ETFinance 2025 Review: Everything You Need to Know

Executive Summary

ETFinance shows mixed results for traders who want to use this Cyprus-based CFD and forex broker. The platform gives you access to MetaTrader 4 and offers educational resources for users who sign up, but there are big concerns about fund security and customer service quality. This etfinance review shows that even though the broker won the "Best Cryptocurrency Broker in Europe" award in 2019, users have made serious claims about unauthorized deposit clearances and poor customer support.

The broker targets traders who want different financial instruments with educational support. It offers CFD and forex trading through their platform, but user feedback shows major trust issues with multiple reports of deposits being canceled without proper explanation. The educational hub and MetaTrader 4 integration are good features, but concerning user experiences about fund safety and customer service problems overshadow these benefits.

Traders who consider ETFinance should carefully think about the risks and rewards. This is especially important given the lack of detailed regulatory information and the many negative user reviews about fund security.

Important Notice

This review uses available user feedback and market information from multiple sources. ETFinance operates in different areas, and regulatory information was not clearly shown in available materials. Traders should check regulatory status on their own and do their own research before using this broker.

Our review method uses user testimonials, platform features analysis, and available market data. This gives a complete assessment of the broker's services and reliability.

Rating Framework

Broker Overview

ETFinance works as a CFD and forex broker based in Cyprus. The company focuses on providing trading services across multiple financial instruments and positions itself as a complete trading platform offering both CFD and foreign exchange trading to retail and institutional clients. According to available information, ETFinance has built itself up in the competitive online trading space, though specific founding details were not clearly documented in source materials.

The broker's business model centers on providing access to financial markets through their trading infrastructure. This is supported by educational resources designed to help trader development, and this etfinance review shows that the company has tried to stand out through educational offerings and platform accessibility, though users have criticized how these services are delivered.

ETFinance provides the MetaTrader 4 trading platform as their main trading interface. It supports various asset classes including forex and CFDs, and the platform appears designed to help traders who want exposure to multiple financial instruments through a single interface. However, specific details about the company's founding year, management structure, and detailed regulatory compliance were not fully available in reviewed materials.

The broker's operational focus includes serving traders interested in access to different financial instruments. There is particular emphasis on providing educational support to registered users through their dedicated educational hub.

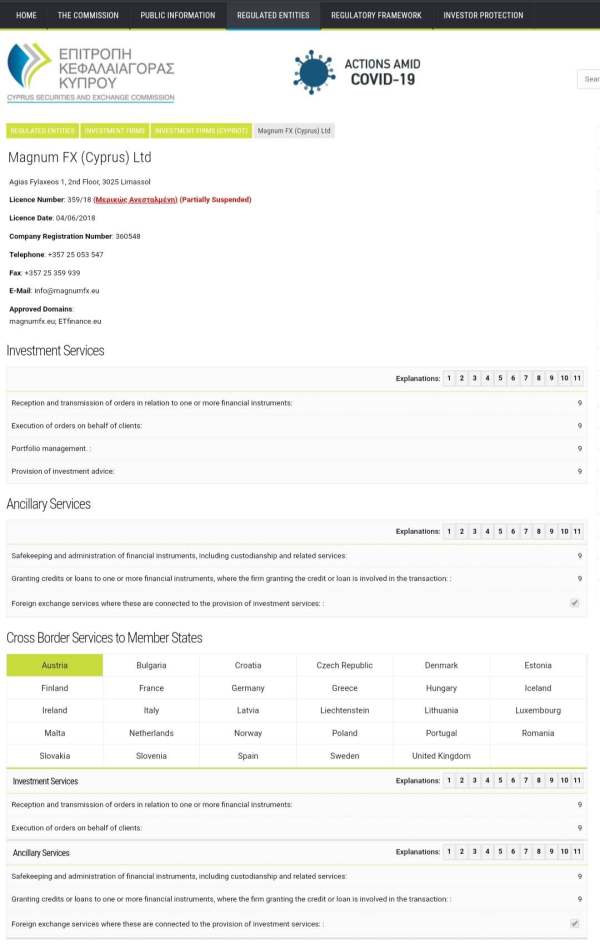

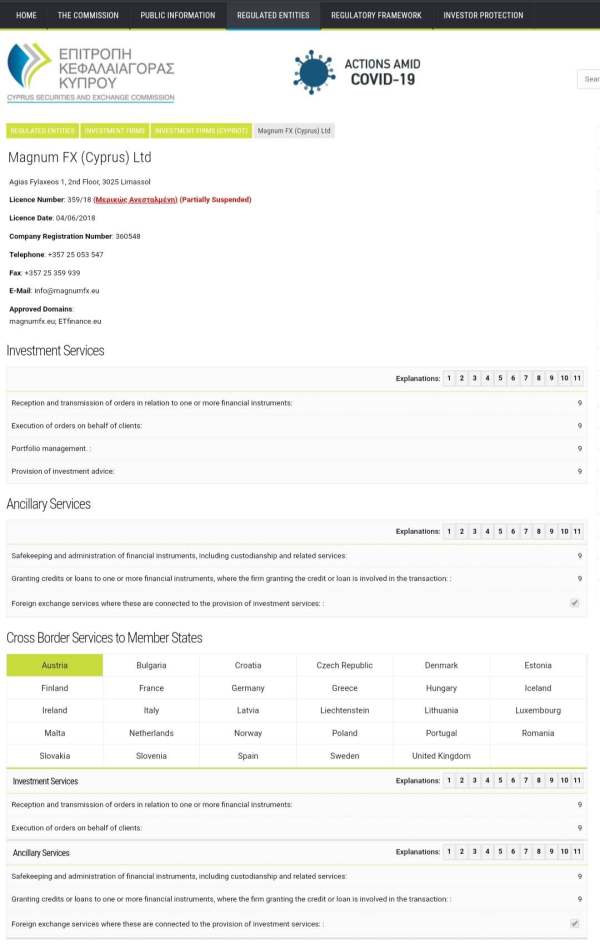

Regulatory Status: Specific regulatory information was not detailed in available source materials. This presents a significant concern for potential traders seeking regulated broker services.

Deposit and Withdrawal Methods: Detailed information about available funding methods was not specified in reviewed materials. This requires direct inquiry with the broker for specific payment processing options.

Minimum Deposit Requirements: Specific minimum deposit amounts were not clearly stated in available documentation. This indicates the need for direct verification with ETFinance.

Promotional Offers: Information regarding current bonus structures or promotional campaigns was not detailed in source materials reviewed.

Tradeable Assets: The platform supports forex and CFD trading across multiple instrument categories. However, specific instrument counts and categories were not comprehensively detailed.

Cost Structure: Detailed information about spreads, commissions, and other trading costs was not available in reviewed materials. This represents a significant information gap for cost-conscious traders.

Leverage Ratios: Specific leverage offerings were not detailed in available source materials. This requires direct verification for leverage-sensitive trading strategies.

Platform Options: This etfinance review confirms MetaTrader 4 availability as the primary trading platform. Additional platform options were not specified.

Geographic Restrictions: Specific regional limitations were not detailed in available materials.

Customer Support Languages: Supported languages for customer service were not specified in reviewed documentation.

Detailed Rating Analysis

Account Conditions Analysis

ETFinance's account structure details remain largely unclear based on available information. This presents challenges for traders seeking specific account type comparisons, and the absence of detailed account tier information, minimum deposit specifications, and account feature differences in source materials suggests potential transparency issues that traders should consider carefully.

Without clear documentation of account opening procedures, verification requirements, or specific account benefits, prospective traders face uncertainty about what to expect from the onboarding process. The lack of detailed account condition information may indicate either poor marketing communication or limited transparency in operational procedures.

This etfinance review notes that the absence of comprehensive account information represents a significant drawback for traders who prefer detailed upfront information before committing to a broker relationship. The platform's educational resources for registered users suggest some account benefits exist, but specific details remain unclear.

Traders considering ETFinance should directly contact the broker to clarify account structures, requirements, and associated benefits before making deposit commitments. This is important given the limited publicly available information regarding account conditions and features.

ETFinance provides MetaTrader 4 as their primary trading platform. It offers standard charting capabilities and automated trading support through Expert Advisors, and the platform represents an industry-standard solution, though additional proprietary tools or enhanced features were not detailed in available materials.

The broker's educational hub stands out as a notable resource. It offers free educational content to registered users, and this educational focus suggests recognition of trader development importance, though specific educational content quality, scope, and delivery methods were not comprehensively detailed in reviewed materials.

Market analysis and research tool availability remains unclear based on available information. This potentially limits traders who rely heavily on broker-provided market insights and analytical resources, and the absence of detailed research tool information may indicate limited analytical support compared to more comprehensive broker offerings.

Automated trading support through MetaTrader 4's standard EA functionality provides some algorithmic trading capability. However, enhanced automation features or proprietary trading tools were not mentioned in available materials, suggesting a more basic tool offering overall.

Customer Service and Support Analysis

Customer service quality emerges as a significant concern based on user feedback indicating poor response to fund-related inquiries and deposit issues. Reports of deposits being nullified without adequate explanation suggest serious customer service and operational problems that extend beyond typical support response time issues.

The absence of detailed customer service channel information compounds concerns about service accessibility and quality. This includes available contact methods, support hours, and escalation procedures, and users experiencing fund-related problems appear to have limited recourse options based on available feedback.

Response time quality appears problematic based on user reports. There are particular concerns about handling of sensitive fund security issues, and the lack of effective problem resolution for deposit-related complaints suggests systematic customer service deficiencies rather than isolated incidents.

Multi-language support availability and service hour coverage were not specified in available materials. This potentially limits accessibility for international traders, and the combination of poor problem resolution and limited service information presents significant concerns for traders prioritizing customer support quality.

Trading Experience Analysis

Trading experience feedback indicates mixed results. Particular concerns about fund security overshadow platform performance considerations, and while MetaTrader 4 provides standard trading functionality, user experiences suggest broader operational issues that impact overall trading satisfaction.

Platform stability and execution quality data were not specifically detailed in available materials. User complaints about deposit handling suggest potential broader operational reliability concerns, and this etfinance review notes that trading environment quality extends beyond platform technical performance to include fund security and operational integrity.

Order execution specifics were not detailed in available performance data. This includes execution speed, slippage rates, and order fill quality, limiting assessment of actual trading conditions, and the absence of concrete execution statistics makes it difficult to evaluate platform performance objectively.

Mobile trading experience details were not provided in reviewed materials. MetaTrader 4 typically includes mobile accessibility, but without specific performance data or user feedback about mobile functionality, mobile trading quality remains uncertain for potential users.

Trust and Safety Analysis

Trust issues represent the most significant concern surrounding ETFinance. Multiple user reports allege fraudulent behavior and unauthorized deposit handling, and these allegations, combined with limited regulatory information transparency, create substantial trust deficits that potential traders should carefully consider.

Fund security measures were not detailed in available materials. This is concerning despite user concerns about deposit safety representing a primary complaint category, and the absence of clear fund protection information, combined with user reports of deposit problems, suggests inadequate security protocols or poor communication about existing protections.

Company transparency appears limited based on available information. There is unclear regulatory status, limited management information, and absent detailed operational procedures, and while the 2019 "Best Cryptocurrency Broker in Europe" award suggests some industry recognition, this positive note is overshadowed by subsequent negative user experiences.

Regulatory verification challenges arise from the absence of clear regulatory information in available materials. This makes it difficult for traders to verify proper oversight and protection, and the combination of limited regulatory transparency and negative user experiences regarding fund security creates significant trust concerns for potential clients.

User Experience Analysis

Overall user satisfaction appears significantly compromised based on available feedback. Fund security concerns dominate user experience discussions, and reports of deposit nullification and poor customer service response create negative user experiences that extend beyond typical trading platform complaints.

User interface design and platform usability were not specifically detailed in available materials. MetaTrader 4 provides standard interface functionality, but broader operational issues appear to overshadow platform usability considerations for affected users.

Registration and verification process details were not specified in available materials. User complaints suggest potential issues with post-registration fund handling rather than initial onboarding problems, and the educational resources for registered users represent a positive user experience element, though this benefit appears diminished by broader operational concerns.

Fund operation experiences represent the most significant user experience concern. Reports of unauthorized deposit clearances create severely negative experiences, and these issues suggest systematic operational problems that significantly impact user confidence and satisfaction with the platform.

Conclusion

ETFinance presents significant concerns that outweigh potential benefits for most traders. While the broker offers MetaTrader 4 access and educational resources, serious allegations regarding fund security and poor customer service create substantial risks that traders should carefully consider.

The platform may appeal to traders seeking educational support and standard platform access. However, the risk profile appears too high for traders prioritizing fund security and reliable customer service, and this etfinance review suggests that the broker's operational issues significantly compromise the value of their positive features.

Primary advantages include educational resource availability and MetaTrader 4 platform access. Major disadvantages center on trust issues, fund security concerns, and poor customer service quality, and traders should explore alternative brokers with stronger regulatory transparency and better user feedback before considering ETFinance for their trading activities.