eOption 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

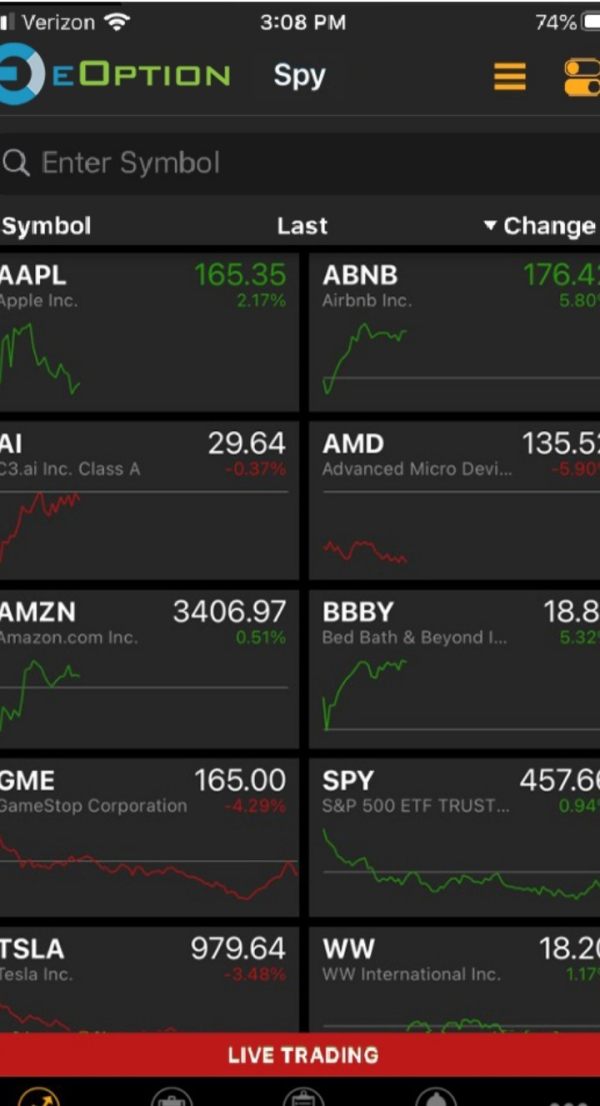

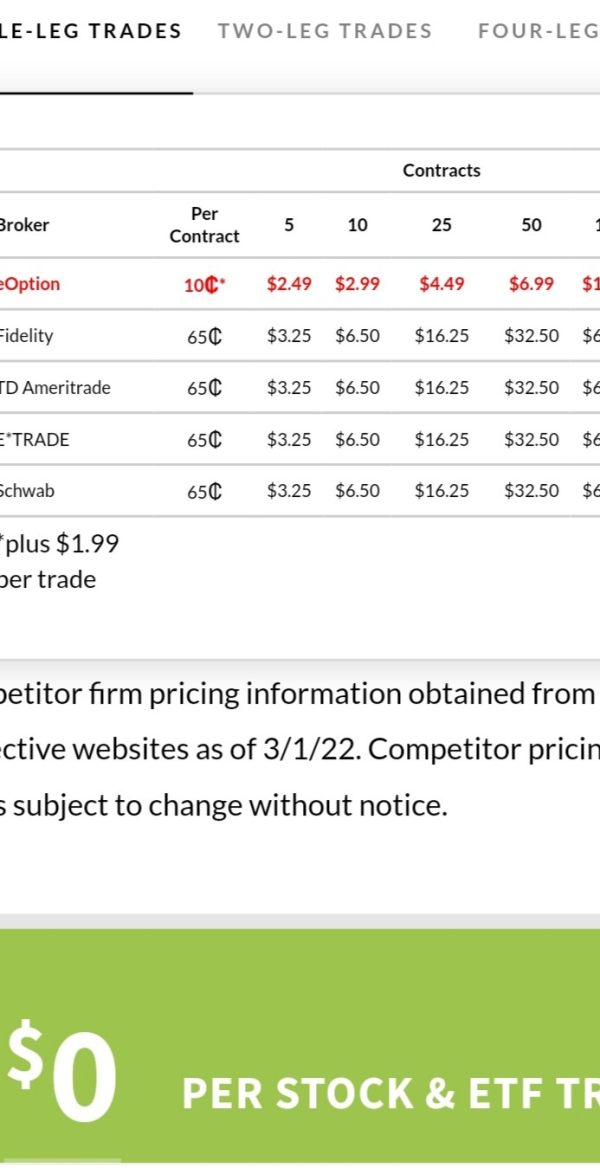

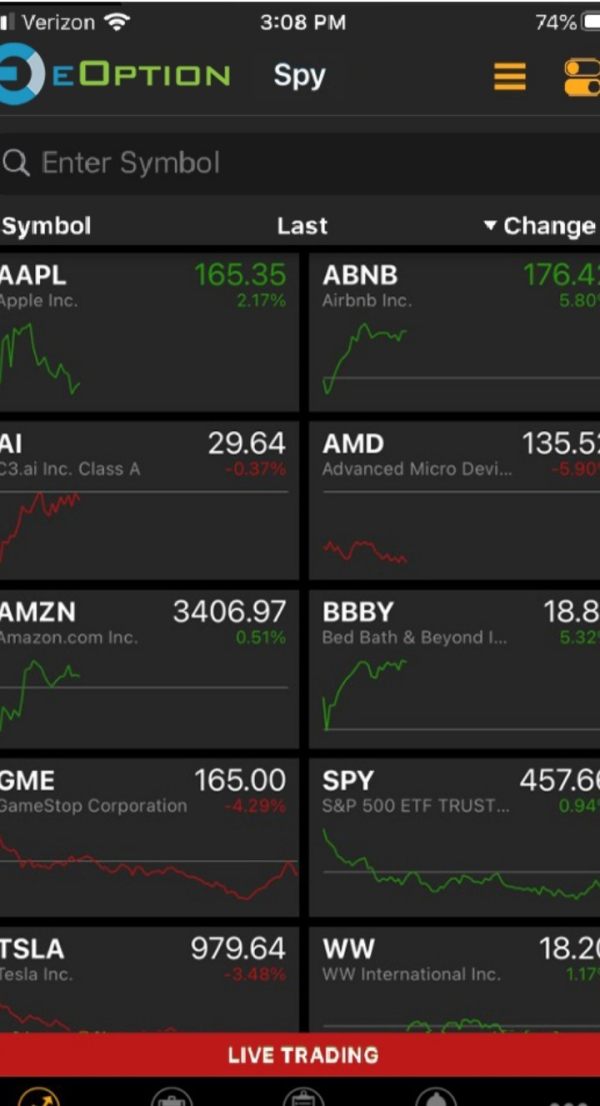

eOption is a prominent low-cost online brokerage that has been operational since 2007. It is primarily focused on options trading and has positioned itself as a favorable platform for experienced traders looking for competitive commissions. One of its major strengths is its low trading fees, which significantly appeal to active traders. For options trading, for instance, eOption charges as low as $0.10 per contract plus a $1.99 fee per trade. Additionally, U.S. residents can open cash trading accounts without a minimum deposit requirement, adding to its appeal.

However, the broker has notable weaknesses. A lack of robust customer support and minimal educational resources can be challenging for novice traders. Furthermore, the unregulated status raises concerns about the safety of funds, particularly for inexperienced investors. As such, while eOption provides excellent trading conditions, it is essential for prospective clients to weigh these against the associated risks, especially those new to trading.

⚠️ Important Risk Advisory & Verification Steps

Important Risk Advisory:

- Regulatory Oversight: eOption operates without supervision from a regulatory authority, potentially increasing the risks associated with fund safety.

- Withdrawal Issues: Many users report complications regarding fund withdrawals, which can affect the overall trading experience.

- Limited Educational Resources: Inexperienced traders might find the lack of comprehensive educational content leaves them ill-equipped to navigate the trading environment.

Steps for Self-Verification:

- Verify Regulatory Status:

- Check reputable regulatory websites, such as FINRA or SIPC.

- Refer to User Reviews:

- Utilize platforms like Trustpilot or ForexPeaceArmy to gather insights from current eOption users.

- Conduct Award Searches:

- Investigate whether eOption has received any accolades or recognitions that validate its credibility.

- Financial Health Assessment:

- Review financial reports and external audits, if available, to gauge the brokers stability.

Rating Framework

Here's a succinct evaluation of eOption, rated across six categories:

Broker Overview

Company Background and Positioning

Founded in 2007, eOption is headquartered in Glenview, Illinois. As a division of Regal Securities, Inc., the company operates as a member of both FINRA and SIPC. With a focus on cost-effective options trading, eOption has built a reputation for catering to active traders and those looking for low commission rates. The organization claims to have established itself as a reliable option for traders seeking a platform that minimizes transaction costs.

Core Business Overview

eOption specializes chiefly in options trading while offering a limited suite of other investment options, such as stocks, ETFs, and bonds. The broker's claimed regulatory affiliations include membership in the Financial Industry Regulatory Authority (FINRA) and affiliation with the Securities Investor Protection Corporation (SIPC), although concerns remain about the lack of comprehensive regulatory oversight. The broker promotes this regulatory affiliation as a measure of client fund protection up to $500,000 with additional coverage through third-party insurance.

Quick-Look Details Table

In-Depth Analysis

1. Trustworthiness Analysis

Teaching users to manage uncertainty.

Analysis of Regulatory Information Conflicts:

The lack of regulatory oversight raises crucial concerns regarding fund safety. eOption has been criticized for its unregulated status, leading to trust issues among potential clients. Most reputable brokers are backed by significant regulatory agencies, which require them to have stringent financial transparency and consumer protection rules in place.

User Self-Verification Guide:

- Visit regulatory websites like FINRA or SIPC.

- Search for “eOption” in the broker directory to check its regulatory affiliation.

- Look for any warnings or complaints posted against eOption on regulatory sites.

Industry Reputation and Summary:

Reviews on eOption are mixed, with many users praising its trading fees but highlighting withdrawal complications and non-responsiveness from customer support. As one user stated, “Withdrawals are made according to the regulations, but there's recent confusion and delays reported,” hinting at the ongoing operational issues users might face.

2. Trading Costs Analysis

The double-edged sword effect.

Advantages in Commissions:

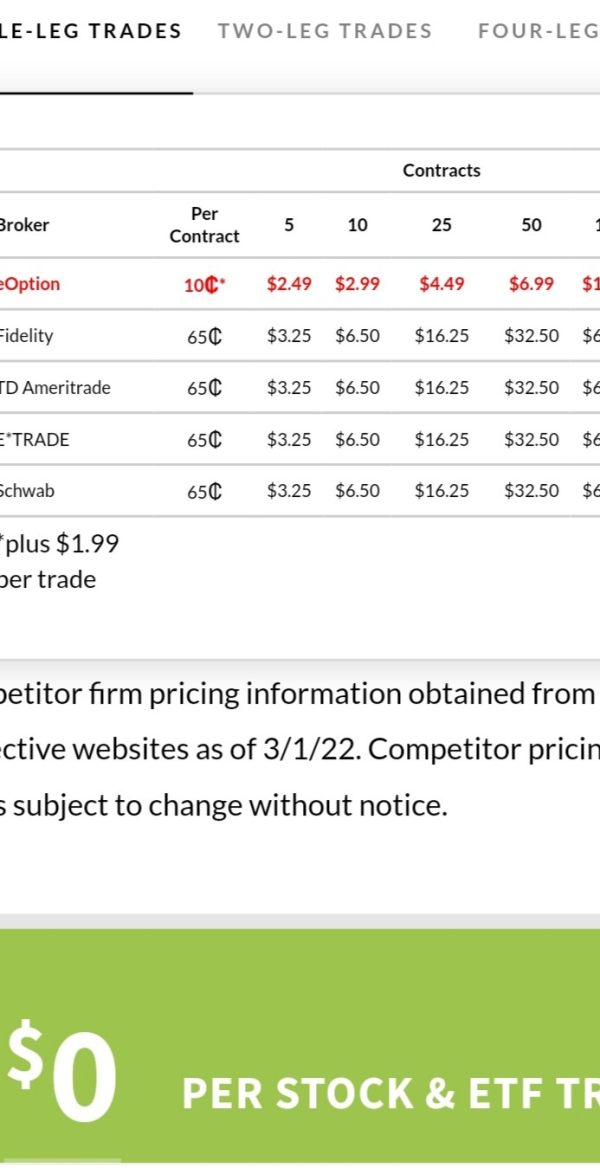

eOption is often lauded for its simplistic commission structure. For options, the brokerage charges a modest $0.10 per contract plus $1.99 per trade, rendering it competitive compared to other platforms.

The "Traps" of Non-Trading Fees:

Hidden fees are a significant drawback. For instance, the withdrawal fees are set at $30 for wire transfers, and there are reported inactivity fees of $50 per year when accounts show no trading activity. User feedback describes situations where unexpected costs arose, with one stating, "You may save on commissions only to face withdrawal and inactivity fees that stack up."

Cost Structure Summary:

Traders must weigh the advantages of low commissions against the backdrop of potential withdrawal and inactivity costs that could negate the savings from trading.

Professional depth vs. beginner-friendliness.

Platform Diversity:

eOption leverages several platforms, including its proprietary web-based access and third-party platforms such as Sterling Trader Pro and DAS. However, some users find these platforms lack certain advanced features present in more robust competitors.

Quality of Tools and Resources:

Users report that while the basic functionalities meet their needs, eOption falls short on advanced analytics and tools, especially for traders focused on multi-leg strategies.

Platform Experience Summary:

Overall user satisfaction leans towards the average; many express a desire for more substantial training resources and advanced trading tools, with one user remarking, "It's a great basic platform, but lacks the analytical depth for serious options trading."

Final Thoughts

eOption presents a mixed offering for prospective traders. The low trading fees and solid platform performance make it appealing for active traders. However, the unregulated environment and reported issues surrounding customer service and withdrawals present substantial risks—particularly for those new to trading.

For active U.S. traders primarily interested in options trading, eOption might align well with their needs. Conversely, novice traders or those requiring more comprehensive support and education may find more value in a different broker that offers robust educational tools and better customer service. As with all trading endeavors, comprehensive research and risk assessment remain vital.

Your capital is at risk. Always consider your investment objectives, level of experience, and risk appetite before trading.