capivo 2025 Review: Everything You Need to Know

1. Abstract

This capivo review looks at Capivo, an offshore broker from the Marshall Islands. The Marshall Islands is known for loose financial rules. Based on public information and user feedback, Capivo is an unregulated broker with mixed results and a trust score of 50 out of 100. Many users complain about slow customer support and poor service quality, which makes this broker a bad choice for traders who need quick responses. The lack of clear details about account conditions, trading platforms, and costs creates more problems. Capivo targets traders who can handle high risks in an unregulated market. Some users mention that the platform is simple to use, but most feedback is negative.

usage: "capivo review" *

2. Notice

Capivo operates from the Marshall Islands, which has weak financial rules. Potential clients should be careful and do thorough research before using this platform. This review uses public sources and user feedback, which may not show the complete picture of how the broker works. Details about deposit methods, minimum deposits, and other transaction information are not fully available in the materials we found. Readers should keep these limits in mind when reading this assessment.

3. Rating Framework

Here is a detailed rating based on six key areas. Each score comes from current data, user reviews, and industry reports:

4. Broker Overview

Company Background

Capivo is an online forex broker that works mainly from the Marshall Islands. The broker's headquarters are at the Trust Company Complex on Ajeltake Island, Majuro, which has very loose oversight rules. We don't have much information about when the company started or its detailed history, but Capivo's business focuses on providing online trading for forex and possibly other assets. However, details about account types, leverage options, and spreads are unclear. Online sources and user reviews show that the broker has not built a strong reputation in the trading community because users cite poor customer service and limited transparency.

usage: "capivo review" *

Information about Capivo's trading platforms and asset offerings is very limited. The broker doesn't clearly say which trading platforms are available or give detailed information about tradable assets like currencies, commodities, indices, or cryptocurrencies. Capivo's regulatory status is also a major concern because operating in the Marshall Islands means the broker doesn't face strict oversight, which industry experts see as a big risk factor. The lack of clear regulatory credentials or following industry best practices shows up often in user reviews and expert analyses. While Capivo seems to offer a simple platform for online trading, the missing operational details and regulatory clarity leave potential traders with many questions.

Data sources: Various online reviews published between July and November 2024.

The following section breaks down key operational parts:

Regulatory Region :

Capivo operates from the Marshall Islands, which is known for loose regulatory rules. This lack of strict oversight means many of the broker's operations go unmonitored, which creates big risks for traders about fund security and fair operations.

Source: Multiple online broker reviews from 2024 indicate concerns about unregulated operations.

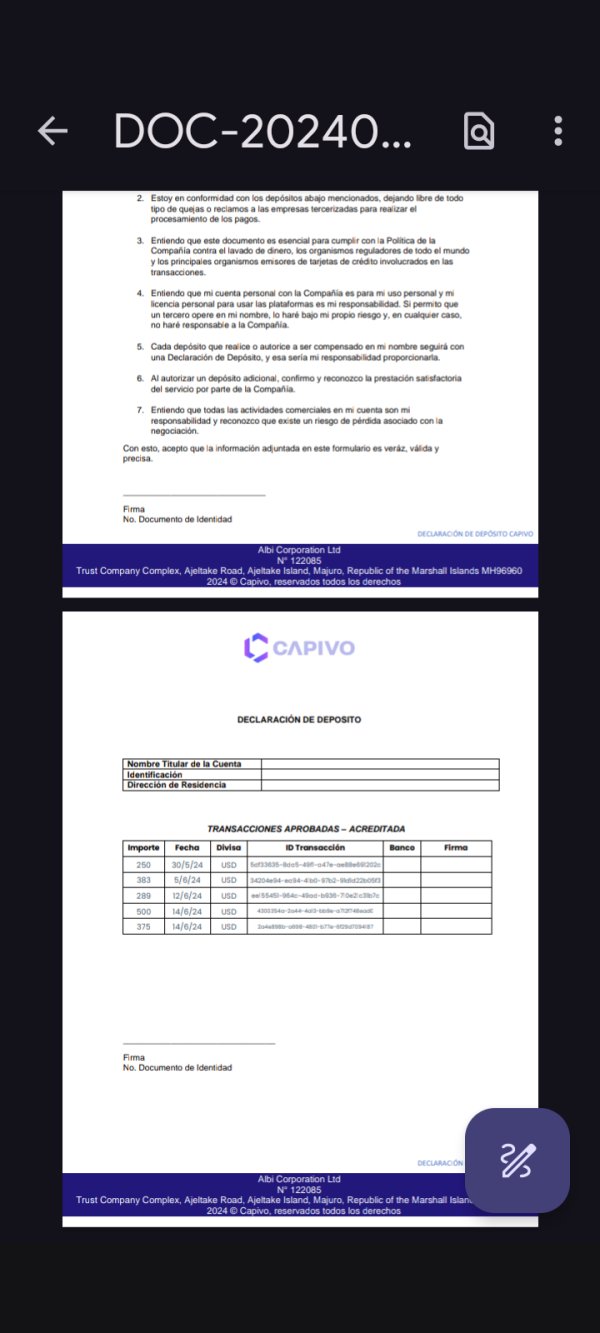

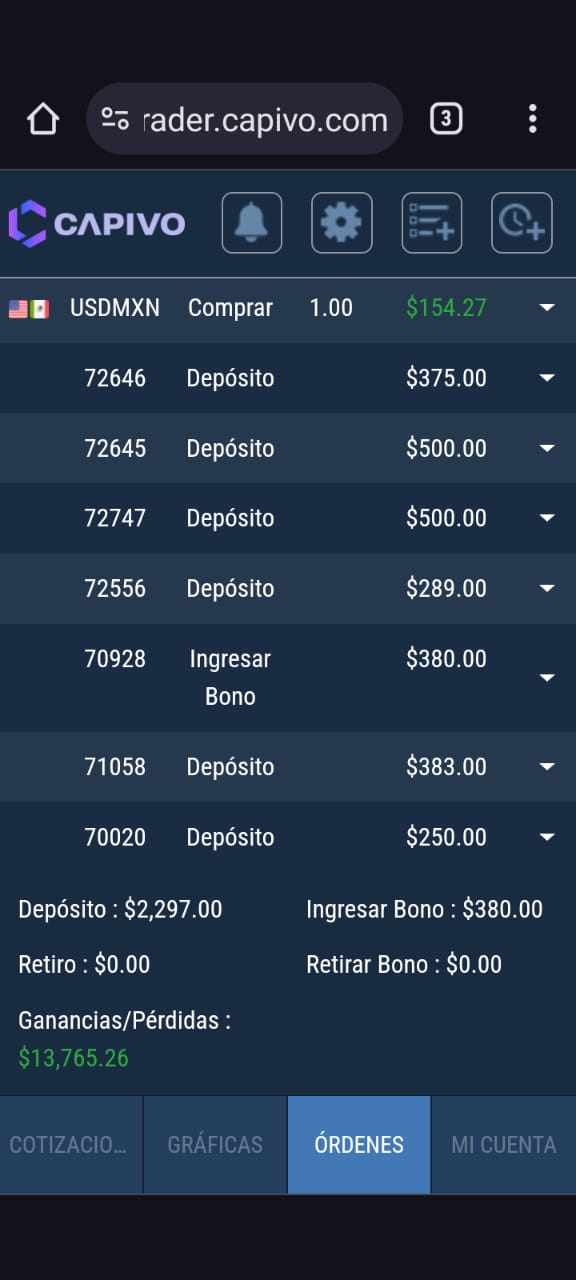

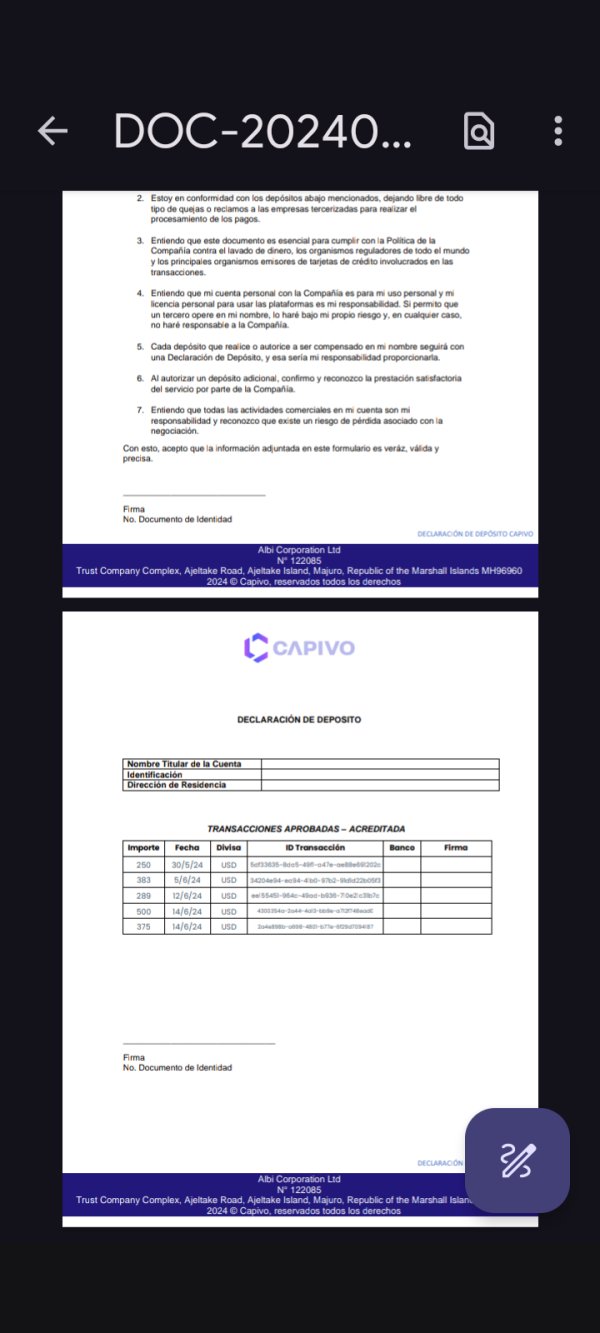

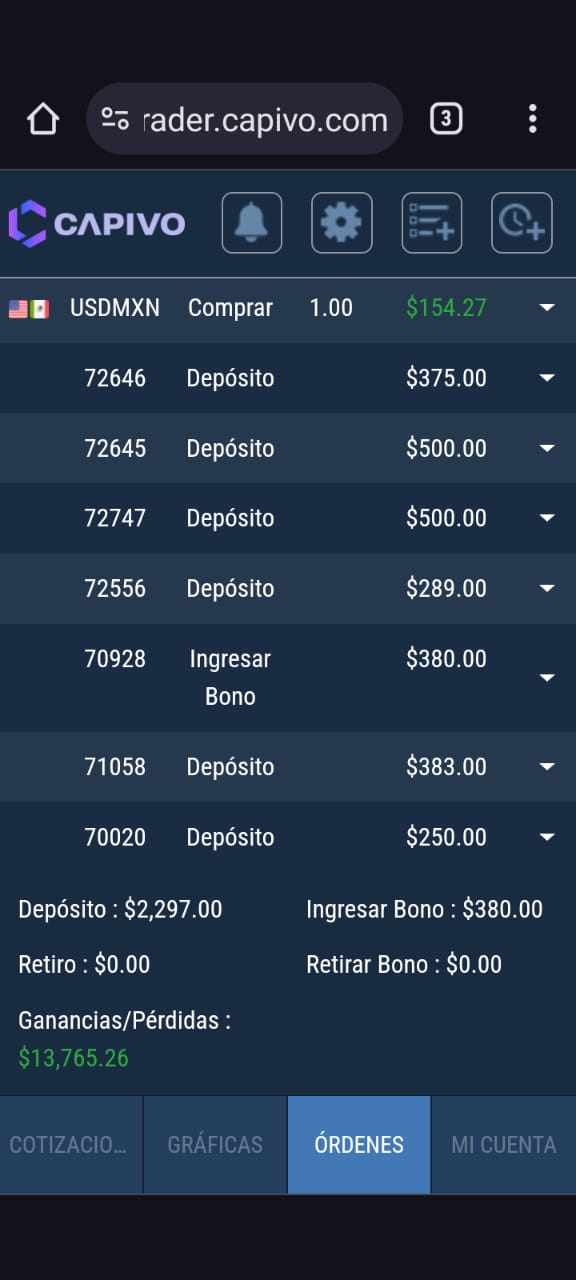

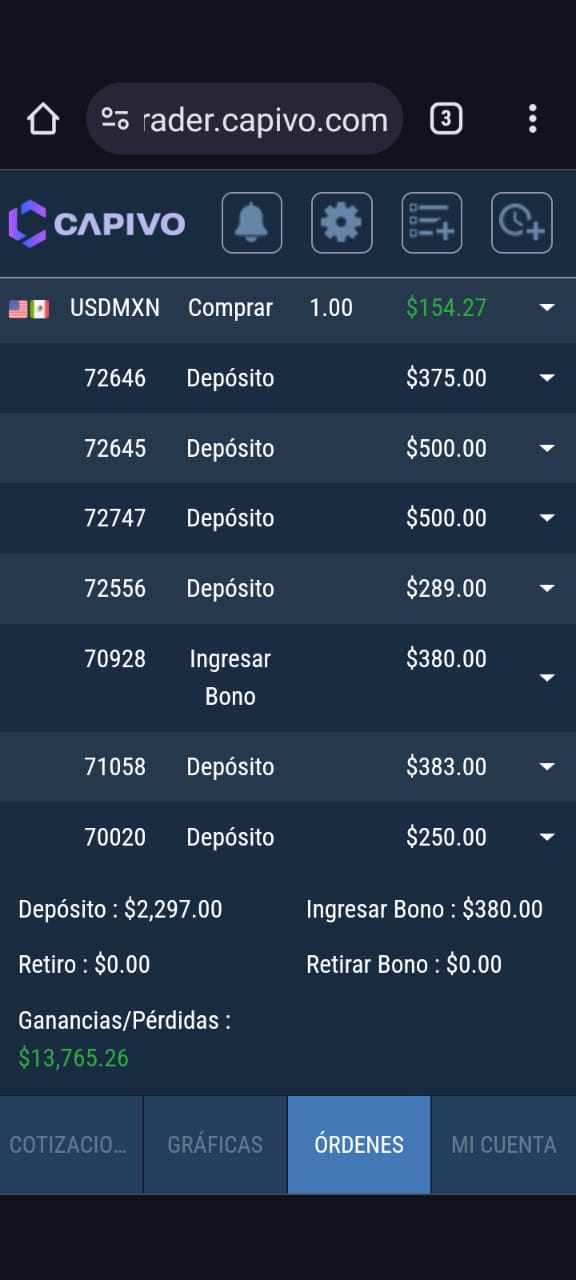

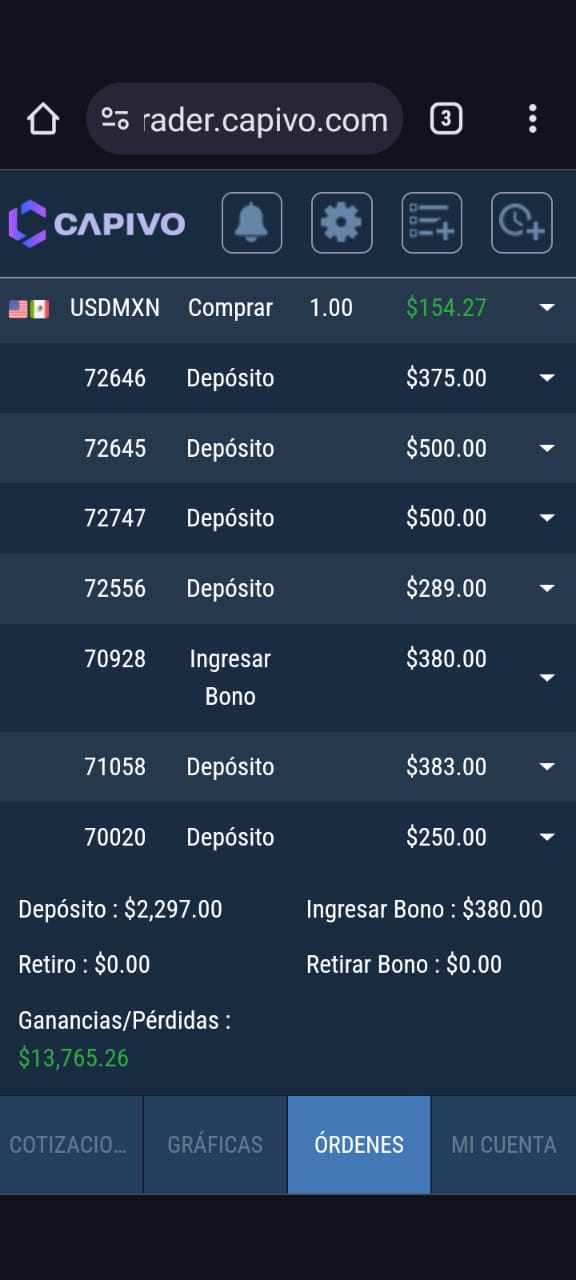

Deposit and Withdrawal Methods :

The available documents don't show specific deposit and withdrawal methods. This missing information leaves traders unsure about how easy and reliable it is to move funds in and out of their trading accounts.

Information not provided in the summary.

Minimum Deposit Requirements :

There is no clear information about minimum deposit requirements. This suggests that this detail may be very low or purposely vague.

Information not provided in the summary.

Bonuses and Promotions :

There is no record of any bonus or promotional offers from Capivo. Traders should be careful because the broker doesn't seem to offer any incentives to new or existing clients.

Information not provided in the summary.

Tradable Assets :

The list of tradable assets is not clearly mentioned. While Capivo is described as a forex broker, there are no details about whether other asset classes like commodities or indices are available for trading.

Information not provided in the summary.

Cost Structure :

Capivo doesn't share detailed cost information, including spreads, commissions, or additional trading fees. The lack of clear pricing details raises serious concerns about overall trading costs. Users don't have solid data to compare cost efficiency against other brokers in the market, which increases the risk of hidden fees or poor trading conditions.

Information not provided in the summary.

Leverage :

Information about leverage ratios is missing from public disclosures. Traders should assume there might be standard or non-competitive leverage offerings without further checking.

Information not provided in the summary.

Platform Selection :

Capivo doesn't provide detailed descriptions of available trading platforms. This includes missing information about software usability, mobile versus desktop compatibility, or advanced platform functions.

Information not provided in the summary.

Regional Restrictions :

No specific regional restrictions are detailed in the available information. However, the platform's offshore status may limit its availability in certain areas.

Information not provided in the summary.

Customer Service Languages :

Information about languages supported by Capivo's customer service is not shared. This leaves uncertainty about multilingual support for global users.

Information not provided in the summary.

usage: "capivo review" *

6. Detailed Rating Analysis

6.1 Account Conditions Analysis

The analysis of Capivo's account conditions shows that important details like different account types, minimum deposits, spreads, and commissions are not clearly provided. This unclear information makes it hard for traders to see if the broker's account offerings compete well with internationally regulated brokers. The lack of clear information on leverage and special account features, like Islamic accounts, makes the broker less appealing. User feedback in various online reviews shows that missing detailed account specifications has led to confusion and disappointment among potential clients. Compared with other brokers, Capivo's account conditions are considered below average and often cited as a major problem in multiple user reviews.

*Source: Reviews from forexbrokerz and InvestReviews *

usage: "capivo review" *

When looking at Capivo's trading tools and resources, the broker clearly falls short of industry standards. There is a lack of detailed information on the type and quality of trading platforms offered. No evidence shows that Capivo provides advanced charting tools, technical analysis features, automated trading capabilities, or dedicated research materials. Educational resources for new traders—such as tutorials or webinars—are also not mentioned in available information. Multiple expert reviews have pointed out that missing these tools and resources results in a poor overall trading experience, which puts Capivo at a big disadvantage compared with well-regulated brokers. As a result, traders may need to look elsewhere for a more complete trading environment that supports both new and experienced market participants.

*Source: Various online analyses and expert opinion reports *

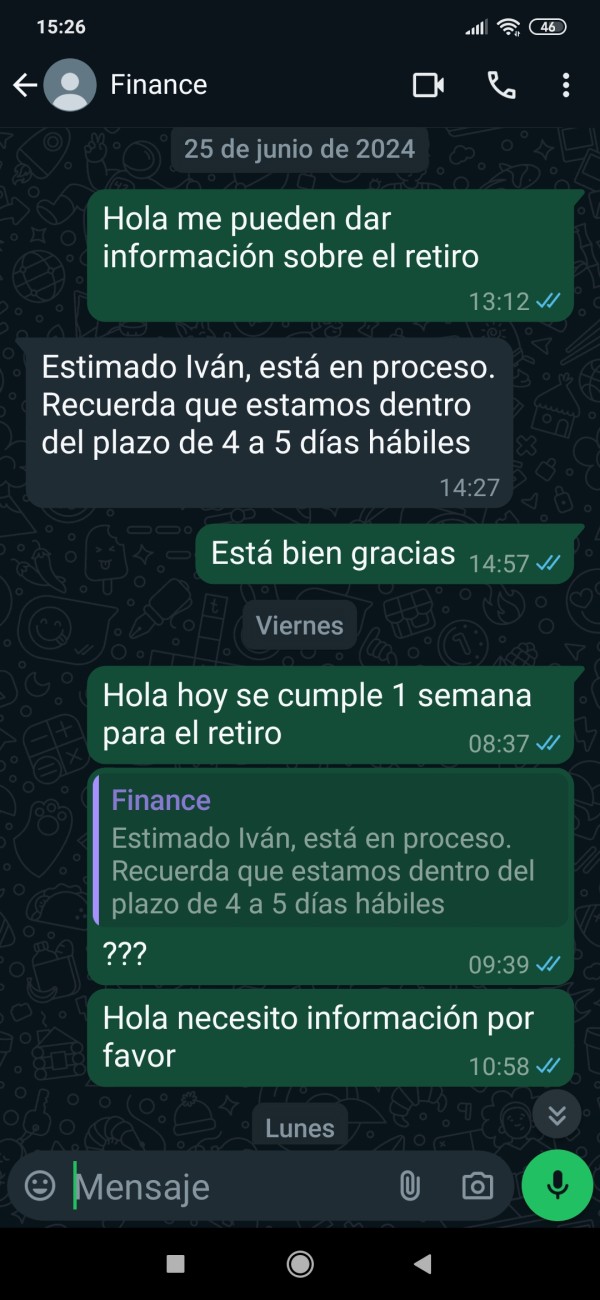

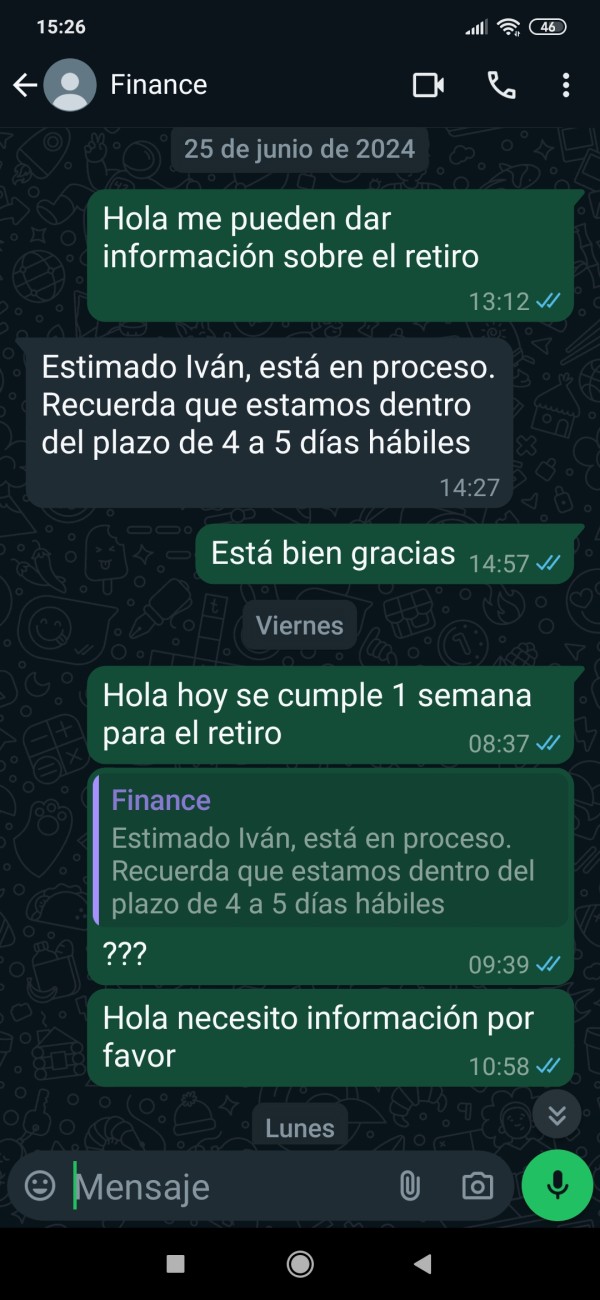

6.3 Customer Service and Support Analysis

Customer service at Capivo has been a repeated criticism in user reviews. The available information shows that the broker's support system has slow response times and poor overall service quality. Users have reported that questions and issues often face long delays, which makes the risks of an unregulated trading platform even worse. The lack of clarity on which communication channels are available or reliably maintained further hurts trust. Without proper multi-language support or clearly defined customer service hours, traders from different regions may struggle to solve problems quickly. These factors lead to a generally low rating in customer service, showing the big problems that can affect the daily trading experience.

*Source: User feedback from ForexBrokerz and InvestReviews *

6.4 Trading Experience Analysis

The overall trading experience with Capivo is hurt by several problems. While the broker claims to provide online trading service, there is little evidence of a strong and reliable trading platform. Detailed aspects like platform stability, order execution speed, and mobile trading options are not addressed in available information. As a result, traders are left unsure about the operational efficiency and security of trade execution. Without detailed information on execution quality—such as slippage, latency, and liquidity—users remain doubtful about the practical usability of the system. Several traders have highlighted these points, noting that the absence of a complete and well-supported trading platform puts Capivo at a disadvantage compared to other industry players.

*Source: Various trading forums and expert reviews *

usage: "capivo review" *

6.5 Trust Analysis

Trust is a critical factor in choosing a forex broker, and Capivo's profile shows major red flags. As an offshore broker operating in the Marshall Islands, Capivo doesn't fall under strict regulatory oversight. This regulatory gap has led to multiple internet warnings about the potential for fraudulent or unethical practices, including concerns about fund security and handling of client assets. The lack of transparency in operational details, along with repeated negative user comments about the broker's reliability, further hurts confidence. Several third-party reports have warned investors about the possibility of scams, which adds to the uncertainty. All these factors contribute to a very low trust rating, suggesting that traders should be extremely careful before engaging with this broker.

*Source: Warnings and analyses from WikiBit, InvestReviews, and other industry platforms *

6.6 User Experience Analysis

The user experience provided by Capivo is generally reported to be below industry standards. The interface and registration process have not been well described in public documents, leaving many potential users unclear about what to expect. Reports show that users often face delays during the account verification process and experience frustration due to the unresponsive customer support system. The absence of detailed feedback on the ease of fund transfers and overall usability of the trading system adds to the platform's weaknesses. While some users appreciate the simplicity of the platform, the consistent theme across multiple sources is a low overall satisfaction level, particularly related to customer service and operational transparency. These problems suggest that Capivo may only be suitable for traders who are willing to accept a high level of risk and uncertainty in their trading experience.

*Source: User reviews on various financial forums and investigative reports *

7. Conclusion

In summary, the capivo review shows that Capivo is an unregulated broker operating from the Marshall Islands, which brings many risks. The broker's lack of transparency about critical details—such as account conditions, trading tools, and cost structures—further hurts confidence. Poor customer service performance and multiple warnings from industry sources make Capivo a less attractive option for traders who value security and reliability. Therefore, Capivo is only recommended for those with high risk tolerance who can handle a challenging trading environment and are prepared for potential issues.

Optional keyword usage: "capivo review"