Mead 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive mead review examines a trading platform that offers Meta Trader 4/5 trading capabilities. However, limited information is available about its full range of services. Based on available data from forex platforms, Mead operates as a trading entity using the widely recognized MT4/MT5 platform infrastructure. The broker targets retail and small-scale investors seeking access to established trading platforms.

Our analysis reveals significant information gaps regarding regulatory oversight, account conditions, and comprehensive trading terms. While the platform benefits from the robust MT4/MT5 ecosystem, the lack of transparent regulatory information and detailed service specifications raises questions about overall reliability. This mead review maintains a neutral stance given the limited available data. Traders should exercise caution when considering this platform due to insufficient transparency in key operational areas.

The broker may appeal to users familiar with Meta Trader platforms. However, the absence of clear regulatory credentials and detailed trading conditions suggests it may be better suited for experienced traders who can navigate environments with limited disclosure rather than newcomers to forex trading.

Important Notice

This review is based on publicly available information and market analysis conducted in 2025. Due to the limited information available about this broker, specific details regarding regulatory compliance, account terms, and operational procedures could not be comprehensively verified. Traders should conduct their own due diligence and verify all information directly with the broker before making any trading decisions.

The evaluation methodology employed in this review follows industry-standard assessment criteria. Some sections may reflect incomplete data where specific information was not available in accessible sources.

Rating Framework

Broker Overview

Mead operates within the competitive forex trading landscape. Comprehensive details about its establishment date and corporate history remain limited in publicly accessible sources. According to available information from forex platform listings, the broker offers access to Meta Trader 4 and Meta Trader 5 trading platforms. This positions it within the established MT4/MT5 ecosystem that serves millions of traders worldwide.

The platform focuses on providing trading services through these industry-standard platforms. However, specific details about its business model, whether operating as a market maker, ECN, or STP broker, are not clearly disclosed in available documentation. This lack of transparency regarding operational structure represents a significant consideration for potential traders evaluating the platform.

The broker's integration with Meta Trader platforms suggests it targets traders familiar with these interfaces. This potentially includes both retail and institutional clients. However, without clear information about minimum account sizes, target demographics, or specialized services, the exact positioning within the market remains somewhat unclear. This mead review notes that while MT4/MT5 access provides certain technical advantages, the absence of comprehensive broker-specific information limits our ability to fully assess the platform's competitive positioning.

Regulatory Status: Specific regulatory information is not detailed in available sources. This represents a significant concern for trader protection and fund security. Traders should verify regulatory compliance directly with the broker.

Deposit and Withdrawal Methods: Payment processing options and procedures are not specified in accessible documentation. This requires direct inquiry with the broker for clarification.

Minimum Deposit Requirements: Specific minimum deposit amounts have not been disclosed in available sources. This suggests potential flexibility or the need for direct consultation.

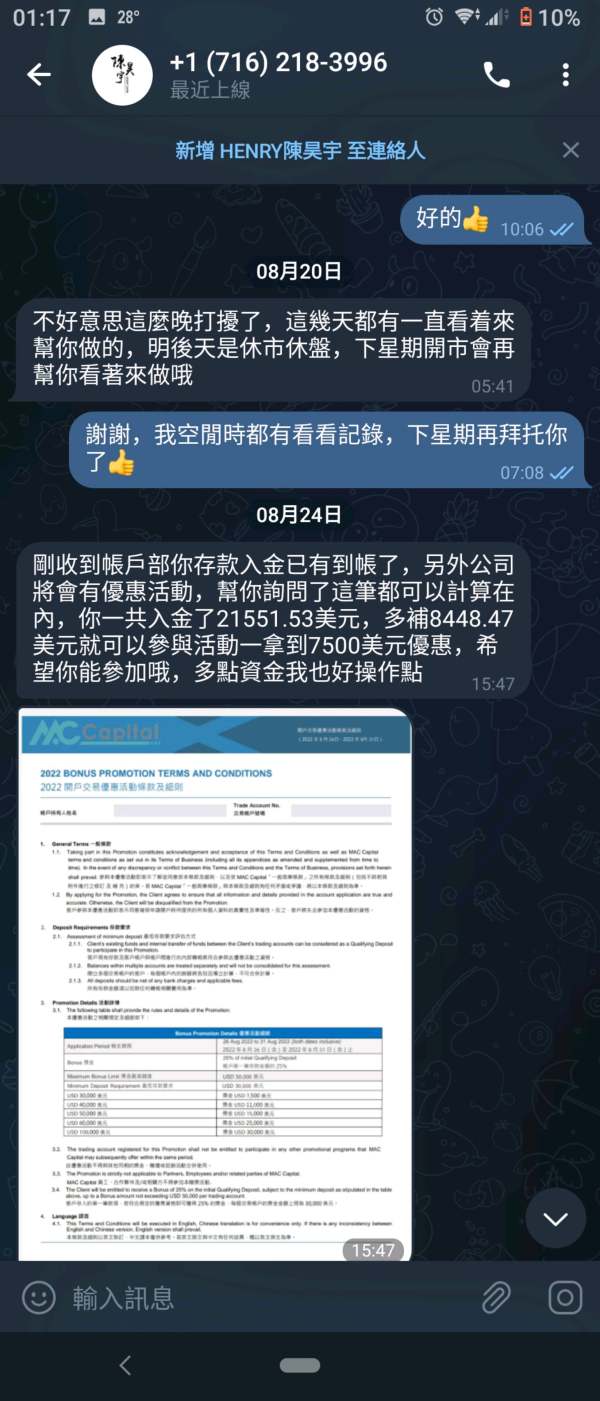

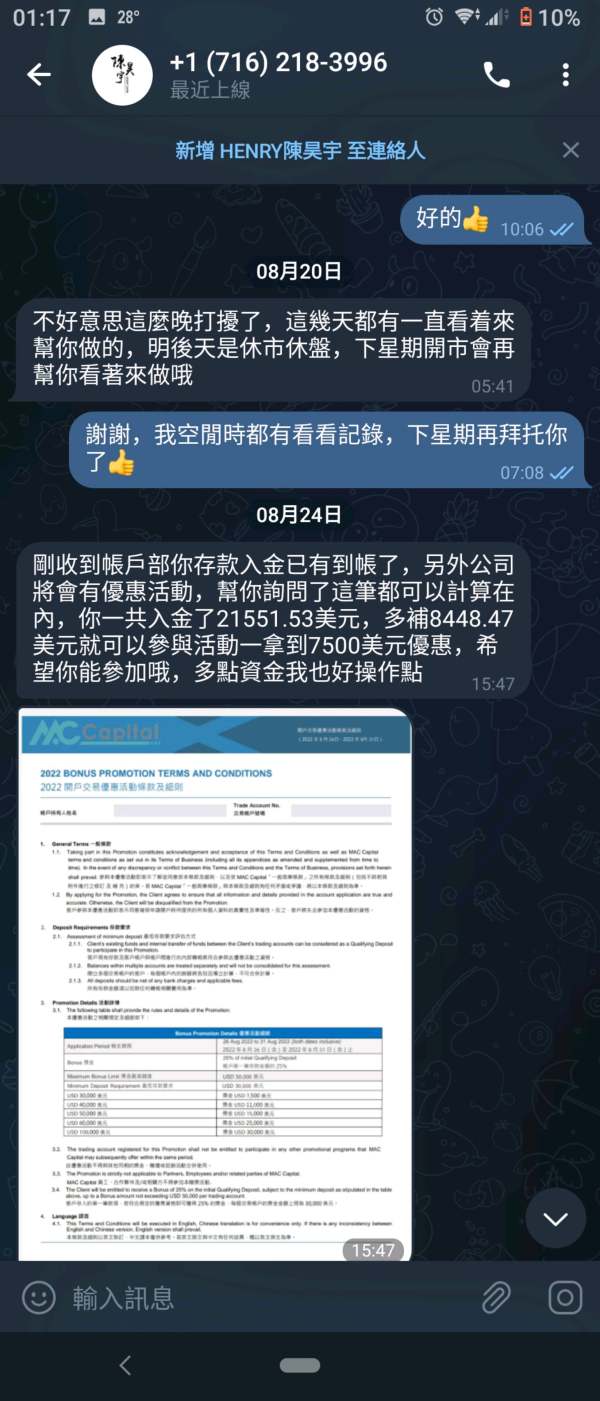

Promotional Offers: Current bonus structures or promotional campaigns are not detailed in publicly available information.

Available Assets: The range of tradeable instruments, including forex pairs, commodities, indices, and other assets, is not comprehensively outlined in accessible sources.

Cost Structure: Detailed information about spreads, commissions, overnight fees, and other trading costs requires direct verification with the broker.

Leverage Options: Maximum leverage ratios and risk management parameters are not specified in available documentation.

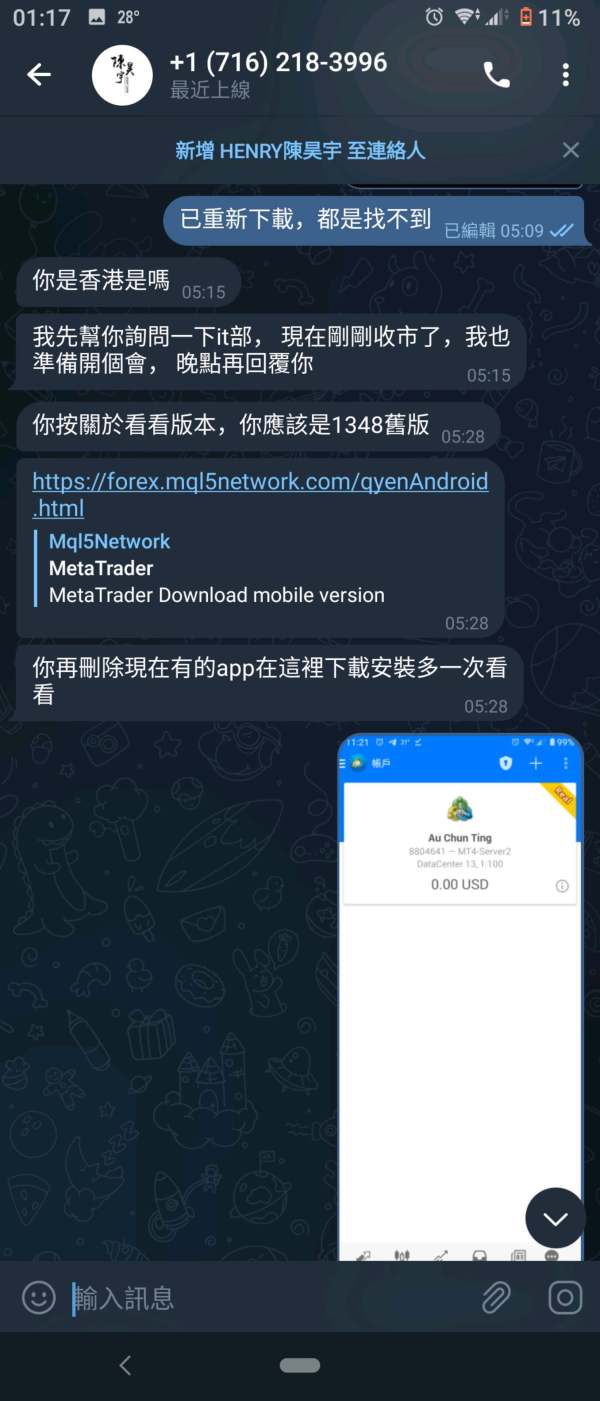

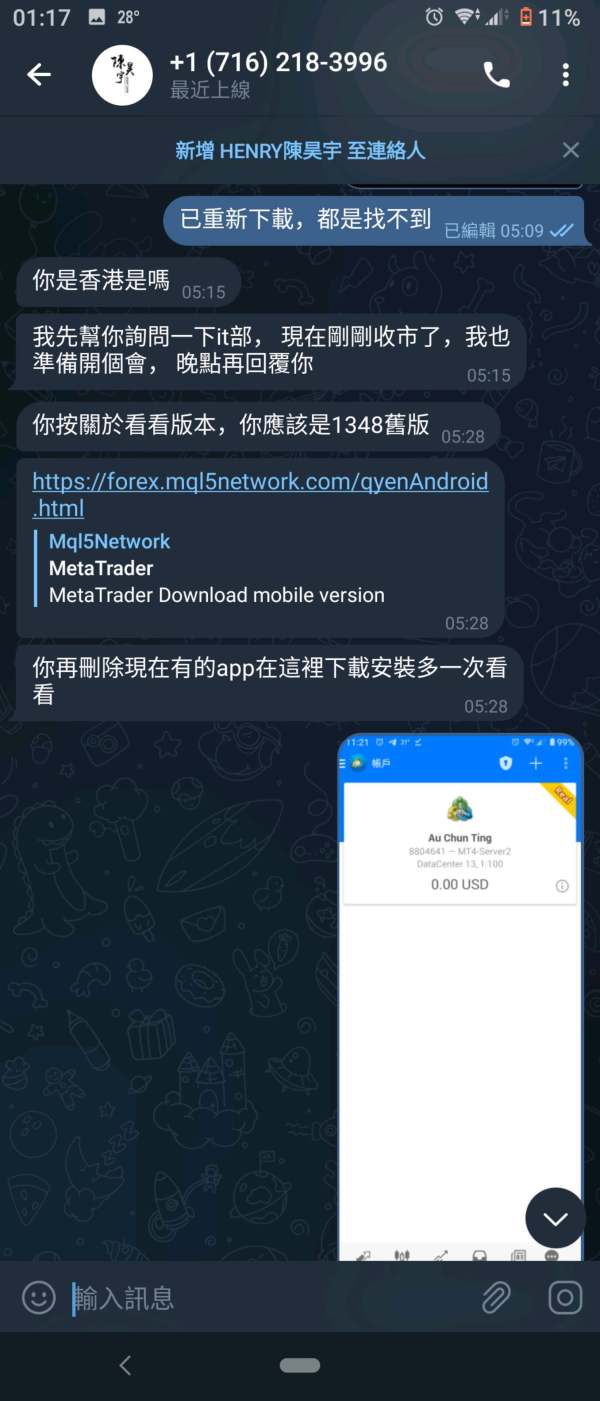

Platform Options: Meta Trader 4 and Meta Trader 5 platforms are available. These provide access to advanced charting, automated trading capabilities, and extensive technical analysis tools.

Geographic Restrictions: Specific regional limitations or service availability by jurisdiction is not detailed in accessible sources.

Customer Support Languages: Available support languages and communication channels require direct verification with the broker.

This mead review emphasizes the importance of obtaining detailed information directly from the broker regarding these essential trading parameters.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of account conditions for Mead proves challenging due to limited publicly available information about account types, structures, and requirements. Standard forex brokers typically offer multiple account tiers ranging from basic retail accounts to professional and institutional options. Each tier has varying minimum deposits, spread structures, and feature sets.

Without specific details about Mead's account offerings, traders cannot adequately assess whether the broker provides suitable options for their trading capital and experience level. Key considerations that remain unclear include minimum deposit requirements, account verification procedures, and any special account features such as Islamic accounts for Muslim traders or demo account availability for practice trading.

The absence of transparent account condition information represents a significant limitation for this mead review. Account terms fundamentally impact the trading experience and cost structure. Professional traders typically require detailed information about account specifications before committing funds, making this information gap particularly concerning.

Potential traders should directly contact the broker to obtain comprehensive account documentation. This includes terms of service, account opening procedures, and any restrictions that may apply to different account types. This direct verification becomes essential when publicly available information lacks sufficient detail for informed decision-making.

Mead's utilization of Meta Trader 4 and Meta Trader 5 platforms represents a significant strength in terms of available trading tools and resources. These platforms are industry standards, providing comprehensive charting capabilities with over 50 technical indicators, multiple timeframes, and advanced analytical tools that professional traders rely upon daily.

The MT4/MT5 ecosystem includes automated trading support through Expert Advisors. This allows traders to implement algorithmic strategies and automated risk management systems. The platforms also feature advanced order types, one-click trading capabilities, and mobile applications that enable trading from any location with internet connectivity.

However, beyond the standard MT4/MT5 feature set, specific additional tools, research resources, or proprietary analytical content provided by Mead are not detailed in available sources. Many brokers supplement the basic platform offering with market research, daily analysis, economic calendars, and educational resources that enhance the trading experience.

The platform's integration with MT4/MT5 ensures compatibility with third-party indicators, trading robots, and signal services. This provides flexibility for traders who utilize external tools. This compatibility represents a key advantage for experienced traders who have developed specific workflows around these platforms.

Customer Service and Support Analysis

Customer service evaluation for Mead faces significant limitations due to insufficient publicly available information about support structures, response times, and service quality metrics. Effective customer support represents a critical component of forex broker operations, particularly given the 24-hour nature of currency markets and the technical complexity of trading platforms.

Standard industry expectations include multiple communication channels such as live chat, email support, and telephone assistance. Response times vary based on inquiry complexity and account types. Many brokers provide dedicated account managers for higher-tier clients and multilingual support to serve international trader bases.

Without specific information about Mead's customer service capabilities, including available hours, supported languages, and typical response times, traders cannot adequately assess whether the broker meets their support requirements. This information gap becomes particularly significant for traders in different time zones or those requiring support in non-English languages.

The absence of customer service details in this review reflects the broader transparency concerns identified throughout our analysis. Traders should directly test support responsiveness and quality through pre-account inquiries to gauge service levels before committing to the platform.

Trading Experience Analysis

Evaluating the trading experience with Mead encounters substantial limitations due to insufficient data about platform performance, execution quality, and user interface customizations. While the broker's utilization of MT4/MT5 platforms provides a foundation of familiar functionality, broker-specific implementation details significantly impact the actual trading experience.

Key performance metrics such as execution speeds, slippage rates, requote frequency, and server stability are not available in accessible sources. These factors critically influence trading outcomes, particularly for scalping strategies or high-frequency trading approaches that depend on precise execution timing.

The MT4/MT5 platform foundation does provide certain experience advantages. These include intuitive interfaces, comprehensive mobile applications, and extensive customization options. However, individual broker implementations can vary significantly in terms of server infrastructure, connectivity options, and platform modifications.

Without specific user feedback or performance data, this mead review cannot provide definitive conclusions about trading experience quality. The platform's success would largely depend on the broker's technical infrastructure investment and commitment to maintaining competitive execution standards.

Potential traders should consider testing the platform through demo accounts or small initial deposits to evaluate execution quality and platform stability under real trading conditions before making larger commitments.

Trust and Reliability Analysis

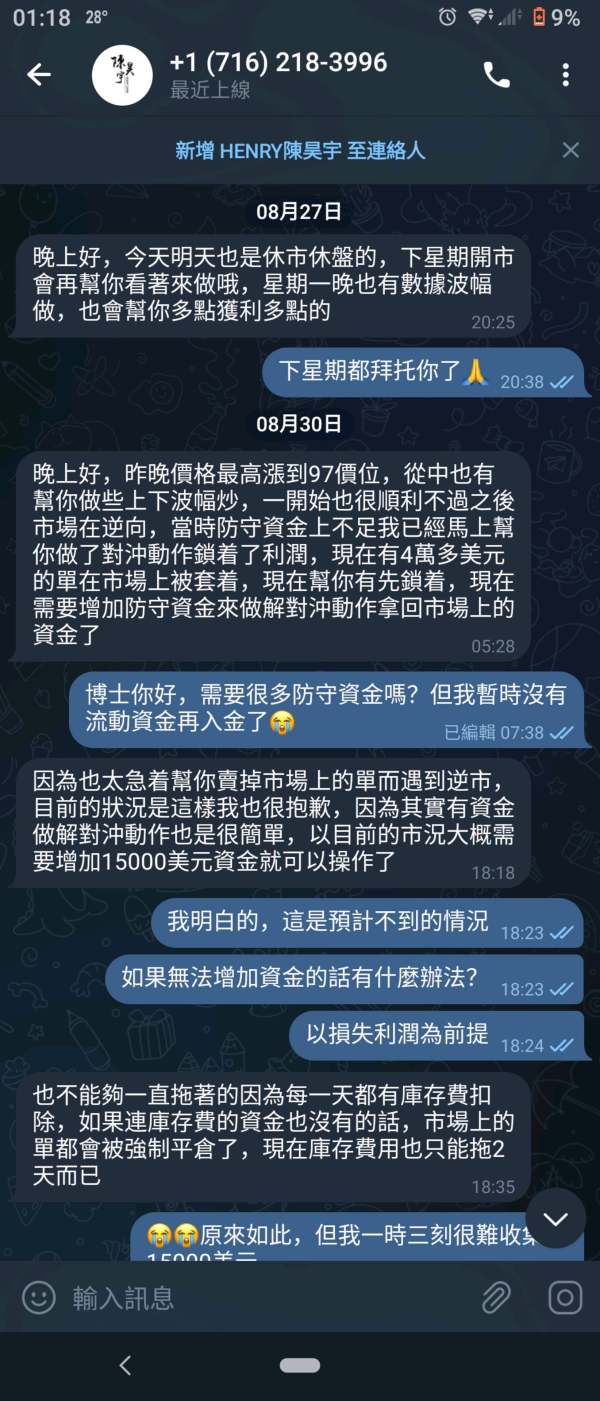

The trust and reliability assessment for Mead reveals significant concerns due to limited regulatory information and transparency gaps in operational disclosure. Regulatory oversight represents the primary foundation for trader protection, fund security, and operational standards in forex trading.

Without clear regulatory credentials from recognized authorities such as the FCA, CySEC, ASIC, or other major financial regulators, traders face increased risks regarding fund safety and dispute resolution mechanisms. Regulated brokers must maintain segregated client accounts, participate in compensation schemes, and adhere to strict operational standards that protect trader interests.

The absence of detailed regulatory information in available sources suggests either unregulated status or limited regulatory scope. Both present significant risk factors for traders. Professional traders typically require comprehensive regulatory documentation before considering platform engagement.

Additionally, the lack of transparent operational information about company ownership, financial backing, and business history further compounds trust concerns. Established brokers typically provide detailed company information, regulatory documentation, and transparent operational disclosures that enable informed decision-making.

This trust evaluation emphasizes the critical importance of regulatory verification and comprehensive due diligence before engaging with any trading platform that lacks clear regulatory credentials.

User Experience Analysis

User experience evaluation for Mead faces constraints due to limited available feedback and interface documentation beyond the standard MT4/MT5 platform features. While these platforms provide familiar interfaces for experienced traders, broker-specific implementations and additional services significantly impact overall user satisfaction.

The Meta Trader platforms offer well-designed interfaces with intuitive navigation, comprehensive mobile applications, and extensive customization options that generally receive positive user feedback across the industry. However, individual broker implementations may include modifications, additional features, or restrictions that alter the standard user experience.

Account opening procedures, verification processes, and fund management workflows represent crucial user experience components that are not detailed in available sources. Streamlined onboarding processes and efficient fund operations significantly impact user satisfaction, particularly for traders making frequent deposits or withdrawals.

Without specific user feedback or detailed interface documentation, this analysis cannot provide comprehensive conclusions about Mead's user experience quality. The platform's success would depend largely on implementation quality and additional services beyond the basic MT4/MT5 offering.

Potential users should evaluate the complete user journey, from account opening through active trading and fund management, to assess whether the platform meets their specific workflow requirements and usability expectations.

Conclusion

This mead review concludes with a neutral assessment based on limited available information about the broker's comprehensive operations and regulatory standing. While Mead's utilization of Meta Trader 4/5 platforms provides access to industry-standard trading tools and familiar interfaces, significant information gaps regarding regulatory oversight, account conditions, and operational transparency present notable concerns for potential traders.

The platform may suit experienced traders familiar with MT4/MT5 environments who can navigate platforms with limited disclosure. However, newcomers to forex trading should consider more transparent alternatives with clear regulatory credentials and comprehensive service documentation. The absence of detailed regulatory information represents the most significant limitation identified in this analysis.

Traders considering Mead should conduct thorough due diligence, including direct verification of regulatory status, account terms, and trading conditions before making any financial commitments. The broker's reliance on established MT4/MT5 platforms provides certain technical advantages, but regulatory transparency and operational clarity remain essential for informed trading decisions.