Is Capivo safe?

Business

License

Is Capivo A Scam?

Introduction

Capivo is an offshore forex broker that has recently attracted attention in the trading community. Positioned as a platform offering access to a wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies, Capivo aims to cater to both novice and experienced traders. However, the rise of online trading has also led to an increase in scams and unregulated brokers, making it crucial for traders to conduct thorough evaluations before committing their funds. In this article, we will analyze Capivo's credibility by examining its regulatory status, company background, trading conditions, customer experiences, and overall risk profile. Our investigation draws on various online reviews, regulatory warnings, and user testimonials to provide a comprehensive assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical factor in evaluating its legitimacy. Regulation serves as a safeguard for investors, ensuring that brokers adhere to strict standards of conduct and transparency. Capivo operates under the jurisdiction of the Marshall Islands, a region known for its lenient regulatory framework. This lack of stringent oversight raises significant concerns about investor protection.

| Regulatory Authority | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Marshall Islands | N/A | Marshall Islands | Unregulated |

As indicated in the table, Capivo does not hold a license from any reputable financial authority, such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC). The absence of regulatory oversight means that traders using Capivo have little to no recourse in case of disputes or financial issues. Additionally, the Comisión Nacional del Mercado de Valores (CNMV) in Spain has issued warnings against Capivo, stating that it is not authorized to provide investment services within its jurisdiction. Such warnings are serious red flags that suggest potential fraudulent activities.

Company Background Investigation

Capivo is operated by Albi Corporation Ltd., which is registered in the Marshall Islands. While the company claims to offer a user-friendly trading platform and a variety of investment options, its lack of transparency regarding ownership and management raises concerns. There is limited information available about the company's history or the qualifications of its management team. This lack of disclosure makes it difficult for potential investors to assess the credibility and reliability of the broker.

Moreover, the company's website appears to be primarily targeted at Spanish and Portuguese-speaking clients, which could indicate a focus on regions with less stringent regulatory oversight. The absence of verifiable information about the company's operational practices and ownership structure contributes to suspicions regarding its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value. Capivo presents itself as a competitive option in terms of trading fees and conditions. However, a closer examination reveals some concerning aspects.

| Fee Type | Capivo | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3.0 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

As shown in the table, Capivo's spreads for major currency pairs are significantly higher than the industry average. A spread of 3.0 pips is unfavorable compared to the typical 1.5 pips offered by reputable brokers. This discrepancy can lead to higher trading costs and reduced profitability for traders. Additionally, the lack of a clear commission structure raises questions about hidden fees that may not be disclosed upfront.

Customer Funds Security

The safety of customer funds is paramount when evaluating any broker. Capivo's offshore status raises concerns about the security measures in place to protect client investments. The broker does not provide information on fund segregation, which means that client funds may not be held in separate accounts. This lack of transparency regarding fund safety measures is alarming, especially for traders who prioritize the security of their investments.

Furthermore, Capivo does not appear to offer negative balance protection, which is a critical feature that prevents traders from losing more than their initial deposit. The absence of such protections increases the risk of significant financial losses, particularly in volatile market conditions. Historical data on Capivo's handling of customer funds indicates that there have been issues with withdrawals, further complicating the trustworthiness of the broker.

Customer Experience and Complaints

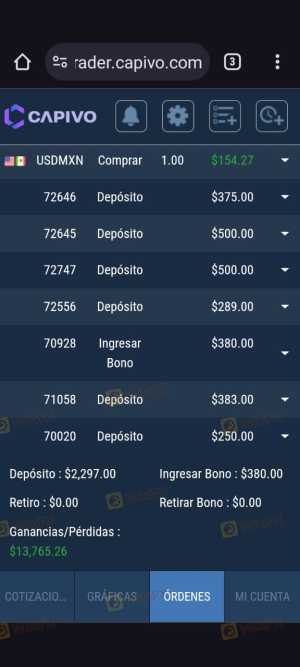

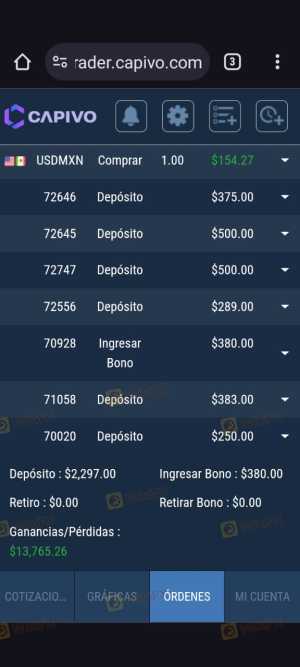

Customer feedback is a valuable indicator of a broker's reliability and service quality. A review of user experiences with Capivo reveals a pattern of negative feedback, with many traders expressing frustration over withdrawal issues and poor customer support. Common complaints include delays in processing withdrawal requests, unexpected fees, and aggressive sales tactics from customer service representatives.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Practices | High | Poor |

The severity of these complaints suggests a systematic issue within Capivo's operations. For instance, several users have reported being unable to access their funds after making deposits, which raises concerns about the broker's business practices. In one notable case, a trader reported being pressured to deposit additional funds in order to facilitate a withdrawal, a tactic commonly associated with scam brokers.

Platform and Execution

The trading platform offered by a broker plays a crucial role in the overall trading experience. Capivo claims to provide a user-friendly interface; however, user reviews indicate that the platform lacks advanced features commonly found in established trading software. Concerns regarding order execution quality, including slippage and rejections, have also been raised by traders.

The absence of reliable trading tools and features could hinder traders' ability to make informed decisions and execute trades effectively. Furthermore, any signs of platform manipulation or technical issues could significantly impact trading performance and investor confidence.

Risk Assessment

Engaging with Capivo entails several risks, primarily due to its unregulated status and history of negative user experiences.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Financial Risk | High | Potential for loss of funds. |

| Withdrawal Risk | High | Reports of difficulties in accessing funds. |

| Platform Reliability | Medium | Concerns about execution and service quality. |

Given these risk factors, it is vital for traders to exercise caution when considering Capivo as their trading platform. Potential investors should conduct thorough research and consider alternative brokers with better regulatory standing and customer feedback.

Conclusion and Recommendations

In conclusion, the evidence gathered in this analysis strongly suggests that Capivo exhibits several characteristics of a potentially fraudulent broker. The lack of regulatory oversight, coupled with numerous customer complaints and poor transparency, raises significant red flags.

For traders seeking a secure and reliable trading experience, it is advisable to avoid Capivo and consider alternative brokers that are regulated by reputable authorities. Brokers like FP Markets, XM, or HFM, which offer robust regulatory frameworks and positive user experiences, may provide safer trading environments. Always prioritize due diligence and choose brokers that demonstrate transparency, accountability, and a commitment to protecting client interests.

Is Capivo a scam, or is it legit?

The latest exposure and evaluation content of Capivo brokers.

Capivo Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Capivo latest industry rating score is 1.31, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.31 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.