Ambition 2025 Review: Everything You Need to Know

Executive Summary

This ambition review looks at a forex broker that has caught the trading community's attention. The broker has 572 user reviews on platforms like G2 and Capterra, though specific rating scores aren't shared in available materials. The large number of user reviews suggests this broker has a strong presence in the forex industry.

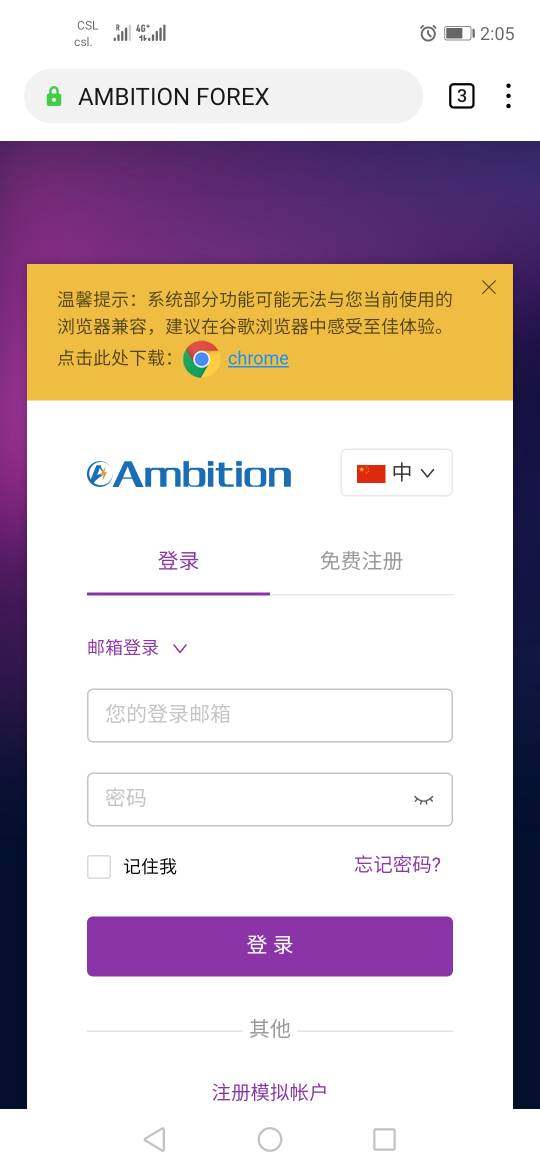

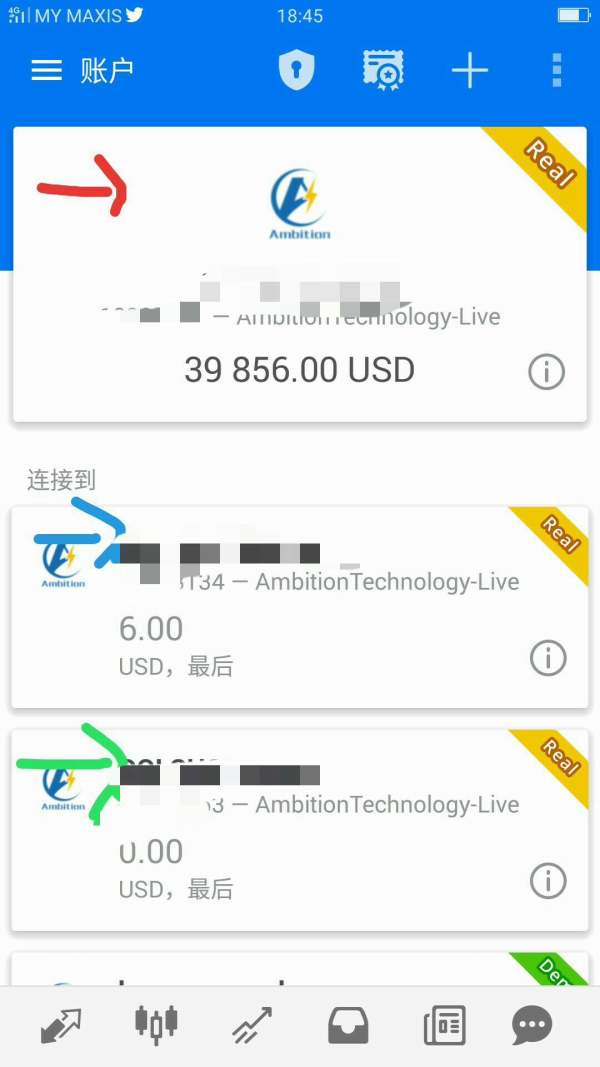

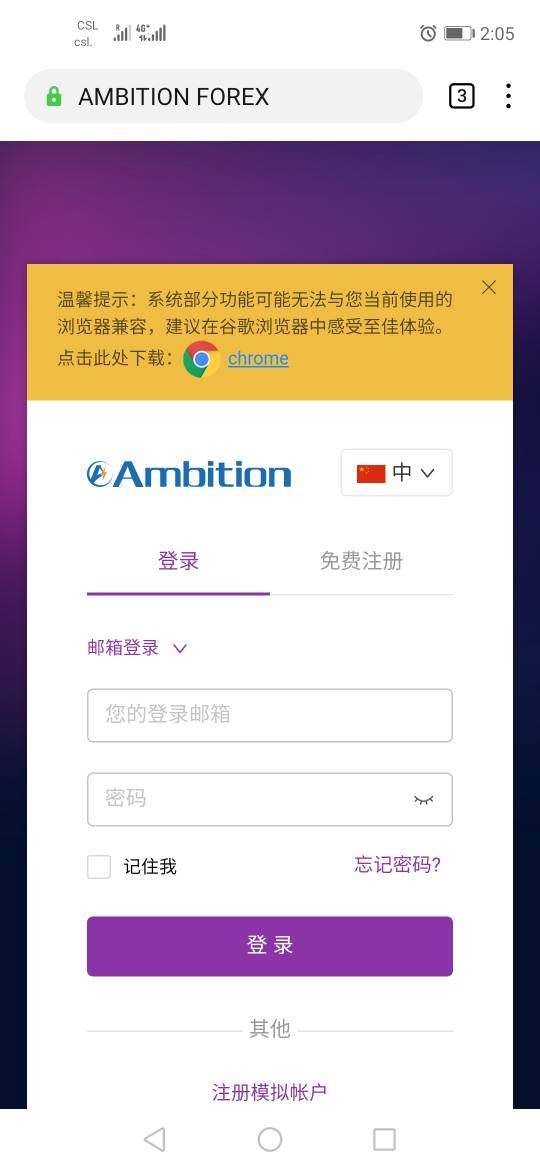

Ambition works as a trading platform that offers multiple trading solutions. These include MT4, MT5, and WebTrader platforms, plus access to over 55 forex currency pairs. The broker targets traders who want diverse trading tools and platform options, though several important parts of their service remain unclear in public information.

Key highlights include their multi-platform approach and extensive forex asset selection. This could appeal to traders looking for flexibility in their trading environment. However, potential clients should note that regulatory information and specific account conditions aren't clearly shown in available documentation, which may require additional research before making a decision.

Important Notice

Regulatory Caution: Based on available information, specific regulatory details for Ambition are not clearly disclosed. Traders should be very careful and do thorough research about the broker's regulatory status before putting money in. This review uses available user feedback and publicly accessible information, which may be incomplete or subject to updates.

Potential traders should verify all information independently and make sure the broker meets their regulatory requirements before opening an account.

Rating Overview

Broker Overview

AmbitionTrader works as a forex brokerage service provider. Specific details about when it was established and its founding background aren't easily found in current documentation. The company seems to focus mainly on forex trading services, positioning itself in the competitive online trading market through its multi-platform approach.

The broker's business model centers around giving traders access to foreign exchange markets. However, the specific operational structure and revenue model details aren't extensively detailed in available materials. The platform stands out through its technology offerings, providing traders with three distinct trading platforms: MetaTrader 4, MetaTrader 5, and a proprietary WebTrader solution.

This ambition review finds that the broker offers access to more than 55 forex currency pairs. This suggests a comprehensive approach to major, minor, and potentially exotic currency trading. However, information about the company's regulatory oversight, licensing jurisdictions, and compliance framework remains unclear in publicly accessible documentation, which represents a significant consideration for potential traders evaluating the platform.

Regulatory Jurisdiction: Current available information does not specify the regulatory bodies overseeing Ambition's operations. This represents a critical information gap for potential traders.

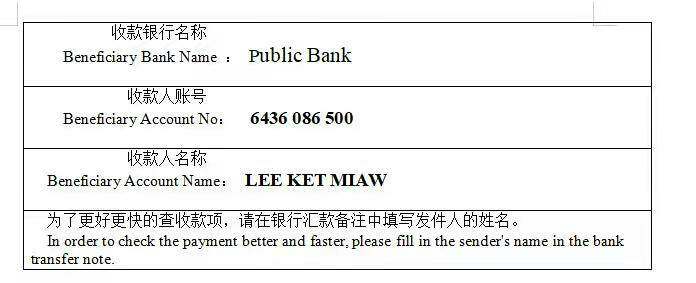

Deposit and Withdrawal Methods: Specific funding options and withdrawal procedures are not detailed in accessible materials. This requires direct inquiry with the broker.

Minimum Deposit Requirements: The minimum account funding requirement is not specified in available documentation.

Promotional Offers: Details about welcome bonuses, promotional campaigns, or trading incentives are not currently available.

Trading Assets: The platform provides access to over 55 forex currency pairs. This indicates a substantial selection for currency trading enthusiasts.

Cost Structure: Specific information about spreads, commissions, overnight fees, and other trading costs is not detailed in current materials. This represents another area requiring direct clarification.

Leverage Options: Available leverage ratios are not specified in accessible information.

Platform Selection: Traders can access MT4, MT5, and WebTrader platforms. This provides flexibility in trading environment preferences.

Geographic Restrictions: Information about restricted territories or regional limitations is not currently available.

This ambition review highlights significant information gaps that potential traders should address through direct communication with the broker before making account decisions.

Account Conditions Analysis

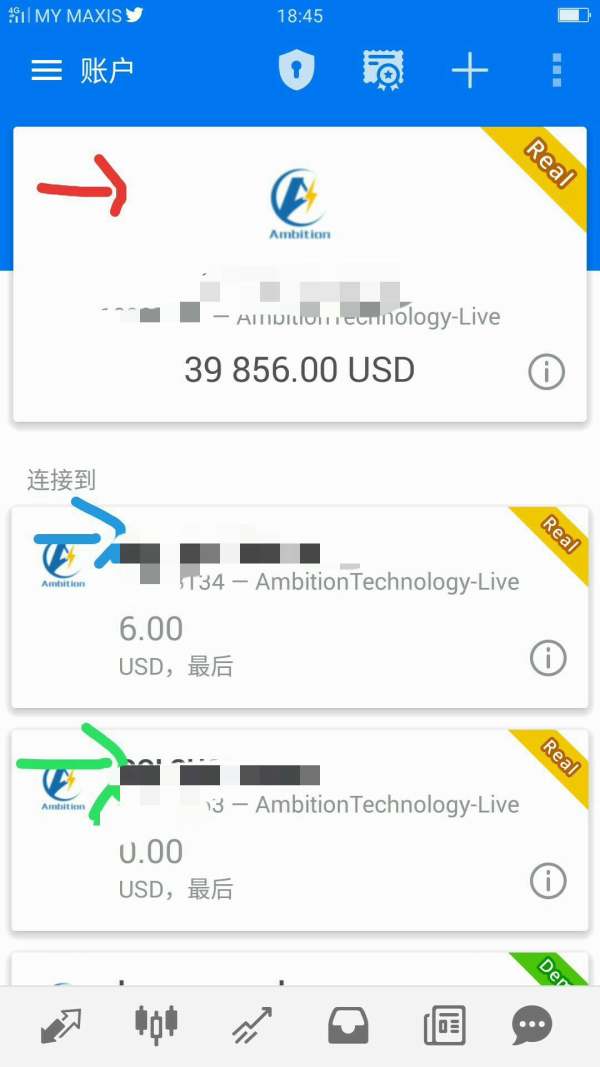

The evaluation of Ambition's account conditions presents challenges due to limited publicly available information. Standard account types, their respective features, and differentiation factors are not clearly outlined in accessible materials. This lack of transparency about account structures makes it difficult for potential traders to understand what options are available and how they might align with different trading strategies or experience levels.

Minimum deposit requirements are crucial for trader decision-making, but they aren't specified in current documentation. Similarly, information about account opening procedures, verification requirements, and timeline expectations is not readily available. The absence of details about specialized account options, such as Islamic accounts for Muslim traders or professional accounts for qualified investors, further limits the ability to assess the broker's accommodation of diverse trader needs.

Without clear information about account conditions, this ambition review cannot provide a comprehensive assessment of how competitive or suitable these offerings might be compared to industry standards. Potential clients would need to engage directly with Ambition's representatives to obtain detailed account information before making informed decisions about their trading relationship.

Ambition demonstrates strength in its platform diversity. The broker offers three distinct trading environments that cater to different trader preferences and technical requirements. The inclusion of MetaTrader 4 and MetaTrader 5 platforms provides traders with access to industry-standard tools that are widely recognized for their reliability, analytical capabilities, and automated trading support.

The additional WebTrader option suggests an effort to accommodate traders who prefer browser-based trading without software downloads. The availability of over 55 forex currency pairs indicates a comprehensive approach to currency trading, potentially spanning major pairs like EUR/USD and GBP/USD, minor crosses, and exotic currency combinations. This selection could satisfy both conservative traders focusing on liquid major pairs and more adventurous traders seeking opportunities in less common currency combinations.

However, information about additional research resources, market analysis tools, educational materials, or trading signals is not detailed in available documentation. The extent of charting tools, technical indicators, and fundamental analysis resources remains unclear. Similarly, details about automated trading capabilities, expert advisor support, or algorithmic trading features are not specified, limiting the ability to fully assess the platform's technological sophistication and trader support resources.

Customer Service and Support Analysis

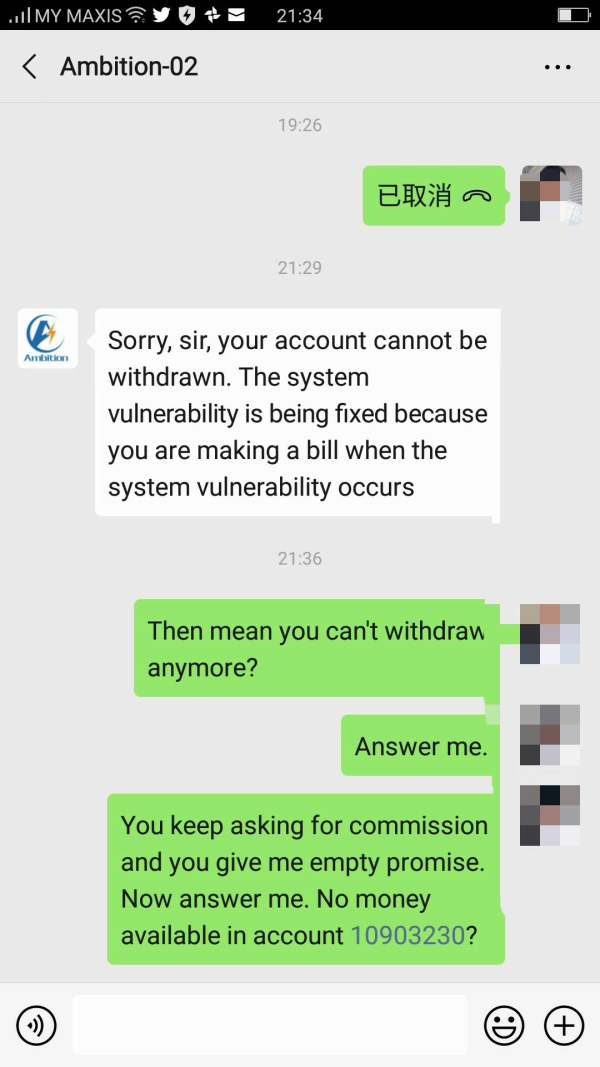

Customer service evaluation for Ambition faces significant limitations due to the absence of detailed support information in available materials. Critical aspects such as available communication channels, whether through phone, email, live chat, or social media, are not specified in current documentation. This lack of transparency about customer support accessibility represents a notable concern for potential traders who value responsive assistance.

Response time expectations, service quality standards, and problem resolution procedures are not outlined in accessible information. The availability of multilingual support, which is crucial for international traders, remains unspecified. Additionally, customer service operating hours, timezone coverage, and weekend support availability are not detailed, making it difficult for traders to understand when assistance would be accessible.

Without specific user feedback about customer service experiences, this review cannot assess the practical quality of support interactions, problem-solving effectiveness, or overall satisfaction levels with Ambition's customer service delivery. The absence of this information suggests that potential traders should prioritize direct evaluation of customer service responsiveness and quality before committing to the platform, particularly if ongoing support is important to their trading strategy.

Trading Experience Analysis

The trading experience evaluation for Ambition is constrained by limited available information about platform performance, execution quality, and user interface design. While the broker offers multiple trading platforms including MT4, MT5, and WebTrader, specific details about platform stability, execution speeds, or technical performance metrics are not provided in accessible materials.

Order execution quality, including factors such as slippage rates, rejection frequencies, and fill quality, is not documented in available information. Similarly, details about trading environment characteristics, such as dealing desk versus no dealing desk operations, market maker versus ECN models, or liquidity provider relationships, are not specified.

Mobile trading capabilities, which are increasingly important for modern traders, are not detailed in current documentation. The quality of mobile applications, their feature completeness compared to desktop platforms, and user interface design remain unclear. This ambition review cannot assess how well the platform accommodates traders who require flexible, on-the-go trading capabilities or those who prioritize seamless cross-device trading experiences.

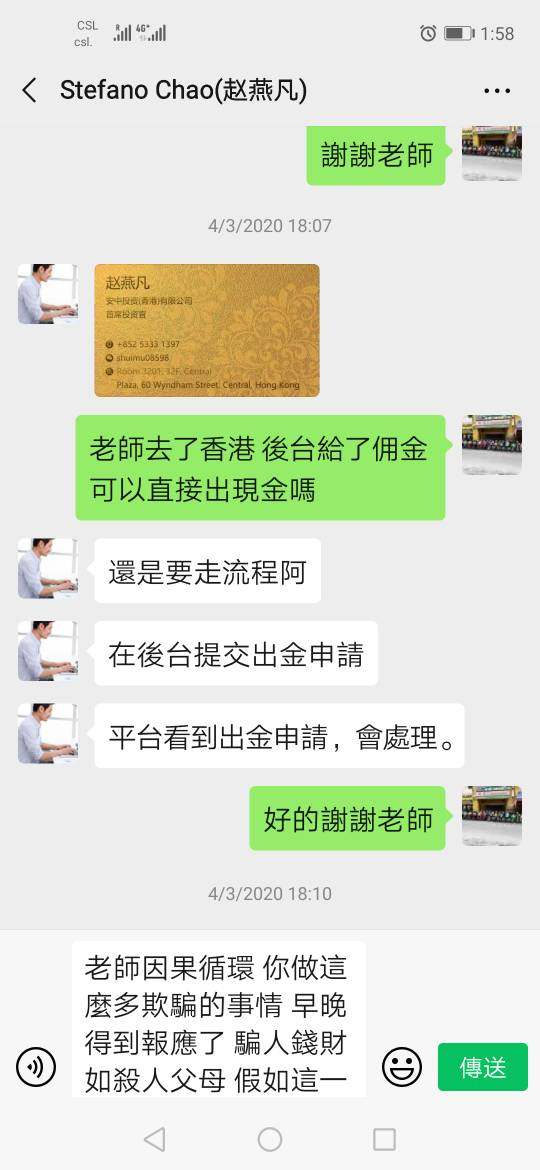

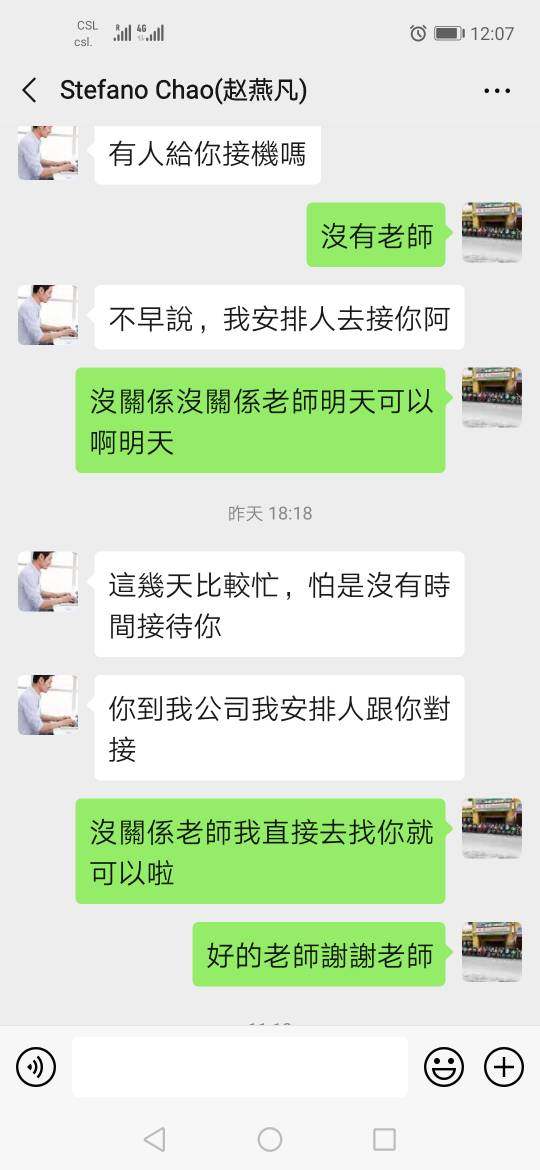

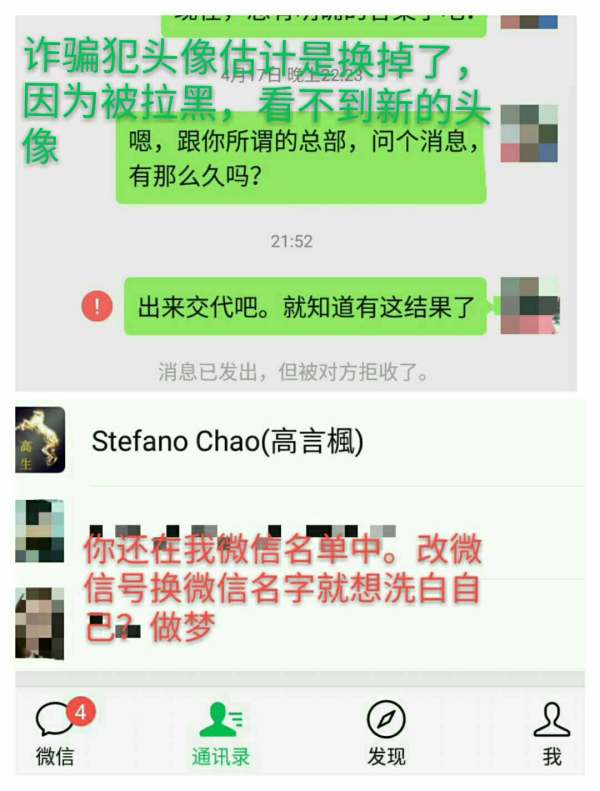

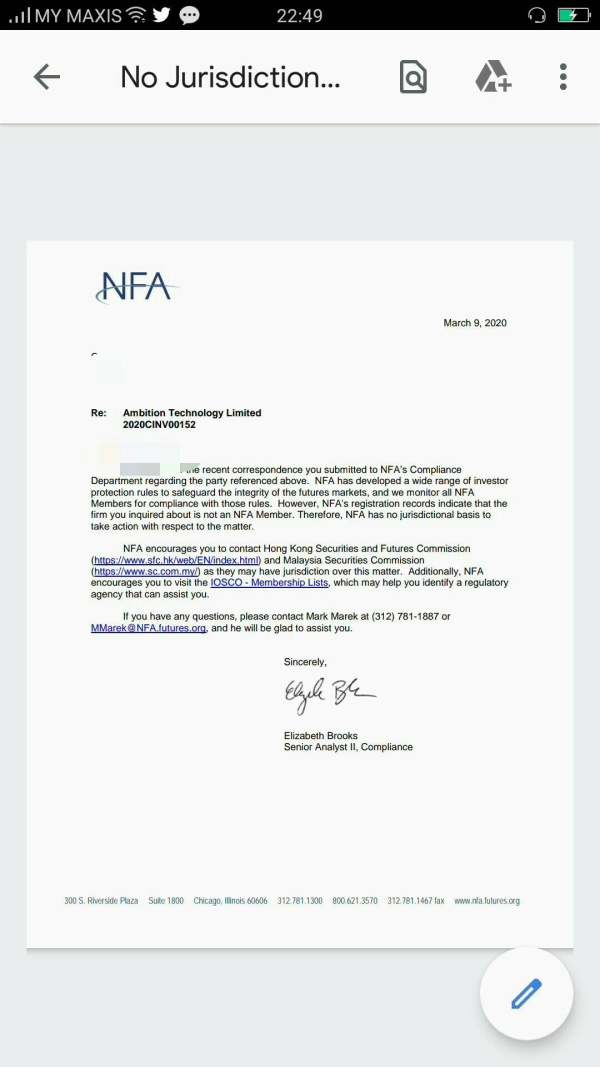

Trust and Regulation Analysis

Trust and regulatory assessment presents the most significant concern in this Ambition evaluation. The absence of clear regulatory information in available materials raises important questions about oversight, compliance, and trader protection measures. Regulatory licensing provides crucial safeguards including segregated client funds, dispute resolution mechanisms, and operational oversight that protect trader interests.

Without specific regulatory body identification, license numbers, or compliance certifications, potential traders cannot verify the legal framework governing their relationship with Ambition. This lack of regulatory transparency makes it impossible to assess what protections would be available in case of disputes, operational issues, or financial difficulties.

Fund safety measures, including client money segregation practices, insurance coverage, and bankruptcy protection, are not detailed in available information. The absence of third-party auditing information, financial reporting transparency, or regulatory filing accessibility further compounds trust assessment challenges. These factors collectively represent significant due diligence requirements that potential traders must address independently before considering Ambition as their trading partner.

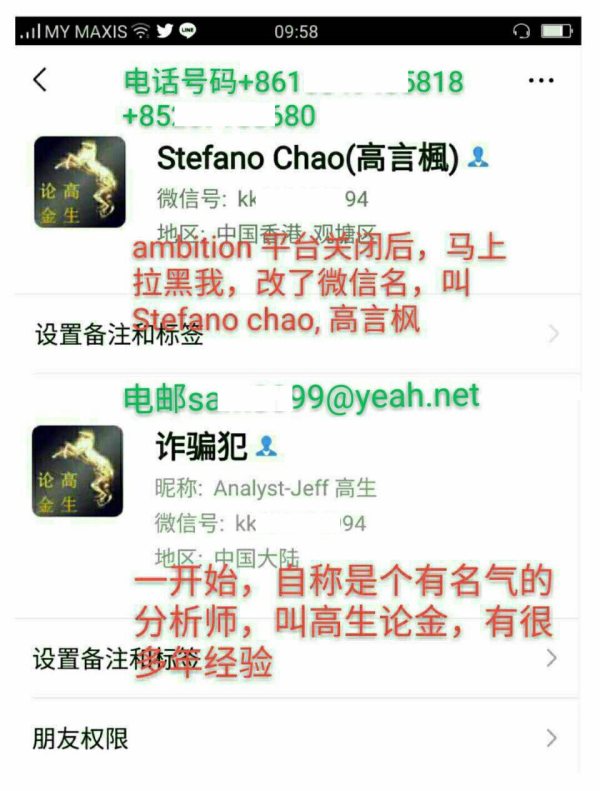

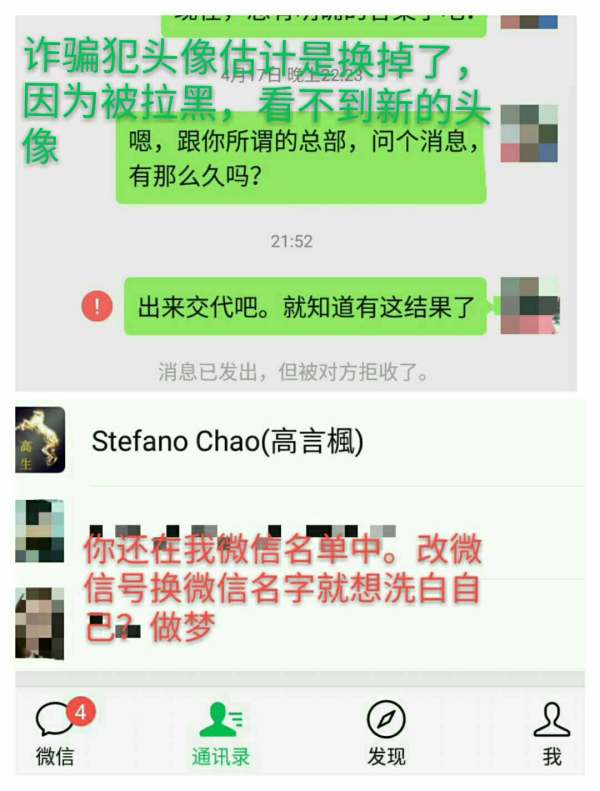

User Experience Analysis

User experience evaluation for Ambition is limited by the lack of detailed feedback and interface information in available materials. While the platform has attracted 572 user reviews across various platforms, the specific content and sentiment of these reviews are not detailed in accessible documentation, limiting the ability to assess overall user satisfaction levels.

Interface design quality, navigation intuitiveness, and learning curve considerations for new users are not described in current information. The user onboarding process, including registration simplicity, account verification procedures, and initial setup experience, remains unspecified. Similarly, the quality of educational resources, tutorial availability, and new trader support systems cannot be evaluated based on available information.

Common user concerns, frequently reported issues, or areas of particular satisfaction are not identified in accessible materials. The absence of user testimonials, case studies, or detailed feedback summaries makes it difficult to understand real-world user experiences with the platform. This gap in user experience information suggests that potential traders should seek out independent user reviews and potentially test the platform through demo accounts before making commitment decisions.

Conclusion

This ambition review reveals a forex broker with some notable strengths, particularly in platform diversity and forex asset selection, but significant transparency gaps that may concern potential traders. While Ambition offers multiple trading platforms and access to over 55 currency pairs, the lack of clear regulatory information, account condition details, and comprehensive service descriptions creates substantial due diligence requirements for interested traders. The platform may suit traders seeking platform flexibility and extensive forex options, but the absence of regulatory clarity and detailed operational information suggests that thorough independent research and direct broker communication are essential before making account decisions.