DaVinci 2025 Review: Everything You Need to Know

Executive Summary

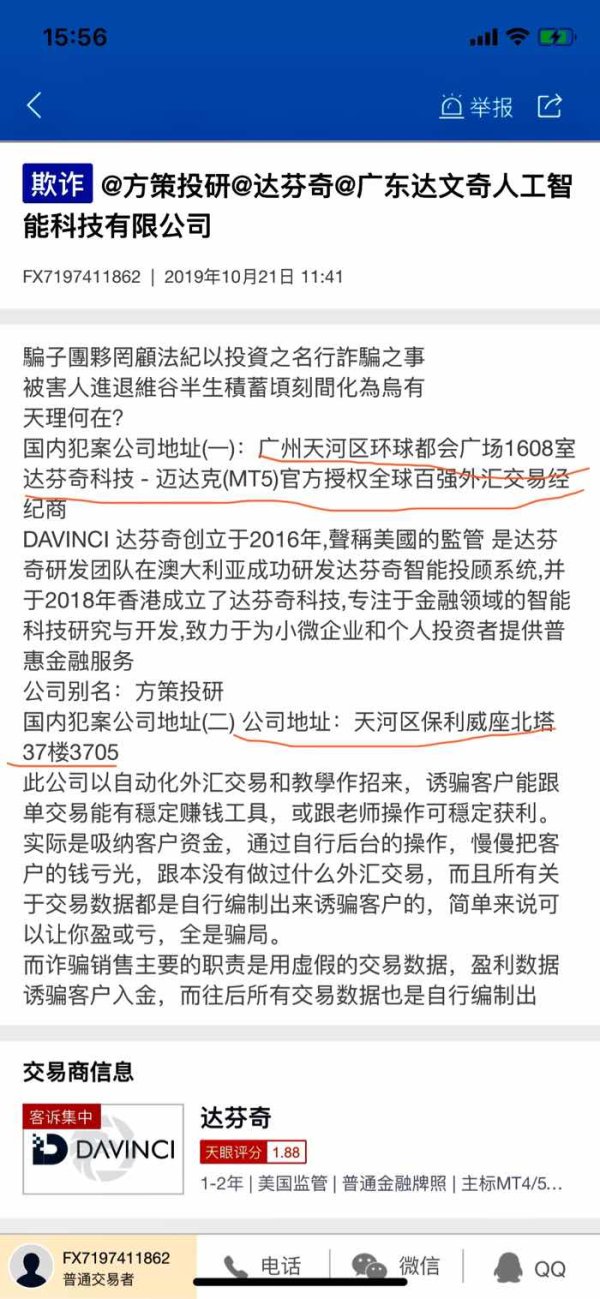

This davinci review shows a complete analysis of DaVinci broker's services and performance in 2025. Our assessment reveals major concerns about this broker's overall reliability and service quality, based on WikiFX's evaluation showing a troubling rating of 1.95 out of 10 and 69 recorded user complaints. The platform mainly operates through the MT5 trading platform with PC system support. It positions itself within the competitive forex trading market.

DaVinci's key offering centers around MetaTrader 5 platform access. This platform provides traders with professional-grade trading tools and functionality. However, the large volume of user complaints and poor third-party ratings suggest serious operational challenges. Potential clients should carefully consider these issues.

The broker appears to target experienced forex traders familiar with MT5 platform operations. It particularly focuses on those who prioritize desktop trading environments. However, given the negative feedback patterns and low trust scores, this davinci review recommends extreme caution for prospective clients considering this broker for their trading activities.

Important Notice

This evaluation is based on available market data, user feedback, and third-party assessment platforms. Traders should note that information regarding regulatory oversight and cross-jurisdictional entity differences was not available in the source materials reviewed. Our assessment methodology incorporates user experience reports, platform functionality analysis, and comparative market positioning. This provides an objective evaluation framework.

Potential clients are advised to conduct additional due diligence and verify all information independently before making any trading decisions or financial commitments.

Rating Framework

Broker Overview

DaVinci established operations in 2018. It positioned itself as a forex trading service provider headquartered in Hong Kong. The company operates under a traditional brokerage model, focusing primarily on foreign exchange trading services for retail and institutional clients. Since its inception, the broker has attempted to carve out a niche in the competitive Asian forex market. Performance indicators suggest significant operational challenges.

The company's business model centers on providing access to global forex markets through electronic trading platforms. Revenue generation primarily comes through spread-based pricing structures. DaVinci's operational framework emphasizes desktop trading solutions, targeting traders who prefer comprehensive platform functionality over mobile convenience.

This davinci review identifies the broker's primary service offering as MetaTrader 5 platform access. This represents industry-standard trading technology. The platform choice suggests an attempt to provide professional-grade trading tools, though the execution and support quality appear problematic based on user feedback patterns. The broker's focus on established trading technology indicates awareness of trader preferences. Implementation effectiveness remains questionable given the substantial negative feedback volume.

Regulatory Status: Specific regulatory information was not available in the reviewed materials. This raises immediate concerns about oversight and compliance frameworks.

Deposit and Withdrawal Methods: Payment processing options and procedures were not detailed in available sources. This creates uncertainty about fund management capabilities.

Minimum Deposit Requirements: Entry-level investment thresholds were not specified. This limits assessment of accessibility for different trader segments.

Promotional Offers: No information regarding bonus structures or promotional incentives was available for evaluation.

Tradeable Assets: The platform primarily focuses on forex trading pairs. Specific instrument availability was not comprehensively detailed in source materials.

Cost Structure: Detailed information about spreads, commissions, and fee structures was not available. This prevents accurate cost analysis for potential clients.

Leverage Options: Leverage ratios and margin requirements were not specified in the available documentation.

Platform Selection: DaVinci offers MetaTrader 5 platform access with PC system compatibility. Notably, mobile platform support appears limited or unavailable, significantly restricting trading flexibility.

Geographic Restrictions: Specific regional limitations or service availability constraints were not detailed in the reviewed materials.

Customer Service Languages: Language support options for client service were not specified in available sources.

This davinci review highlights significant information gaps. Prospective clients should address these through direct broker contact before proceeding with account opening procedures.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of DaVinci's account conditions presents significant challenges due to limited publicly available information. This lack of transparency regarding account types, minimum deposit requirements, and specific account features raises immediate concerns. The broker's commitment to client communication and market transparency standards appears questionable.

Industry-standard practice requires brokers to clearly communicate account structures. This includes entry-level requirements, premium account benefits, and any special features or restrictions. The absence of such fundamental information in this davinci review suggests either poor marketing communication or potential reluctance to disclose terms. These terms might not be competitive within the current market environment.

Without clear account condition details, potential clients cannot effectively evaluate whether DaVinci's offerings align with their trading goals. They also cannot assess risk tolerance or investment capacity. This information gap represents a significant barrier to informed decision-making and raises questions about the broker's operational transparency standards.

The limited account information availability, combined with the poor WikiFX rating and substantial user complaint volume, suggests problems. Account conditions may not meet contemporary market expectations for flexibility, fairness, or competitive positioning within the broader forex brokerage landscape.

DaVinci's tools and resources offering centers primarily around MetaTrader 5 platform access. This provides a foundation of professional trading functionality including advanced charting, technical analysis indicators, and automated trading capabilities. MT5 represents industry-standard technology that experienced traders typically find familiar and functional for executing trading strategies.

However, the limitation to desktop-only platform access significantly restricts trading flexibility in today's mobile-centric trading environment. Most competitive brokers now provide comprehensive mobile solutions alongside desktop platforms. They recognize that modern traders require seamless access across multiple devices and locations.

The absence of detailed information regarding additional research resources, market analysis tools, educational materials, or proprietary trading aids suggests a limited value proposition. This goes beyond basic platform access. Contemporary successful brokers typically provide comprehensive research departments, daily market analysis, educational webinars, and specialized trading tools to differentiate their service offerings.

Without evidence of robust research and educational resources, DaVinci's tool suite appears to rely entirely on MT5's built-in functionality. While competent, this may not provide the comprehensive support that traders increasingly expect from their brokerage relationships in competitive market conditions.

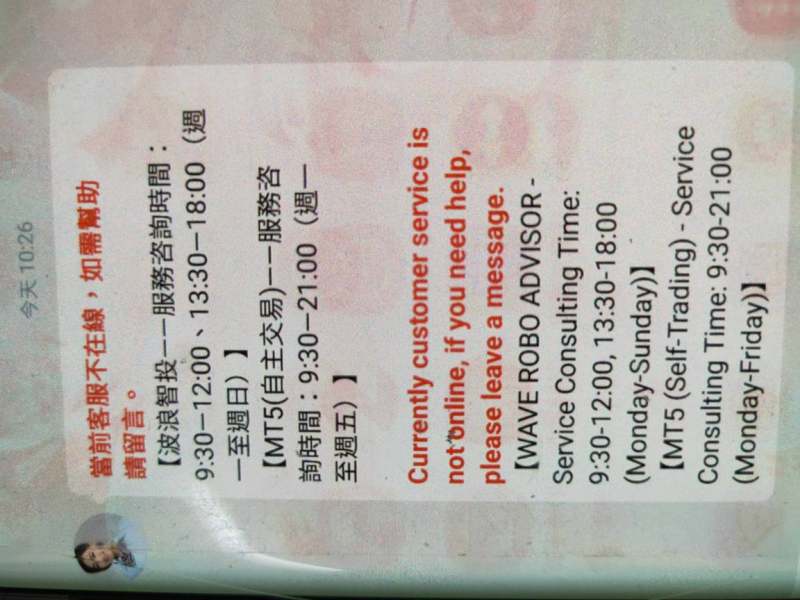

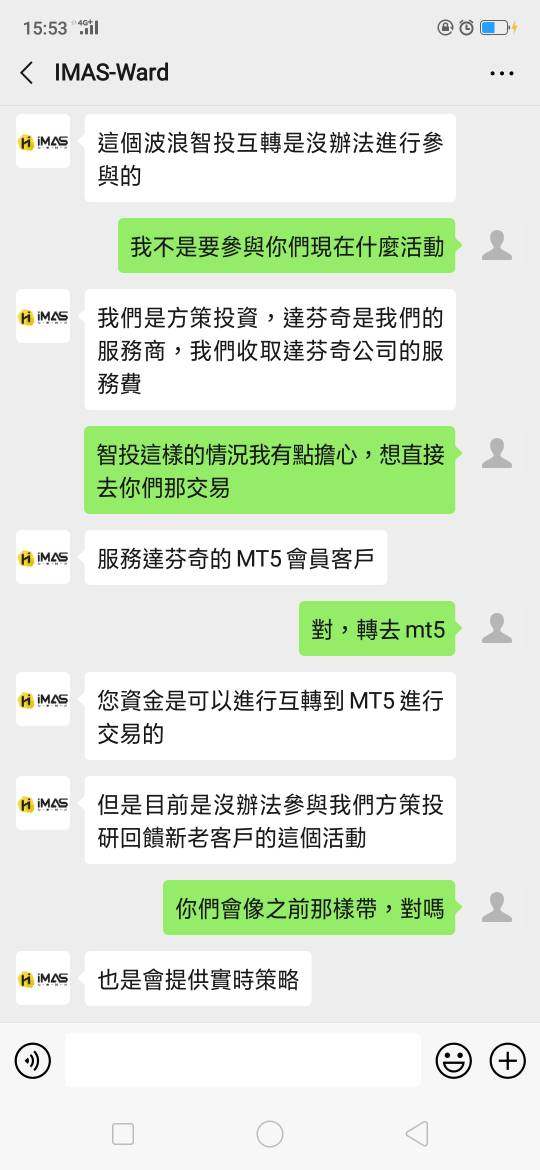

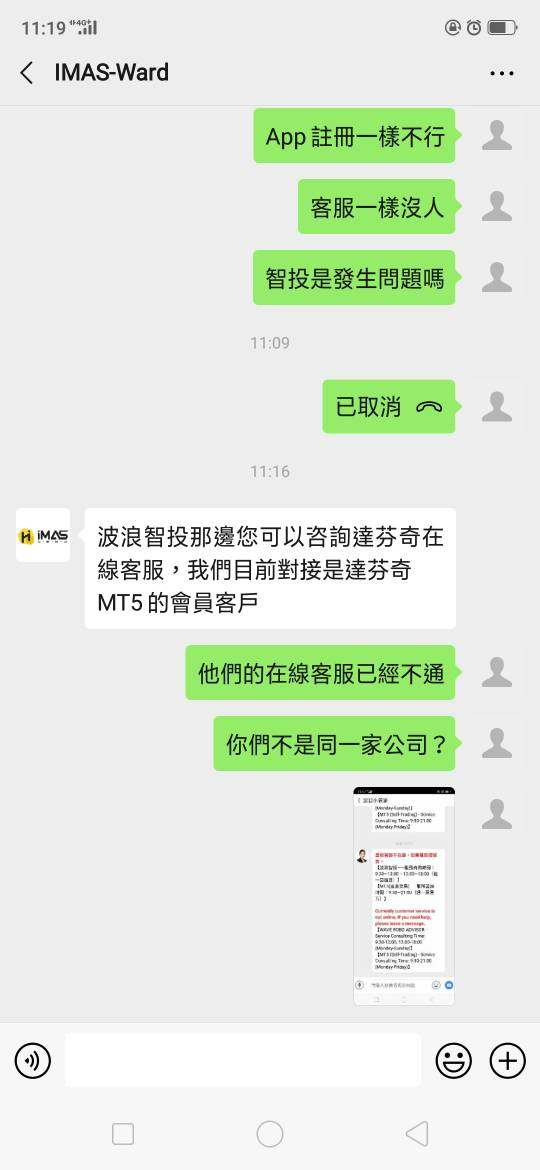

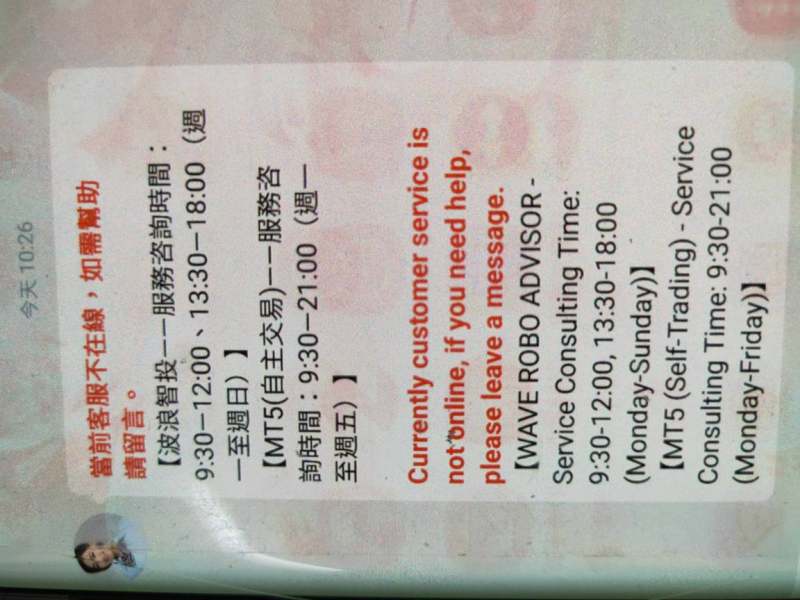

Customer Service and Support Analysis

The customer service evaluation reveals serious concerns. 69 documented user complaints represent a substantial volume of negative feedback for a broker of DaVinci's apparent size and market presence. This complaint volume suggests systematic service delivery problems rather than isolated incidents or individual dissatisfaction cases.

Effective customer service represents a critical differentiator in the competitive forex brokerage market. Traders require responsive support for technical issues, account management, and trading-related inquiries. The high complaint volume indicates potential problems with response times, issue resolution effectiveness, or fundamental service quality standards.

Without specific information about customer service channels, availability hours, or language support options, potential clients cannot assess whether the broker provides adequate support infrastructure. This is necessary for their trading requirements. The lack of transparent customer service information, combined with the substantial complaint volume, suggests significant operational deficiencies in client support capabilities.

The customer service challenges evidenced by user complaints likely contribute significantly to the poor WikiFX rating and overall negative market perception. Effective customer service recovery and improvement would be essential for any potential reputation rehabilitation efforts.

Trading Experience Analysis

The trading experience evaluation centers on MetaTrader 5 platform functionality. This provides a solid foundation for forex trading activities including advanced order types, comprehensive charting capabilities, and algorithmic trading support. MT5's established market position and feature set offer experienced traders familiar functionality for implementing various trading strategies.

However, the absence of mobile platform support represents a significant limitation in contemporary trading environments. Flexibility and accessibility have become standard expectations. Modern traders frequently require the ability to monitor positions, execute trades, and respond to market developments while away from desktop environments.

Platform stability and execution quality information was not available in the reviewed materials. This prevents assessment of critical performance factors including order execution speed, slippage rates, and system reliability during high-volume trading periods. These technical performance aspects significantly impact actual trading outcomes regardless of platform feature availability.

This davinci review identifies the trading experience as fundamentally limited by infrastructure gaps and the lack of comprehensive platform ecosystem. Contemporary traders typically expect this from competitive brokerage relationships.

Trustworthiness Analysis

The trustworthiness evaluation reveals severe concerns. WikiFX's 1.95 rating represents one of the lowest possible assessments on their evaluation scale. This rating typically indicates significant problems with regulatory compliance, operational transparency, or client fund security measures that pose substantial risks to potential traders.

The absence of clear regulatory information compounds trust concerns. Legitimate brokers typically maintain transparent regulatory status disclosure including license numbers, regulatory authority details, and compliance framework information. Regulatory oversight provides essential client protections including fund segregation requirements, dispute resolution mechanisms, and operational standard enforcement.

The combination of poor third-party ratings and substantial user complaint volume creates a pattern of trust-related issues. This extends beyond isolated incidents to suggest systematic operational problems. The 69 documented complaints represent significant negative feedback that would typically prompt regulatory investigation in properly overseen markets.

Without evidence of robust regulatory oversight, transparent operational practices, or effective complaint resolution procedures, DaVinci's trustworthiness profile presents substantial concerns. Potential clients should be cautious when considering fund deposits or trading activities with this broker.

User Experience Analysis

The user experience assessment reveals significant satisfaction challenges. The low WikiFX rating and substantial complaint volume indicate widespread dissatisfaction among the broker's client base. This pattern suggests systematic problems with service delivery rather than isolated negative experiences or unrealistic client expectations.

User experience encompasses multiple touchpoints including account opening procedures, platform usability, customer service interactions, fund management processes, and overall service reliability. The negative feedback patterns suggest problems across multiple service areas rather than concentrated issues in specific operational aspects.

The limitation to desktop-only trading platforms significantly impacts user experience in contemporary trading environments. Mobile accessibility has become a standard expectation. This technological limitation restricts trading flexibility and convenience, potentially frustrating users who require comprehensive platform access across multiple devices.

The substantial complaint volume indicates that current clients have experienced sufficient service problems to motivate formal complaint submissions. This suggests that issues extend beyond minor inconveniences to more serious operational deficiencies that impact trading activities and client satisfaction levels.

Conclusion

This comprehensive davinci review reveals significant concerns across multiple evaluation dimensions. The result is an overall negative assessment that suggests extreme caution for potential clients. The combination of WikiFX's 1.95 rating and 69 user complaints indicates systematic operational problems that extend beyond isolated incidents to suggest fundamental service delivery challenges.

While DaVinci's MetaTrader 5 platform support provides basic trading functionality, the numerous operational deficiencies, trust concerns, and user satisfaction problems significantly outweigh any potential benefits. The broker appears unsuitable for most trader segments, with particular concerns for newer traders who require reliable support and transparent operational practices.

The primary advantages include access to established MT5 trading technology. However, these benefits are substantially overshadowed by poor customer service performance, limited platform accessibility, trust and regulatory concerns, and widespread user dissatisfaction. Prospective clients would be well-advised to consider alternative brokers with stronger regulatory oversight, better customer service records, and more comprehensive service offerings.