Is FX Choice safe?

Pros

Cons

Is FX Choice A Scam?

Introduction

FX Choice, established in 2010 and based in Belize, positions itself as a competitive player in the forex and CFD trading market. It offers a range of trading instruments, including forex pairs, commodities, indices, and cryptocurrencies, catering to both novice and experienced traders. Given the complexities and risks associated with forex trading, it is crucial for traders to thoroughly evaluate brokers before committing their funds. This article aims to provide an objective analysis of FX Choice's credibility, focusing on regulatory compliance, company background, trading conditions, customer fund security, and user experiences. The findings are based on a comprehensive review of various sources, including regulatory databases, user feedback, and industry reports.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in assessing its legitimacy. FX Choice is regulated by the International Financial Services Commission (IFSC) of Belize, which is considered a tier-3 regulatory authority. While it does provide some oversight, it lacks the stringent requirements associated with top-tier regulators like the FCA or ASIC. Below is a summary of FX Choice's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | 000067/301 | Belize | Verified |

The significance of regulatory oversight cannot be overstated, as it serves to protect traders interests and ensures fair trading practices. However, the IFSC's regulations are often viewed as less robust compared to those of more established jurisdictions. This raises concerns regarding the level of investor protection offered by FX Choice. Traders should be aware that while the broker is legally registered, the lack of a more reputable regulatory framework may expose them to higher risks, especially in terms of fund security and dispute resolution.

Company Background Investigation

FX Choice was founded in 2010 and has steadily built a reputation in the forex market. The company operates under the ownership of FX Choice Limited, and its headquarters are located in Belize. The management team comprises individuals with extensive experience in the financial markets, though detailed information about their professional backgrounds is limited. Transparency is a crucial aspect of any financial institution, and while FX Choice does provide some insights into its operations, the overall level of information disclosure is not as comprehensive as that of its competitors.

The company has maintained a consistent operational history, which is a positive indicator of its stability. However, the offshore nature of its regulation raises questions about its accountability and the protections available to its clients. Traders should consider these factors when evaluating the trustworthiness of FX Choice, as a lack of transparency can often be a red flag in the brokerage industry.

Trading Conditions Analysis

FX Choice offers various trading accounts, including Classic, Pro, and Optimum accounts, each with distinct features and fee structures. The overall cost structure is competitive, but traders should be aware of potential hidden fees. Below is a comparison of FX Choice's core trading costs:

| Fee Type | FX Choice | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | From 0.5 pips | From 1.0 pips |

| Commission Model | $3.50 per side | $2.50 per side |

| Overnight Interest Range | Varies by pair | Varies by pair |

FX Choice's spreads are competitive, especially for the Pro account, which offers spreads starting at 0 pips but comes with a commission charge. The Classic account, while offering no commission, has slightly higher spreads. This tiered pricing model is beneficial for high-volume traders but may be less appealing for those with lower trading frequencies. Additionally, FX Choice does not charge inactivity fees, which is a positive aspect for traders who do not engage in frequent trading.

However, potential issues arise from the commission structure, particularly for the Pro account. The commission may be higher than that of some competitors, which could deter certain traders. It is essential for prospective clients to carefully analyze their trading styles and select the account type that aligns with their needs.

Customer Fund Security

The safety of customer funds is paramount in the forex industry. FX Choice employs several measures to ensure the security of its clients' deposits. Funds are held in segregated accounts, meaning they are kept separate from the company's operational funds. This practice is essential in protecting clients' money in the event of the company's insolvency. Additionally, FX Choice claims to implement negative balance protection, which prevents clients from losing more than their deposited amounts.

Despite these measures, the broker's regulatory status raises concerns about the overall safety of funds. The IFSC does not offer the same level of investor protection as top-tier regulators, which can leave clients vulnerable in case of disputes. Historical issues surrounding fund security have been noted in user reviews, with some clients reporting difficulties in withdrawing their funds. These experiences highlight the importance of conducting thorough due diligence before trading with FX Choice.

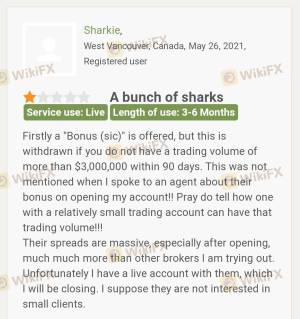

Customer Experience and Complaints

User feedback is a valuable source of insight into a broker's reliability and service quality. FX Choice has received a mix of positive and negative reviews from its clients. Common complaints include issues with fund withdrawals and customer service responsiveness. Below is a summary of prevalent complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Service | Medium | Generally responsive |

| Trading Conditions | Medium | Mixed reviews |

Several users have reported challenges in withdrawing their funds, often citing delays and complications during the process. In some cases, clients have expressed frustration over the lack of clear communication from the broker regarding their withdrawal requests. On the other hand, some users have praised the broker's trading conditions and execution speed, indicating that experiences can vary significantly.

One notable case involved a trader who faced difficulties withdrawing their funds after a profitable trading period. The broker's response was reportedly slow, leading to dissatisfaction and a loss of trust. Such experiences underscore the importance of assessing a broker's customer service quality before committing to a trading account.

Platform and Trade Execution

FX Choice offers two popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are well-regarded in the industry for their advanced features and user-friendly interfaces. However, the performance and stability of the platforms are critical for a seamless trading experience. Traders have generally reported positive experiences with FX Choice's platforms, citing fast order execution and minimal slippage.

While there have been no widespread reports of platform manipulation, traders should remain vigilant and monitor their trading conditions closely. The quality of order execution is essential for maintaining profitability, and any signs of manipulation or delays can significantly impact trading outcomes.

Risk Assessment

Engaging with FX Choice involves certain risks that traders should consider. Below is a summary of the key risk areas associated with trading through this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack robust protections. |

| Withdrawal Risk | Medium | Reports of delayed withdrawals raise concerns. |

| Trading Risk | Medium | Leverage can amplify both gains and losses. |

To mitigate these risks, traders should adopt sound risk management practices, including setting appropriate stop-loss levels and avoiding excessive leverage. Additionally, conducting thorough research and remaining informed about market conditions can help traders make more informed decisions.

Conclusion and Recommendations

In conclusion, FX Choice presents a mixed picture regarding its reliability as a forex broker. While it offers competitive trading conditions and a variety of account options, its offshore regulatory status and reported withdrawal issues raise concerns about fund safety and overall trustworthiness. Traders should approach FX Choice with caution, particularly if they are new to forex trading or require robust customer support.

For traders seeking alternatives, consider brokers with stronger regulatory oversight, such as those regulated by the FCA or ASIC. These brokers typically offer better investor protection and more comprehensive customer service. Ultimately, it is crucial for traders to evaluate their individual needs and risk tolerance when selecting a broker, ensuring they choose a platform that aligns with their trading goals and provides a secure trading environment.

Is FX Choice a scam, or is it legit?

The latest exposure and evaluation content of FX Choice brokers.

FX Choice Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

FX Choice latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.