Is Crossworld safe?

Pros

Cons

Is Crossworld Safe or a Scam?

Introduction

In the dynamic world of forex trading, brokers play a crucial role in facilitating transactions and providing traders with the necessary tools to navigate the market. One such broker is Crossworld, which has garnered attention for its services in foreign currency exchange. However, the increasing number of scam reports in the forex industry necessitates that traders exercise caution when selecting a broker. This article aims to provide an objective analysis of whether Crossworld is a safe trading platform or a potential scam. To achieve this, we will employ a comprehensive evaluation framework, examining regulatory status, company background, trading conditions, customer safety measures, user feedback, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor that determines its legitimacy and reliability. A well-regulated broker is subject to stringent oversight, which helps protect traders' interests and funds. In the case of Crossworld, it is essential to note that it operates without any valid regulatory licenses, which raises significant red flags.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Crossworld is not held accountable to any governing body, leaving traders vulnerable to potential fraud and malpractice. Moreover, the lack of transparency regarding its operations further complicates the situation. There have been numerous complaints regarding the broker's practices, with users alleging manipulation of trades and difficulty in withdrawing funds. This lack of oversight and the reported issues suggest that traders should be wary of engaging with Crossworld.

Company Background Investigation

Crossworld Securities Limited, the entity behind the Crossworld brand, has a somewhat opaque history. Established in Nigeria, the company claims to offer services in stockbroking, asset management, and financial advisory. However, the lack of detailed information regarding its ownership structure and management team raises concerns about its credibility.

The company's website does not provide sufficient transparency regarding its operational history, and the absence of information about its founders or key personnel makes it challenging to assess the expertise and professionalism of its management. A transparent company typically shares information about its team and their qualifications, which is crucial for building trust with clients. The limited disclosure from Crossworld indicates a lack of commitment to transparency, which is a significant factor when evaluating its safety.

Trading Conditions Analysis

Understanding a broker's trading conditions is vital for traders looking to maximize their potential profits while minimizing costs. Crossworld's fee structure appears to be complex, with various charges that may not be immediately clear to traders.

| Fee Type | Crossworld | Industry Average |

|---|---|---|

| Major Currency Pair Spread | High | 1-3 pips |

| Commission Model | Varies | Fixed/Variable |

| Overnight Interest Range | N/A | 0.5%-2% |

The spreads offered by Crossworld are reportedly higher than the industry average, which can significantly impact a trader's profitability. Additionally, the broker's commission structure is not clearly defined, making it difficult for traders to understand the total cost of their trades. Such lack of clarity can lead to unexpected expenses, further complicating the trading experience.

Customer Funds Safety

The safety of customer funds is paramount when selecting a forex broker. Crossworld's approach to fund security is concerning, as there is no indication that it employs adequate measures such as segregated accounts or investor protection schemes. Segregating client funds from the broker's operational funds is a standard practice among reputable brokers, ensuring that traders' money is safe even in the event of the broker's insolvency.

Furthermore, the absence of negative balance protection is alarming, as this policy protects traders from losing more than their initial investment. Without these safety measures, traders who engage with Crossworld may be at risk of significant financial loss, especially in volatile market conditions.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. In the case of Crossworld, numerous complaints have surfaced, highlighting issues such as withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

Many users have reported that they faced challenges when attempting to withdraw their funds, with some alleging that their requests were ignored or met with vague responses. This pattern of complaints is concerning and suggests that Crossworld may not prioritize customer satisfaction or transparency. For potential traders, these reports serve as a warning sign regarding the broker's reliability.

Platform and Trade Execution

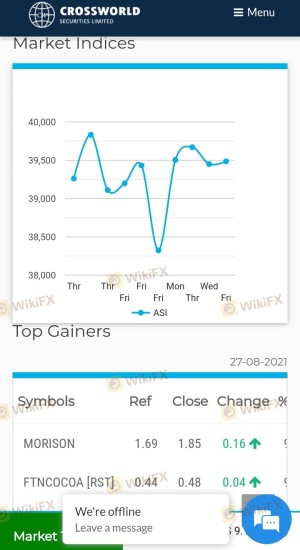

A broker's trading platform is a critical component of the trading experience. Crossworld's platform has been described as unstable, with users experiencing frequent downtimes and execution delays.

The quality of order execution is another critical aspect, as traders rely on timely and accurate trade placements. Reports of slippage and rejections of orders have surfaced, further indicating potential manipulation or inefficiencies within the trading system. Such issues can severely impact a trader's ability to capitalize on market opportunities, raising further doubts about the safety of trading with Crossworld.

Risk Assessment

Engaging with Crossworld presents several risks that potential traders should consider.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | Medium | Poor responsiveness to complaints |

| Execution Risk | High | Reports of slippage and order rejections |

Given these risks, it is advisable for traders to approach Crossworld with caution. Implementing effective risk mitigation strategies, such as using a demo account or starting with small investments, may help alleviate some concerns.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Crossworld raises significant concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with numerous customer complaints and insufficient transparency, indicates that traders should be cautious when considering this broker.

For those seeking reliable alternatives, it is recommended to explore brokers that are well-regulated, have a proven track record of customer satisfaction, and demonstrate transparency in their operations. Some reputable options include brokers regulated by tier-1 authorities such as the FCA or ASIC, which provide robust protections for traders.

In summary, while Crossworld may offer trading services, the potential risks associated with this broker suggest that it may not be a safe choice for traders looking to protect their investments.

Is Crossworld a scam, or is it legit?

The latest exposure and evaluation content of Crossworld brokers.

Crossworld Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Crossworld latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.