Is Yorker Capital Markets safe?

Pros

Cons

Is Yorker Capital Markets A Scam?

Introduction

Yorker Capital Markets is a relatively new player in the forex trading arena, having been established in 2023. Operating primarily from the United Arab Emirates, the broker positions itself as a comprehensive trading platform offering a variety of financial instruments, including forex, cryptocurrencies, commodities, and indices. However, the emergence of numerous brokers in the forex market necessitates a cautious approach for traders. Many brokers operate without appropriate regulatory oversight, which can lead to financial losses for unsuspecting investors. Therefore, it is crucial for traders to conduct thorough due diligence before engaging with any broker.

This article aims to provide a balanced and comprehensive evaluation of Yorker Capital Markets, examining its regulatory status, company background, trading conditions, customer experience, and overall risk profile. The analysis is based on a review of multiple sources, including user feedback, regulatory information, and expert assessments, to offer a well-rounded perspective on whether this broker is a safe option for traders or if it poses potential risks.

Regulation and Legitimacy

The regulatory environment in which a broker operates is a critical factor in assessing its legitimacy and safety. Yorker Capital Markets claims to be regulated by the Mwali International Services Authority (MISA) in Comoros. This regulatory body, however, is often viewed as less stringent compared to major financial regulators like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Mwali International Services Authority (MISA) | T2023326 | Comoros | Verified, but considered weak |

While the presence of a license suggests some level of oversight, the quality of regulation is paramount. Offshore regulations, such as those from MISA, often lack the rigorous standards and investor protections found in more reputable jurisdictions. Additionally, no significant negative regulatory disclosures were found during the evaluation period, which may indicate that the broker has not faced any major compliance issues to date. However, the lack of a robust regulatory framework raises concerns about the potential for mismanagement or fraudulent practices.

Company Background Investigation

Yorker Capital Markets was founded in 2023, positioning itself as a modern brokerage aimed at providing a diverse range of trading options. The company's ownership structure and management team are not extensively detailed in public records, which can be a red flag for potential investors. Transparency regarding ownership and management is essential for establishing trust, and a lack of information can lead to skepticism about the broker's intentions.

The management teams professional experience is also a crucial factor. A well-qualified team with a proven track record in the financial industry can enhance a broker's credibility. However, the absence of detailed bios or backgrounds for key personnel in Yorker Capital Markets limits the ability to fully assess their expertise and reliability.

Overall, while the company is relatively new and presents itself as a legitimate broker, the lack of transparency regarding its management and ownership structure warrants caution.

Trading Conditions Analysis

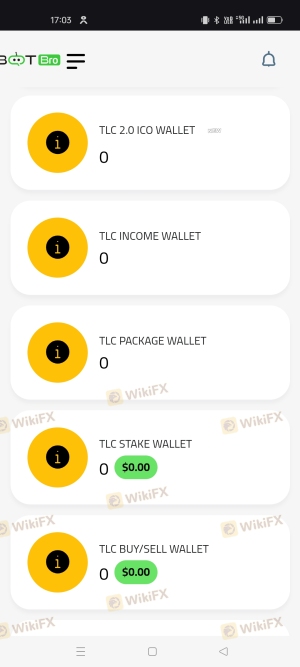

When evaluating a broker, understanding the trading conditions it offers is essential for determining overall cost-effectiveness and user experience. Yorker Capital Markets provides various account types, each with distinct features and fee structures.

Trading Costs Comparison Table

| Cost Type | Yorker Capital Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 1.0 to 1.5 pips | 1.0 to 2.0 pips |

| Commission Model | Zero commission | Varies (often 0.1% to 0.5%) |

| Overnight Interest Range | Varies by account type | Varies widely |

The broker's spreads are competitive, particularly for major currency pairs, with some accounts offering spreads as low as 1.0 pips. However, the promise of zero commissions may raise questions, as many brokers incorporate hidden fees elsewhere, such as in the spread or overnight financing costs.

Moreover, the minimum deposit requirement for opening a trading account is as low as $10, which may appeal to beginner traders. However, this low barrier to entry can also attract less experienced traders who may not fully understand the risks involved.

Client Funds Security

The security of client funds is paramount in the forex trading landscape. Yorker Capital Markets claims to implement measures to protect client funds, including segregated accounts and investor protection policies. However, the specifics of these measures are not clearly outlined, making it challenging to gauge their effectiveness.

Isolating client funds from the broker's operational funds is crucial for safeguarding against insolvency risks. Additionally, the absence of a clear negative balance protection policy raises concerns, as traders could potentially lose more than their initial deposits in volatile market conditions.

Historically, there have been no reported incidents of significant fund security issues with Yorker Capital Markets, but the lack of comprehensive transparency makes it essential for potential clients to approach with caution.

Customer Experience and Complaints

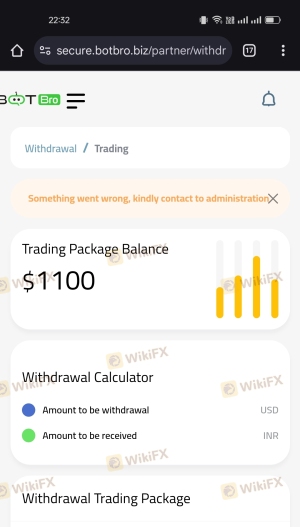

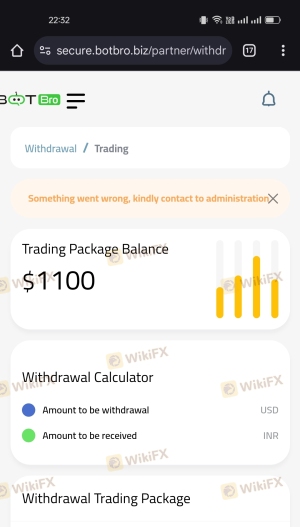

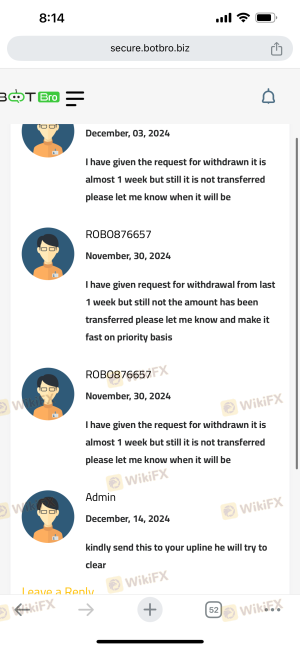

Customer feedback is a vital indicator of a broker's reliability and service quality. Reviews of Yorker Capital Markets reveal a mixed bag of experiences, with some users praising the platform's ease of use and customer service, while others report significant issues, particularly regarding withdrawals.

Complaints Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal delays | High | Slow response |

| Unresponsive customer support | Medium | Average response |

| Misleading marketing | High | No clear response |

Common complaints include difficulties in withdrawing funds and slow customer support responses. Users have reported delays in processing withdrawal requests, which can be a significant red flag for potential scams.

A notable case involved a user who attempted to withdraw funds but faced multiple delays and unresponsive support, leading to frustration and allegations of fraud. Such complaints highlight the importance of reliable customer support and prompt withdrawal processing, which can significantly impact a trader's experience.

Platform and Execution Quality

The trading platform's performance is another critical aspect of a broker's offering. Yorker Capital Markets utilizes the MetaTrader 5 (MT5) platform, known for its advanced features and user-friendly interface. However, the overall stability and execution quality of the platform are essential for a positive trading experience.

Users have reported satisfactory execution speeds with minimal slippage, which is a positive indicator. However, any signs of platform manipulation or technical glitches could severely impact traders' ability to execute trades effectively.

Risk Assessment

Using Yorker Capital Markets comes with inherent risks that potential traders should consider. While the broker offers competitive trading conditions, the offshore regulatory environment raises concerns about the overall safety and reliability of trading with them.

Risk Scorecard

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Offshore regulation lacks robustness. |

| Withdrawal Risk | Medium | Complaints about delays and unresponsive support. |

| Operational Risk | Medium | Limited transparency on management and ownership. |

To mitigate these risks, traders should engage in thorough research, consider using smaller amounts for initial trading, and maintain a diversified portfolio to reduce exposure to any single broker.

Conclusion and Recommendations

In summary, while Yorker Capital Markets presents itself as a legitimate forex broker with various trading options, several red flags warrant caution. The offshore regulatory status, limited transparency regarding management, and mixed customer feedback raise concerns about the overall safety and reliability of the broker.

Traders are advised to proceed with caution, particularly if they are inexperienced or risk-averse. It may be prudent to explore alternatives that are regulated by more reputable authorities, such as brokers operating under FCA or ASIC oversight.

For those still considering Yorker Capital Markets, it is recommended to start with a small investment and closely monitor the trading experience, particularly regarding withdrawal processes and customer support responsiveness.

Is Yorker Capital Markets a scam, or is it legit?

The latest exposure and evaluation content of Yorker Capital Markets brokers.

Yorker Capital Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Yorker Capital Markets latest industry rating score is 1.38, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.38 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.