Investments Global 2025 Review: Everything You Need to Know

Investments Global has emerged as a notable player in the online trading landscape, offering a range of financial instruments including forex, cryptocurrencies, commodities, indices, and stocks. However, the broker's unregulated status raises significant concerns about its reliability and trustworthiness. This review synthesizes various perspectives from users and experts to provide a comprehensive overview of Investments Global.

Note: It is crucial to recognize that the broker operates under different entities across regions, which may impact regulatory oversight and user experience. This review aims for fairness and accuracy by drawing on a wide array of sources.

Ratings Overview

How We Rated the Broker: Our ratings are based on a thorough analysis of user experiences, expert opinions, and factual data regarding the broker's offerings.

Broker Overview

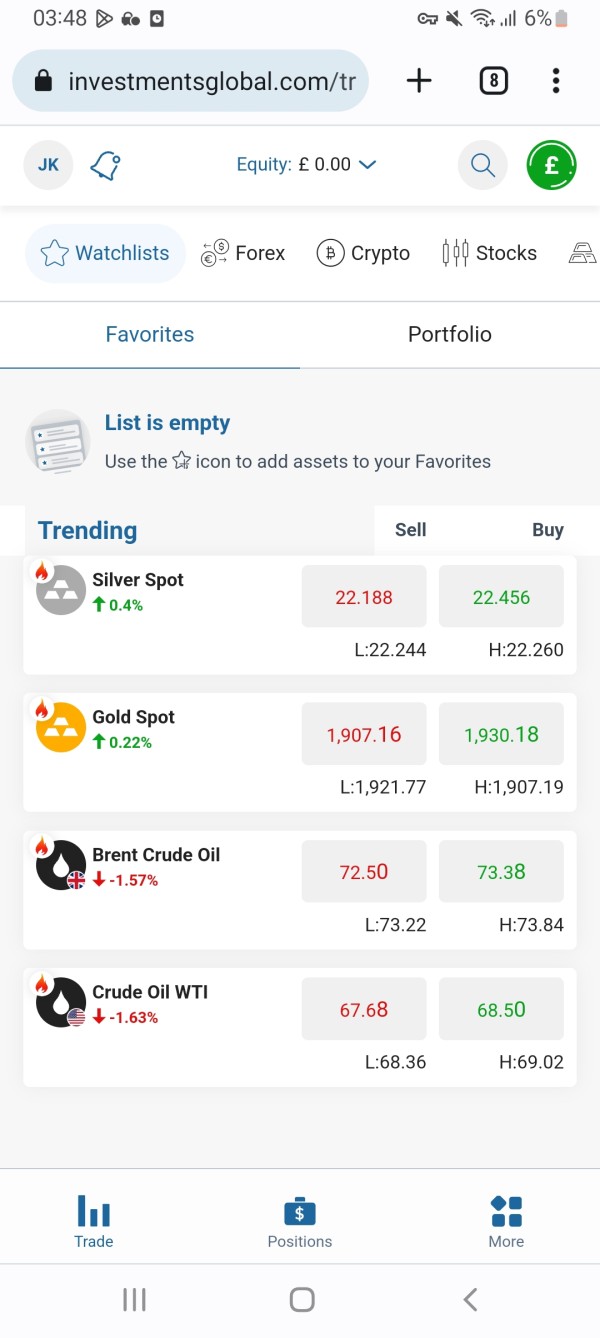

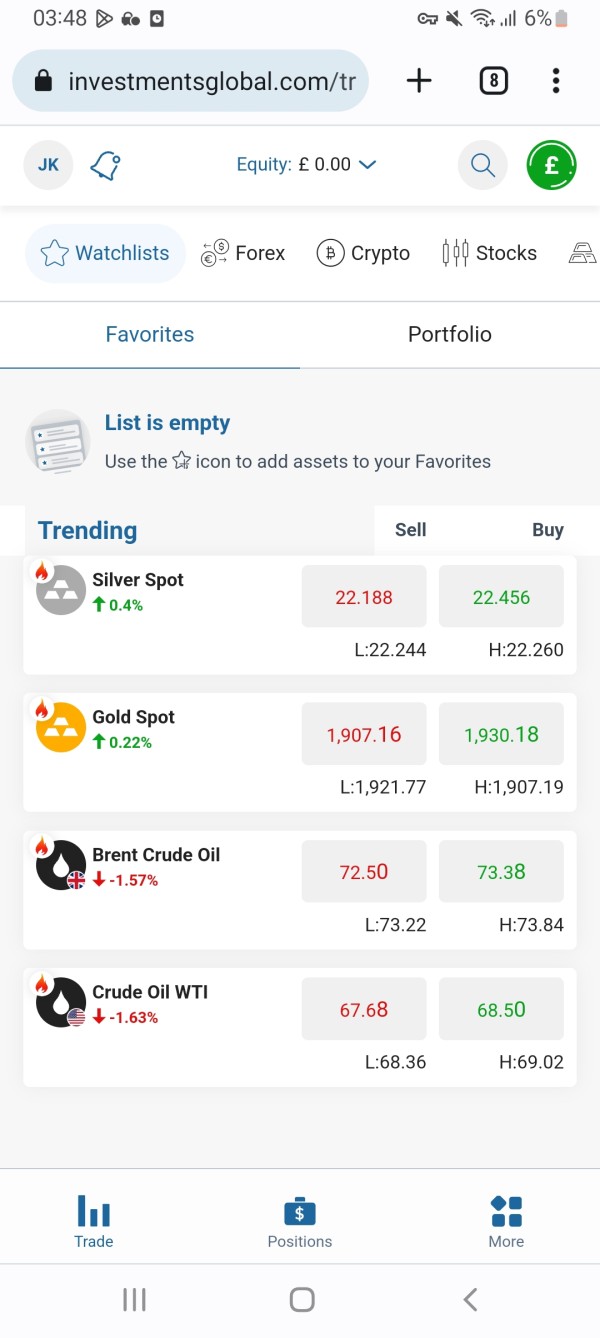

Founded in 2002, Investments Global is headquartered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework. The broker provides a proprietary web trading platform, which is accessible on both desktop and mobile devices. However, it does not support popular platforms like MT4 or MT5, which can be a drawback for many traders. Investments Global offers a variety of trading instruments, including over 50 currency pairs, cryptocurrencies like Bitcoin and Ethereum, commodities, and indices.

Detailed Breakdown

Regulatory Overview

Investments Global operates without any verifiable regulatory oversight, which is a significant red flag. According to various sources, the broker is not registered with any major financial authorities, raising concerns about the safety of client funds. The lack of regulation means that clients have limited recourse in case of disputes or fraudulent activities.

Deposit/Withdrawal Methods

Investments Global accepts various deposit methods, including bank transfers, credit/debit cards, and cryptocurrencies. The minimum deposit required to open an account is $250, which is relatively accessible compared to other brokers. However, users have reported difficulties in withdrawing funds, often citing delays and excessive fees that were not disclosed upfront.

While Investments Global hints at promotional bonuses, detailed information about these offers is scarce, leading to skepticism among potential clients. The absence of clear terms regarding bonuses can be a tactic to lure clients into making larger deposits.

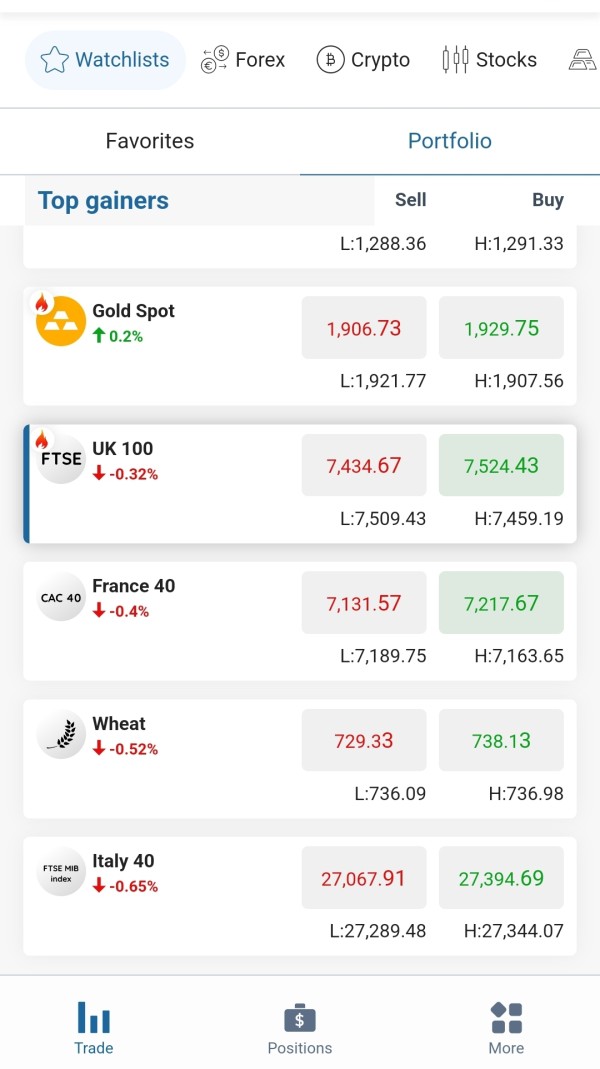

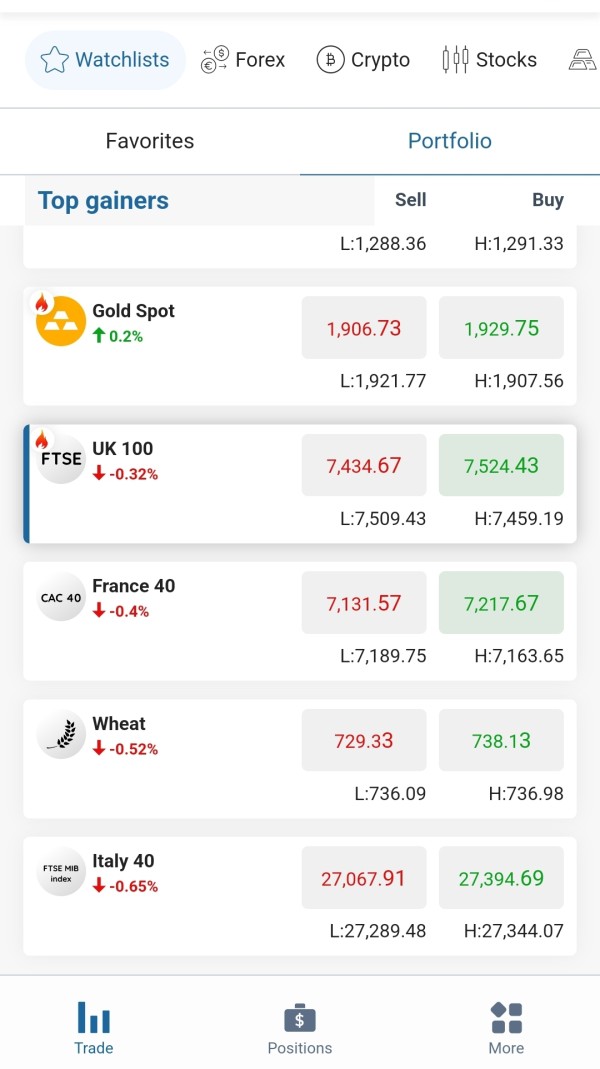

Tradable Asset Classes

The broker provides a broad range of tradable assets, including forex, cryptocurrencies, commodities, stocks, and indices. This extensive selection allows for diversified trading strategies, although the quality of execution and market access remains questionable due to the broker's unregulated status.

Costs (Spreads, Fees, Commissions)

Investments Global reportedly offers variable spreads starting from 1.6 pips for major currency pairs. However, user reviews suggest that actual spreads can be higher, especially during volatile market conditions. Additionally, the broker imposes an inactivity fee of $99 if an account remains dormant for 30 days or more, which could be a deterrent for casual traders.

Leverage

The broker offers leverage up to 1:400, which is considered high in the industry. While this can amplify potential profits, it also increases the risk of significant losses, making it more suitable for experienced traders who understand the implications of high-leverage trading.

Investments Global does not support MT4 or MT5, which are widely regarded as industry standards. Instead, it offers a proprietary web-based platform that may lack some advanced features that seasoned traders expect.

Restricted Regions

Investments Global does not accept clients from the United States, which limits its accessibility to a significant market. This restriction could be due to the broker's unregulated status, as U.S. traders are often advised to engage only with regulated entities.

Available Customer Support Languages

The broker provides customer support primarily in English, with a 24/5 availability. However, many users have reported difficulties in reaching customer service and receiving timely responses, raising concerns about the overall quality of support.

Repeated Ratings Overview

Detailed Assessment

-

Account Conditions: Investments Global offers a minimum deposit of $250, which is competitive. However, the lack of regulatory oversight makes these conditions less appealing.

Tools and Resources: The proprietary platform provides basic tools, but the absence of MT4/MT5 is a drawback for many traders who rely on advanced charting and analysis tools.

Customer Service and Support: Users have reported poor customer service experiences, with long wait times and unresponsive support channels.

Trading Setup (Experience): The trading experience can be hindered by the platform's limitations and the broker's unregulated status, which may affect order execution and market access.

Trustworthiness: The lack of regulation and numerous negative user reviews significantly impact the broker's trustworthiness, making it a risky choice for traders.

User Experience: While the platform is user-friendly, the overall experience could be marred by the broker's unregulated status and customer service issues.

In conclusion, the Investments Global review indicates that while the broker offers a range of trading instruments and has a user-friendly platform, significant concerns regarding its regulatory status, customer service, and withdrawal processes make it a risky choice for potential investors. Traders are advised to exercise caution and consider regulated alternatives to safeguard their investments.