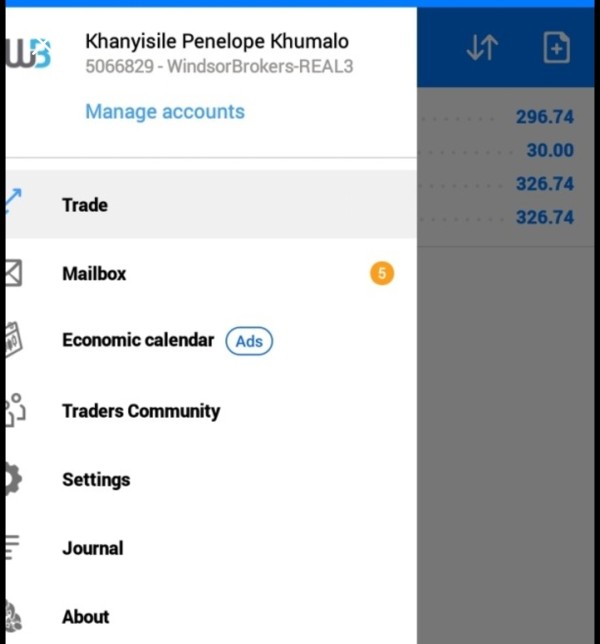

Windsor Brokers offers the widely-used MT4 platform across various devices, providing a robust environment for traders. The accessibility and effectiveness of MT4 make it suitable for both novice and experienced traders.

Windsor Brokers provides advanced trading tools including forex calculators and an economic calendar. Moreover, their educational resources aim to empower traders. This commitment to user learning is commendable.

Users generally appreciate the functionality of the MT4 platform, noting its user-friendly interface and analytical capabilities. However, some reviews mention challenges with the web-trader, citing instances of performance lags.

User Experience Analysis

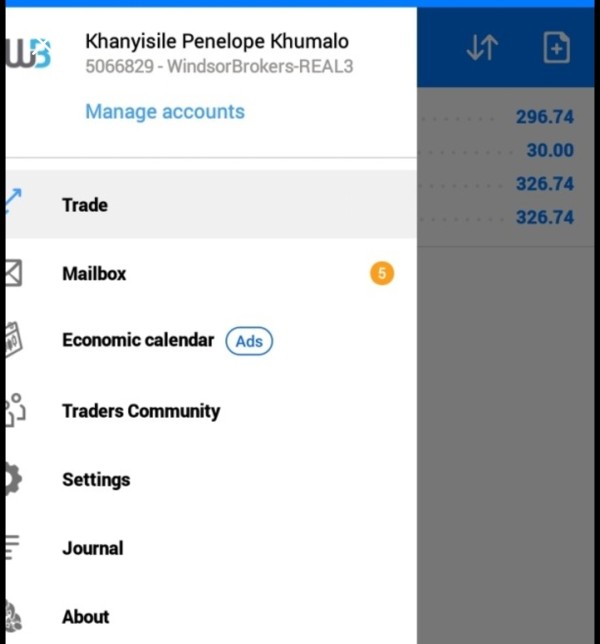

The user experience at Windsor Brokers presents a mixed picture. While many traders appreciate the competitive trading environment, the repeated complaints regarding withdrawal delays significantly impact the overarching sentiment. Overall, while the trading process is often seamless for many, critical voices suggest that the broker must address specific concerns for wider acceptance.

Customer Support Analysis

Customer support at Windsor Brokers operates 24/5 via multiple channels, including email, phone, and live chat. However, it lacks 24/7 availability, leading to complaints regarding responsiveness during off-hours. Chronic user feedback suggests that while the support team is knowledgeable, response times can be inconsistent.

Account Conditions Analysis

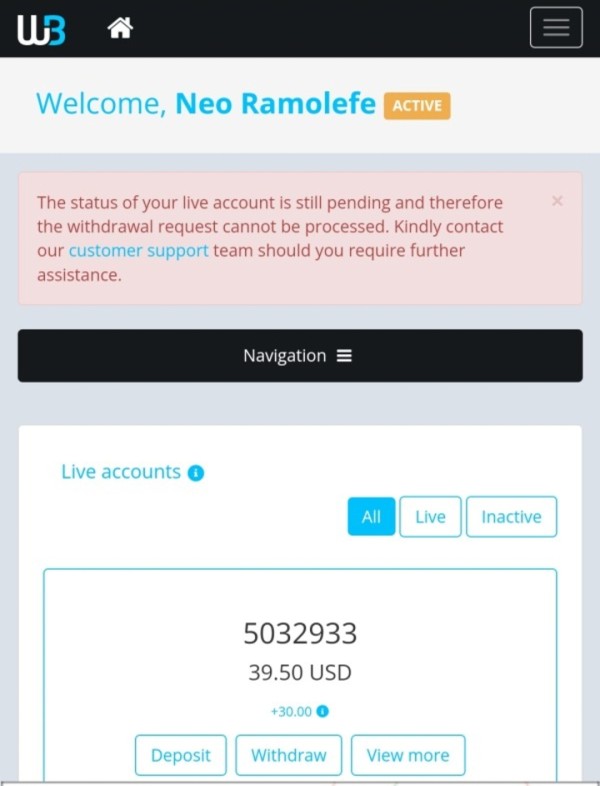

Windsor Brokers offers multiple account types tailored to different trading needs, including a beginner-friendly prime account and a more professional zero account. Both accounts come with varying spreads and commission structures, enabling traders to choose based on their style and risk appetite.

User Exposure

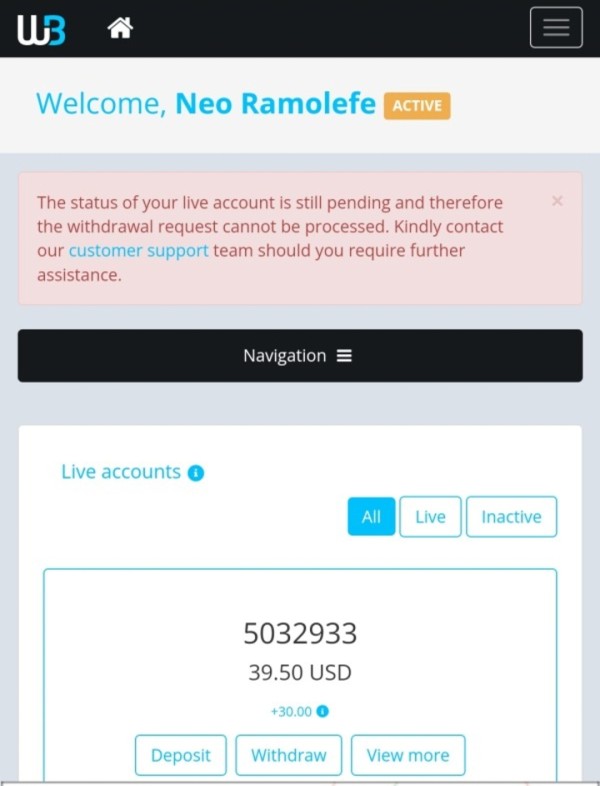

Recent feedback indicates a concerning pattern of withdrawal issues. Platforms like WikiFX have recorded numerous complaints regarding Windsor Brokers, urging prospective clients to proceed with caution before committing funds.

Conclusion

Windsor Brokers presents itself as a potentially rewarding option for traders seeking competitive trading conditions within a regulated environment. However, the broker's history of withdrawal challenges and mixed user experiences poses significant risks.

Recommendations for potential traders:

- Conduct thorough research and utilize the self-verification steps provided.

- Engage with customer support before committing large sums.

- Evaluate personal risk tolerance and review trading objectives carefully.

With this analysis, traders are encouraged to weigh their options and consider the pros and cons carefully before engaging with Windsor Brokers.