Crossworld Review 1

Operations are being manipulated and causing to lose everything. I called customer support and they tell me that there is no solution, but everything is within mafia. My investment is $ 2,430. Please help me

Crossworld Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Operations are being manipulated and causing to lose everything. I called customer support and they tell me that there is no solution, but everything is within mafia. My investment is $ 2,430. Please help me

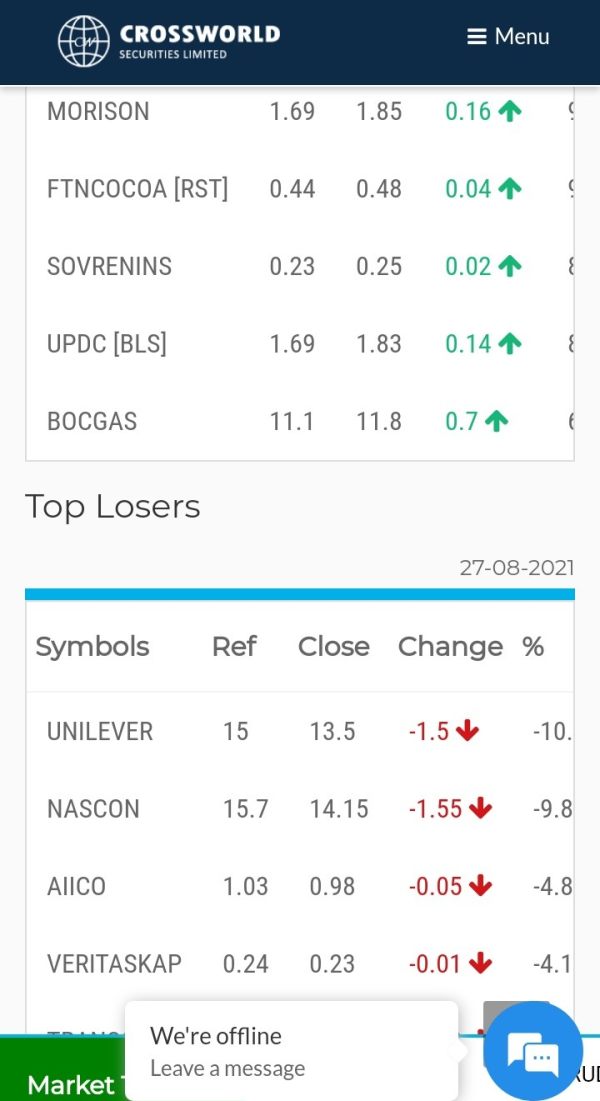

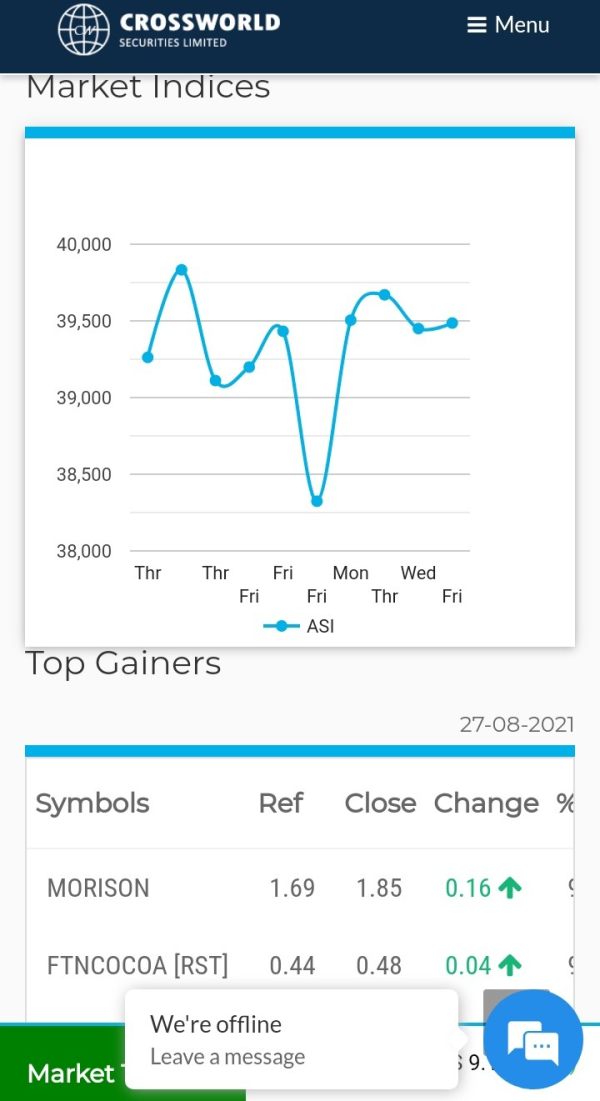

This Crossworld review examines a Nigerian-based securities brokerage firm that has been operating since 1984. Crossworld Securities is based in Lagos, Nigeria, and presents itself as an established player in the Nigerian securities market with regulatory backing from the Nigerian Stock Exchange and the Securities & Exchange Commission. The company focuses mainly on stock brokerage services within the Nigerian financial market.

However, our detailed analysis reveals major limitations in available information about trading conditions, platform offerings, and user feedback. The company's online presence lacks detailed information about trading costs, account types, leverage options, and customer service standards that modern traders typically expect. While Crossworld has been in the Nigerian market since 1984, which suggests some level of market credibility, the absence of detailed trading information makes it hard to provide a thorough assessment for potential international forex and CFD traders.

Our evaluation shows that Crossworld may primarily serve local Nigerian investors interested in domestic securities trading rather than offering comprehensive international trading services. The limited transparency about trading conditions and platform capabilities raises questions about its suitability for sophisticated retail traders seeking competitive forex and CFD trading environments.

This Crossworld review is based on publicly available information as of 2025. Crossworld's operations may vary significantly across different regions due to local regulatory requirements and market conditions in Nigeria. The evaluation methodology relies primarily on official company communications and regulatory filings, as detailed user feedback and comprehensive trading condition data were not readily available through standard industry channels.

Potential clients should note that regulatory oversight from Nigerian authorities may differ substantially from international financial regulatory standards. Traders considering Crossworld should conduct independent verification of all trading conditions, fees, and service offerings directly with the company before making any investment decisions.

| Criteria | Score | Rating |

|---|---|---|

| Account Conditions | 5/10 | Below Average |

| Tools and Resources | 3/10 | Poor |

| Customer Service | 4/10 | Below Average |

| Trading Experience | 4/10 | Below Average |

| Trustworthiness | 6/10 | Average |

| User Experience | 4/10 | Below Average |

| Overall Rating | 4.3/10 | Below Average |

Crossworld Securities was established in 1984 as a stock brokerage company based in Lagos, Nigeria. According to available company information, Crossworld Securities Ltd was later incorporated in 1997, building upon the foundation of the original 1984 establishment. The company positions itself as a securities trading service provider within the Nigerian financial market, focusing primarily on stock brokerage services rather than international forex or CFD trading.

The company's business model centers around traditional securities brokerage, serving clients interested in Nigerian stock market investments. Crossworld's long operational history of over four decades suggests some level of market stability and local market knowledge within Nigeria's financial sector. However, the company's scope appears limited compared to international multi-asset brokers that typically serve the global retail trading community.

Crossworld operates under the regulatory oversight of the Nigerian Stock Exchange and maintains registration with Nigeria's Securities & Exchange Commission as authorized brokers. This regulatory framework provides some level of oversight, though it may not offer the same investor protection standards found in major international financial centers. The company's focus on domestic securities trading distinguishes it from international forex brokers that typically offer multiple asset classes including currency pairs, commodities, and indices.

This Crossworld review notes that the company's online presence and marketing materials provide limited information about modern trading platforms, competitive spreads, or advanced trading tools that contemporary traders typically expect from retail brokers.

Crossworld Securities operates as a member of the Nigerian Stock Exchange and maintains registration with Nigeria's Securities & Exchange Commission as licensed brokers. This regulatory framework provides oversight within Nigeria's domestic financial market structure.

Specific information regarding deposit and withdrawal methods is not detailed in available company materials. Potential clients would need to contact the company directly to understand available funding options and processing procedures.

The minimum deposit requirements for opening accounts with Crossworld are not specified in publicly available information. This lack of transparency regarding entry-level investment requirements may concern potential clients seeking clear cost structures.

No information regarding promotional offers, welcome bonuses, or ongoing trading incentives is available in the company's public communications. This absence of promotional material suggests a traditional approach to client acquisition.

Available company information does not specify the range of tradeable assets beyond general references to securities trading. The specific stocks, bonds, or other financial instruments available for trading are not detailed in accessible materials.

Detailed information about spreads, commissions, overnight fees, or other trading costs is not provided in available company documentation. This lack of fee transparency represents a significant information gap for potential clients.

Leverage options and margin requirements are not specified in publicly available company information. This represents a critical information deficiency for traders seeking to understand available trading conditions.

Specific trading platform information is not detailed in available company materials. The technology infrastructure and trading interface options remain unclear from public sources.

Information regarding geographic trading restrictions or service availability is not specified in accessible company documentation.

The languages supported by customer service teams are not detailed in available company information.

This Crossworld review highlights significant information gaps that potential clients should address through direct company contact before making trading decisions.

The account conditions evaluation for Crossworld reveals substantial information deficiencies that impact our assessment. Available company materials do not specify account types, minimum deposit requirements, or account tier structures that would typically guide potential clients in selecting appropriate trading arrangements. This lack of transparency regarding basic account parameters creates uncertainty for traders attempting to evaluate whether Crossworld's offerings align with their trading capital and objectives.

The absence of detailed account opening procedures, verification requirements, or documentation standards in publicly available information suggests that prospective clients must engage directly with company representatives to understand basic account establishment processes. Modern retail traders typically expect clear, accessible information about account conditions before initiating contact with brokers.

Furthermore, no information is available regarding special account features such as Islamic accounts for Muslim traders, professional account categories, or institutional account options. The lack of account condition transparency, combined with unclear fee structures and trading terms, significantly limits our ability to assess the competitiveness of Crossworld's account offerings compared to international broker standards.

This Crossworld review emphasizes that the limited account condition information available represents a significant barrier for potential clients seeking to make informed broker selection decisions.

Crossworld's tools and resources evaluation reveals minimal information about trading platforms, analytical tools, or educational resources. Available company materials do not specify which trading platforms are offered, whether proprietary or third-party solutions are utilized, or what technical analysis capabilities are provided to clients. This absence of platform information represents a critical gap for traders who rely on sophisticated tools for market analysis and trade execution.

The lack of information regarding research resources, market analysis, economic calendars, or trading signals suggests limited support for traders seeking comprehensive market insights. Modern retail brokers typically provide extensive educational materials, webinars, tutorials, and market commentary to support client trading development, but no such resources are evident in Crossworld's public materials.

Additionally, no information is available regarding automated trading support, expert advisors, copy trading features, or advanced order types that sophisticated traders often require. The absence of mobile trading platform details, charting capabilities, or real-time market data access further limits our assessment of Crossworld's technological offerings.

The minimal information available about tools and resources suggests that Crossworld may operate with a more traditional, service-based approach rather than providing the comprehensive technological infrastructure that contemporary retail traders typically expect from modern brokerages.

Customer service evaluation for Crossworld is constrained by limited publicly available information about support channels, response times, and service quality standards. The company's contact information indicates a Lagos, Nigeria location, but specific details about customer service hours, available communication methods, or support team capabilities are not provided in accessible materials.

No information is available regarding multilingual support capabilities, which could be significant for international clients considering Crossworld's services. The absence of details about email response times, phone support availability, or live chat options makes it difficult to assess the accessibility and responsiveness of customer support services.

Furthermore, there is no available information about account management services, dedicated support representatives for different account tiers, or specialized assistance for technical trading platform issues. Modern retail traders typically expect comprehensive support infrastructure including detailed FAQ sections, video tutorials, and readily accessible help documentation, none of which are evident in Crossworld's public presence.

The limited customer service information available suggests that potential clients would need to test support responsiveness and quality through direct contact before committing to account opening, representing additional due diligence requirements for prospective traders.

The trading experience assessment for Crossworld is significantly limited by the absence of detailed platform information, execution quality data, and user experience feedback. Available company materials do not specify trading platform stability, order execution speeds, or system uptime statistics that would typically inform traders about the reliability of the trading environment.

No information is available regarding slippage rates, requote frequency, or execution methodology, which are critical factors for traders evaluating potential execution quality. The absence of mobile trading platform details, offline trading capabilities, or platform customization options further limits our assessment of the overall trading experience.

Additionally, there is no available information about advanced trading features such as one-click trading, trailing stops, partial position closures, or sophisticated order management tools that active traders often require. The lack of details about market depth, price feed quality, or trading session availability creates uncertainty about the comprehensiveness of the trading environment.

This Crossworld review notes that the limited trading experience information available makes it challenging for potential clients to assess whether the platform and execution environment would meet their trading requirements and performance expectations.

Crossworld's trustworthiness evaluation benefits from its regulatory status with the Nigerian Stock Exchange and Securities & Exchange Commission registration, providing some level of institutional oversight within Nigeria's financial regulatory framework. The company's establishment in 1984 and continued operation suggests some degree of market stability and longevity within the Nigerian securities industry.

However, the assessment is limited by the absence of detailed information about client fund protection measures, segregated account policies, or insurance coverage that would typically enhance client confidence in fund safety. No information is available regarding company financial statements, capital adequacy ratios, or third-party auditing that would provide transparency about the company's financial stability.

The lack of readily available information about dispute resolution procedures, regulatory compliance history, or industry awards and recognition limits our ability to assess the company's reputation within the broader financial services sector. Additionally, the absence of client testimonials, industry reviews, or third-party evaluations makes it difficult to gauge market perception of Crossworld's services.

While the regulatory oversight provides some foundation for trustworthiness, the limited transparency regarding operational practices, financial safeguards, and client protection measures prevents a higher trust rating in this evaluation.

User experience evaluation for Crossworld is significantly constrained by the absence of client feedback, platform usability information, and detailed service descriptions in publicly available materials. No user reviews, testimonials, or experience reports are readily accessible through standard industry channels, making it impossible to assess actual client satisfaction levels or identify common user concerns.

The lack of information about account opening procedures, verification timelines, or onboarding processes creates uncertainty about the initial client experience. Additionally, there are no details available about fund deposit and withdrawal experiences, processing times, or potential complications that clients might encounter during routine account operations.

Furthermore, the absence of information about platform learning curves, interface design quality, or user-friendly features makes it difficult to assess whether Crossworld's services would be suitable for traders with varying levels of experience. No information is available about client education programs, support during the learning process, or resources to help new traders adapt to the platform.

The limited user experience information available suggests that potential clients would need to rely on direct interaction with the company to understand service quality, operational efficiency, and overall client satisfaction levels before making commitment decisions.

This Crossworld review reveals a brokerage with a long operational history in Nigeria's securities market but significant transparency limitations that impact its assessment for modern retail traders. While Crossworld's regulatory status with Nigerian authorities and four-decade operational history provide some credibility foundation, the extensive information gaps regarding trading conditions, platform capabilities, and service standards create substantial uncertainty for potential clients.

Crossworld may be suitable for investors specifically interested in Nigerian securities market exposure and comfortable with traditional brokerage service models. However, traders seeking comprehensive forex and CFD trading environments with competitive conditions, advanced platforms, and transparent fee structures may find Crossworld's offerings insufficient for their requirements.

The primary limitations identified include lack of detailed cost information, absence of platform specifications, minimal customer service details, and no available user feedback. These deficiencies suggest that Crossworld operates with a more traditional, relationship-based approach rather than the transparent, technology-driven model that characterizes competitive retail brokers in the international market.

FX Broker Capital Trading Markets Review