Regarding the legitimacy of TRADEVIEW MARKETS forex brokers, it provides CIMA and WikiBit, (also has a graphic survey regarding security).

Is TRADEVIEW MARKETS safe?

Pros

Cons

Is TRADEVIEW MARKETS markets regulated?

The regulatory license is the strongest proof.

CIMA Derivatives Trading License (EP)

Cayman Islands Monetary Authority

Cayman Islands Monetary Authority

Current Status:

Offshore RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Tradeview Ltd

Effective Date:

2012-04-04Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tradeview Markets Safe or Scam?

Introduction

Tradeview Markets is a global online brokerage that has established itself as a significant player in the forex and CFD trading arena since its inception in 2004. With its headquarters in the Cayman Islands, Tradeview Markets offers a diverse range of financial instruments, including forex, stocks, indices, commodities, and cryptocurrencies. As the popularity of online trading continues to surge, it is imperative for traders to carefully assess the credibility and reliability of brokers they consider for their trading activities. This article aims to provide a comprehensive analysis of Tradeview Markets, focusing on its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory framework is crucial when evaluating the safety of any trading platform. Tradeview Markets operates under the regulatory oversight of the Cayman Islands Monetary Authority (CIMA) and the Malta Financial Services Authority (MFSA). These regulatory bodies are responsible for ensuring that brokers adhere to specific standards and practices that protect traders. Below is a summary of Tradeview Markets' regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CIMA | 585163 | Cayman Islands | Verified |

| MFSA | IS/93990 | Malta | Verified |

The CIMA is not considered a top-tier regulator compared to authorities like the FCA or ASIC, which may raise concerns for risk-averse traders. However, the MFSA is a member of the European Banking Authority and adheres to stringent regulations, which adds a layer of credibility to Tradeview's operations. Historically, Tradeview has maintained compliance with these regulations, but the offshore nature of its primary license may pose certain risks for traders.

Company Background Investigation

Tradeview Markets has a rich history, having been founded in 2004. Over the years, the company has expanded its operations to serve over 100,000 clients globally. The ownership structure of Tradeview is not publicly disclosed in detail, but it is known to operate multiple entities across various jurisdictions, including the Cayman Islands and Malta. The management team comprises experienced professionals from the financial services industry, contributing to the broker's operational stability and growth.

Transparency is a critical factor in assessing a broker's reliability. Tradeview provides information about its services and trading conditions on its website, but the extent of this information may not be as comprehensive as some traders would prefer. The company's commitment to transparency is evident in its regulatory compliance and regular audits, which help build trust among clients.

Trading Conditions Analysis

Tradeview Markets offers competitive trading conditions that appeal to a diverse range of traders. The broker provides two main account types: the Innovative Liquidity Connector (ILC) account and the X Leverage account. Each account type has different fee structures and trading conditions, which can impact overall trading costs. Below is a comparison of core trading costs associated with Tradeview Markets:

| Fee Type | Tradeview Markets | Industry Average |

|---|---|---|

| Spread for Major Pairs | From 0.0 pips | 1.2 pips |

| Commission Model | $2.50 per lot | Varies |

| Overnight Interest Range | Varies | Varies |

The ILC account allows for trading with tight spreads starting from 0.0 pips, but it incurs a commission of $2.50 per standard lot. The X Leverage account does not charge commissions but has slightly wider spreads. While these conditions are generally favorable, traders should be cautious of the inactivity fees and withdrawal charges that may apply, which could affect profitability.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Tradeview Markets implements several measures to ensure the security of client funds. The broker maintains segregated accounts for client deposits, which are kept separate from the company's operational funds. This practice is crucial in safeguarding traders' money in the event of financial difficulties faced by the broker.

Additionally, Tradeview offers negative balance protection (NBP), ensuring that clients cannot lose more than their account balance, even during volatile market conditions. This feature provides an additional layer of security for traders, particularly those employing high-leverage strategies. However, there have been historical concerns regarding fund withdrawals, with some users reporting delays and difficulties in accessing their funds. This aspect warrants careful consideration when evaluating whether Tradeview Markets is safe.

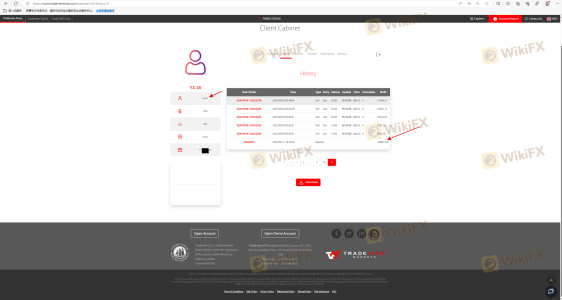

Customer Experience and Complaints

Customer feedback serves as an essential indicator of a broker's reliability and service quality. Tradeview Markets has garnered mixed reviews from users, with many praising its competitive trading conditions and responsive customer support. However, common complaints include issues related to withdrawal delays and insufficient educational resources. Below is a summary of the primary complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Delays | High | Mixed |

| Customer Support Issues | Medium | Generally Positive |

| Lack of Educational Resources | Medium | Needs Improvement |

For instance, some users have reported that while their trading experience has been satisfactory, they encountered challenges when attempting to withdraw funds. In contrast, others have highlighted the broker's effective customer service, noting quick response times and helpful support staff. These mixed experiences suggest that while Tradeview may be a legitimate broker, potential clients should proceed with caution and be prepared for possible challenges.

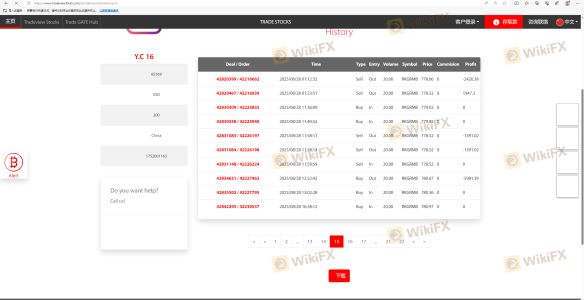

Platform and Trade Execution

The performance of trading platforms is critical for a seamless trading experience. Tradeview Markets offers several platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and Currenex. These platforms are known for their stability, advanced charting tools, and user-friendly interfaces. However, the quality of order execution can vary, with reports of slippage and rejected orders during high volatility periods.

Traders have generally reported positive experiences with platform performance, but it is essential to remain vigilant for any signs of manipulation or unfair practices. The broker's commitment to providing a transparent trading environment is commendable, but traders should always monitor their executions closely to ensure they are receiving fair treatment.

Risk Assessment

Using Tradeview Markets comes with inherent risks that traders must consider. Below is a summary of the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Offshore regulation may not provide the same protections as top-tier regulators. |

| Withdrawal Issues | High | Reports of delays and difficulties in accessing funds. |

| Market Risk | High | Trading involves significant risks, especially with high leverage. |

To mitigate these risks, traders should conduct thorough research, maintain realistic expectations, and consider diversifying their trading activities. It is advisable to start with smaller investments and gradually increase exposure as confidence in the broker grows.

Conclusion and Recommendations

In conclusion, while Tradeview Markets presents itself as a legitimate broker with competitive trading conditions and a range of financial instruments, potential clients should exercise caution. The broker's offshore regulatory status and historical challenges with fund withdrawals raise valid concerns about its overall safety.

For traders considering using Tradeview Markets, it is essential to weigh the benefits against the risks. If you prioritize a regulated environment with strong investor protection, you may want to explore alternative brokers with tier-one regulatory oversight, such as IG, OANDA, or FXCM. These brokers offer robust protections and have established reputations for reliability.

Overall, while Tradeview Markets is not necessarily a scam, traders should remain vigilant and informed, ensuring they understand the risks involved in trading with this broker.

Is TRADEVIEW MARKETS a scam, or is it legit?

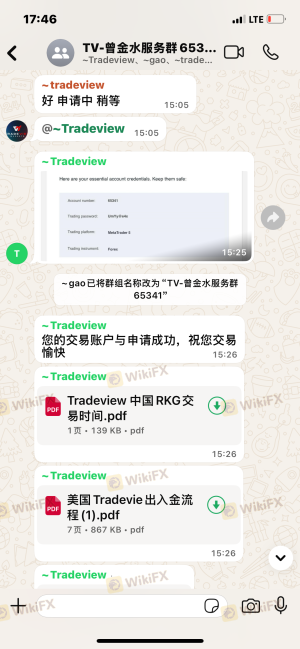

The latest exposure and evaluation content of TRADEVIEW MARKETS brokers.

TRADEVIEW MARKETS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADEVIEW MARKETS latest industry rating score is 2.42, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.42 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.