SK Markets 2025 Review: Everything You Need to Know

Summary

SK Markets is a legitimate and safe online broker. This company has earned an average to good trust rating in the competitive forex market, which shows its solid standing among traders. This sk markets review looks at the broker's complete offerings, particularly its unique service of providing direct USDT trading capabilities, which sets it apart from many traditional forex brokers. Based in Midtown Manhattan, SK Markets serves investors who want to trade forex using USDT. The broker offers a Bronze Plan with a minimum deposit requirement of $500, making it accessible to many traders. SK Markets provides trading access through its WebTrader platform and Tradingweb Mobile App. This setup makes trading possible for both desktop and mobile users, giving traders flexibility in how they access the markets. While the company maintains a solid reputation for safety and legitimacy, this review will explore various aspects of their services, from account conditions to customer support. We aim to provide potential traders with the essential information needed to make an informed decision about whether SK Markets aligns with their trading objectives and requirements.

Important Notice

This evaluation uses available user reviews and market analysis information from various sources. Specific regulatory information was not detailed in the available materials, and there may be differences between regional entities of SK Markets. The assessment methodology relies on gathered user feedback, platform analysis, and publicly available information about the broker's services, which gives us a comprehensive view of their operations. Traders should conduct their own research and verify current regulatory status in their jurisdiction before opening an account. The information presented reflects the broker's status as of the review date. Services, terms, or regulatory compliance may change over time, so staying updated is important for potential clients.

Rating Framework

Overall Rating: 5.7/10 - Fair

The scoring shows SK Markets' position as a legitimate broker with room for improvement in several key areas. The company particularly needs better transparency and service documentation to serve clients more effectively.

Broker Overview

SK Markets operates as an online brokerage company headquartered in Midtown Manhattan. The company positions itself in the competitive forex trading landscape with a focus on cryptocurrency-friendly trading solutions, which appeals to modern traders. SK Markets' primary business model centers around providing direct USDT trading services, which appeals to traders who prefer to operate with stablecoins rather than traditional fiat currencies. This approach reflects the changing demands of modern traders who seek to integrate cryptocurrency elements into their forex trading strategies.

The broker's technology includes two main trading platforms: WebTrader for desktop users and the Tradingweb Mobile App for traders who prefer mobile access. This dual-platform approach ensures that clients can access their trading accounts and execute trades regardless of their preferred device or location, giving traders the flexibility they need in today's fast-paced markets. While specific information about the company's founding year and detailed corporate history was not available in the source materials, SK Markets has established itself as a recognizable entity in the online trading space. The broker's commitment to USDT trading represents a forward-thinking approach to forex trading. This approach acknowledges the growing integration of cryptocurrency elements in traditional financial markets.

Regulatory Status: Specific regulatory information was not detailed in the available materials. This represents a significant information gap for potential traders seeking comprehensive oversight details.

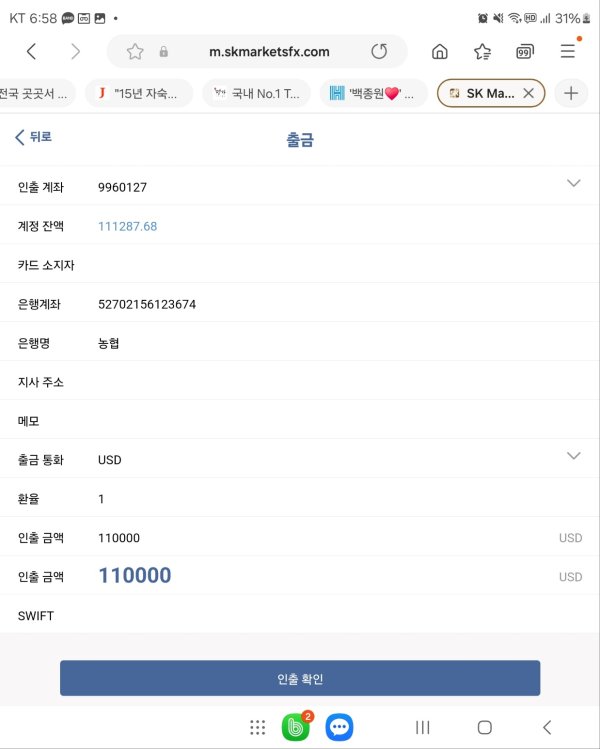

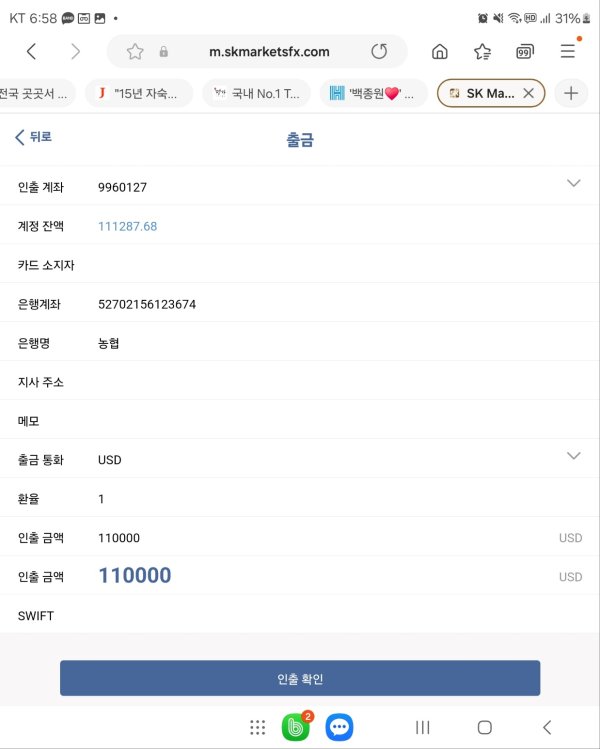

Deposit and Withdrawal Methods: The available information does not specify the exact deposit and withdrawal methods supported by SK Markets. The USDT trading focus suggests cryptocurrency payment options are likely available.

Minimum Deposit Requirements: SK Markets sets its minimum deposit requirement at $500 for the Bronze Plan. This positioning places it in the mid-range category for forex brokers, making it accessible to intermediate-level traders while potentially excluding micro-account seekers.

Bonus and Promotions: No specific information about bonus offerings or promotional campaigns was available in the source materials.

Tradeable Assets: The specific range of tradeable assets was not detailed in the available information. The broker's focus on forex trading with USDT integration is evident.

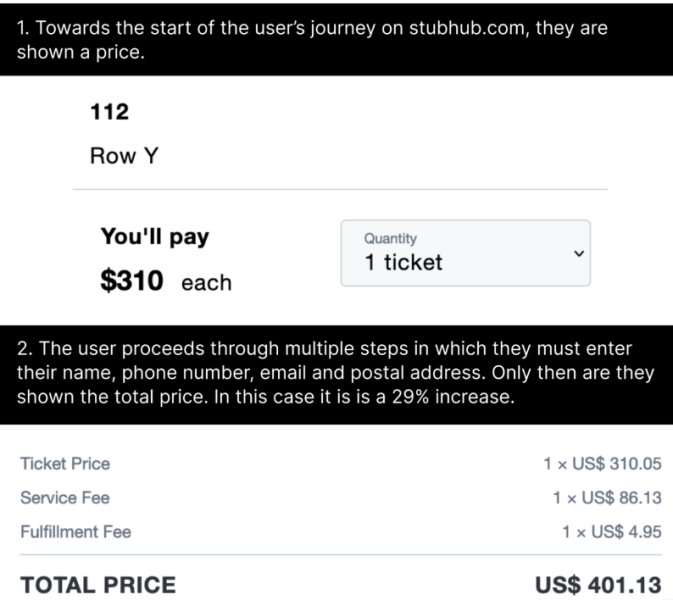

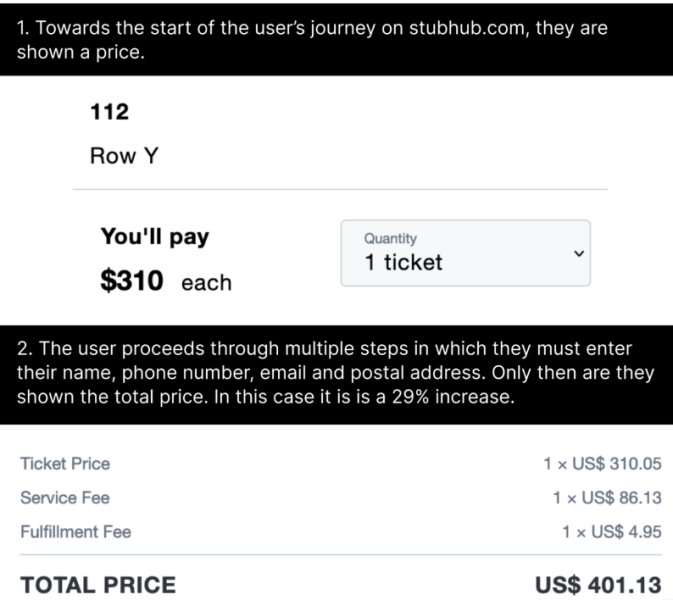

Cost Structure: Commission rates, spread information, and detailed fee structures were not specified in the available materials. This represents a transparency gap for potential clients.

Leverage Ratios: Specific leverage offerings were not mentioned in the source materials.

Platform Options: Trading happens through WebTrader and the Tradingweb Mobile App. These platforms provide both desktop and mobile trading capabilities.

Regional Restrictions: Specific geographical limitations were not detailed in the available information.

Customer Service Languages: Language support information was not specified in the source materials.

This sk markets review reveals several areas where additional transparency would benefit potential clients. Regulatory compliance and detailed service specifications particularly need more clarity.

Detailed Rating Analysis

Account Conditions Analysis (6/10)

SK Markets' account structure centers around its Bronze Plan, which requires a minimum deposit of $500. This entry-level requirement positions the broker in the middle tier of the market, neither targeting micro-account traders with very low minimums nor exclusively serving high-net-worth individuals. The $500 threshold makes the platform reasonably accessible to intermediate-level traders while maintaining a professional standard that suggests serious trading intent.

The account opening process details were not extensively documented in the available materials. This creates some uncertainty for potential clients regarding verification requirements and timeline expectations. The focus on USDT trading represents a unique feature that may appeal to traders comfortable with cryptocurrency integration in their forex activities. However, the lack of detailed information about account features, such as Islamic account options, educational resources, or tiered account benefits, limits the comprehensive assessment of account conditions.

The absence of detailed commission structures and fee schedules in the available information represents a significant transparency gap. Traders typically require comprehensive cost information before committing to a broker. This sk markets review identifies this as an area where additional disclosure would enhance client confidence and decision-making capabilities.

SK Markets provides trading access through two primary platforms: WebTrader and the Tradingweb Mobile App. The WebTrader platform serves desktop users, while the mobile application ensures accessibility for traders who prefer smartphone or tablet-based trading. However, the available information does not detail the specific features, analytical tools, or advanced trading capabilities offered within these platforms.

The absence of information regarding research and analysis resources represents a notable gap in the broker's documented offerings. Modern forex traders typically expect access to market analysis, economic calendars, technical indicators, and educational materials. Without detailed documentation of these resources, it becomes challenging to assess the broker's commitment to supporting trader development and decision-making processes.

Educational resource availability was not specified in the source materials. This is particularly important for newer traders who rely on broker-provided learning materials. Similarly, information about automated trading support, expert advisor compatibility, or algorithmic trading capabilities was not available. This limits the assessment of the platform's sophistication level for advanced trading strategies.

Customer Service and Support Analysis (5/10)

The available information does not provide comprehensive details about SK Markets' customer service infrastructure. This includes specific support channels, availability hours, or response time commitments. This lack of documented customer service information creates uncertainty for potential clients who value reliable support access, particularly during active trading hours or when technical issues arise.

Multi-language support capabilities were not specified in the source materials. This is significant for international traders who may require assistance in their native languages. The absence of information about support quality, staff expertise levels, or problem resolution procedures makes it difficult to assess the broker's commitment to customer satisfaction and service excellence.

Without documented user feedback specifically addressing customer service experiences, this review cannot provide detailed insights into actual support quality or common service issues. The lack of transparency in this area represents an opportunity for SK Markets to improve client confidence. They could provide more comprehensive information about their support infrastructure and service standards.

Trading Experience Analysis (6/10)

The trading experience at SK Markets centers around the WebTrader platform and Tradingweb Mobile App. Specific details about platform stability, execution speed, or advanced trading features were not extensively documented in the available materials. The dual-platform approach suggests recognition of diverse trader preferences, accommodating both desktop-focused and mobile-oriented trading styles.

Order execution quality information was not specified. This is crucial for traders concerned about slippage, requotes, or execution delays during volatile market conditions. The absence of detailed platform functionality descriptions limits the assessment of features such as one-click trading, advanced charting capabilities, or risk management tools that experienced traders typically expect.

Mobile trading experience details were not comprehensively covered in the available information. The existence of the Tradingweb Mobile App indicates the broker's commitment to mobile accessibility. The trading environment specifics, including available order types, market depth information, or real-time data quality, were not detailed in the source materials. These represent areas where additional transparency would benefit potential clients considering this sk markets review.

Trust and Safety Analysis (7/10)

SK Markets receives recognition as a legitimate and safe online broker. The company earns an average to good trust rating based on available assessments. This positive safety evaluation provides a foundation of confidence for potential clients concerned about broker legitimacy and fund security. The company's establishment in Midtown Manhattan adds geographical credibility, though specific regulatory oversight details were not comprehensively documented.

The absence of detailed regulatory information in the available materials represents a significant transparency gap. Traders typically seek specific regulatory body oversight and license numbers for verification purposes. Fund safety measures, segregated account policies, or insurance coverage details were not specified. This limits the comprehensive assessment of client protection protocols.

Industry reputation appears positive based on the legitimate and safe designation. Specific third-party evaluations, regulatory compliance records, or industry award recognition were not detailed in the source materials. The handling of negative events or dispute resolution procedures was not documented. These represent areas where additional transparency would strengthen trust assessment capabilities.

User Experience Analysis (5/10)

Overall user satisfaction metrics were not specifically detailed in the available information. The broker's focus on USDT trading suggests targeting of a specific user demographic interested in cryptocurrency-integrated forex trading. The platform's design and usability features were not comprehensively described. This limits assessment of the user interface quality and navigation efficiency.

Registration and verification process details were not extensively covered in the source materials. This creates uncertainty about account opening complexity and timeline expectations. Fund operation experiences, including deposit and withdrawal procedures, processing times, or user interface quality for account management, were not specifically documented in the available information.

The target user profile appears to focus on traders interested in USDT-based forex trading. This suggests the broker serves a niche market segment. However, without detailed user feedback compilation or specific testimonials, this sk markets review cannot provide comprehensive insights into actual user satisfaction levels. Common experience patterns among the broker's client base also remain unclear.

Conclusion

SK Markets establishes itself as a legitimate and safe online brokerage option. The company earns an average to good trust rating while serving a specific niche in the forex market through its USDT trading focus. The broker's positioning in Midtown Manhattan and its dual-platform approach through WebTrader and mobile applications demonstrates a commitment to accessibility and professional standards. However, this evaluation reveals significant transparency gaps in areas such as regulatory disclosure, detailed fee structures, and comprehensive service documentation.

The broker appears most suitable for traders specifically interested in USDT-based forex trading who are comfortable with a $500 minimum deposit requirement. While the fundamental safety and legitimacy credentials provide confidence, potential clients should conduct additional research regarding regulatory status and detailed service terms. The main advantages include the unique USDT trading service and legitimate operational status. The primary drawbacks center on limited information transparency and insufficient documentation of key service details that traders typically require for informed decision-making.