Regarding the legitimacy of FAMFX forex brokers, it provides ASIC and WikiBit, (also has a graphic survey regarding security).

Is FAMFX safe?

Pros

Cons

Is FAMFX markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Forex Execution (STP)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

UnverifiedLicense Type:

Inst Forex Execution (STP)

Licensed Entity:

FLAG ASSET MANAGEMENT PTY LTD

Effective Date:

2014-08-15Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Level 4, 285-287 George Street, SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Famfx Safe or a Scam?

Introduction

Famfx is a forex broker that positions itself within the competitive landscape of online trading platforms. Established with the aim of providing traders access to various financial markets, Famfx has garnered attention from both novice and experienced traders. However, the forex market is notorious for its risks, and traders must exercise caution when selecting a broker. The importance of thoroughly evaluating a broker cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to investigate whether Famfx is a safe trading option or a potential scam. Our analysis is based on a review of regulatory status, company background, trading conditions, customer feedback, and overall risk assessment.

Regulatory Status and Legitimacy

The regulatory framework surrounding a forex broker is crucial in determining its legitimacy. A regulated broker is typically subject to rigorous oversight, ensuring compliance with industry standards and protecting client interests. In the case of Famfx, concerns have arisen regarding its regulatory status.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Suspicious Clone |

From the table above, it is evident that Famfx operates under the auspices of ASIC, the Australian Securities and Investments Commission. However, the designation of "suspicious clone" raises red flags. This suggests that Famfx may not be a legitimate entity but rather a clone of a regulated broker, which often indicates potential fraud. The absence of a valid license number further complicates the situation, as it implies a lack of regulatory oversight.

The quality of regulation is paramount; brokers regulated by top-tier bodies like ASIC are expected to adhere to strict guidelines that promote transparency and client protection. Unfortunately, Famfx does not appear to meet these criteria, and its historical compliance record is questionable. This lack of robust regulation places traders at risk, making it essential to consider whether Famfx is safe for trading.

Company Background Investigation

Understanding the background of a broker is vital for assessing its reliability. Famfx has been operational for several years, but the specifics of its ownership structure and management team are not widely available. This lack of transparency can be concerning, as it makes it difficult for traders to ascertain the broker's credibility.

The management team of a broker plays a crucial role in its operations. In the case of Famfx, limited information is available regarding the qualifications and experience of its executives. A well-structured management team with relevant industry experience can significantly enhance a broker's trustworthiness. The absence of such information raises questions about the company's commitment to ethical practices and client service.

Moreover, the level of information disclosure by Famfx is not sufficient to instill confidence among potential clients. Transparency is a hallmark of reputable brokers, and the reluctance to provide detailed information about company operations and management can be a warning sign. Given these factors, potential traders must carefully evaluate whether Famfx is safe to use.

Trading Conditions Analysis

When assessing a broker, the trading conditions they offer are paramount. Famfx claims to provide competitive trading fees and a variety of trading instruments. However, it is essential to scrutinize the fee structure to identify any hidden costs that could affect profitability.

| Fee Type | Famfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Structure | None | $5 per lot |

| Overnight Interest Range | 2% | 1.5% |

The table above outlines the core trading costs associated with Famfx. While the spreads appear competitive, the absence of a commission structure may be misleading. Many brokers that do not charge commissions often compensate through wider spreads, which can erode profits. Furthermore, the overnight interest rates are higher than the industry average, suggesting that holding positions overnight could be costly for traders.

These trading conditions, while seemingly favorable at first glance, warrant further investigation. Traders should be cautious of any unusual fee policies that could impact their trading experience. Understanding the full scope of costs associated with trading on Famfx is essential for determining whether Famfx is safe for investment.

Client Fund Security

The safety of client funds is a critical factor when considering a broker. Famfx claims to implement various security measures to protect client deposits. However, the efficacy of these measures must be evaluated in detail.

Famfx reportedly utilizes segregated accounts for client funds, which is a standard practice among reputable brokers. This means that client funds are kept separate from the broker's operational funds, providing an additional layer of security. Furthermore, the broker claims to offer negative balance protection, which is crucial in preventing clients from losing more than their initial deposit.

Despite these assurances, there have been reports of client funds being mishandled, raising concerns about the effectiveness of Famfx's security measures. Historical disputes and complaints related to fund withdrawals further exacerbate these concerns. Therefore, potential clients must carefully consider whether Famfx is safe for their investments.

Customer Experience and Complaints

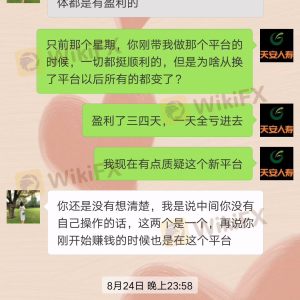

Customer feedback is a valuable indicator of a broker's reliability. Analyzing user experiences can shed light on potential issues and the broker's responsiveness to client concerns. Famfx has received mixed reviews from its clients, with several complaints highlighting significant challenges.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Service | Medium | Average |

| Misleading Information | High | Unresolved |

The table above summarizes the major complaint types against Famfx. The most pressing issue appears to be withdrawal difficulties, which is a common red flag in the forex industry. Delays in processing withdrawals can indicate deeper operational problems and may suggest that the broker is not managing client funds appropriately.

Additionally, clients have reported poor customer service, which can exacerbate frustrations when issues arise. The failure to address complaints effectively can lead to a loss of trust among traders. Given these experiences, it is crucial for potential clients to weigh the risks before deciding if Famfx is safe for trading.

Platform and Trade Execution

The performance of a trading platform is essential for a positive trading experience. Famfx offers a trading platform that is designed to facilitate smooth order execution and provide a user-friendly interface. However, the actual performance can vary significantly based on market conditions and broker practices.

Issues such as slippage and order rejections are common complaints among traders. In the case of Famfx, some users have reported instances of significant slippage during volatile market conditions, which can lead to unexpected losses. Furthermore, the execution quality is a critical factor; if a broker frequently rejects orders or fails to execute trades promptly, it can severely impact a trader's strategy.

While the platform may offer advanced features, the overall reliability and stability must be assessed. Any signs of platform manipulation or consistent execution issues should be treated as serious warnings. Therefore, traders must consider whether Famfx is safe based on their platform's performance.

Risk Assessment

Engaging with any forex broker carries inherent risks, and Famfx is no exception. A comprehensive risk assessment is necessary to understand the potential pitfalls associated with this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of proper regulation |

| Financial Risk | Medium | Concerns over fund safety |

| Operational Risk | High | Issues with withdrawals and customer service |

The table above summarizes the key risk areas associated with Famfx. The high regulatory risk is particularly concerning, as it indicates that traders may not have adequate protections in place. Additionally, the operational risks related to fund withdrawals and customer service further compound the potential dangers of trading with Famfx.

To mitigate these risks, traders should conduct thorough research and consider starting with a small investment. It is also advisable to keep abreast of any regulatory updates or changes in the broker's status. Thus, assessing whether Famfx is safe involves understanding and addressing these risks.

Conclusion and Recommendations

In conclusion, the investigation into Famfx reveals several concerning factors that warrant careful consideration. The lack of robust regulation, mixed customer feedback, and operational challenges raise significant doubts about the broker's reliability. While Famfx may offer attractive trading conditions, the associated risks cannot be overlooked.

For traders seeking a safe trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of customer satisfaction. Brokers regulated by top-tier authorities like the FCA or ASIC should be prioritized, as they typically offer better protections and transparency.

In summary, potential clients must approach Famfx with caution and thoroughly evaluate whether Famfx is safe for their trading needs. It may be prudent to explore more established and reputable brokers to ensure a secure trading experience.

Is FAMFX a scam, or is it legit?

The latest exposure and evaluation content of FAMFX brokers.

FAMFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FAMFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.