bgc Review 4

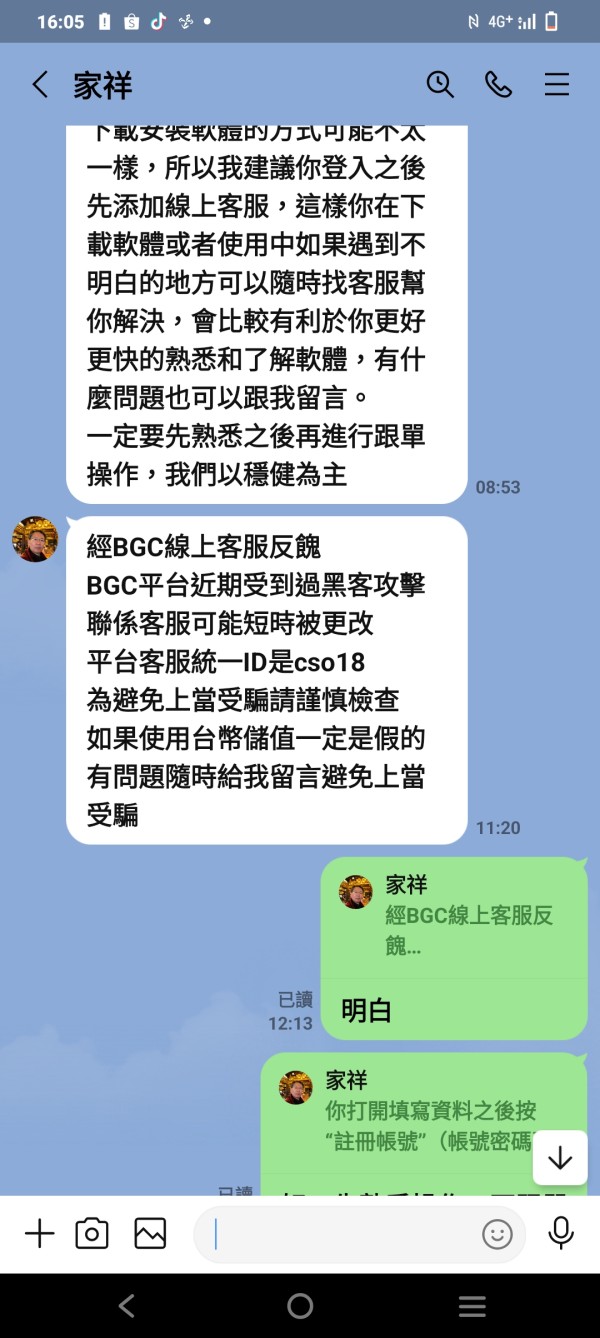

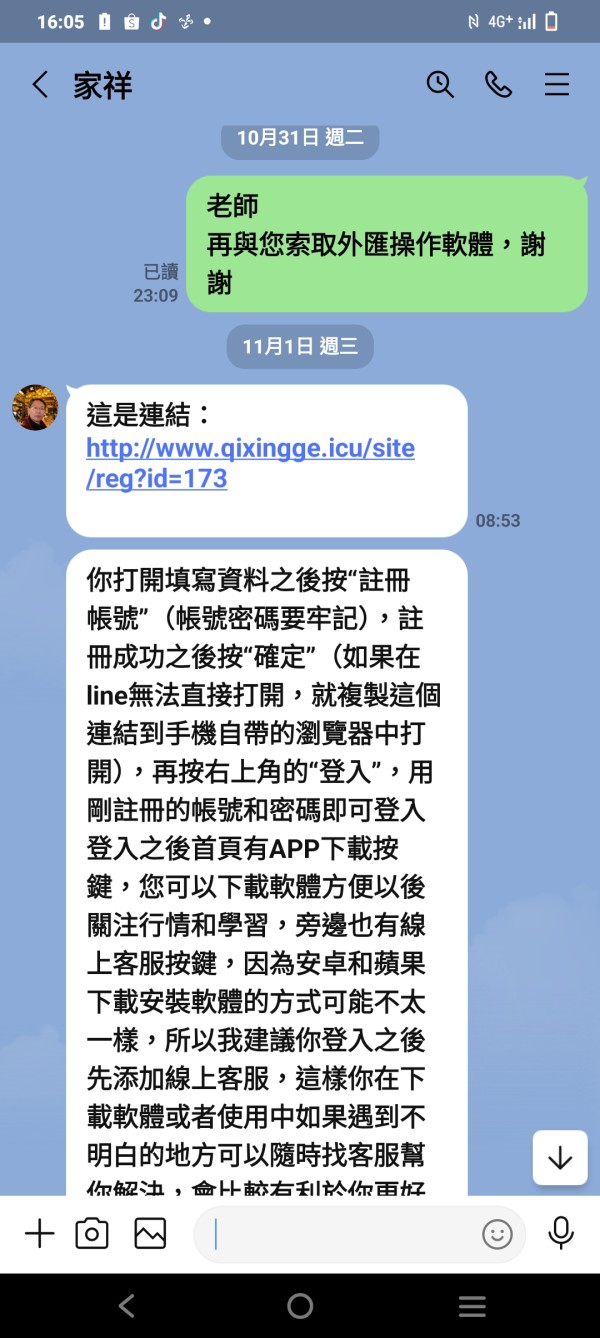

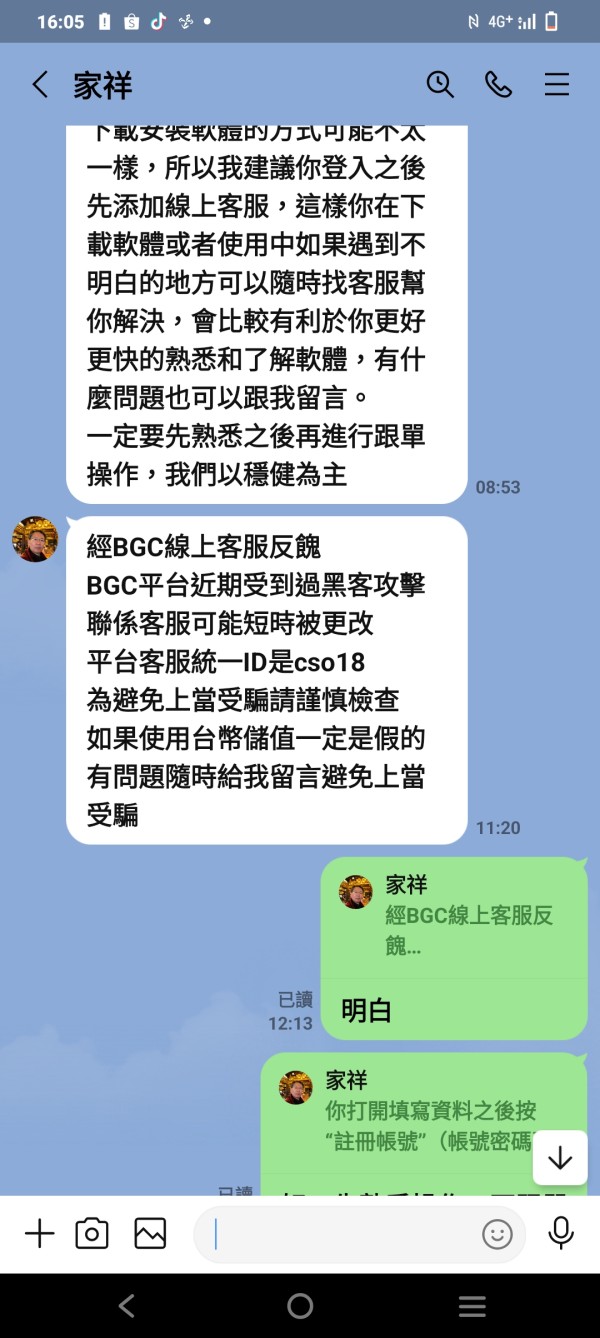

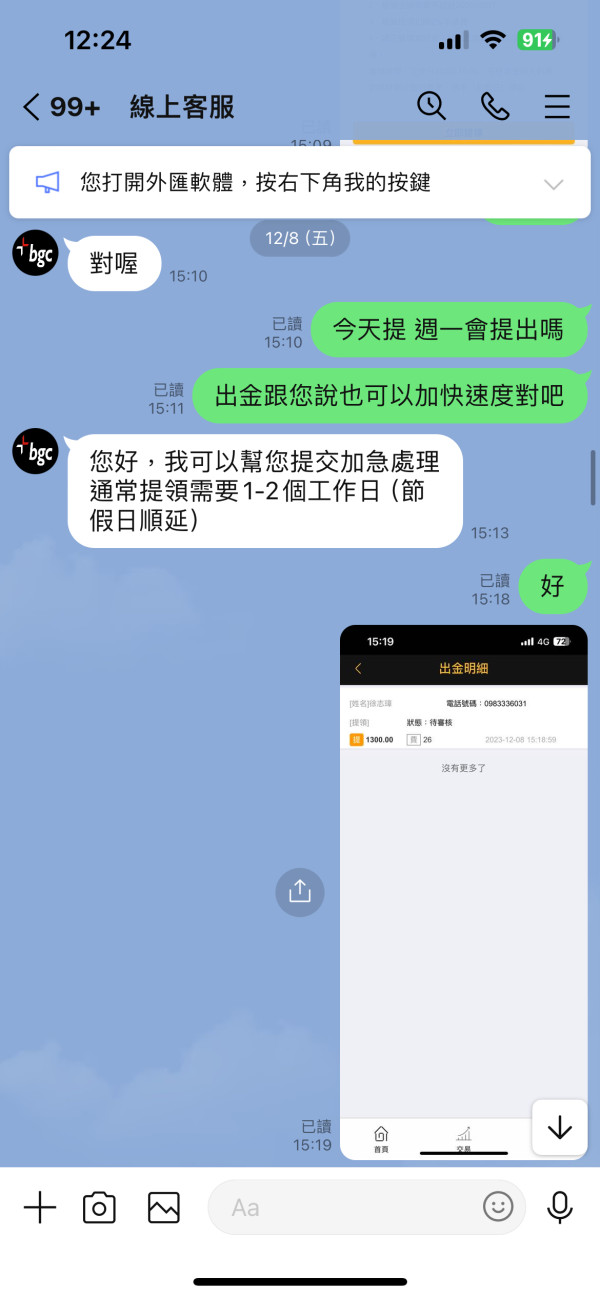

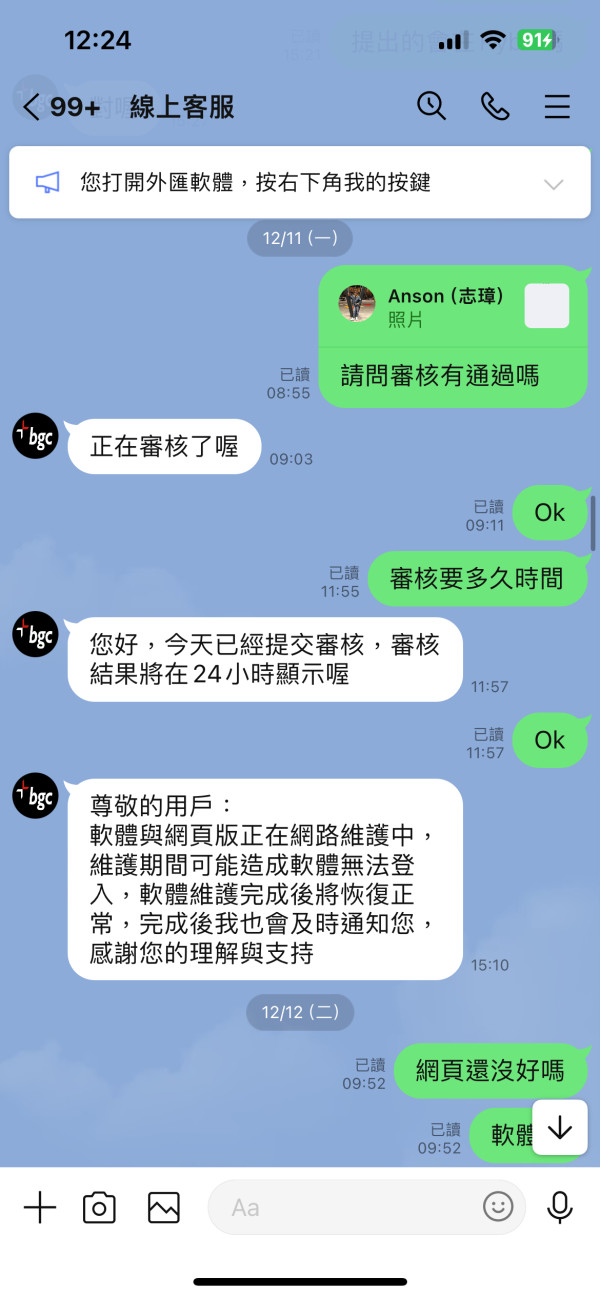

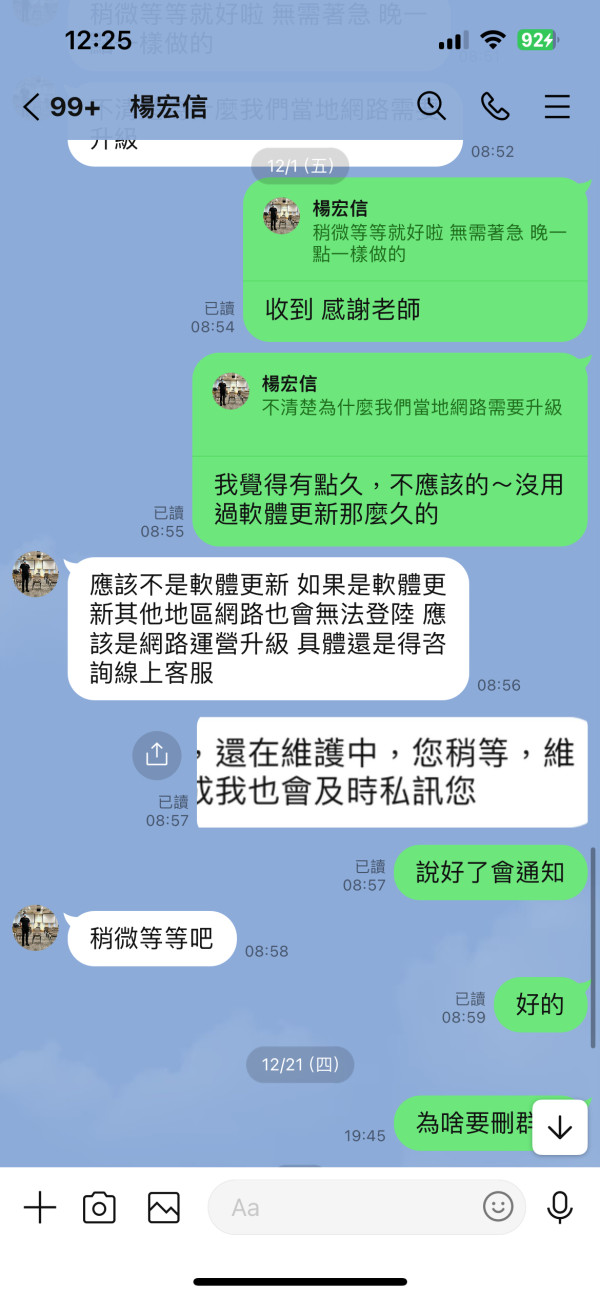

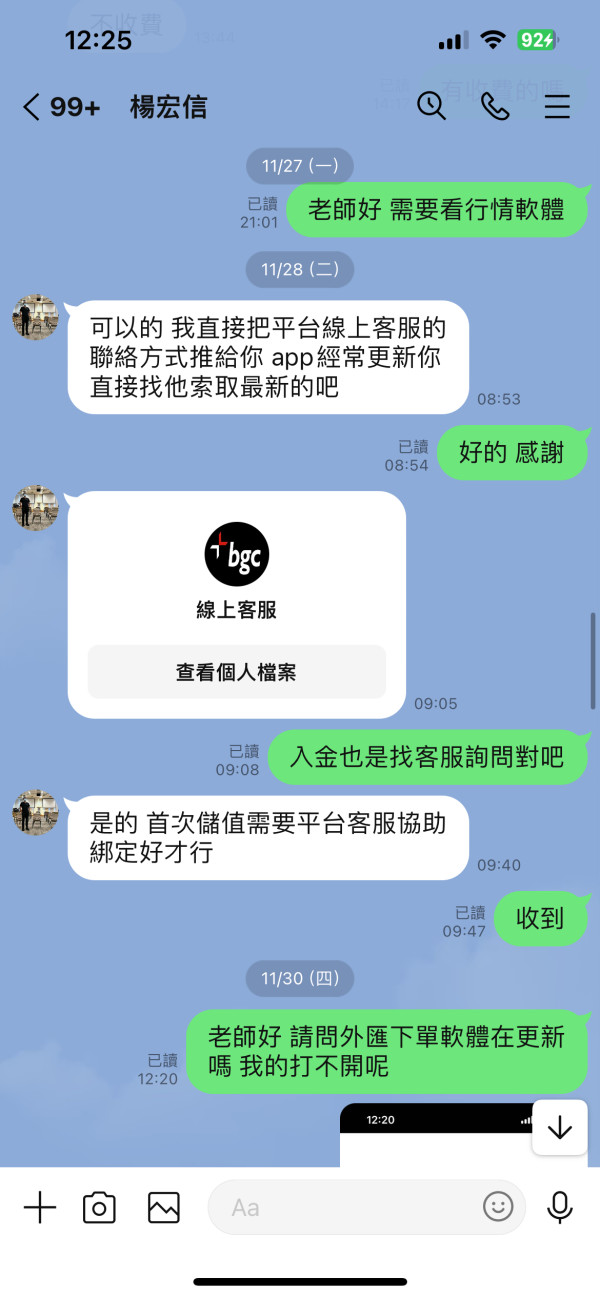

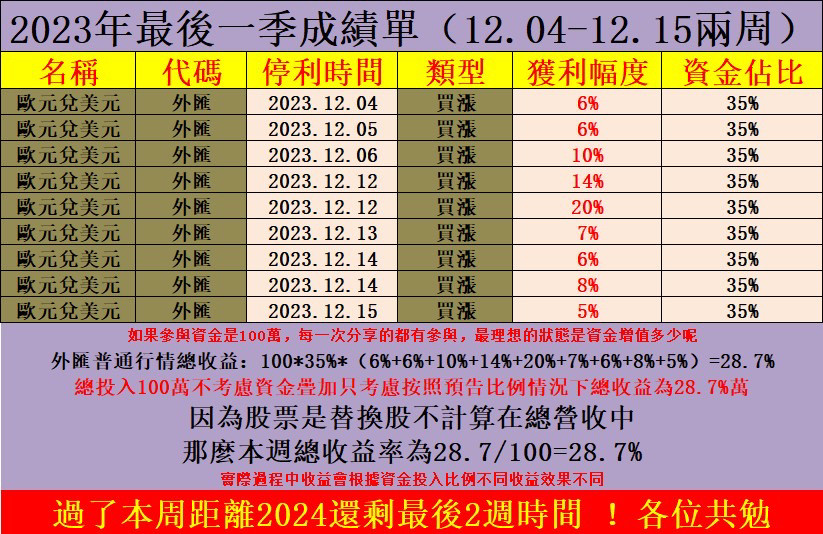

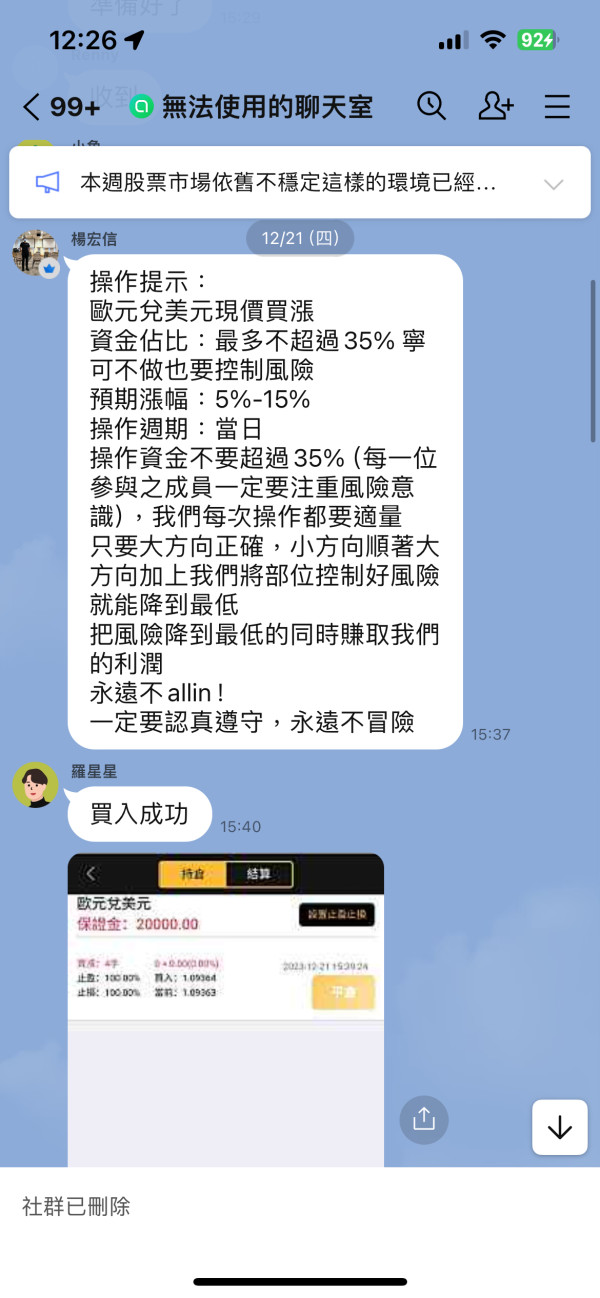

I hope I can remind you to stay away~ (There are currently new groups in working) It is roughly estimated that the total amount defrauded by the former group is close to NT$3 million. Keywords: Yang Jiaxiang/Jiaxiang/Forex/BGC/USDT I originally saw it on Facebook or in the community - Teacher Yang Jiaxiang leads a line group. In the beginning, the teacher shares the so-called high-quality stocks, provides accurate stock entry times, and later informs the profit-making exit times. Every transaction is indeed accurate. Later, Teacher Jiaxiang said that his account had been fraudulently used and he wanted to reorganize a new group, so the number of people in the group dropped from more than 200 to more than 100. Later, a super VIP group was established to make long-term profits through cultivation. Invite your trust to join the paid group (pay virtual USDT, not NT$). During this period, many members were shills, and they kept posting profit orders through the forex operation platform provided by the teacher. The transactions ranged from one hand/second hand/three hands/four hands (each hand was 5,000 USDT, and each USDT was equivalent to 1 US dollar). , each operation will control the profit to 5% to 15%, and repeatedly emphasize not to chase the profit of each operation and the funds are not all in. Then take off your guard, because it is not a huge profit in an instant. After all, shorting in the stock market Or the profit from going long will exceed 5%. After downloading the application provided by Mr. Jiaxiang, the 2023 version of the scam will ask you to join the application’s customer service account and learn how to purchase virtual currencies and deposit funds into the forex platform BGC. You can check online to see if BGC is real and valid. Officially certified, but The Forex platform they operate for you is fake. I encountered a lot of problems when I started to withdraw money. At the same time, I asked Teacher Jiaxiang for help, and he also asked me to actively contact customer service. Problems encountered when withdrawing funds are as follows: 1. Customer service said that the wallet information I used to withdraw money was abnormal and I could not withdraw money. 2. It means that the channel for applying for withdrawal is full and you need to wait. 3. Indicates that the blockchain is congested and is continuing to wait. The status of the withdrawal application has been reviewed and will be remitted later. 4. Customer service started to disappear, at least for more than 10 hours. 5. Customer service provides that after re-depositing funds, the speed of withdrawal can be accelerated, and a fast channel for large withdrawals can be opened. 6. The customer service apologized and was willing to provide a one-time fee for delayed withdrawals. 7. Follow-up messages keep pending, indicating that the withdrawal is still waiting for remittance. What’s crazy is that when I started to seek confirmation from other members of the group about their withdrawal status, Mr. Jiaxiang began to disband the original super VIP group and set up a new group and then excluded me because he knew If I ask him publicly, it will affect his plan to let others be played for suckers. At the same time, the trading website of the forex platform was closed. At the same time, customer service said that the website was under maintenance. Some members who were asked to enter the group revealed that the forex trading website is still operating and trading, and internal members (stakeholders) continue to share operations and profit rates. Once someone enters the group to warn everyone, they will remove the person who warned them from the group. Currently, both groups that have been alerted have been removed from the group. I entered the fund at the beginning of November this year. I found out that I was defrauded and started applying for a withdrawal on December 1, but I found that I could not successfully withdraw the money. I completed the reporting procedure this afternoon. I understand that the police can only help so much, so I would like to post here. I can remind you by turning my hard-earned money into experience. After checking websites and associations online, I found that in May 2022, someone had already described being deceived in a similar situation. The method has not been upgraded to the BGC forex platform.

I saw the reminder from netizens too late. Let me share my painful experience on 2023/11/28. I started practicing BGC customer service deposits. I made normal profits at the beginning. Later, I had a direct liquidation of 5,000 USDT and lost money instantly. I still had almost 2,000 USDT on hand. When I wanted to withdraw money, I started to delay the customer service for various reasons. In the end, the customer service ignored me and the operation group was deleted. Yang Xinhong disappeared from the world and lost almost NT$170,000. I remind you not to be deceived again. The following are the same keywords shared by netizens: Yang Xinhong/Forex/BGC/USDT/Stock Profits were originally seen on Facebook or in the community - teacher Yang Xinhong led the line group. At the beginning, the teacher shared so-called high-quality stocks and provided accurate stock entry times and follow-up The profit trading time will be informed, and indeed the accuracy of each transaction is very high. Later, Teacher Yang Xinhong invited to join the paid group (paying virtual USDT, no New Taiwan Dollar) based on his trust in stock raising and high profits in the growth period. Due to the poor stock market, members can use forex to compensate for the fact that during the period, many members were idle. Through the forex operation platform provided by the teacher, profit orders were posted continuously. The transactions ranged from one hand/second hand/three hands/four hands. (Each lot is 5,000 USDT, each USDT is equivalent to 1 US dollar). Each operation will control the profit at 5% to 15%, and repeatedly emphasizes not to chase the profit every time and the funds are not all in., so as to take off the guard. Because it is not a huge profit in an instant. After all, the profit from short or long positions in the stock market will also exceed 5%. After downloading the software provided, the version of the scam in 2023 is, you will be asked to join the customer service account of the software and how to purchase virtual currency in the future. Regarding how to deposit funds into the forex platform BGC, if you check online that BGC is real and has been officially certified, the forex platform they operate for you is fake. I encountered a lot of situations when I started to withdraw money, and at the same time I asked for help. Teacher Xiang also asked me to actively contact customer service. The problems I encountered when withdrawing money are as follows: 1. The customer service said that the wallet information for my withdrawal was abnormal and I could not withdraw money. 2. It said that the channel for applying for a withdrawal was crowded and I needed to wait. 3. It said that the blockchain Crowded, waiting continuously, the status of the withdrawal application has been reviewed, and the follow-up is pending remittance 4. The customer service began to disappear, at least 10 hours or more 5. The customer service provides that after re-depositing, the speed of withdrawal can be accelerated, and it can be opened Fast track for large withdrawals 6. The customer service apologized and was willing to provide a one-time fee for delayed withdrawals 7. The follow-up continued to hit the wall, indicating that the withdrawal was still waiting for the remittance. At the same time, the trading website of the forex platform It was closed. At the same time, customer service said that the website was under maintenance. There were members who were asked to enter the group. It was later revealed that the forex trading website is still operating and trading, and internal members (stakeholders) continue to share operations and profit rates. Once someone enters the group, follow If everyone warns them, they will leave the group and throw their money into the sea. Alas, if you don’t have a greedy mentality, it will be easy to suffer misfortune.

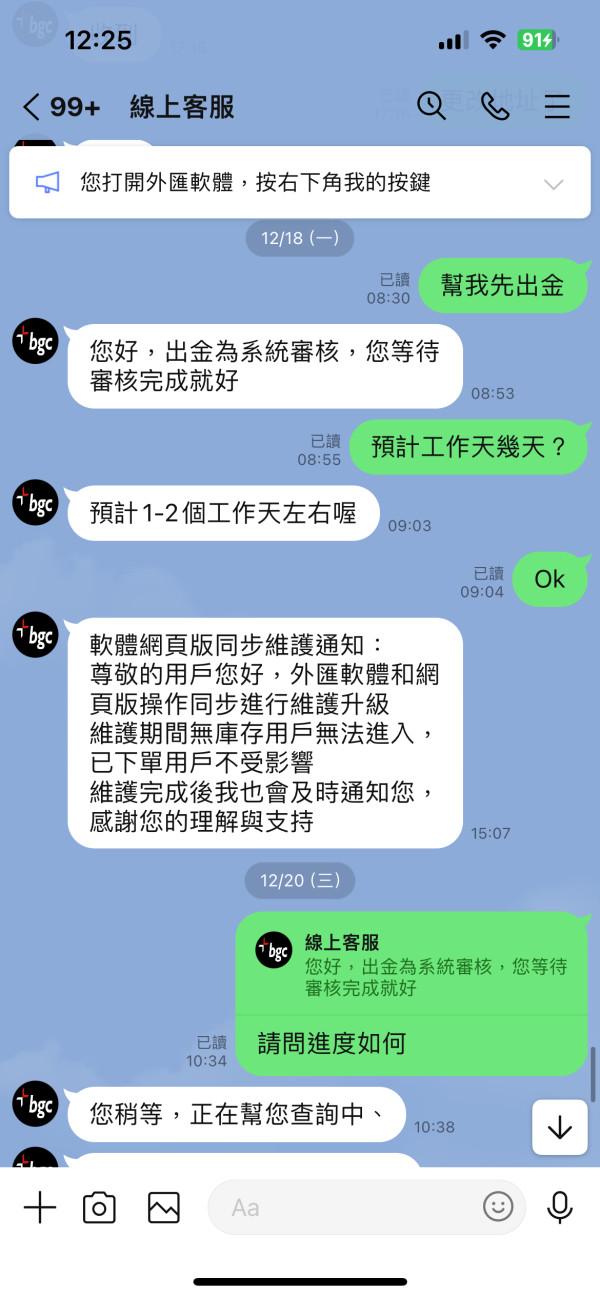

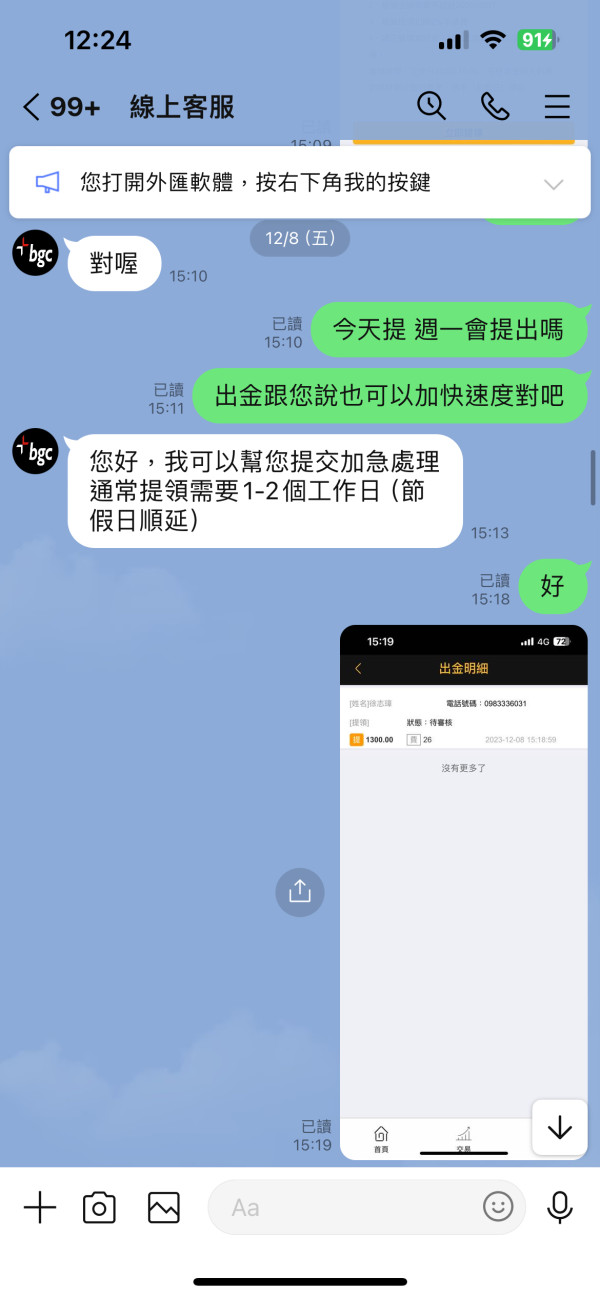

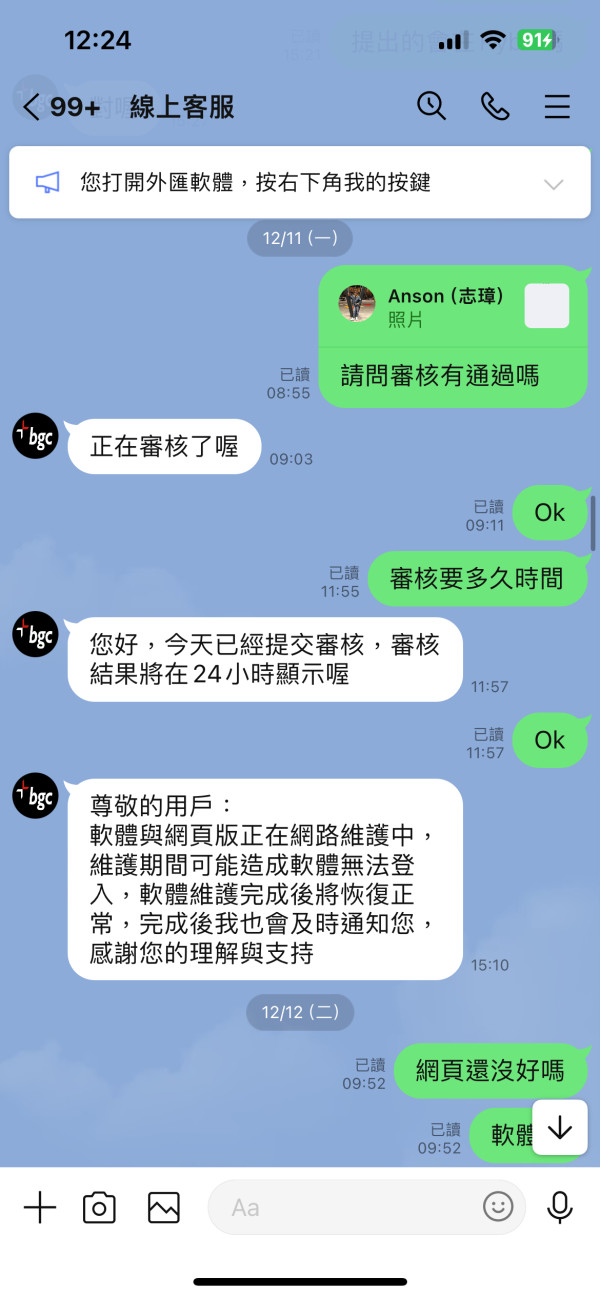

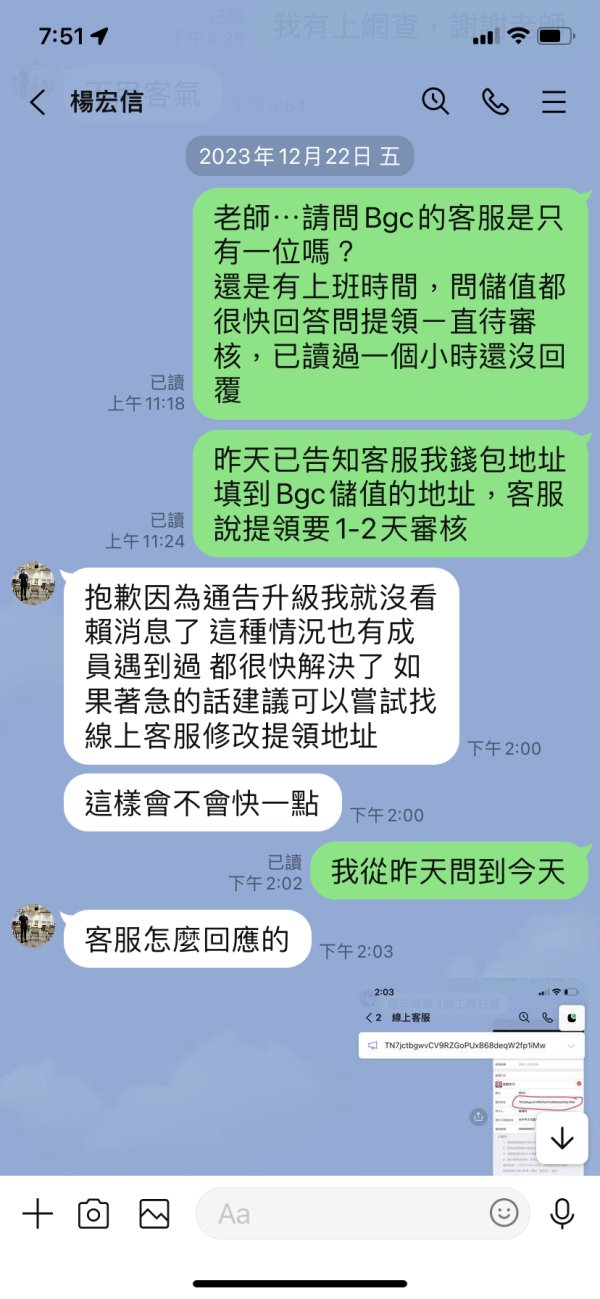

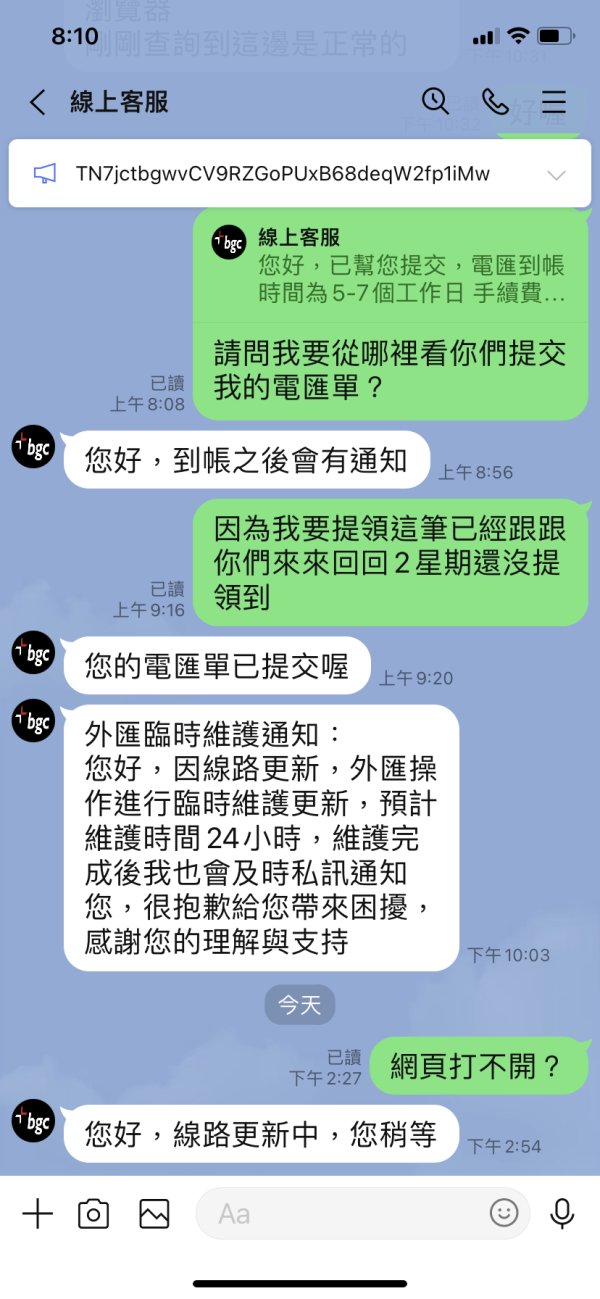

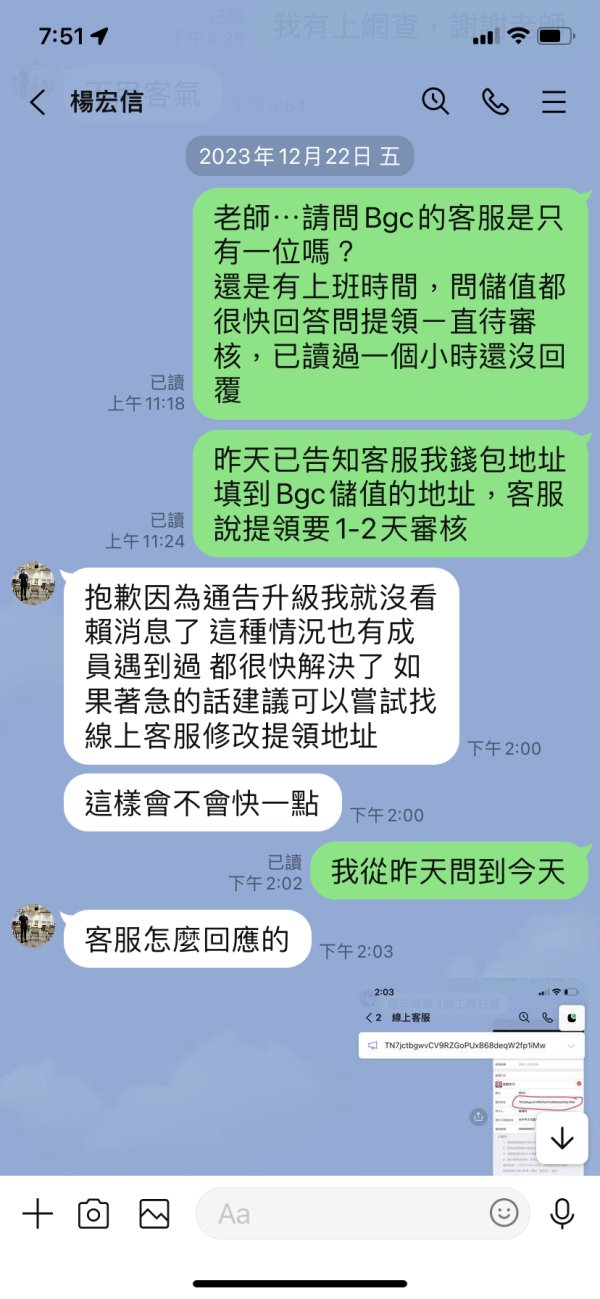

Yang Hongxin told everyone about a forex software with fast, stable and reliable withdrawals. 112.12/18 After joining the platform, he frequently upgraded the network and changed lines. It took 2 weeks to withdraw USDT2000, but I was told that the withdrawal website needs to be confirmed (confirmation requires 24-hour feedback). At the end of the year, many people choose to withdraw via wire transfer. When I asked them to give me a wire transfer form, they only said that it had been submitted. I asked Yang Xinhong if there is only one customer service staff? Questions about deposited value were quickly answered. Questions about withdrawal were pending review. It has been read for an hour and cannot be read back. Yang Xinhong asked me to contact the customer service staff. What happens after recharging is different from what Yang Xinhong said. Everyone, please don’t be deceived.

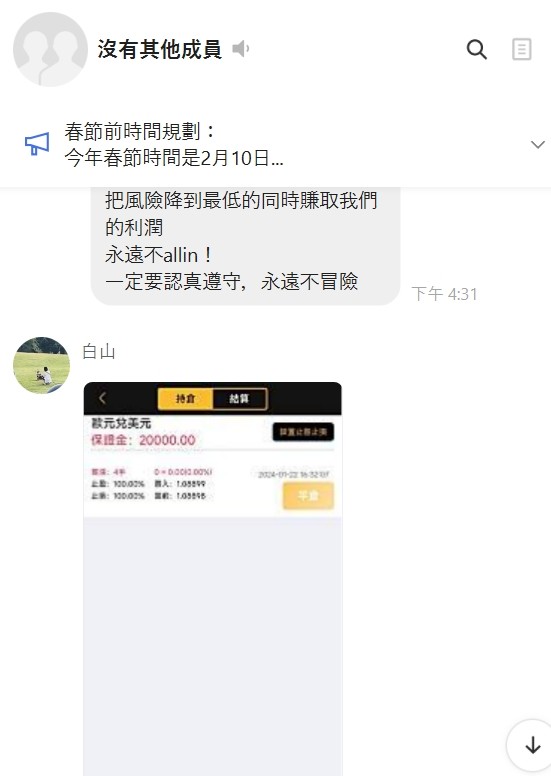

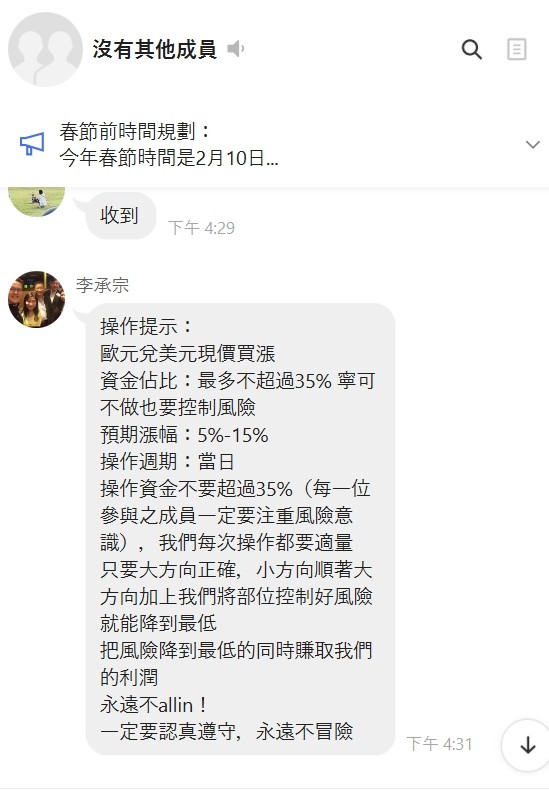

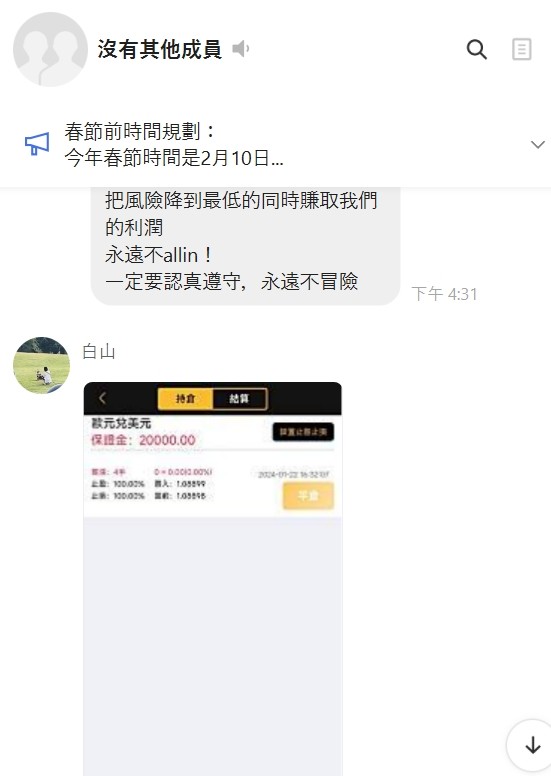

Situation description 1. Joined the stock investment LINE group where Li Chengzong is the moderator for about a year, and started soliciting foreign exchange transactions. After relying on the moderator privately, the moderator provided a LINE online customer service account, and the online customer service guided the registration and account opening, and provided a deposit wallet. Address and transaction URL that can be logged in after registration. 2. The transaction URL is displayed as a BGC webpage, which often requires maintenance and suspends transactions. 3. The general trading time is mostly led by the moderator Li Chengzong from Monday to Thursday every week, choosing to trade in the afternoon or evening, choose the foreign exchange transaction of the euro against the US dollar, trade with the virtual currency USDT, the first-hand margin is 5000 USDT, and the transaction fee is 200 USDT. 4. The profit of each order is about 5~15%, and the trading method is to earn the price difference. 5. When I applied for a withdrawal on January 21st of this month, the system showed that it would take 1-2 days for the account to be credited. The result was not even reviewed. After contacting customer service for a reply, they will submit a review and wait for a reply. As a result, there was no message at all after that. Please contact us again. The moderator did the same and later determined it to be a fraud and immediately reported it to the police.