SDFX Global 2025 Review: Everything You Need to Know

Executive Summary

SDFX Global is an unregulated forex broker. This company has raised major concerns about whether it can be trusted by traders and industry watchers. The broker started in 2022 and operates from India without any oversight from trusted regulatory authorities like the FCA, which creates big risks for potential clients. Our sdfx global review shows a troubling lack of clear information about trading conditions. The company provides no specific details about spreads, commissions, or leverage ratios.

User feedback shows mixed results. Some traders say their experience was "very nice," but others have serious doubts about whether the broker can be trusted. The company's website has quality problems including spelling mistakes and broken links. These issues make people less confident in their professional standards.

SDFX Global seems to target forex traders who want low-cost trading options. However, the lack of regulatory protection makes it wrong for most serious investors. The broker has only been operating for a short time, and they don't provide clear information about their trading platform or account conditions. This means potential clients should be very careful.

Some users have reported good experiences. But the overall risks of trading with an unregulated company are much greater than any possible benefits.

Important Disclaimers

Regional Entity Differences: SDFX Global operates without supervision from any trusted regulatory authority. Investors must be extra careful about whether their services are legal and safe. Without regulatory oversight, standard investor protections like compensation schemes or separated client funds may not exist.

Review Methodology: This evaluation uses user feedback and public information. SDFX Global's operations have limited transparency, and unregulated brokers change often, so our assessment results may change when new information becomes available. Readers should check all information independently before making any trading decisions.

Overall Rating Framework

Broker Overview

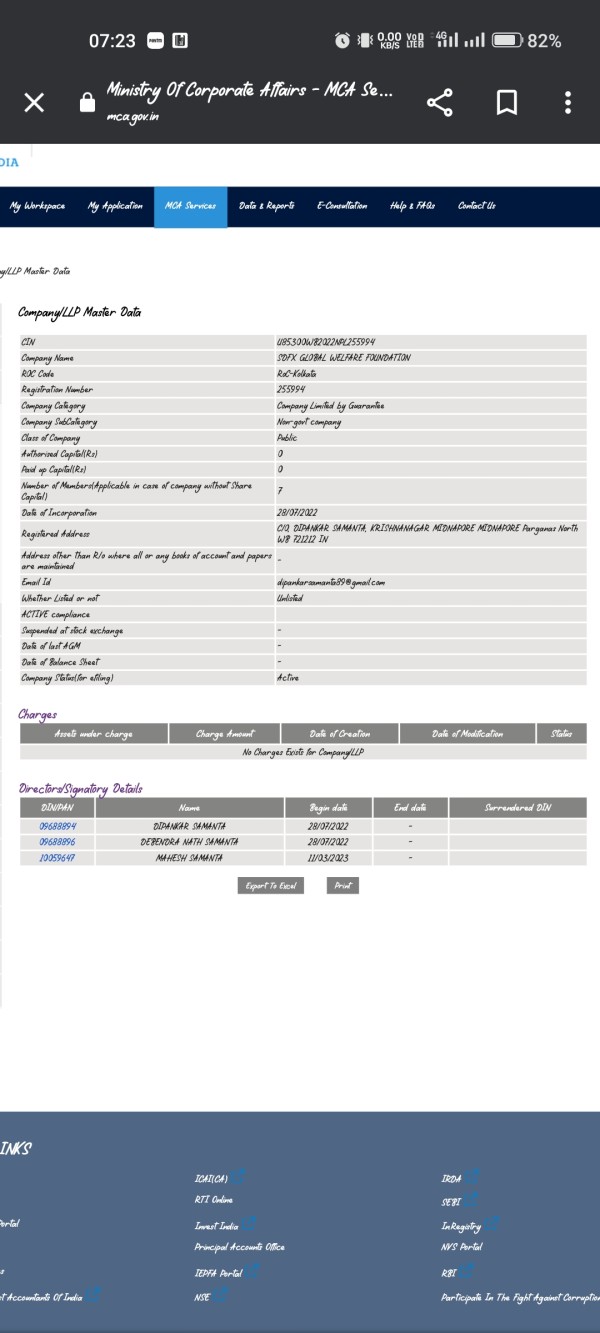

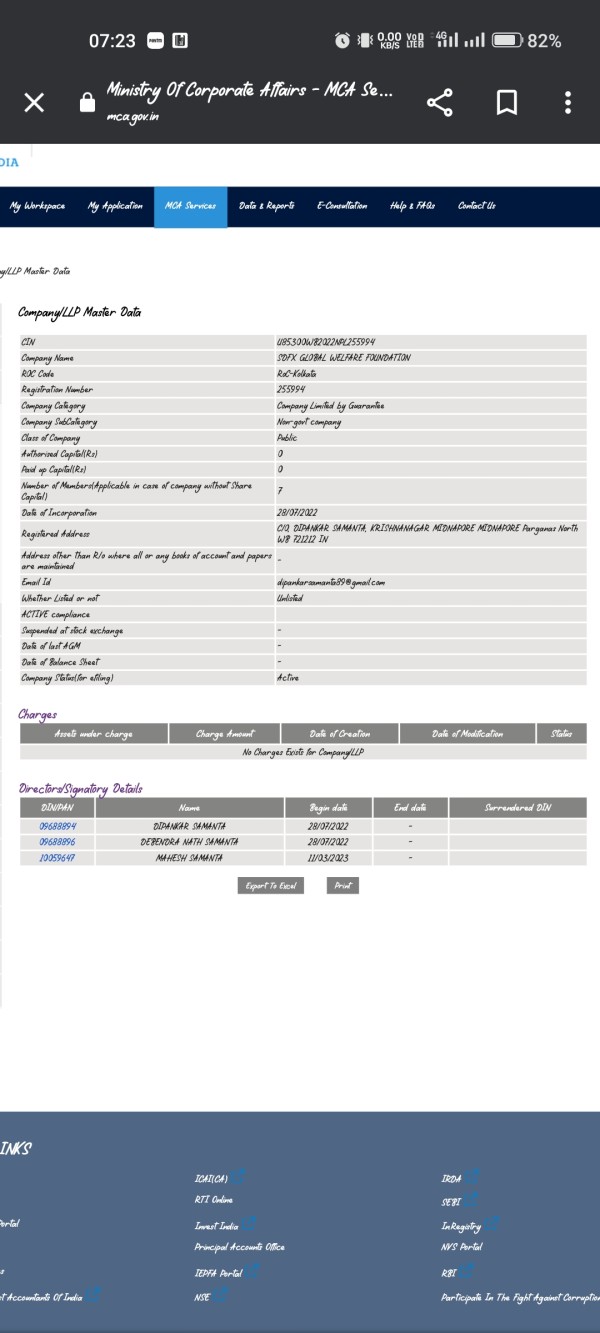

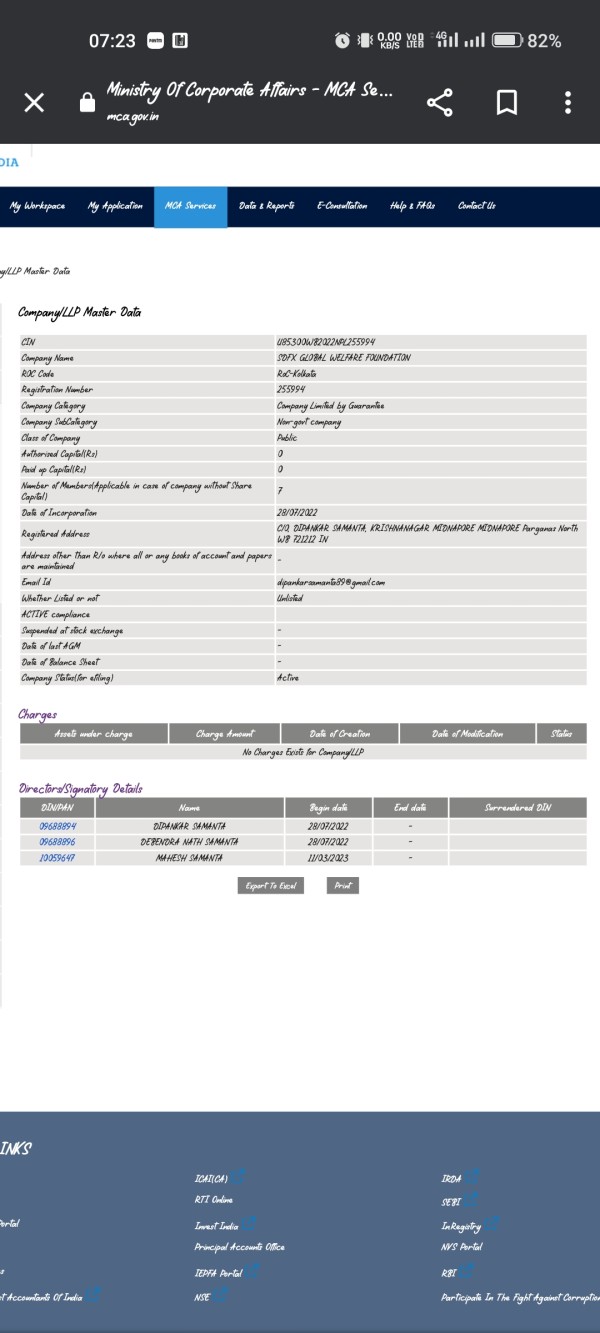

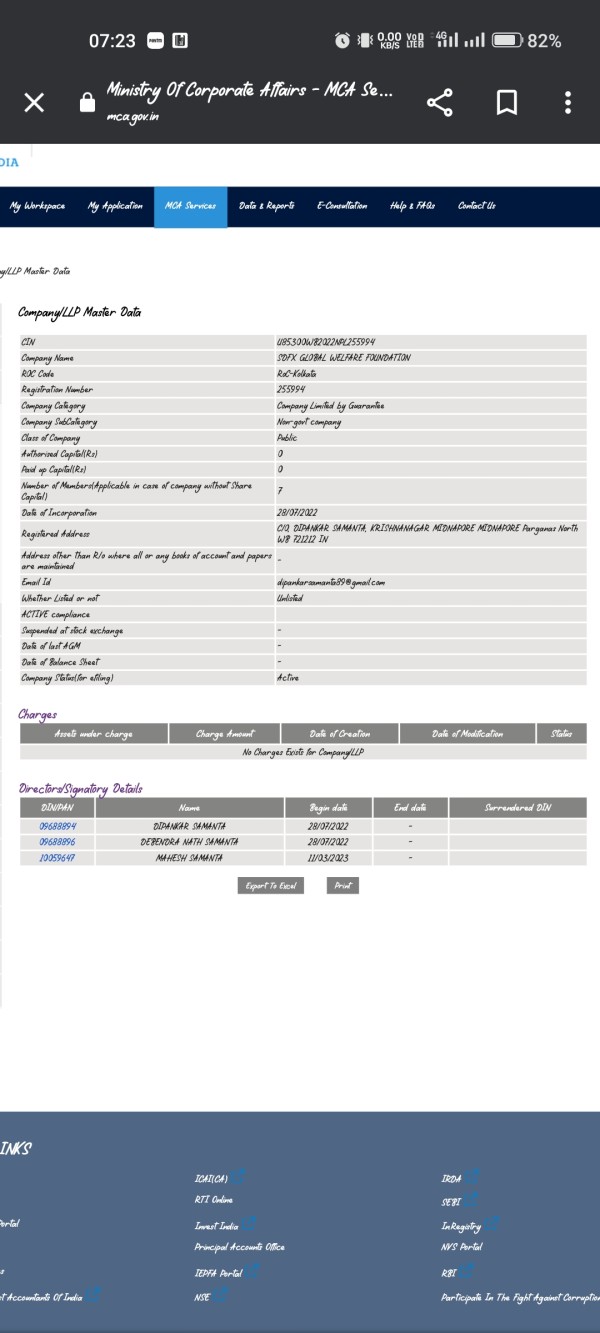

SDFX Global entered the forex market in 2022 as a brokerage firm based in India. The company presents itself as a provider of foreign exchange trading services. However, the company operates in a regulatory gray area because it lacks authorization from established financial supervisory bodies like the Financial Conduct Authority (FCA) or other internationally recognized regulators.

This unregulated status immediately puts the broker in a high-risk category for potential clients who want secure trading environments. The company's business model seems to focus only on forex trading services, but specific details about their trading conditions, platform offerings, and operational procedures remain mostly hidden. This lack of transparency is especially concerning for an industry where clear communication of terms and conditions is essential for trader confidence and regulatory compliance.

According to available information, SDFX Global targets traders interested in low-cost forex trading solutions. However, the absence of detailed information about spreads, commissions, minimum deposits, and leverage ratios makes it hard for potential clients to properly evaluate the true cost of trading with this broker. The company's limited operational history and questionable regulatory status suggest that it may not be suitable for serious forex traders who prioritize security and transparency in their trading relationships.

Detailed Specifications

Regulatory Oversight: SDFX Global operates without authorization from any credible regulatory authority, including the FCA or other internationally recognized financial supervisors. This unregulated status creates significant risks for client fund safety and dispute resolution.

Deposit and Withdrawal Methods: Specific information about available funding methods has not been disclosed in available materials. This raises concerns about operational transparency.

Minimum Deposit Requirements: The broker has not published clear minimum deposit requirements. This makes it difficult for potential clients to understand entry-level investment needs.

Promotional Offers: No information about bonus programs or promotional incentives has been identified in available sources.

Tradeable Assets: The broker appears to focus exclusively on forex trading services. However, the specific currency pairs and trading instruments available remain unclear.

Cost Structure: Critical pricing information including spreads, commissions, and overnight fees has not been transparently disclosed. This represents a significant red flag for potential clients seeking to understand true trading costs.

Leverage Ratios: Maximum leverage offerings and margin requirements have not been specified in available documentation.

Platform Options: Specific trading platform information, including whether the broker offers MetaTrader or proprietary solutions, remains undisclosed.

Geographic Restrictions: Service availability by region has not been clearly communicated in available materials.

Customer Support Languages: Supported languages for client communication have not been specified. The broker appears to operate primarily in English.

This sdfx global review highlights the concerning lack of basic operational transparency that potential clients should expect from any legitimate forex broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 4/10)

The account conditions offered by SDFX Global present significant transparency issues that severely impact the broker's credibility. Available materials provide no specific information about account types, their distinctive features, or the requirements for opening different account tiers. This lack of clarity makes it impossible for potential clients to understand what services they would receive or how different account levels might affect their trading experience.

Minimum deposit requirements remain undisclosed, which is highly unusual for legitimate forex brokers who typically provide clear entry-level investment information to help traders make informed decisions. The account opening process has not been detailed in available sources, and user feedback suggests that the overall experience may be complicated by the broker's limited operational infrastructure. Special account features, such as Islamic accounts for Muslim traders or professional trading accounts with enhanced leverage, have not been mentioned in any available documentation.

This suggests either a very limited service offering or poor communication of available options to potential clients. User feedback regarding account conditions has been minimal, with most available reviews focusing on broader concerns about the broker's legitimacy rather than specific account features. The absence of detailed account information in this sdfx global review reflects the broker's overall lack of transparency, making it difficult to recommend their services to traders who require clear terms and conditions.

SDFX Global's trading tools and educational resources appear to be severely limited based on available information. No specific details about trading platforms, analytical tools, or research capabilities have been disclosed, which is concerning for traders who rely on comprehensive market analysis and advanced trading features. The broker has not provided information about research and analysis resources, such as market commentary, economic calendars, or technical analysis tools that are standard offerings among reputable forex brokers.

Educational materials, including webinars, tutorials, or trading guides, have not been mentioned in available sources. This suggests that new traders would receive minimal support for skill development. Automated trading support, including Expert Advisor compatibility or algorithmic trading features, remains unclear due to the lack of specific platform information.

This absence of technical details makes it difficult for experienced traders to assess whether the broker can support their trading strategies. User feedback regarding tools and resources has been limited, primarily due to the overall lack of detailed information about the broker's offerings. The few available reviews do not provide specific insights into platform functionality or tool quality, further highlighting the broker's transparency issues.

Customer Service and Support Analysis (Score: 5/10)

Customer service quality at SDFX Global appears to be inconsistent based on limited user feedback available. While specific contact methods and availability hours have not been clearly communicated, some users have reported longer-than-expected response times when attempting to reach customer support representatives. The professional quality of customer service interactions has received mixed reviews, with some users expressing concerns about the expertise level of support staff.

This is particularly problematic for an unregulated broker, where quality customer service becomes even more critical for building client confidence. Multi-language support capabilities have not been specified, though the broker appears to operate primarily in English. Customer service hours and availability across different time zones remain unclear, which could pose challenges for international clients requiring assistance during their local trading hours.

User feedback suggests that while some clients have had satisfactory interactions with customer support, others have experienced delays and less-than-professional responses. The lack of detailed contact information and support procedures in available materials further undermines confidence in the broker's commitment to client service.

Trading Experience Analysis (Score: 4/10)

The trading experience offered by SDFX Global has received mixed feedback from users, with significant concerns raised about overall platform quality and reliability. User reviews indicate inconsistent experiences, with some traders reporting satisfactory trading conditions while others have expressed dissatisfaction with various aspects of the trading environment. Platform stability and execution speed have not been thoroughly documented, though some user feedback suggests potential issues with website functionality, including reported spelling errors and broken links that could indicate broader technical problems.

These quality concerns extend beyond mere cosmetic issues and may reflect underlying infrastructure limitations. Order execution quality and slippage information have not been transparently disclosed, making it difficult for traders to assess the true cost and reliability of trade execution. The absence of detailed execution statistics or third-party verification of trading conditions represents a significant transparency gap.

Mobile trading capabilities and cross-platform functionality remain unclear due to limited platform information. This sdfx global review notes that the lack of specific trading environment details makes it challenging for potential clients to evaluate whether the broker can meet their technical trading requirements.

Trust and Reliability Analysis (Score: 2/10)

SDFX Global's trust and reliability profile presents serious concerns that significantly impact its suitability for forex trading. The broker's unregulated status represents the most critical risk factor, as it operates without oversight from credible financial authorities such as the FCA or other internationally recognized regulatory bodies. The absence of regulatory authorization means that standard investor protections, including segregated client funds, compensation schemes, and dispute resolution mechanisms, are not available to clients.

This regulatory gap creates substantial risks for trader capital and leaves clients with limited recourse in case of disputes or operational failures. Company transparency is severely lacking, with no publicly available financial reports, management team information, or operational audits that would typically support a legitimate brokerage operation. The limited operational history since 2022 provides insufficient track record for assessing long-term reliability.

Industry reputation has suffered due to user concerns about legitimacy and reliability, with multiple sources questioning the broker's credibility. The combination of unregulated status, limited transparency, and mixed user feedback creates a risk profile that is unsuitable for most serious forex traders seeking secure trading environments.

User Experience Analysis (Score: 3/10)

Overall user satisfaction with SDFX Global presents a mixed picture, with some users describing their experience as "very nice" while others express significant concerns about various operational aspects. This disparity in user feedback suggests inconsistent service delivery and potential issues with quality control. Interface design and website usability have been specifically criticized by users who report spelling errors, broken links, and other quality issues that negatively impact the user experience.

These technical problems extend beyond minor inconveniences and may indicate broader operational challenges that could affect trading functionality. The registration and account verification process has not been clearly documented, though the lack of detailed procedural information suggests potential complications for new clients attempting to open accounts. Fund management procedures, including deposit and withdrawal processes, remain unclear due to limited available information.

Common user complaints focus on website quality issues and customer service response times, though the limited volume of detailed feedback makes it difficult to identify consistent patterns. The broker's short operational history and limited user base contribute to the scarcity of comprehensive user experience data, making this sdfx global review necessarily cautious about recommending the broker's services.

Conclusion

SDFX Global represents a high-risk forex broker option that fails to meet basic standards for regulatory compliance and operational transparency. The broker's unregulated status, combined with significant gaps in disclosed trading conditions and operational procedures, makes it unsuitable for most serious forex traders who prioritize security and professional service. While the broker may appeal to traders seeking potentially low-cost trading solutions, the substantial risks associated with unregulated operations far outweigh any potential cost benefits.

The lack of investor protections, unclear trading conditions, and mixed user feedback create an environment where trader capital faces unnecessary exposure to operational and regulatory risks. The main advantages appear limited to potentially low trading costs, though even this cannot be confirmed due to the lack of transparent pricing information. The disadvantages are substantial and include regulatory risk, limited transparency, questionable operational quality, and insufficient investor protections that are standard in the legitimate forex industry.