Is eOption safe?

Pros

Cons

Is eOption Safe or a Scam?

Introduction

eOption, established in 2007, is a division of Regal Securities, Inc., operating as an online brokerage that primarily focuses on low-cost options trading. Known for its competitive pricing structure, eOption aims to cater to active traders who seek cost-effective trading solutions. However, with the proliferation of online trading platforms, it is crucial for traders to carefully evaluate the trustworthiness and reliability of their chosen broker. This article will investigate whether eOption is safe for traders or if it raises concerns about potential scams. Our analysis is based on a thorough review of regulatory status, company background, trading conditions, customer experiences, and security measures.

Regulation and Legitimacy

The regulation of a brokerage firm is paramount in assessing its safety and reliability. eOption operates under the oversight of the Financial Industry Regulatory Authority (FINRA) and is a member of the Securities Investor Protection Corporation (SIPC). These regulatory bodies are designed to protect investors and ensure fair practices within the financial markets.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINRA | 7297 | United States | Verified |

| SIPC | N/A | United States | Verified |

The presence of FINRA oversight indicates a level of compliance with industry standards, while SIPC membership provides an additional layer of security, covering customer accounts up to $500,000, with a cash limit of $250,000. However, it is essential to note that SIPC does not protect against losses from market fluctuations. Historically, eOption has maintained its regulatory compliance, but potential clients should remain vigilant and conduct their due diligence before engaging with the platform.

Company Background Investigation

eOption is part of Regal Securities, Inc., which has been in operation since 1977. The parent company has a long-standing history in the brokerage industry, which lends credibility to eOption. The management team at eOption comprises professionals with significant experience in financial services, enhancing the firm's operational integrity.

However, transparency regarding the ownership structure and detailed backgrounds of the management team is somewhat limited. While the company provides basic information, further disclosures about its leadership could improve trust among potential clients. Overall, eOption's established history in the market and its affiliation with Regal Securities suggest a level of reliability, but the lack of comprehensive information on management could be a concern for some investors.

Trading Conditions Analysis

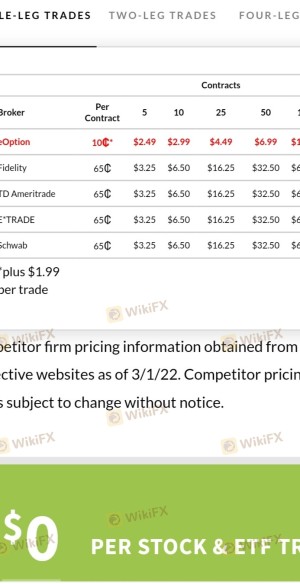

eOption offers a competitive fee structure that primarily focuses on options trading. The brokerage charges a base commission of $1.99 per trade, with an additional fee of $0.10 per options contract. This pricing is significantly lower than many competitors, making it appealing for active traders. However, the overall cost structure also includes various other fees that could impact profitability.

| Fee Type | eOption | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.5 pips |

| Commission Model | $1.99 + $0.10/contract | $6.95 + $0.65/contract |

| Overnight Interest Range | 7% - 10% | 5% - 8% |

While eOption's commission rates are attractive, traders should be wary of the $50 inactivity fee and the $15 annual fee for IRAs. These additional charges could accumulate, especially for traders who may not execute frequent trades. Thus, while eOption is generally cost-effective for active traders, those who trade less frequently may find themselves facing higher costs than anticipated.

Client Funds Safety

The safety of client funds is a critical aspect of evaluating any brokerage. eOption employs several measures to protect client assets, including segregating client funds from its operational funds and maintaining SIPC insurance coverage. In addition, the clearing firm, Hilltop Securities, Inc., provides excess SIPC insurance, which covers net equity in customer accounts up to $150 million.

Despite these protections, potential clients should be aware of the risks associated with trading, including the possibility of loss due to market fluctuations. eOption has not reported any significant security breaches or issues regarding client fund safety. However, it is advisable for traders to remain informed and vigilant regarding their investments, as no system is entirely foolproof.

Customer Experience and Complaints

Customer feedback is a valuable source of information when assessing the reliability of a brokerage. Reviews of eOption indicate a mixed bag of experiences. Many users appreciate the low fees and ease of use of the trading platform, while others have raised concerns about customer service and technical issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Delayed Withdrawals | High | Slow Response |

| Platform Stability | Medium | Acknowledged |

| Customer Service Issues | High | Inconsistent |

For instance, some users have reported significant delays in fund withdrawals, which can be frustrating for traders needing immediate access to their funds. Furthermore, complaints regarding the platform's stability highlight the need for improvements in technology and customer support. Overall, while many clients have had positive experiences, the recurring issues indicate areas where eOption could enhance its service.

Platform and Trade Execution

eOption provides a browser-based trading platform known as eOption Trader, which is designed for ease of use and efficiency. The platform supports various order types and offers real-time market data. However, users have reported occasional stability issues and slow execution times, which can impact trading performance.

The order execution quality is generally satisfactory, but instances of slippage and order rejections have been noted, particularly during volatile market conditions. These factors can be detrimental for active traders who rely on precise execution to capitalize on market movements.

Risk Assessment

Engaging with eOption presents several risks that traders should consider. While the low-cost structure is appealing, the potential for technical issues and customer service challenges could pose significant risks to trading success.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | While regulated, historical compliance issues exist. |

| Operational Risk | High | Reports of technical difficulties and slow customer service. |

| Market Risk | High | Standard risk associated with market fluctuations. |

To mitigate these risks, traders should conduct thorough research, maintain a diversified portfolio, and consider using risk management strategies, such as setting stop-loss orders.

Conclusion and Recommendations

In conclusion, eOption appears to be a legitimate brokerage with a focus on low-cost options trading. However, potential clients should remain cautious and consider the mixed reviews regarding customer service and platform stability. While there are no overt signs of fraudulent activity, the presence of recurring complaints warrants a careful approach.

For traders looking for alternatives, firms such as Ally Invest or Charles Schwab offer robust platforms with comprehensive services and support. Ultimately, whether eOption is safe for trading will depend on individual risk tolerance and trading needs. It is essential for traders to weigh the pros and cons before making a decision.

Is eOption a scam, or is it legit?

The latest exposure and evaluation content of eOption brokers.

eOption Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

eOption latest industry rating score is 1.66, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.66 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.