Cabana Capital 2025 Review: Everything You Need to Know

Summary

Cabana Capital is a forex broker that started in 2018. It's registered in Saint Vincent and the Grenadines under CCL FINTECH LIMITED, which gives it a base in the Caribbean for its operations. This cabana capital review shows that the broker follows rules set by the South African Financial Sector Conduct Authority (FSCA), though we can't easily find the specific license numbers in public records. The broker lets traders use leverage up to 1:400 and only needs $100 to start an account, which works for traders with different amounts of money to invest.

The company gives access to many types of investments like forex, precious metals, commodities, CFD indices, and cryptocurrencies using an ECN/STP business model that helps trades happen quickly. Customer support seems to respond well and act professionally based on what users say, though people still talk about whether the broker is completely safe and open about its business. This makes Cabana Capital a broker that might work for experienced traders, especially those who want high leverage for quick trading strategies, but new clients should think carefully about the rules that govern it and do their homework before signing up.

Important Notice

Cabana Capital works in different countries, and traders need to know that rules and legal risks change depending on where they live. The broker's main registration in Saint Vincent and the Grenadines, plus FSCA rules in South Africa, creates a complicated regulatory setup that potential clients need to think about carefully.

This review uses information that anyone can find and user comments available as of 2025, trying to give fair analysis. But the forex industry changes fast, so traders should check current conditions directly with the broker before making any trading choices.

Rating Framework

Broker Overview

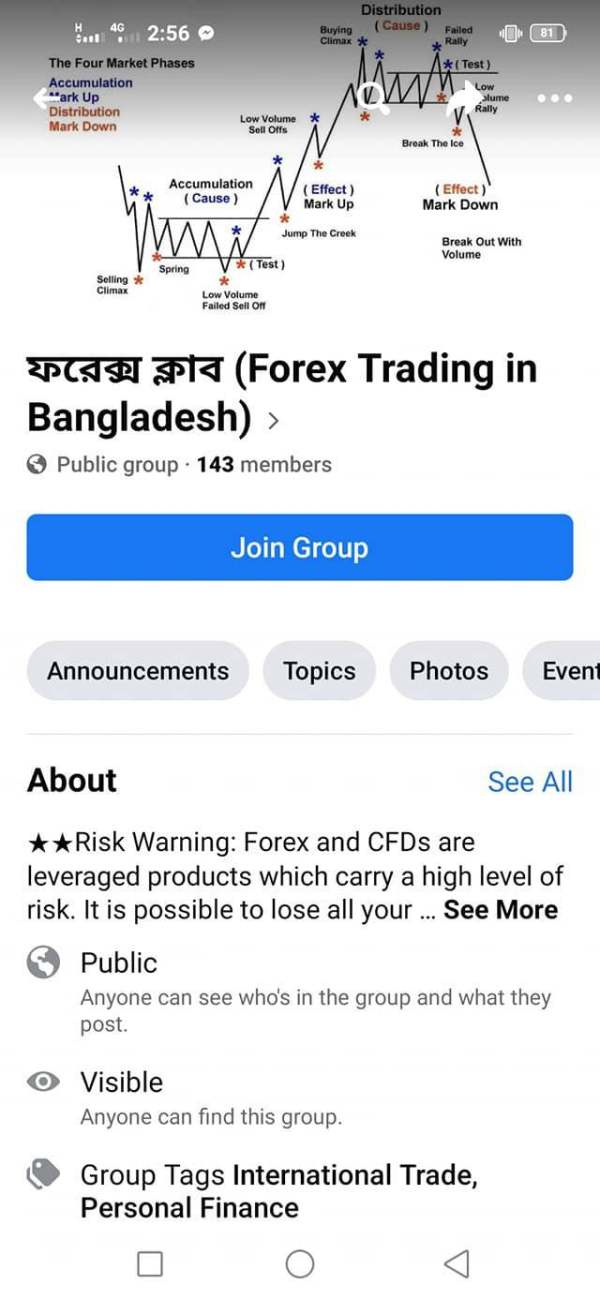

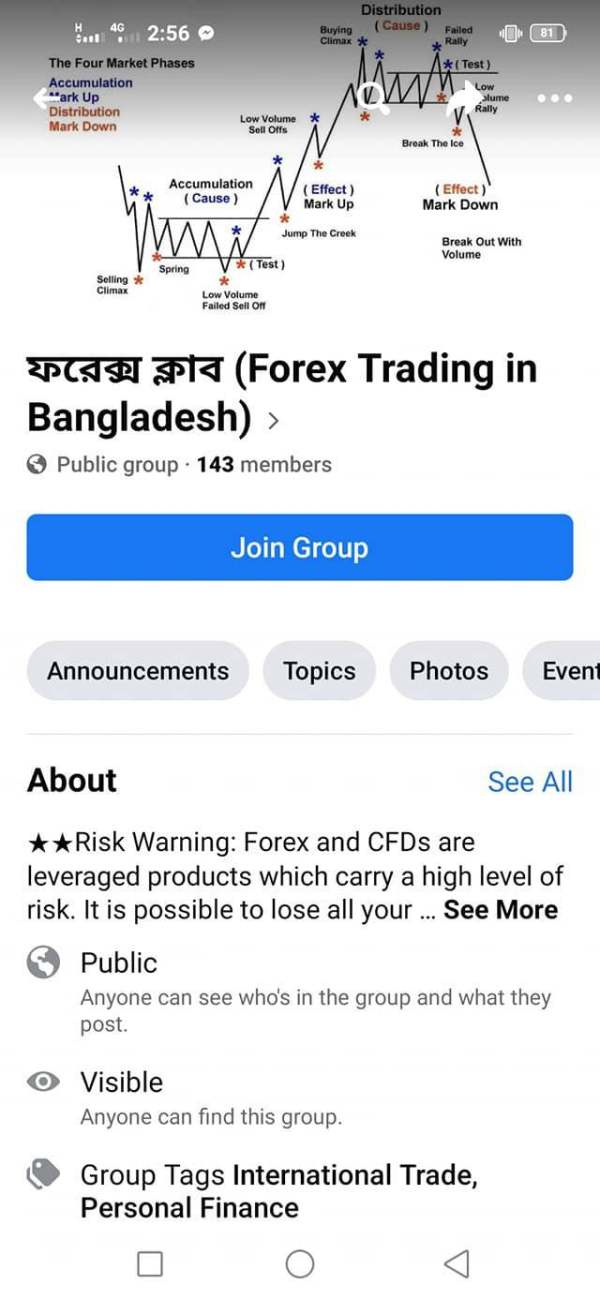

Cabana Capital started in the forex market in 2018 as part of CCL FINTECH LIMITED, setting up its main office in Saint Vincent and the Grenadines. The company calls itself an ECN/STP broker, using Electronic Communication Network and Straight Through Processing models to give direct market access and fast trade completion. This business model usually allows for better prices and fewer conflicts between the broker and its clients.

The broker's setup focuses on giving access to global financial markets through advanced trading systems. Based on what we can find, Cabana Capital serves traders in multiple countries, though the specific trading platforms they use aren't clearly explained in current paperwork. The company's approach focuses on technology efficiency and market connections, which matches what modern traders expect for speed and reliability.

Cabana Capital offers many different trading instruments including major and minor forex pairs, precious metals like gold and silver, various commodities, CFD indices covering global markets, and cryptocurrency trading options. The broker works under the watch of the South African Financial Sector Conduct Authority (FSCA), though specific license details need to be checked directly with the regulatory body. This cabana capital review notes that the regulatory structure gives some level of oversight, though traders should understand what the Saint Vincent and the Grenadines registration means.

Regulatory Jurisdiction: Cabana Capital is registered in Saint Vincent and the Grenadines and operates under the watch of the South African Financial Sector Conduct Authority (FSCA). This two-country structure means traders need to understand what regulatory protections apply to them.

Deposit and Withdrawal Methods: Specific deposit and withdrawal options aren't explained in available paperwork, though the broker accepts a minimum deposit of $100, which suggests it's accessible for regular traders.

Minimum Deposit Requirements: The broker keeps a $100 minimum deposit requirement, making it accessible to new and small-scale traders compared to some brokers that focus on institutions.

Bonus and Promotional Offers: Current promotional activities and bonus structures aren't specified in available paperwork and would need direct questions to the broker.

Available Trading Assets: Cabana Capital provides access to forex currency pairs, precious metals including gold and silver, commodity CFDs, stock index CFDs, and cryptocurrency trading instruments.

Cost Structure: Detailed information about spreads, commissions, and overnight financing costs isn't fully available in current paperwork, requiring direct checking with the broker.

Leverage Ratios: The broker offers maximum leverage of 1:400, which is quite high and suitable for experienced traders who understand the risks that come with it.

Platform Options: Specific trading platform information isn't detailed in available paperwork, though the ECN/STP model suggests professional-grade trading systems.

Geographic Restrictions: Specific country restrictions and availability aren't clearly outlined in current paperwork.

Customer Service Languages: Supported languages for customer service aren't specified in available materials.

This cabana capital review emphasizes how important it is to check current terms and conditions directly with the broker, as many operational details need confirmation through direct communication.

Detailed Scoring Analysis

Account Conditions Analysis (Score: 6/10)

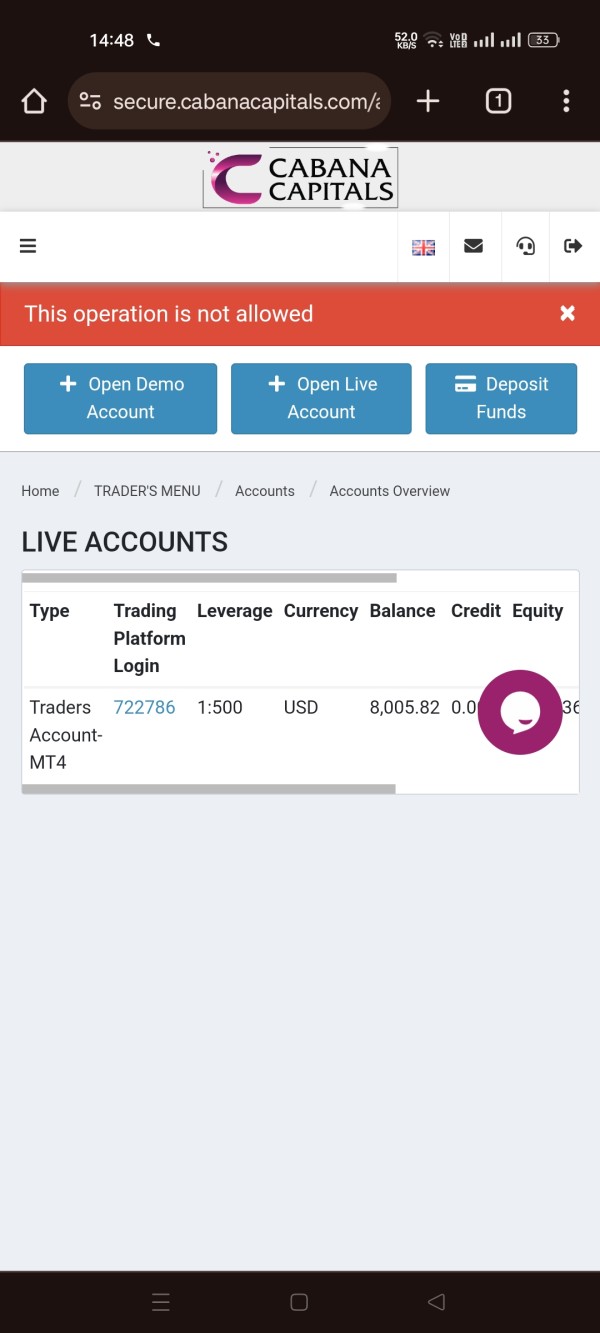

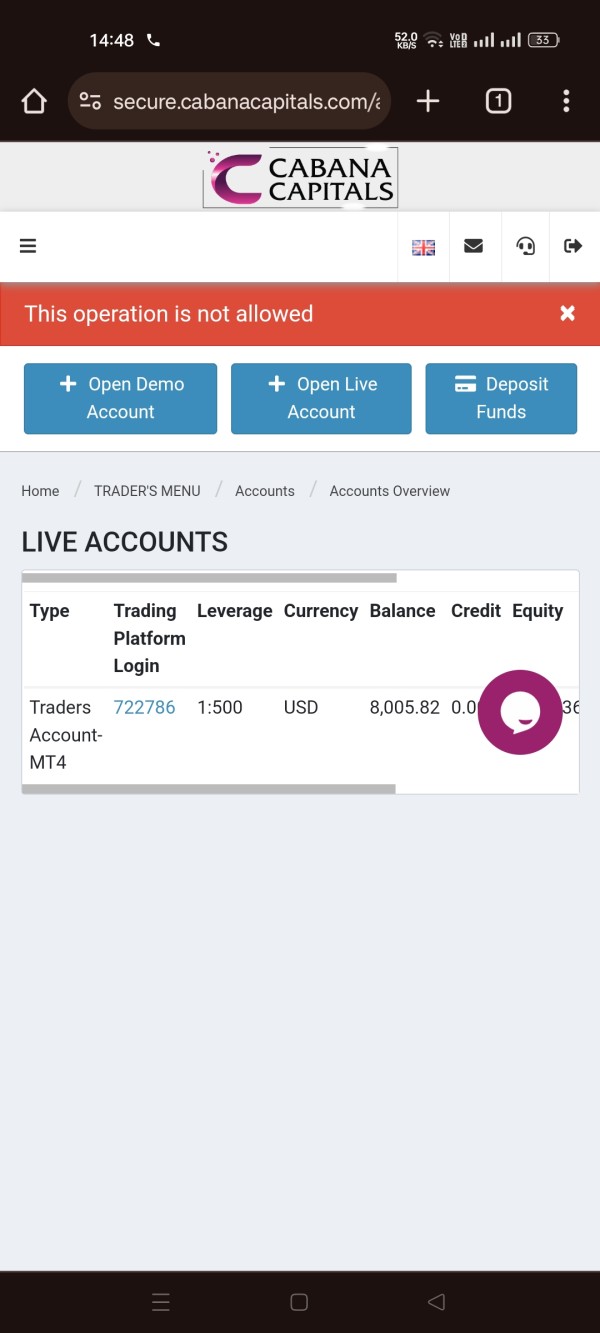

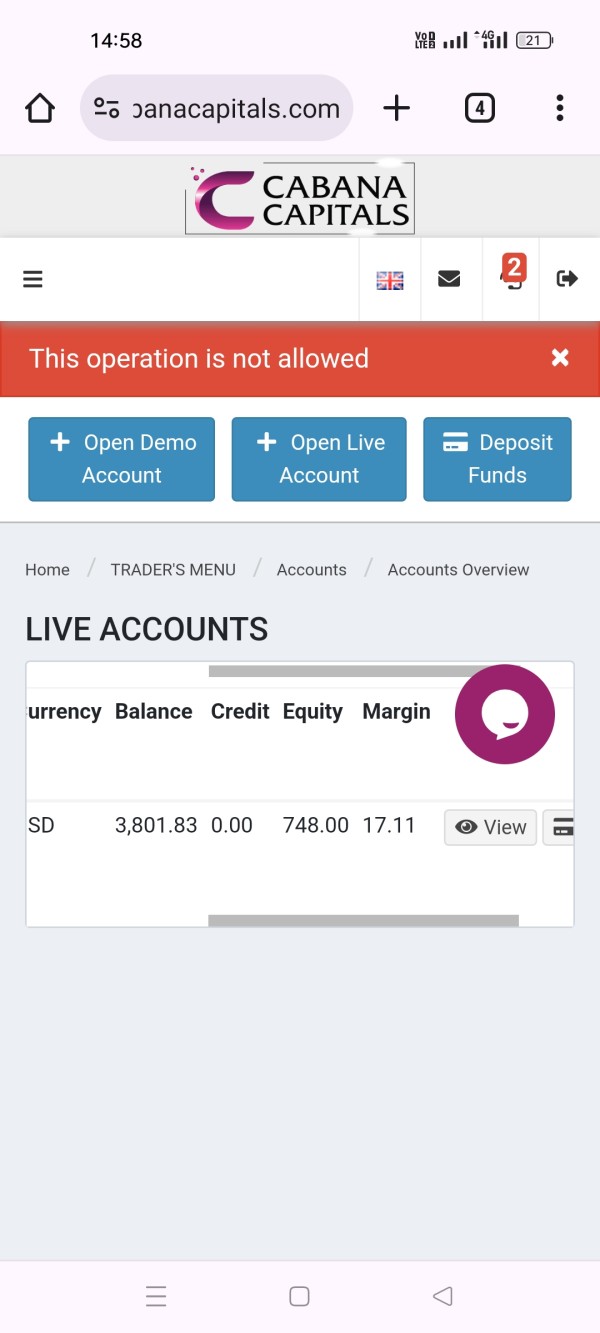

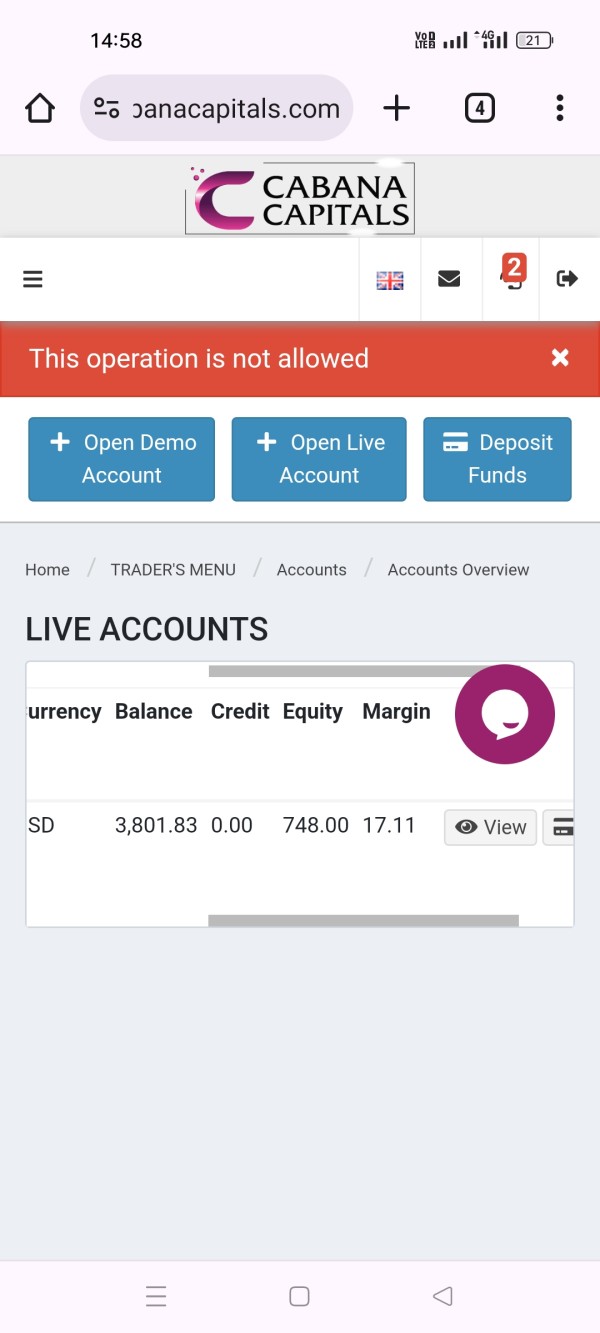

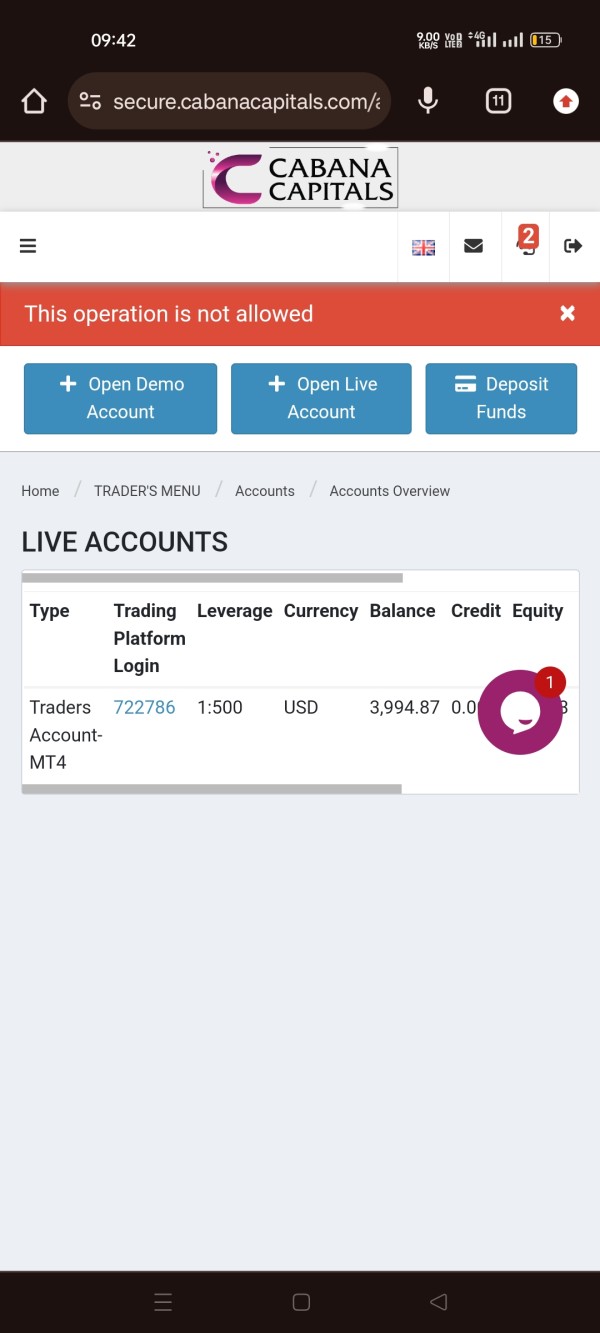

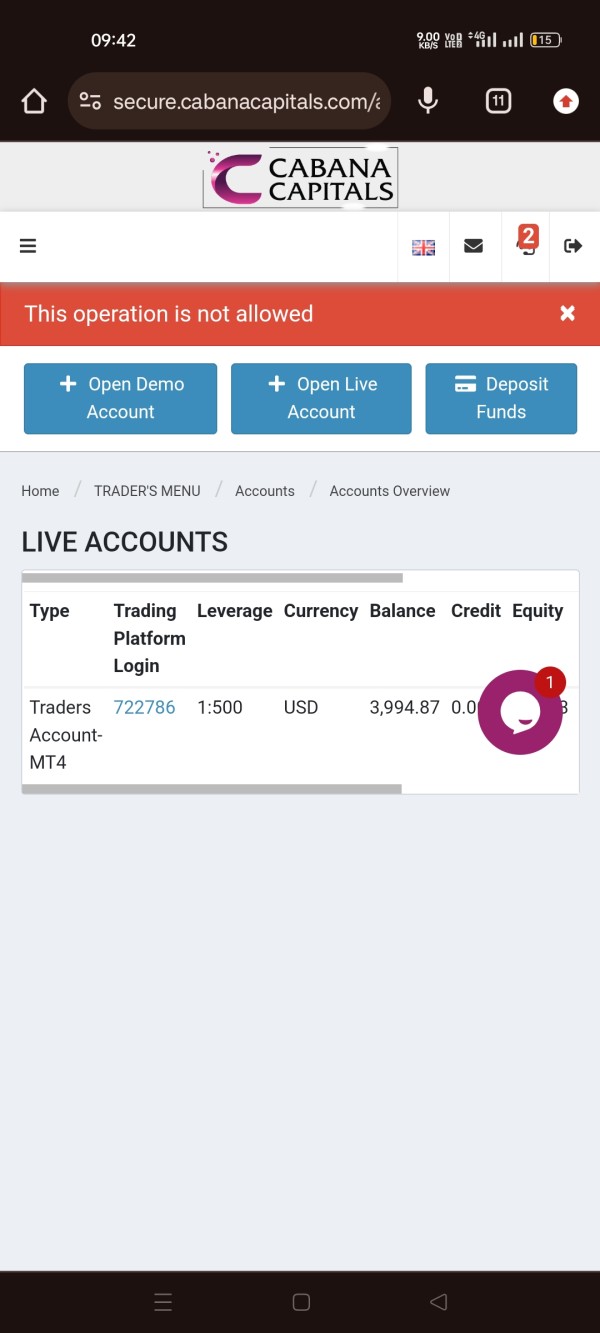

Cabana Capital's account conditions show a mixed picture for potential traders. The broker's $100 minimum deposit requirement stands out as very accessible, especially when compared to institutional brokers that may require much higher initial investments. This low barrier makes the broker potentially suitable for new traders or those with limited capital who want to test forex trading.

The maximum leverage of 1:400 represents one of the more aggressive offerings in the market, which can be both good and risky. Experienced traders may like the capital efficiency that high leverage provides, allowing them to control larger positions with smaller account balances. But this level of leverage also greatly increases both potential profits and losses, making it crucial for traders to have strong risk management strategies.

Unfortunately, specific details about account types, their features, and the account opening process aren't easily available in current paperwork. This lack of transparency about account structures makes it hard for potential clients to fully evaluate whether the broker's offerings match their trading needs. The absence of clear information about different account levels, their benefits, and any costs represents a significant gap in publicly available information.

The broker's ECN/STP business model suggests that account holders should benefit from direct market access and competitive pricing, though specific spread and commission structures need verification. This cabana capital review notes that while the basic account conditions appear reasonable, the lack of detailed information about account features and costs prevents a higher rating in this category.

The evaluation of Cabana Capital's tools and resources faces big limitations due to the lack of detailed information in available paperwork. While the broker operates on an ECN/STP model, which typically means access to professional-grade trading systems, specific details about trading platforms, analytical tools, and educational resources aren't fully outlined.

Professional ECN/STP brokers generally provide access to advanced charting capabilities, real-time market data, and sophisticated order types. But without specific information about which trading platforms Cabana Capital offers or how extensive their analytical tools are, it's challenging to assess the quality and completeness of their trading environment.

Educational resources represent a crucial part for trader development, particularly for the retail segment that the broker appears to target with its low minimum deposit. The absence of information about webinars, tutorials, market analysis, or educational content suggests either limited offerings in this area or poor communication of available resources.

Research and analysis capabilities are essential for informed trading decisions, yet current paperwork doesn't detail whether Cabana Capital provides market commentary, economic calendars, or fundamental analysis. Similarly, information about automated trading support, API access, or third-party tool integration isn't available.

The lack of transparency about tools and resources significantly impacts the broker's rating in this category. Traders typically expect clear information about platform capabilities and available resources when evaluating a broker, and this information gap represents a notable weakness in Cabana Capital's public presentation.

Customer Service and Support Analysis (Score: 8/10)

Customer service and support emerge as one of Cabana Capital's stronger areas based on available feedback. User reports consistently show that the broker's customer support team is responsive and professional, with many clients noting quick response times to questions and issues. This responsiveness is particularly important in the forex market, where trading opportunities can be time-sensitive and technical issues need rapid resolution.

The quality of support appears to be generally high, with users reporting that support staff show good knowledge of trading-related issues and can provide effective help. This suggests that Cabana Capital has invested in training their support team and maintaining service standards that meet trader expectations.

But specific details about support channels, availability hours, and multilingual capabilities aren't clearly documented. Modern traders typically expect multiple contact options including live chat, email, and phone support, along with extended hours to accommodate global trading schedules. The absence of clear information about these operational details prevents a perfect score despite positive user feedback.

The broker's support quality becomes particularly important given some of the transparency issues noted in other areas of this review. When detailed information about trading conditions or platform features isn't easily available, responsive customer service can help bridge these information gaps through direct communication.

User feedback suggests that Cabana Capital's support team can address both technical issues and account-related questions effectively, which contributes significantly to the overall trading experience and helps maintain client satisfaction despite other potential concerns.

Trading Experience Analysis (Score: 7/10)

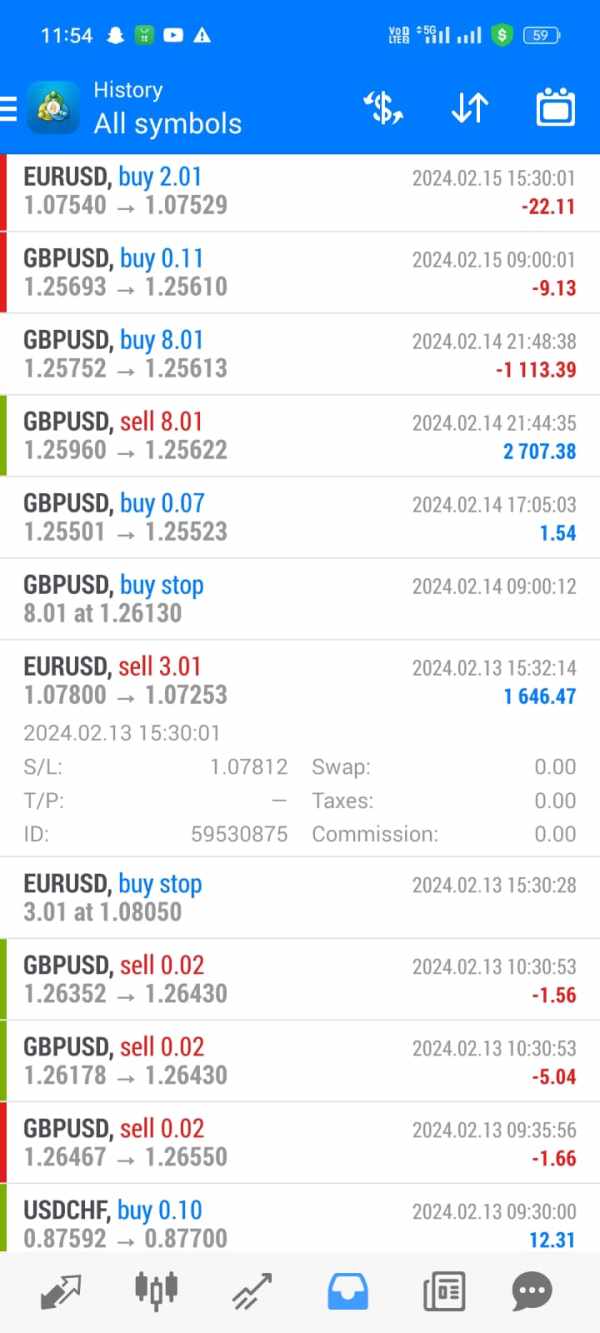

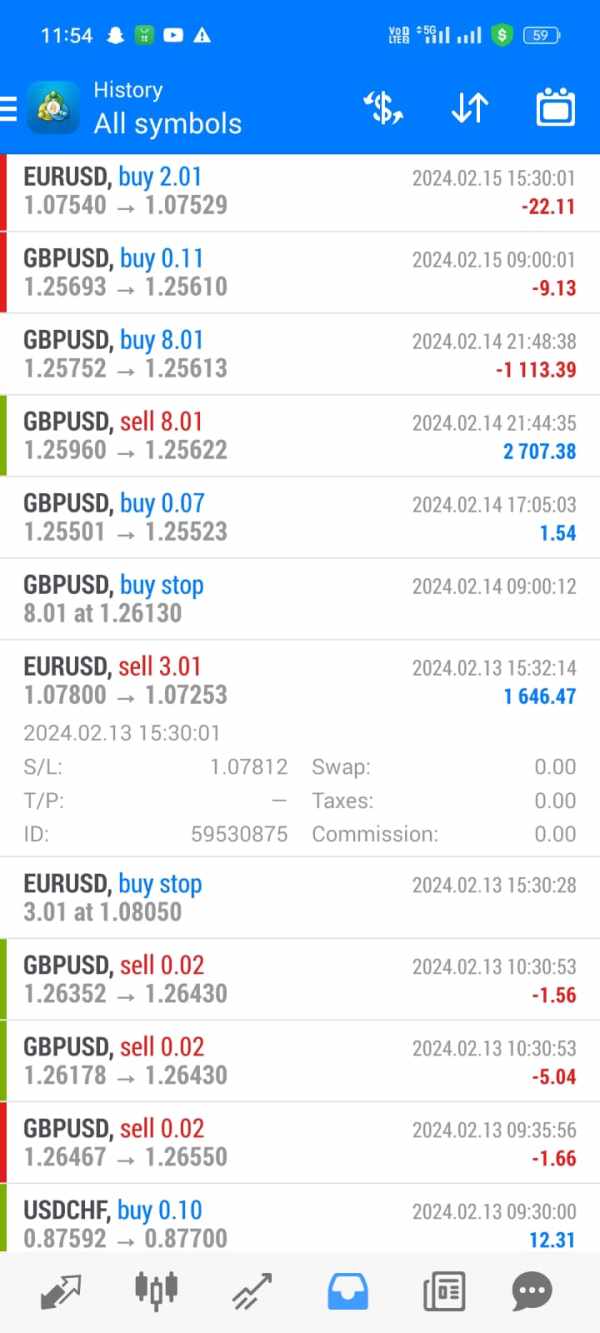

The trading experience with Cabana Capital appears to be generally positive based on available user feedback, though specific technical performance data is limited. The broker's ECN/STP business model typically provides advantages in terms of execution speed and price transparency, as orders are sent directly to liquidity providers rather than being processed through a dealing desk.

Users haven't reported significant issues with platform stability or execution quality, which suggests that the broker maintains adequate technical systems to support its trading operations. But without specific data on execution speeds, slippage rates, or platform uptime, it's difficult to provide a comprehensive technical assessment.

The variety of available trading instruments, including forex, precious metals, commodities, indices, and cryptocurrencies, provides traders with diversification opportunities within a single account. This range of assets can be particularly valuable for traders who employ multi-asset strategies or who want to capitalize on different market conditions across various asset classes.

Mobile trading capabilities and platform functionality details aren't specified in available paperwork, which represents a significant information gap given the importance of mobile trading in today's market. Modern traders expect seamless experiences across desktop and mobile platforms, with full functionality available regardless of device.

The high leverage of 1:400 can enhance the trading experience for sophisticated traders who understand how to manage the associated risks effectively. But this level of leverage also requires robust risk management tools and education, which aren't clearly documented. This cabana capital review notes that while the basic trading environment appears functional, the lack of detailed platform information limits the assessment of the complete trading experience.

Trust and Safety Analysis (Score: 5/10)

Trust and safety represent areas of concern for Cabana Capital, primarily due to limited transparency and regulatory clarity. While the broker operates under FSCA regulation in South Africa, the primary registration in Saint Vincent and the Grenadines creates a complex regulatory environment that may not provide the same level of client protection as brokers regulated in major financial centers.

The absence of specific license numbers or detailed regulatory information in public paperwork raises questions about transparency. Reputable brokers typically prominently display their regulatory credentials and provide clear information about client fund protection measures, segregation policies, and dispute resolution procedures.

User discussions about safety concerns, as noted in available feedback, suggest that some clients have reservations about the broker's security measures or operational transparency. These discussions, while not necessarily indicative of actual problems, highlight the importance of clear communication about safety measures and regulatory compliance.

The lack of information about fund segregation, insurance coverage, or participation in compensation schemes represents a significant transparency gap. These protections are standard among reputable brokers and their absence from public paperwork may concern potential clients who prioritize fund safety.

Company transparency regarding management, financial reporting, and business operations is also limited in available paperwork. Established brokers typically provide comprehensive information about their corporate structure, management team, and operational history to build client confidence.

The regulatory framework, while providing some oversight through FSCA supervision, may not offer the same level of protection as regulation by authorities in major financial centers such as the FCA, ASIC, or CySEC, which have more comprehensive client protection requirements.

User Experience Analysis (Score: 6/10)

User experience evaluation for Cabana Capital faces limitations due to the lack of comprehensive user feedback and detailed operational information. The broker's $100 minimum deposit and high leverage offering suggest an attempt to cater to retail traders, but the overall user journey from registration through active trading isn't well documented.

The absence of detailed information about the registration and verification process makes it difficult to assess how user-friendly the onboarding experience might be. Modern traders expect streamlined account opening procedures with clear documentation requirements and reasonable processing times.

Interface design and platform usability can't be properly evaluated without specific information about the trading platforms offered. User experience heavily depends on platform intuitiveness, customization options, and the learning curve for new users, none of which are adequately addressed in available paperwork.

Fund management experience, including deposit and withdrawal processes, processing times, and associated costs, lacks detailed documentation. These operational aspects significantly impact user satisfaction and are crucial factors in broker selection for many traders.

The target user profile appears to be experienced traders who can effectively utilize high leverage and navigate potential information gaps through direct communication with customer support. This suggests that the broker may be less suitable for complete beginners who require extensive educational resources and highly transparent operational procedures.

User feedback available in public forums is limited, making it challenging to identify common user concerns or satisfaction patterns. The lack of comprehensive user reviews or testimonials represents a significant gap in understanding the actual user experience with Cabana Capital.

Conclusion

This cabana capital review reveals a broker with mixed characteristics that may appeal to specific trader segments while raising concerns for others. Cabana Capital demonstrates strengths in customer service responsiveness and offers competitive basic conditions including a low $100 minimum deposit and high 1:400 leverage. But significant transparency gaps regarding platform details, comprehensive trading conditions, and regulatory specifics limit its appeal to traders who prioritize full disclosure and regulatory clarity.

The broker appears most suitable for experienced traders who can navigate information gaps through direct communication and who value high leverage for their trading strategies. The responsive customer support can help address specific questions about trading conditions and platform features that aren't clearly documented publicly.

Major limitations include insufficient transparency regarding trading platforms, detailed cost structures, fund protection measures, and comprehensive regulatory information. These gaps prevent Cabana Capital from achieving higher ratings and may concern traders who prioritize complete transparency and robust regulatory protection in their broker selection process.