Is MING safe?

Pros

Cons

Is Ming Safe or a Scam?

Introduction

Ming is a forex and CFD broker that has emerged in the competitive landscape of online trading. Positioned as a platform for both novice and experienced traders, Ming claims to offer a variety of trading instruments and a user-friendly interface. However, prospective traders must exercise caution when evaluating such brokers. The forex market is notorious for its lack of regulation and the presence of unscrupulous operators, making it essential for traders to thoroughly assess the legitimacy and safety of their chosen broker. In this article, we will investigate whether Ming is a safe trading platform or if it raises red flags indicating potential scams. Our analysis will be based on a combination of regulatory status, company background, trading conditions, customer experiences, and risk assessments sourced from various reputable online reviews.

Regulation and Legitimacy

Regulation is a critical aspect of any trading broker, as it provides a framework for accountability and protection for clients. Ming does not appear to be regulated by any major financial authority, which raises concerns about its legitimacy. The absence of regulation can expose traders to higher risks, as unregulated brokers often lack the necessary oversight to ensure fair trading practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight means that there is no governing body to which traders can turn in case of disputes or malpractice. This situation is further compounded by reports suggesting that Ming operates from Hong Kong, a jurisdiction often criticized for its lax regulatory framework in the financial sector. Without robust regulation, traders may find it challenging to recover funds in the event of a dispute, making it imperative to question is Ming safe for trading.

Company Background Investigation

Understanding a broker's history and ownership structure is vital for assessing its credibility. Ming's website offers limited information regarding its founding, management team, and operational history, which is a significant transparency issue. The absence of detailed background information can be a red flag, as reputable brokers typically provide extensive details about their operations and leadership.

Moreover, the management teams qualifications and experience play a crucial role in determining the broker's reliability. A lack of information about the team behind Ming raises questions about their expertise and commitment to providing quality services. Additionally, the minimal disclosure of corporate information can lead to concerns about accountability and the potential for fraudulent activities. Therefore, when considering is Ming safe, the company's opacity is a cause for concern.

Trading Conditions Analysis

When evaluating a broker, it is essential to analyze its trading conditions, including fees and spreads. Ming claims to offer competitive trading conditions, but a deeper examination reveals potential issues. The broker's fee structure is not clearly outlined, which can lead to unexpected costs for traders.

| Fee Type | Ming | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The lack of transparency regarding trading fees and commissions can be problematic, as hidden charges may erode trading profits. Traders should be wary of any unusual fee policies that could indicate a lack of integrity or fairness in trading practices. Therefore, understanding the costs involved is crucial for determining is Ming safe for trading activities.

Customer Funds Security

The security of customer funds is paramount when choosing a broker. Ming's website does not provide comprehensive information about its fund protection measures, which raises concerns about the safety of traders' investments. Proper fund security protocols include segregating client funds from the broker's operational funds, ensuring that traders' money is protected in the event of insolvency.

Moreover, the absence of investor protection schemes, such as compensation funds, further heightens the risk associated with trading on the platform. Without these safeguards, traders may find themselves vulnerable to financial losses without any recourse. Thus, the question of is Ming safe becomes increasingly relevant, as the lack of clarity surrounding fund security measures could lead to significant risks for clients.

Customer Experience and Complaints

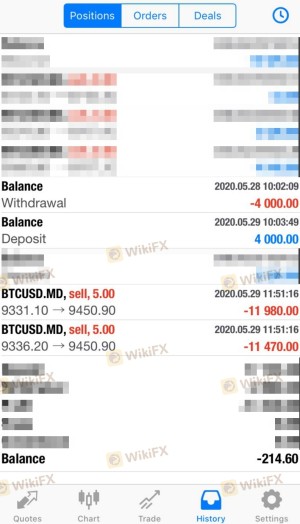

Customer feedback is a vital indicator of a broker's reliability. Reviews and testimonials about Ming reveal a mixed bag of experiences, with some users reporting difficulties in withdrawals and poor customer service. Common complaints include slow response times and a lack of transparency regarding account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service | Medium | Average |

| Transparency Concerns | High | Poor |

For instance, some users have reported that their withdrawal requests were delayed without explanation, leading to frustration and loss of trust in the broker. These issues highlight significant concerns regarding the overall customer experience and the quality of support provided by Ming. Therefore, it is essential for potential clients to consider these testimonials when evaluating is Ming safe for their trading needs.

Platform and Trade Execution

The performance of the trading platform is another crucial factor in assessing a broker's reliability. Ming claims to offer a user-friendly trading environment, but there are concerns about the platform's stability and execution quality. Reports of slippage and order rejections have surfaced, which can significantly impact trading outcomes.

Traders expect their orders to be executed promptly and at the desired price. However, if a broker's platform frequently experiences issues, it can lead to substantial losses. Therefore, understanding the execution quality and potential for manipulation is vital for determining is Ming safe for trading.

Risk Assessment

Using Ming as a trading platform presents several risks that traders should be aware of. The absence of regulation, opaque company information, and customer complaints all contribute to an elevated risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker without oversight. |

| Financial Security Risk | High | Lack of fund protection measures. |

| Customer Support Risk | Medium | Poor response to customer complaints. |

To mitigate these risks, traders should consider using a demo account to test the platform before committing real funds, and they should also diversify their investments to avoid significant losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ming raises several red flags that warrant caution among prospective traders. The lack of regulation, transparency issues, and customer complaints indicate that is Ming safe is a question that remains largely unanswered. Given the potential risks involved, it is advisable for traders to consider alternative brokers that offer robust regulation, transparent trading conditions, and a proven track record of customer satisfaction.

For those seeking reliable trading options, consider brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a safer trading environment and better protection for client funds. Always conduct thorough research and due diligence before engaging with any broker to ensure a secure trading experience.

Is MING a scam, or is it legit?

The latest exposure and evaluation content of MING brokers.

MING Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

MING latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.