Is ICBFX safe?

Pros

Cons

Is Icbfx Safe or Scam?

Introduction

Icbfx is a forex brokerage that has emerged in the competitive landscape of foreign exchange trading since its establishment in 2018. Based in the United Kingdom, Icbfx positions itself as a platform for traders looking to engage in various financial instruments, including forex, commodities, and CFDs. However, the rise of online trading has also led to an increase in fraudulent activities, making it imperative for traders to exercise caution and conduct thorough assessments of the brokers they choose to work with. This article aims to investigate whether Icbfx is a safe trading platform or a potential scam. The evaluation will be based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer experiences, and risk factors.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial for determining its legitimacy and safety. Icbfx claims to be regulated by the Financial Conduct Authority (FCA) in the United Kingdom. However, it is essential to note that there are indications that Icbfx may be operating as a clone firm, which raises questions about its regulatory authenticity. Here is a summary of the core regulatory information regarding Icbfx:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 306088 | United Kingdom | Suspicious Clone |

The FCA is known for its stringent regulations, which include requirements for client fund protection, transparency, and operational integrity. However, the mention of Icbfx as a "suspicious clone" suggests that it may not be adhering to these regulations, putting traders at risk. The lack of a robust regulatory framework can lead to potential issues such as fund mismanagement and a lack of recourse for traders in case of disputes. Thus, the question "Is Icbfx safe?" becomes increasingly pertinent as we delve deeper into its operations.

Company Background Investigation

Understanding the company behind a brokerage is vital for assessing its credibility. Icbfx was founded in 2018, and while its establishment timeline might suggest a degree of stability, the regulatory concerns overshadow this aspect. The ownership structure of Icbfx is not transparently disclosed, which is a red flag for potential investors. A lack of information regarding the management team further complicates the evaluation process.

The management teams background and expertise can significantly influence a brokerage's operational integrity. Unfortunately, there is limited public information available about the individuals behind Icbfx, making it challenging to gauge their qualifications and experience in the financial services industry. The opacity surrounding the company's operations and its ownership structure raises concerns about transparency and accountability, which are crucial for any brokerage aiming to build trust with its clients.

Trading Conditions Analysis

When evaluating whether Icbfx is safe, it is essential to analyze its trading conditions. A thorough understanding of the fee structure and trading costs can provide insights into the broker's overall reliability. The following table summarizes the core trading costs associated with Icbfx:

| Fee Type | Icbfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Disclosed | 1.0 - 2.0 pips |

| Commission Model | Not Disclosed | Varies by broker |

| Overnight Interest Range | Not Disclosed | Varies by broker |

The absence of clear information regarding spreads and commissions is concerning. In the forex industry, transparency in pricing is critical, as hidden fees can significantly impact trading profitability. Traders should be wary of brokers that do not provide explicit details about their fee structures, as this can be indicative of potential scams.

Additionally, if Icbfx's spreads are significantly higher than the industry average, it could lead to increased trading costs, which may deter traders from engaging with the platform. Therefore, the lack of transparency regarding trading costs raises further questions about the overall safety and reliability of Icbfx.

Customer Funds Security

The safety of customer funds is paramount when assessing any brokerage. Icbfx claims to implement certain security measures to protect client funds. However, the specifics of these measures, such as fund segregation, investor protection schemes, and negative balance protection, are not clearly outlined.

Fund segregation ensures that client funds are kept separate from the broker's operational funds, providing a safety net in case of financial difficulties. Without clear information on whether Icbfx practices fund segregation, traders may face risks regarding the safety of their investments.

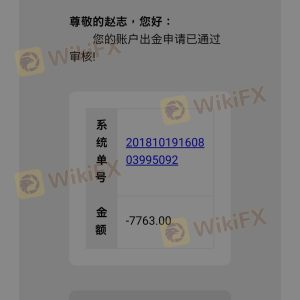

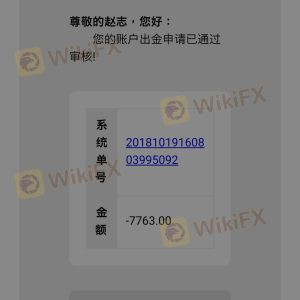

Moreover, the lack of a robust investor protection scheme can leave traders vulnerable in the event of broker insolvency. Historical issues related to fund safety, such as complaints regarding withdrawal difficulties, further exacerbate concerns about the security of funds held with Icbfx.

Customer Experience and Complaints

Customer feedback is a vital component of evaluating a broker's reliability. Reviews and complaints regarding Icbfx indicate a pattern of issues faced by traders. Many users report difficulties in withdrawing their funds, with some alleging that their accounts were banned without explanation. This raises serious concerns about the broker's operational practices and customer service quality.

The following table summarizes the main types of complaints associated with Icbfx:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Bans | High | Poor |

| Slippage and Execution Issues | Medium | Average |

Typical cases include traders who claim to have been unable to withdraw their funds after experiencing significant slippage during trading. The company's response to these complaints has been described as inadequate, with many users feeling ignored or dismissed.

These complaints highlight a concerning trend that suggests a lack of accountability on the part of Icbfx, raising further doubts about whether Icbfx is safe for trading.

Platform and Execution

The trading platform is another crucial aspect of a broker's offering. Icbfx utilizes the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and advanced trading tools. However, the platform's performance, stability, and execution quality are critical factors that influence the overall trading experience.

Reports of execution issues, such as high slippage and order rejections, have surfaced among Icbfx users. Such problems can significantly affect trading outcomes, especially in volatile market conditions. Additionally, any signs of platform manipulation, such as consistently unfavorable slippage, should be closely scrutinized, as they can indicate unethical practices.

Risk Assessment

When considering whether Icbfx is safe, it is essential to evaluate the overall risk associated with trading on the platform. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Potential clone operation |

| Financial Risk | High | Lack of transparency in fees and safety |

| Operational Risk | Medium | Issues with withdrawals and execution |

Given the identified risks, traders should exercise caution when considering Icbfx for their trading activities. It is advisable to implement risk mitigation strategies, such as starting with a small deposit and conducting thorough due diligence before committing significant funds.

Conclusion and Recommendations

In conclusion, the investigation into Icbfx raises significant concerns about its legitimacy and safety as a forex broker. The potential regulatory issues, lack of transparency regarding trading conditions, and numerous customer complaints suggest that traders should approach this broker with caution.

For traders seeking a reliable and secure trading environment, it may be prudent to consider alternative brokers that are well-regulated, transparent in their operations, and have a positive reputation among users. Some recommended alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer robust investor protection and transparent fee structures.

Ultimately, the question remains: Is Icbfx safe? Based on the available evidence, it is advisable for traders to be wary of potential risks and consider more reputable options for their trading activities.

Is ICBFX a scam, or is it legit?

The latest exposure and evaluation content of ICBFX brokers.

ICBFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ICBFX latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.