Regarding the legitimacy of DV Markets forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is DV Markets safe?

Business

License

Is DV Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Market Making License (MM)

Licensed Entity:

FTX AUSTRALIA PTY LTD

Effective Date:

2008-07-01Email Address of Licensed Institution:

chris.chen@ftx.comSharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 6, 228 Pitt Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

90483838Licensed Institution Certified Documents:

Is DV Markets Safe or Scam?

Introduction

DV Markets is a forex broker that positions itself as a provider of trading services in various financial instruments, including forex and CFDs. With a presence in the competitive landscape of online trading, it is essential for traders to thoroughly evaluate the credibility of any broker before committing their funds. This is particularly crucial given the prevalence of scams in the forex market, where unregulated brokers may exploit unsuspecting traders. In this article, we will investigate whether DV Markets is a safe trading option or if it raises red flags that warrant caution. Our analysis is based on a comprehensive review of available information, including regulatory status, company background, trading conditions, and customer feedback.

Regulation and Legitimacy

Understanding the regulatory framework under which a broker operates is vital for assessing its legitimacy. DV Markets claims to be regulated by the Australian Securities and Investments Commission (ASIC), a reputable authority known for its strict oversight of financial services. The significance of regulatory compliance cannot be overstated, as it provides a level of assurance regarding the broker's operational integrity and adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 323193 | Australia | Verified |

ASIC requires brokers to maintain a certain level of capital and adhere to stringent reporting and operational standards, which can help protect clients' funds. However, it is important to note that there have been multiple complaints about DV Markets, including issues related to withdrawal processes and customer service. This raises concerns about the broker's compliance with regulatory requirements and overall trustworthiness.

Company Background Investigation

DV Markets is operated by Forex Financial Services Pty Ltd and has been active since 2008. The company is headquartered in Sydney, Australia, and has claimed to offer a range of trading services to clients across various jurisdictions. However, the transparency regarding its ownership structure and management team is lacking. A thorough background check reveals that the broker has faced criticism for its operational practices, and there are indications that it may not be as forthcoming with information as required.

The management team's background and experience in the financial industry are critical factors that affect the broker's credibility. Unfortunately, details about the team are sparse, making it difficult to assess their qualifications and expertise. The overall transparency regarding company operations and information disclosure appears to be below industry standards, which further complicates the determination of whether DV Markets is safe for traders.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is crucial. DV Markets offers a variety of trading accounts with different features, including leverage up to 1:400 and variable spreads. However, the overall cost structure and any unusual fee policies should be scrutinized closely.

| Cost Type | DV Markets | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 1.2 pips | 0.6 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spreads offered by DV Markets are competitive, the absence of a commission model on certain accounts may mask hidden costs. Traders should be aware of any additional fees that may arise during trading, such as withdrawal fees or inactivity charges, which can impact overall profitability.

Client Fund Safety

The safety of client funds is paramount in the forex trading environment. DV Markets claims to implement measures such as segregated accounts to protect clients' money. This means that client funds are kept separate from the broker's operational funds, which is a standard practice among reputable brokers. Additionally, ASIC regulations mandate that brokers maintain sufficient capital to meet their obligations to clients.

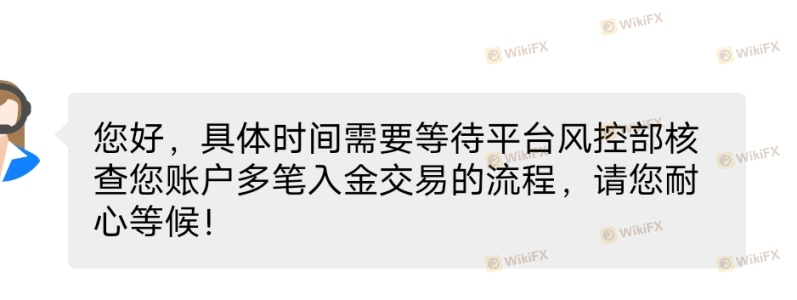

However, there have been reports of withdrawal issues, with some users claiming that their requests were delayed or denied. Such incidents raise concerns about the broker's commitment to safeguarding client funds and fulfilling withdrawal requests. It is essential for traders to consider these factors when determining if DV Markets is safe for their investments.

Customer Experience and Complaints

Analyzing customer feedback is a crucial component in assessing whether DV Markets is a safe broker. Numerous reviews highlight a pattern of complaints regarding withdrawal delays, poor customer service, and unresponsive support channels.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Customer Service Quality | Medium | Poor |

| Account Freezes | High | Unclear |

For instance, several clients have reported that their withdrawal requests were marked as "in process" for extended periods, leading to frustration and mistrust. Such experiences indicate a significant risk for traders, suggesting that DV Markets may not prioritize customer satisfaction or timely service.

Platform and Execution

The trading platform's performance is critical for a smooth trading experience. DV Markets offers the widely-used MetaTrader 4 platform, known for its user-friendly interface and advanced trading tools. However, the quality of order execution, including slippage and rejection rates, is also vital to assess.

Traders have reported mixed experiences regarding execution quality, with some noting instances of slippage during volatile market conditions. While slippage is common in forex trading, excessive slippage or frequent order rejections can be indicative of deeper issues within the broker's operations, potentially raising concerns about whether DV Markets is safe for trading.

Risk Assessment

Using DV Markets involves inherent risks that potential traders should acknowledge. The combination of negative customer feedback, regulatory concerns, and transparency issues contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | Medium | Complaints about compliance |

| Operational Risk | High | Issues with withdrawals and service |

| Market Risk | High | High leverage increases potential loss |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions before committing real funds. Additionally, setting strict risk management strategies, such as using lower leverage, can help protect against significant losses.

Conclusion and Recommendations

In conclusion, while DV Markets presents itself as a regulated forex broker, various red flags suggest that traders should exercise caution. The combination of regulatory complaints, customer service issues, and withdrawal difficulties raises concerns about the broker's overall safety.

For traders seeking a reliable and trustworthy broker, it may be prudent to explore alternatives that have consistently positive reviews and a solid regulatory track record. Options such as brokers regulated by multiple authorities or those with a transparent operational history might provide a safer trading environment.

Ultimately, the question "Is DV Markets safe?" leans toward a cautious "no" based on the available evidence. Traders should prioritize their security and due diligence when selecting a broker to avoid potential pitfalls in their trading journey.

Is DV Markets a scam, or is it legit?

The latest exposure and evaluation content of DV Markets brokers.

DV Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

DV Markets latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.