Populus 2025 Review: Everything You Need to Know

Executive Summary

This populus review shows mixed results for Populus Financial Group's operations and user satisfaction. User feedback about Populus Financial Group is mostly negative, with main concerns about pay structures, limited benefits packages, and poor support systems. The company works in financial services and offers short-term loans, card services, check cashing, money transfers, and bill payment solutions.

Key features from user experiences include no profit-sharing and no full benefits packages. Many users feel disappointed with the support they get, especially after their contracts end. The company targets customers who need short-term financial help and banking alternatives.

Populus Financial Group offers many financial products and services but faces big problems with user satisfaction and keeping employees. Poor pay packages and limited growth opportunities have led to negative user experiences in many areas.

Important Notice

Users should know that experiences with Populus Financial Group can be very different across regions because of different rules and operations. Since specific rule information was not detailed in available materials, potential clients should check local compliance and operational standards in their areas.

This review is based on detailed analysis of user feedback, available company information, and industry standard assessment criteria. The review method uses multiple data points to give an objective assessment of the company's services and user experience quality.

Rating Framework

Company Overview

Populus Financial Group works as a financial services provider that specializes in accessible banking alternatives and short-term lending solutions. The company has positioned itself to serve customers who need immediate financial services, including short-term loans, various card services, check cashing facilities, money transfer services, and bill payment processing. While specific founding details were not available in source materials, the company has built a presence in the competitive financial services marketplace.

The business model mainly focuses on providing financial products and services to customers who may have limited access to traditional banking services. This positioning suggests a focus on underserved market segments requiring alternative financial solutions. However, the company's operational approach has created mixed responses from both customers and employees.

Available information shows that Populus Financial Group operates without comprehensive regulatory oversight details being publicly accessible. The company's service portfolio suggests a focus on immediate financial needs rather than long-term investment or wealth management services. This populus review finds that while the company offers multiple service categories, the execution and customer satisfaction levels need significant improvement.

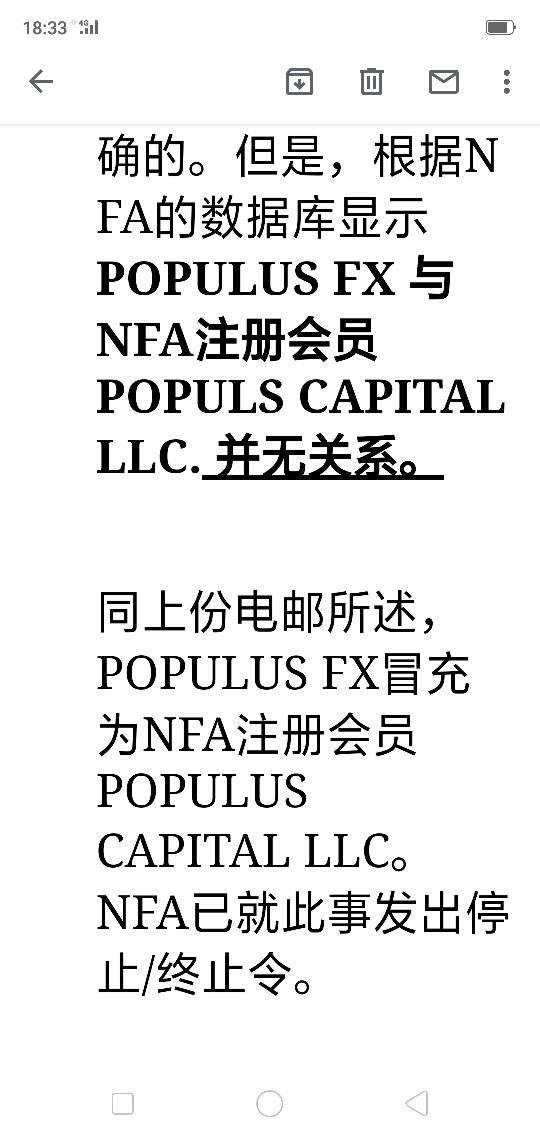

Regulatory Oversight: Specific regulatory authority information was not detailed in available source materials, which raises questions about transparency and compliance standards across different operational jurisdictions.

Payment Methods: Deposit and withdrawal options were not specifically outlined in available documentation, requiring potential customers to contact the company directly for payment processing information.

Minimum Deposit Requirements: Specific minimum deposit amounts were not disclosed in publicly available materials, indicating a need for direct customer inquiry to determine account opening requirements.

Promotional Offers: Information about bonus structures or promotional campaigns was not available in source documentation, suggesting limited marketing incentive programs.

Available Assets: Specific tradeable assets or investment options were not detailed in available materials, focusing primarily on basic financial services rather than investment opportunities.

Cost Structure: Detailed fee schedules and cost breakdowns were not provided in accessible documentation, requiring direct customer contact for pricing information.

Leverage Options: Leverage ratios and margin requirements were not specified in available materials, indicating these services may not be primary offerings.

Platform Options: Specific trading platform details were not available in source materials, suggesting limited technological infrastructure for investment activities.

Geographic Restrictions: Service availability limitations were not clearly outlined in accessible documentation.

Customer Service Languages: Supported languages for customer service were not specified in available materials.

This populus review identifies significant information gaps that potential customers should address through direct company contact before engaging services.

Detailed Rating Analysis

Account Conditions Analysis (4/10)

The account conditions offered by Populus Financial Group present several areas of concern for potential users. Available information suggests limited transparency about account types, opening requirements, and ongoing maintenance conditions. The absence of detailed account specification information in publicly accessible materials indicates potential challenges for customers seeking to understand service terms before commitment.

Minimum deposit requirements remain unclear, with no specific amounts disclosed in available documentation. This lack of transparency creates uncertainty for potential customers trying to budget for service initiation. The account opening process details were not adequately described in source materials, suggesting potential complications during onboarding procedures.

User feedback shows dissatisfaction with overall account management and support structures. The absence of special account features or accommodations for specific customer needs further limits the attractiveness of account offerings. Without clear information about account benefits, fee structures, or special features, customers face uncertainty about the value proposition of establishing accounts with Populus Financial Group.

This populus review finds that the lack of transparent account condition information significantly impacts the overall user experience and decision-making process for potential customers.

The tools and resources available through Populus Financial Group appear limited based on available information. Specific details about technological tools, analytical resources, or customer support materials were not adequately documented in accessible sources. This suggests a basic service approach focused on fundamental financial transactions rather than comprehensive resource provision.

Educational resources and training materials were not mentioned in available documentation, indicating limited support for customer financial literacy development. The absence of research and analysis tools suggests that customers seeking comprehensive financial planning support may need to look elsewhere for these services.

Automation features and advanced technological capabilities were not detailed in source materials, suggesting a traditional approach to service delivery. Without modern digital tools and resources, customers may experience limitations in service efficiency and convenience compared to more technologically advanced competitors.

The lack of comprehensive tool and resource information creates uncertainty about the company's technological capabilities and commitment to customer empowerment through education and advanced service features.

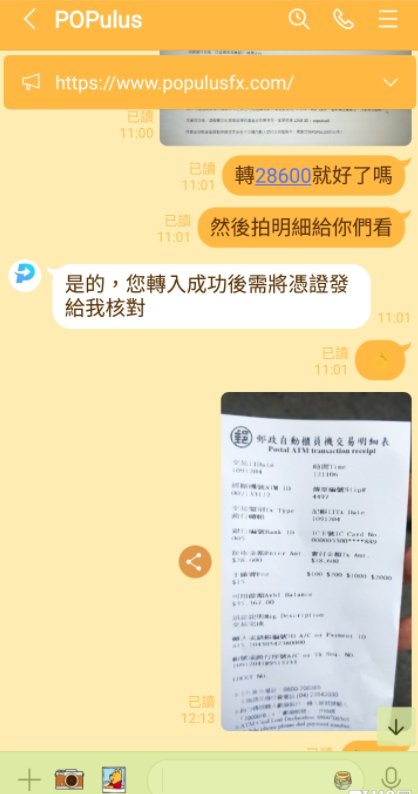

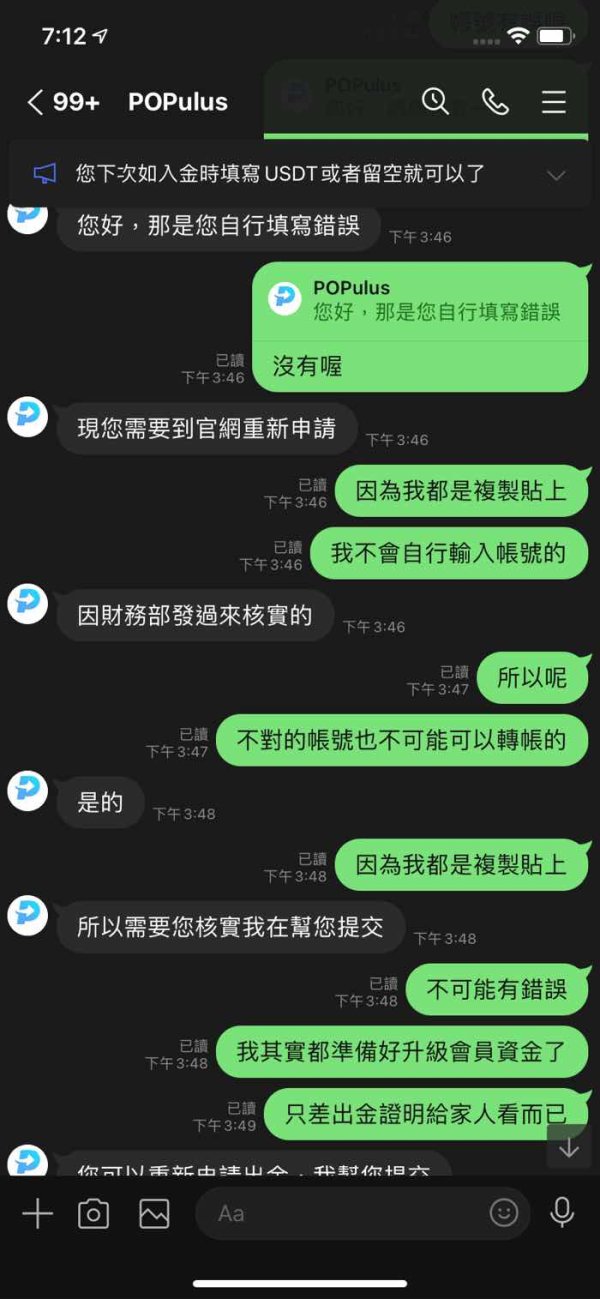

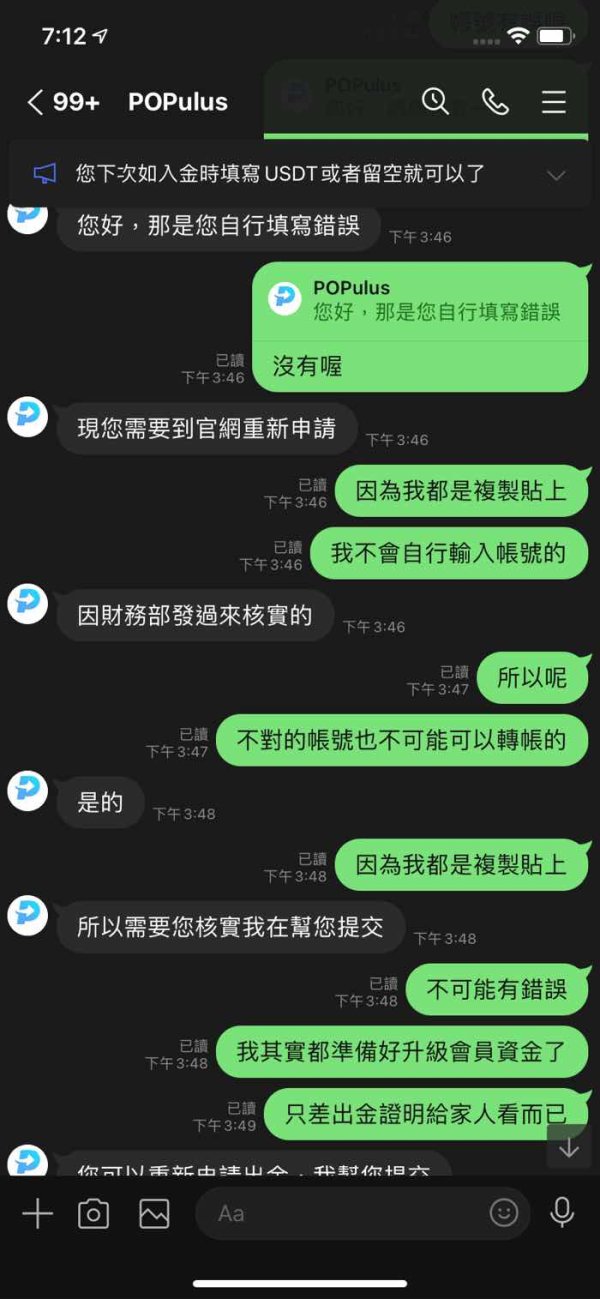

Customer Service and Support Analysis (2/10)

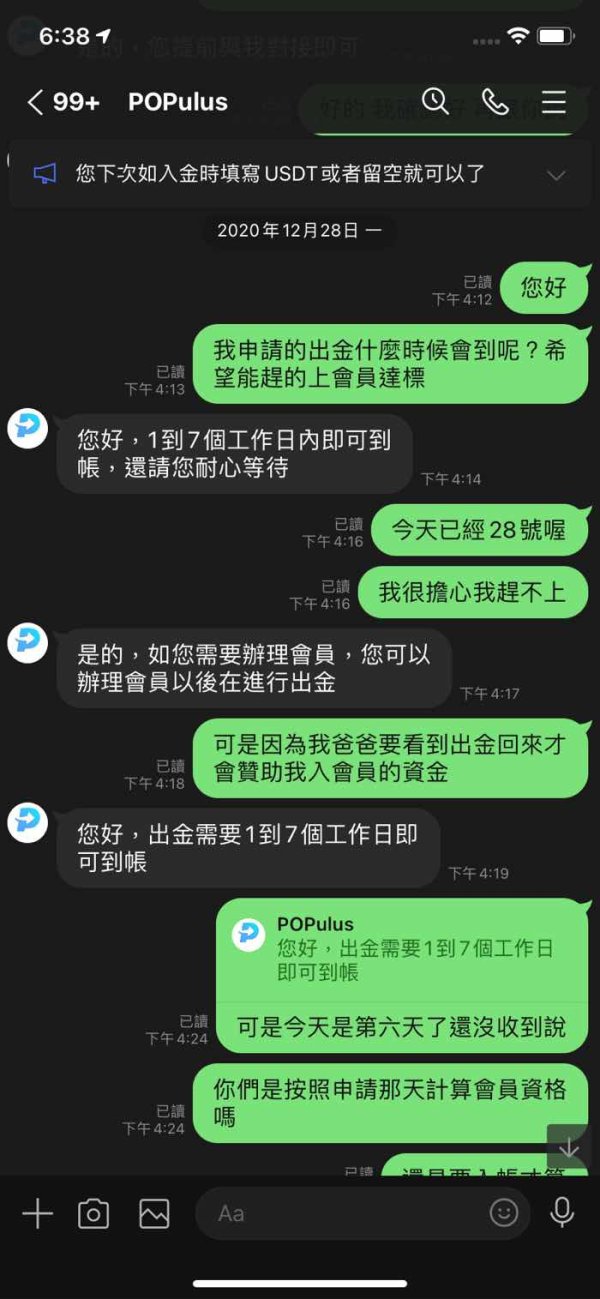

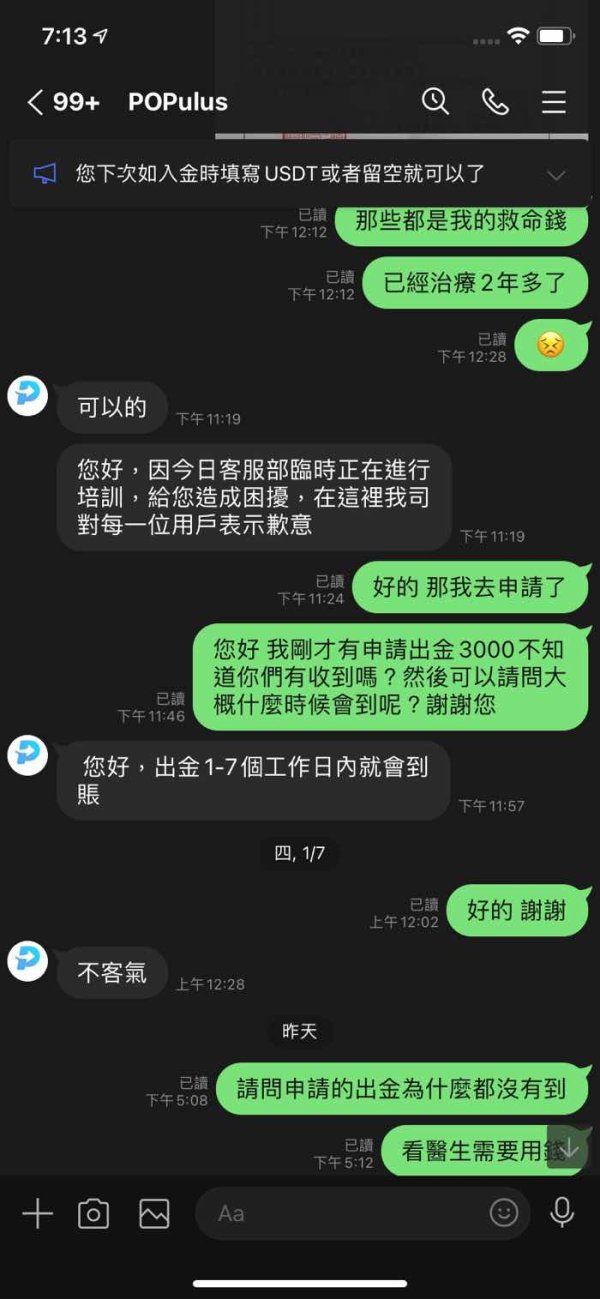

Customer service and support represent significant weakness areas for Populus Financial Group based on available user feedback. Multiple users have expressed disappointment with support levels, particularly about post-contract assistance and ongoing customer care quality. The absence of detailed customer service channel information suggests limited accessibility options for customers requiring assistance.

Response time performance appears problematic based on user complaints about insufficient support. Service quality concerns emerge consistently in user feedback, indicating systemic issues with customer care delivery. The lack of multi-language support information suggests potential limitations for diverse customer populations requiring assistance in various languages.

Customer service availability hours were not specified in available materials, creating uncertainty about when customers can access support services. Problem resolution capabilities appear limited based on user experiences, with many expressing frustration about unresolved issues and inadequate follow-up support.

The overall customer service experience appears to fall significantly below industry standards, with users consistently reporting negative experiences and insufficient support quality across multiple service touchpoints.

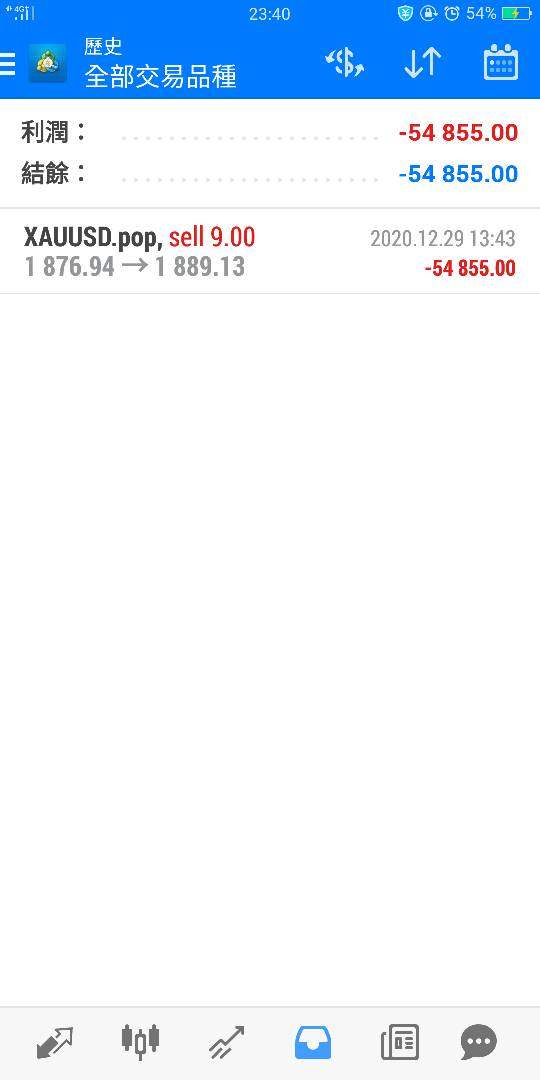

Trading Experience Analysis (3/10)

The trading experience offered by Populus Financial Group appears limited based on available information. Platform stability and execution speed details were not provided in accessible documentation, suggesting that advanced trading capabilities may not be primary service offerings. The company's focus appears to center on basic financial services rather than sophisticated trading environments.

Order execution quality information was not available in source materials, indicating potential limitations for customers seeking advanced trading capabilities. Platform functionality appears basic, with no detailed information about advanced trading features or analytical tools available to users.

Mobile platform experience details were not documented in available sources, suggesting potential limitations in modern digital trading accessibility. The overall trading environment appears focused on basic financial transactions rather than comprehensive investment and trading services.

This populus review indicates that customers seeking advanced trading experiences and sophisticated investment tools may find Populus Financial Group's offerings insufficient for their needs, with the company appearing to focus on fundamental financial services rather than comprehensive trading solutions.

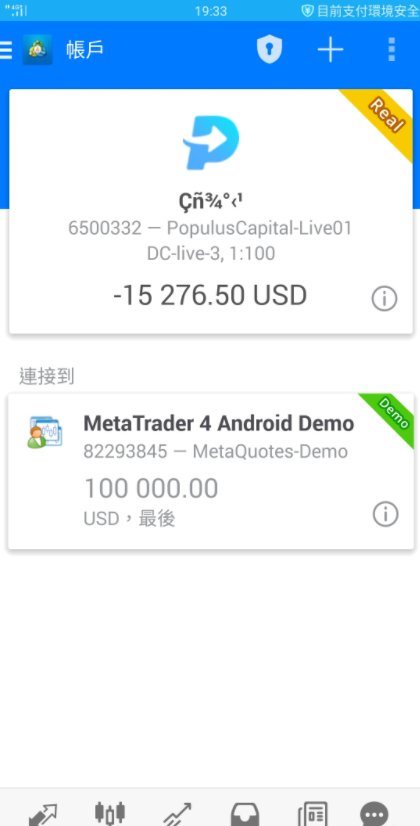

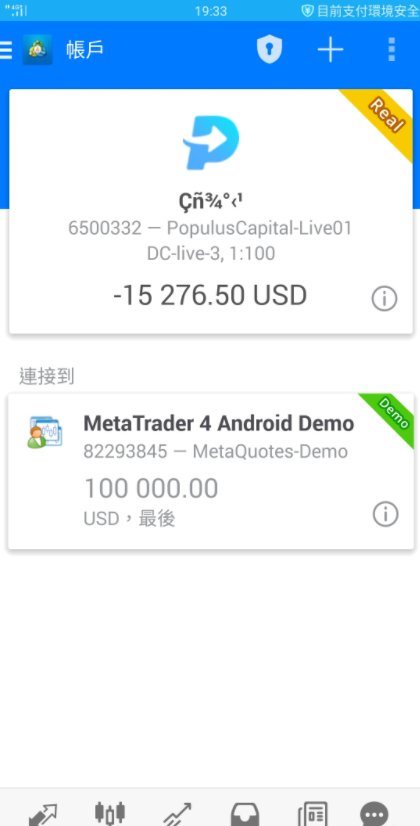

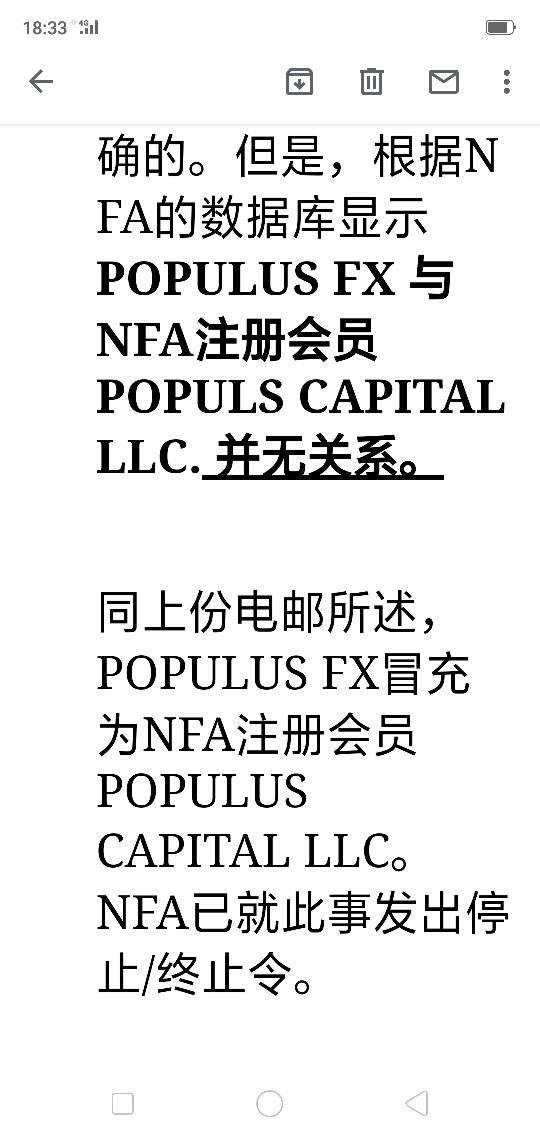

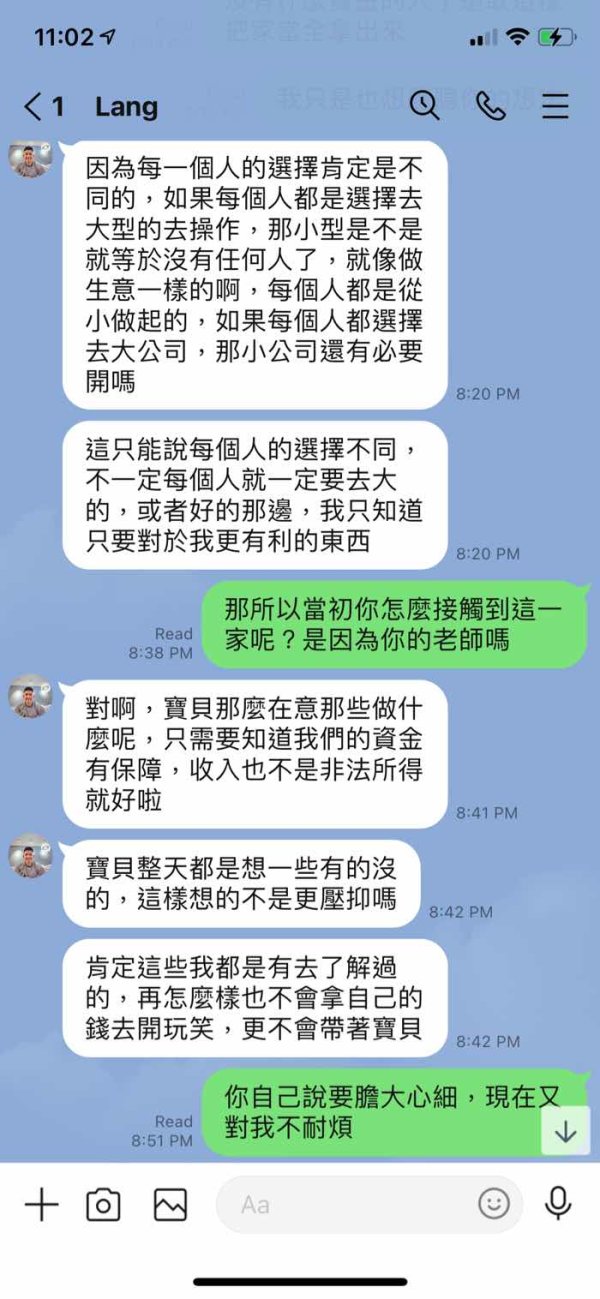

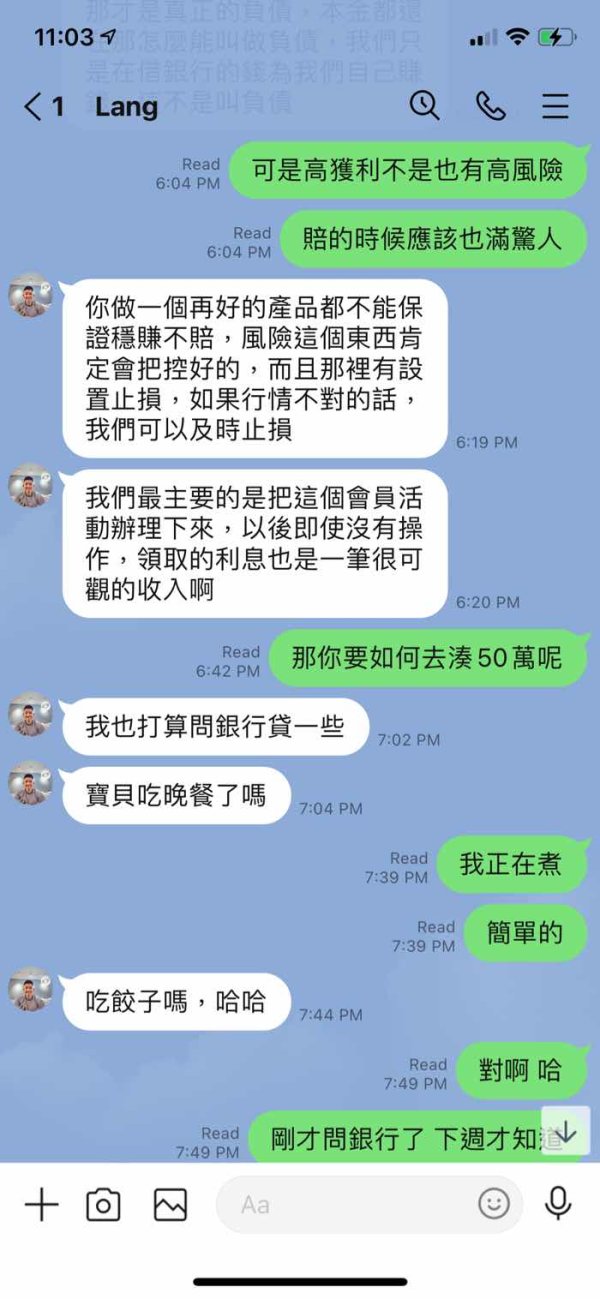

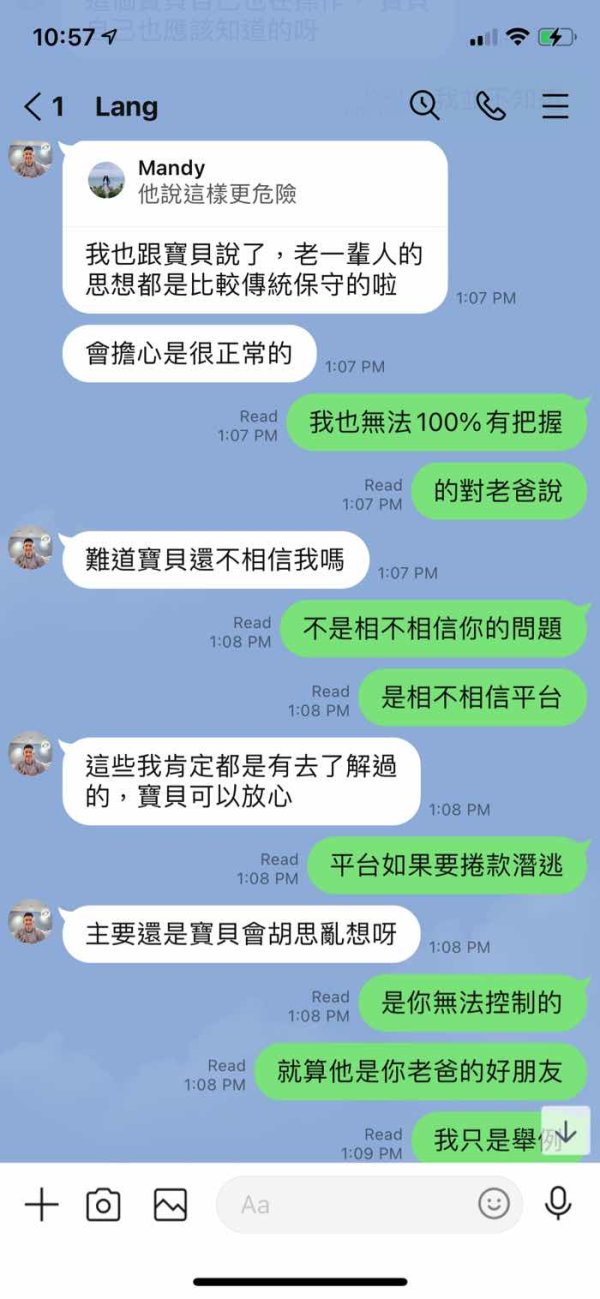

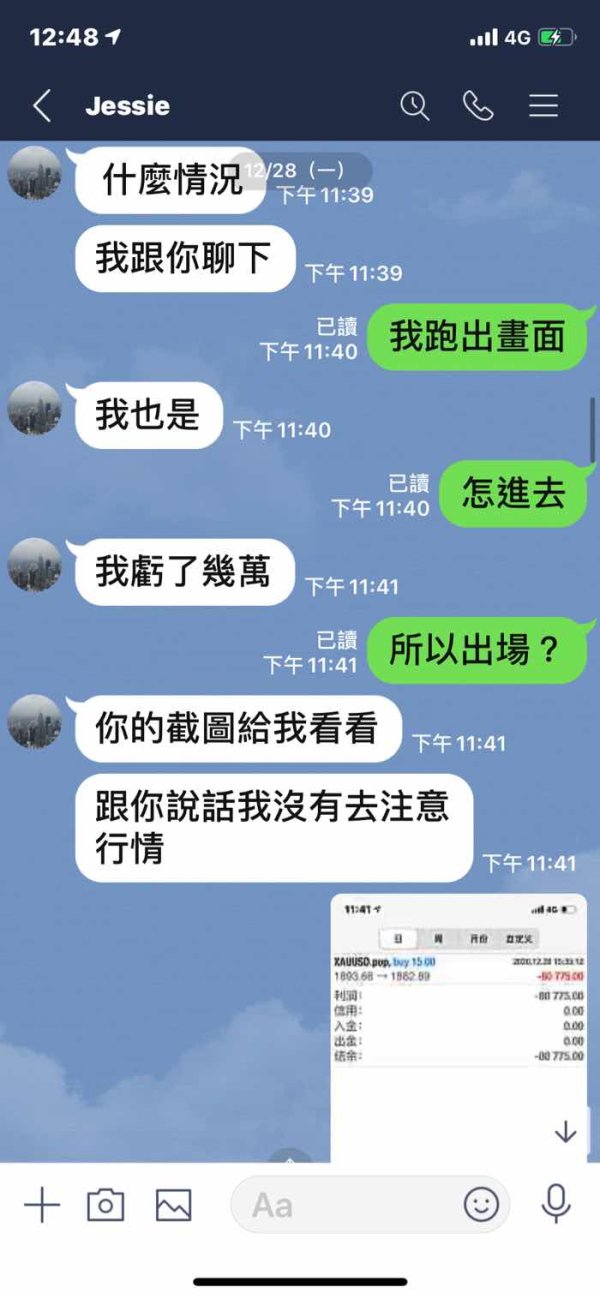

Trust and Reliability Analysis (2/10)

Trust and reliability concerns emerge as significant issues for Populus Financial Group based on available information. The absence of detailed regulatory authority information in accessible documentation raises questions about oversight and compliance standards. Without clear regulatory backing, customers may have concerns about fund security and operational oversight.

Fund security measures were not detailed in available materials, creating uncertainty about customer asset protection protocols. Company transparency appears limited, with significant information gaps in publicly accessible documentation about operational procedures, regulatory compliance, and security measures.

Industry reputation information was not available in source materials, making it difficult to assess the company's standing within the broader financial services sector. The handling of negative events or customer complaints appears problematic based on user feedback indicating unresolved issues and inadequate support responses.

The lack of third-party regulatory verification and limited transparency about operational standards contribute to reduced trust levels. Users seeking high-security, well-regulated financial services may find significant concerns with Populus Financial Group's trust and reliability profile.

User Experience Analysis (3/10)

Overall user satisfaction with Populus Financial Group appears notably poor based on available feedback. Users consistently report negative experiences across multiple service areas, including compensation, benefits, and ongoing support quality. The absence of detailed interface design and usability information suggests limited focus on user experience optimization.

Registration and verification process details were not adequately documented in available sources, potentially indicating complications during customer onboarding. Fund operation experiences appear problematic based on user feedback about insufficient support and limited service quality.

Common user complaints center around low compensation, lack of benefits, and inadequate support systems. These consistent negative feedback patterns suggest systemic issues with service delivery and customer satisfaction management. The absence of positive user testimonials or satisfaction indicators in available materials reinforces concerns about overall experience quality.

User demographic analysis suggests that the company may not be suitable for customers seeking high-quality service, competitive benefits, or comprehensive support systems. The pattern of negative feedback indicates significant room for improvement across multiple user experience dimensions.

Conclusion

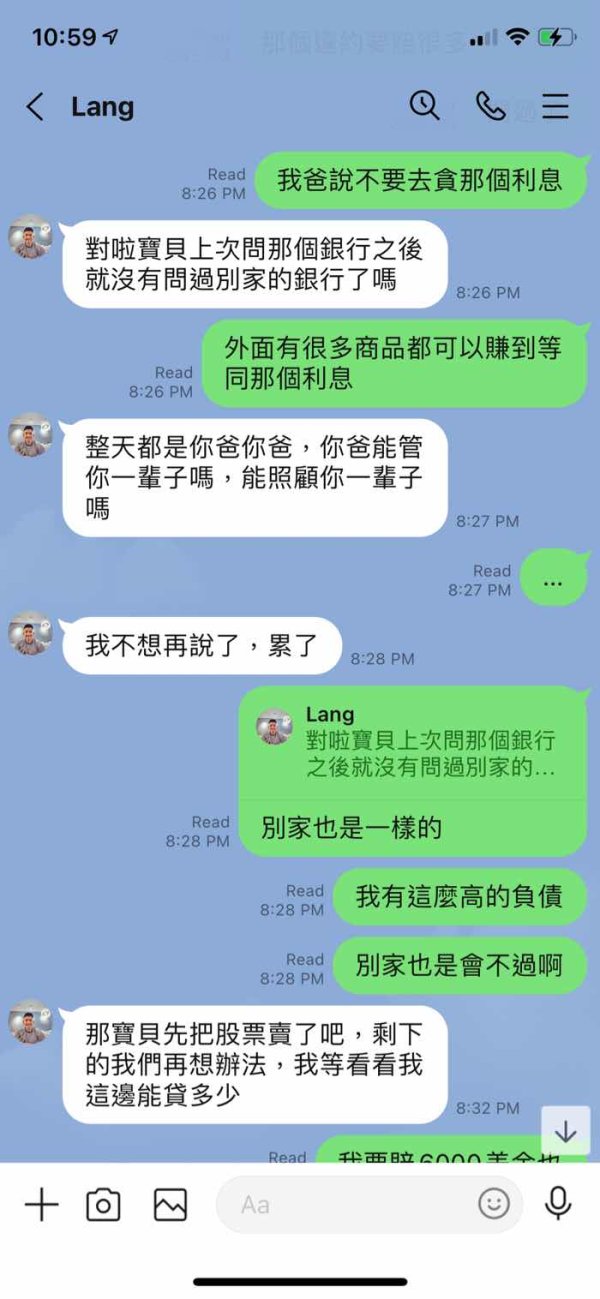

This comprehensive populus review reveals significant challenges with Populus Financial Group's service delivery and customer satisfaction levels. Overall assessment indicates that user feedback remains mostly negative, with particular concerns about inadequate support systems, limited benefits packages, and poor compensation structures. The company's focus on basic financial services appears insufficient to meet modern customer expectations for comprehensive service quality.

The analysis suggests that Populus Financial Group may not be suitable for users seeking high-quality customer service, competitive compensation packages, or comprehensive support systems. The consistent pattern of negative user feedback across multiple service areas indicates systemic issues requiring significant operational improvements.

Primary advantages include the company's range of financial service offerings, while significant disadvantages include poor customer support, limited transparency, inadequate compensation structures, and insufficient user satisfaction levels. Potential customers should carefully consider these factors before engaging with Populus Financial Group's services.