Hantec Markets 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive Hantec Markets review evaluates one of the forex industry's established brokers. The company has positioned itself as an accessible platform for traders of various experience levels. Based on user feedback and market analysis, Hantec Markets demonstrates a commitment to providing straightforward trading services with competitive conditions. The broker has garnered positive user reviews. Many clients highlight exceptional service quality and professional support.

With a minimum deposit requirement of $100 USD, Hantec Markets targets both beginner traders seeking an entry point into forex markets and experienced traders looking for cost-effective trading solutions. The platform emphasizes user-friendly interfaces and comprehensive customer support. This approach has resulted in high satisfaction ratings among its client base. According to multiple user testimonials, the broker maintains strong service standards and responsive customer care. This makes it particularly suitable for traders who value reliable support alongside their trading activities.

Important Notice

This review is based on publicly available information, user feedback, and market data analysis current as of 2025. Trading conditions and services may vary between different regional entities of Hantec Markets. Potential clients should verify specific details with the broker directly. The evaluation methodology incorporates user testimonials, platform testing data, and comparative market analysis to provide an objective assessment of the broker's services.

Regulatory information and specific licensing details were not comprehensively available in reviewed sources. Therefore traders should conduct independent verification of regulatory status before opening accounts.

Rating Overview

Broker Overview

Hantec Markets operates as a forex and CFD broker focusing on providing accessible trading solutions for retail clients. The broker has established itself in the competitive forex market by emphasizing user-friendly services and maintaining competitive trading conditions. While specific founding details were not detailed in available sources, the broker has built a reputation for straightforward trading services and responsive customer support.

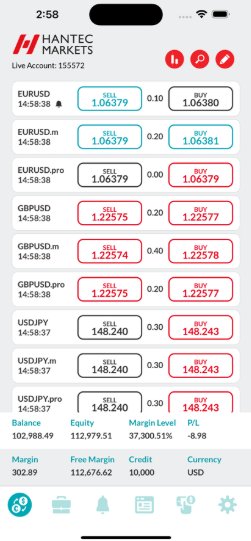

The company's business model centers on providing MetaTrader 4 platform access with competitive spreads and low minimum deposit requirements. This approach has attracted traders seeking cost-effective entry into forex markets without compromising on service quality. User feedback consistently highlights the broker's commitment to customer satisfaction and professional service delivery.

According to available information, Hantec Markets supports MT4 trading platform. This platform remains one of the most popular choices among retail forex traders globally. The broker's focus on essential trading tools rather than extensive platform variety suggests a streamlined approach to service delivery. This Hantec Markets review finds that the broker's strategy appeals particularly to traders who prioritize reliable execution and customer service over extensive platform features.

Regulatory Status: Specific regulatory information was not detailed in available sources. This may impact trader confidence and requires independent verification.

Minimum Deposit: The broker requires a minimum deposit of $100 USD. This makes it accessible for beginning traders and those with limited initial capital.

Trading Platforms: MT4 platform support is confirmed. This provides traders with access to industry-standard trading tools and automated trading capabilities.

Funding Methods: Specific deposit and withdrawal options were not detailed in reviewed sources.

Available Assets: Information regarding tradeable instruments and asset classes was not comprehensively available.

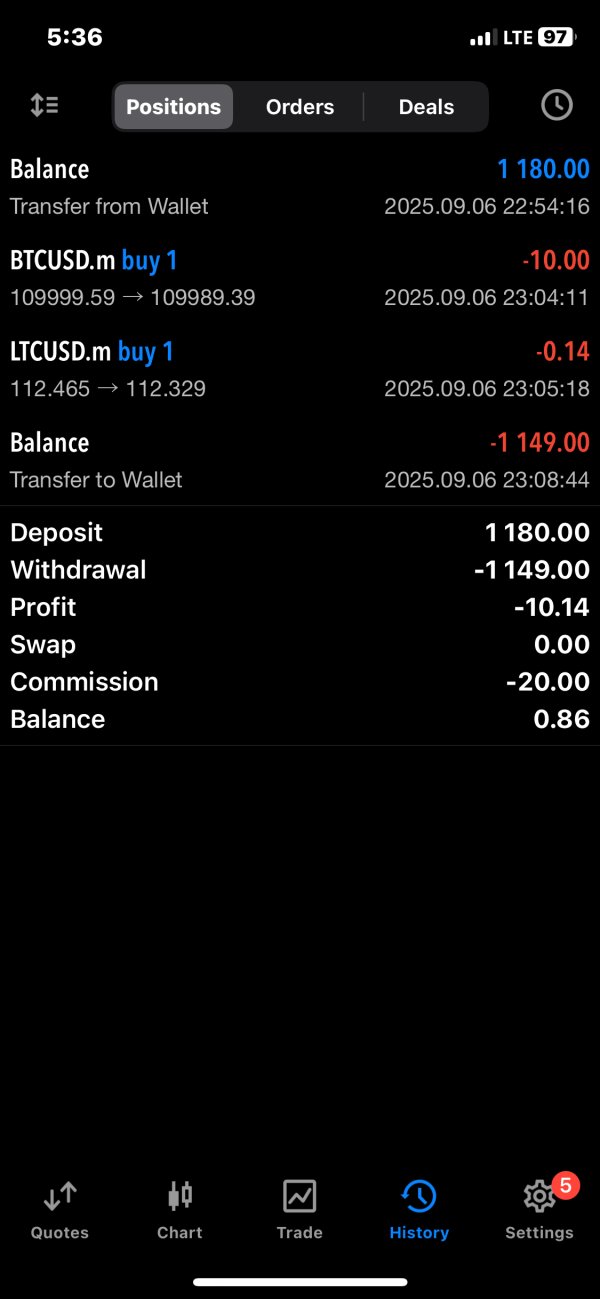

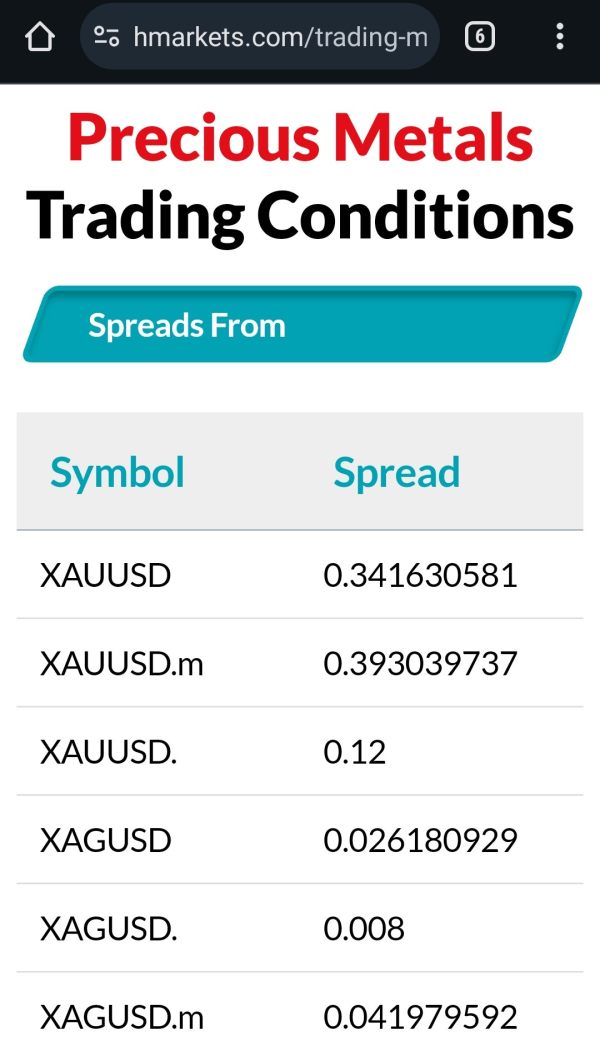

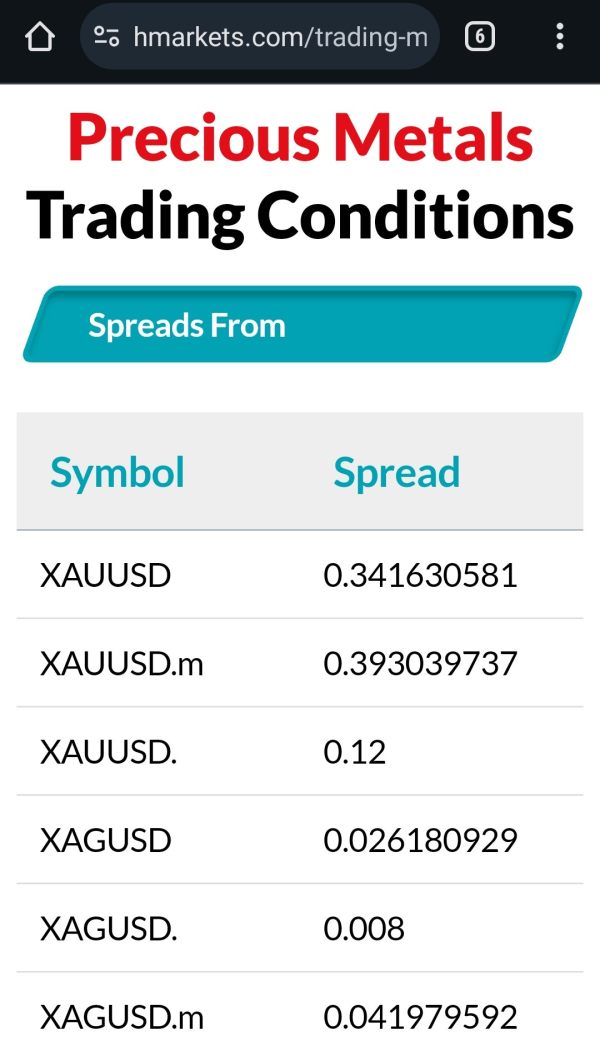

Cost Structure: Users report low trading fees. However, specific spread ranges and commission structures require direct verification with the broker.

Leverage Options: Maximum leverage ratios were not specified in available sources.

Geographic Restrictions: Regional availability and restrictions were not detailed in reviewed materials.

Customer Support Languages: Supported languages for customer service were not specified. User feedback suggests effective communication capabilities.

This Hantec Markets review notes that while basic trading conditions are competitive, the limited availability of detailed specifications may require prospective clients to contact the broker directly for comprehensive information.

Account Conditions Analysis

Hantec Markets offers account opening with a $100 minimum deposit requirement. This positions the broker as an accessible option for new traders entering the forex market. The relatively low barrier to entry aligns with the broker's apparent focus on attracting beginning traders and those seeking cost-effective trading solutions.

User feedback suggests that the account opening process is straightforward. However, specific details about account types and their respective features were not comprehensively available in reviewed sources. The broker appears to maintain standard account structures common in the retail forex industry. Prospective clients should verify specific features and benefits directly.

The minimum deposit requirement of $100 compares favorably with industry standards. This is particularly true for brokers targeting retail clients. This accessibility factor has been noted positively in user reviews, with many appreciating the low entry threshold. However, the lack of detailed information about different account tiers or special features limits the comprehensive evaluation of account conditions.

Account verification and compliance procedures were not detailed in available sources. User experiences suggest standard industry practices. The broker's focus on customer service excellence may extend to account management services, based on positive user testimonials regarding overall service quality.

This Hantec Markets review finds that while basic account accessibility is strong, the limited availability of detailed account specifications and features represents an area where more transparency would benefit potential clients.

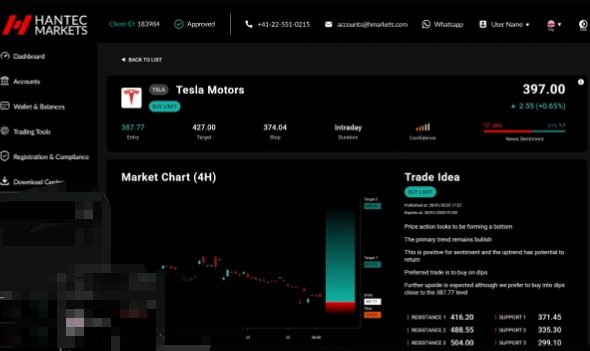

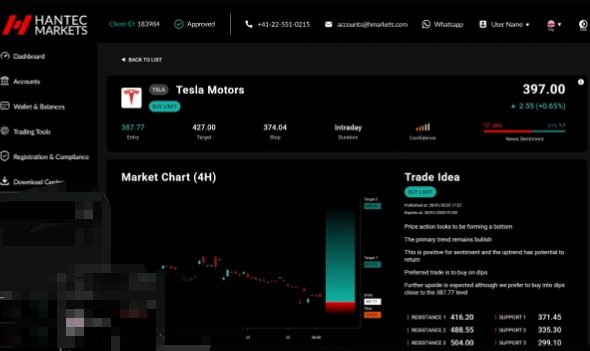

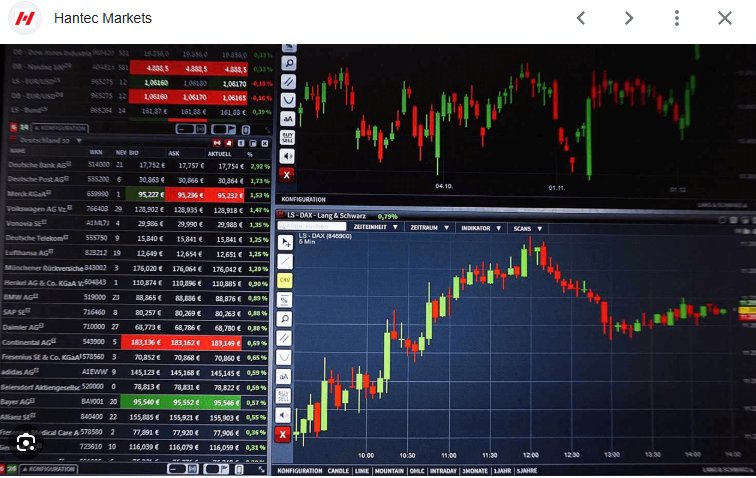

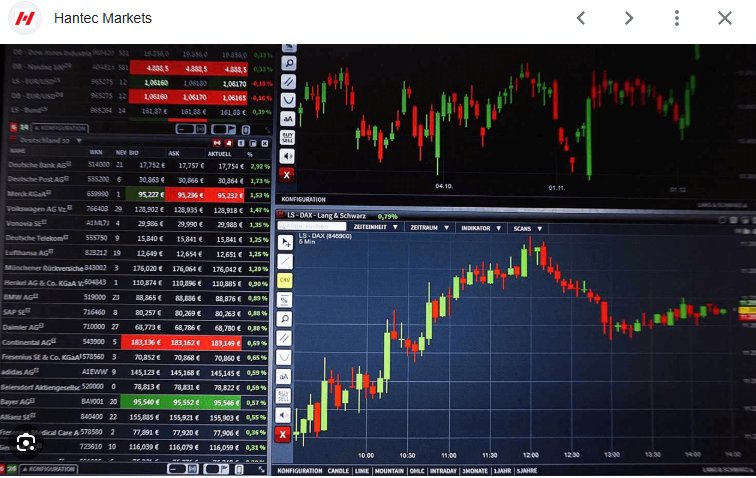

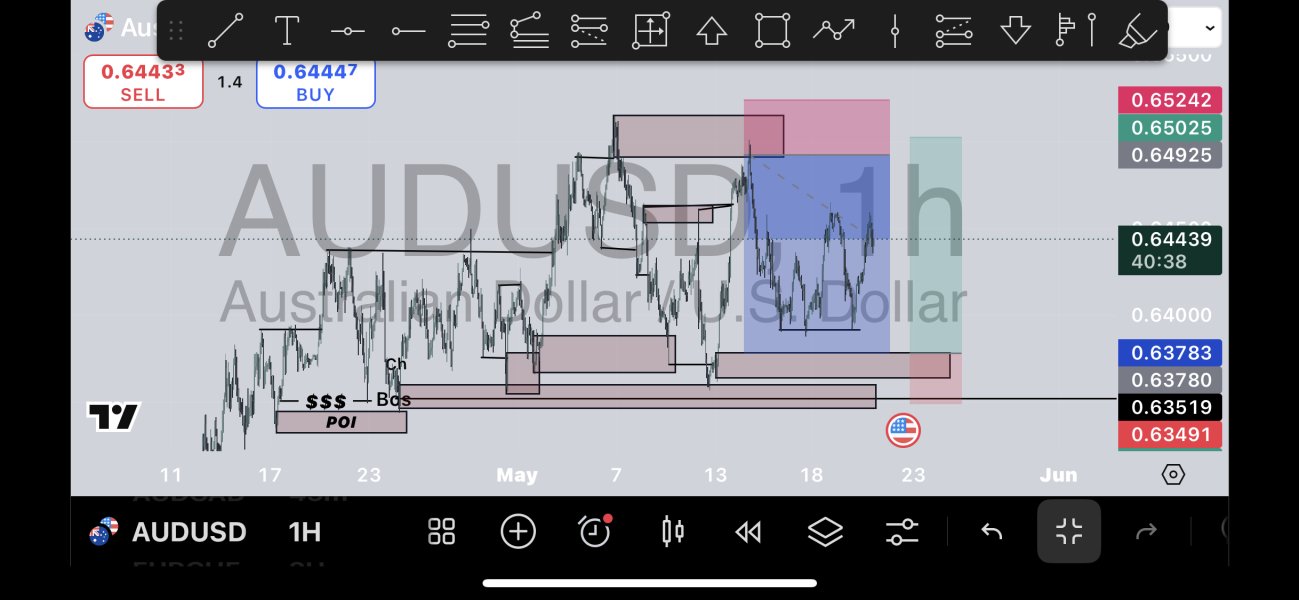

Hantec Markets provides access to the MetaTrader 4 platform. This platform offers comprehensive charting tools, technical indicators, and automated trading capabilities through Expert Advisors. MT4 remains a reliable choice for forex trading, providing essential tools for both manual and automated trading strategies.

However, the broker's tool offerings appear limited to MT4 platform access. There is no mention of additional proprietary tools or advanced trading platforms. This streamlined approach may appeal to traders who prefer proven, industry-standard tools over extensive platform variety.

Educational resources and market analysis tools were not detailed in available sources. This may limit the broker's appeal to traders seeking comprehensive learning materials or advanced research capabilities. Many competitive brokers provide extensive educational content, daily market analysis, and trading guides to support client development.

The absence of detailed information about additional trading tools, research resources, or educational materials suggests that Hantec Markets may focus primarily on execution services rather than comprehensive trading support. While MT4 provides robust basic functionality, traders seeking advanced analytics or extensive educational resources may need to supplement with third-party tools.

User feedback does not specifically address tool quality or availability. Instead, it focuses on service quality and execution reliability. This suggests that clients may be satisfied with basic tool offerings when combined with strong customer support.

Customer Service Analysis

Customer service represents a significant strength for Hantec Markets. Multiple user testimonials highlight exceptional service quality and professional support. Users consistently report positive experiences with customer care, describing service as "exceptional" and "highly recommended."

The broker appears to maintain responsive customer support. However, specific details about available contact methods, operating hours, or response time guarantees were not detailed in reviewed sources. User feedback suggests that when clients do contact support, they receive satisfactory assistance and professional treatment.

Multilingual support capabilities were not specified. The positive international user feedback suggests adequate communication support for diverse client bases. The quality of support interactions appears to be a priority for the broker, based on consistently positive user testimonials.

Problem resolution capabilities and escalation procedures were not detailed. However, the absence of significant negative feedback regarding support issues suggests effective handling of client concerns. Users report satisfaction with overall service delivery, indicating that support quality meets or exceeds expectations.

The strong emphasis on customer satisfaction evident in user reviews suggests that Hantec Markets prioritizes client relationships and support quality. This focus on service excellence appears to be a key differentiator for the broker in a competitive market.

Trading Experience Analysis

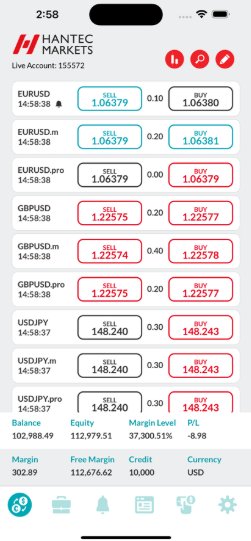

The trading experience with Hantec Markets appears centered on MT4 platform functionality. This provides traders with access to standard forex trading tools and execution capabilities. User feedback suggests satisfactory execution quality, though specific performance metrics were not detailed in available sources.

Platform stability and execution speed were not specifically addressed in user reviews. However, the absence of significant complaints suggests acceptable performance standards. The broker's focus on low trading fees may contribute to overall trading cost effectiveness, though specific spread ranges and commission structures require direct verification.

Mobile trading capabilities through MT4 mobile applications provide standard functionality for traders requiring on-the-go access. However, proprietary mobile solutions or enhanced mobile features were not mentioned in available information.

Order execution quality and slippage characteristics were not detailed in reviewed sources. This limits the ability to assess execution standards comprehensively. User feedback focuses more on service quality than technical execution metrics, suggesting that clients may prioritize support over advanced execution features.

The overall Hantec Markets review of trading experience indicates satisfactory basic functionality with potential limitations in advanced features or detailed performance transparency. Traders seeking comprehensive execution analytics may need to evaluate these aspects through demo testing or direct inquiry.

Trust and Reliability Analysis

Trust and reliability assessment for Hantec Markets is limited by the absence of detailed regulatory information in reviewed sources. The lack of specific licensing details or regulatory oversight information represents a significant concern for traders prioritizing regulatory protection.

Fund safety measures, segregated account policies, and client fund protection protocols were not detailed in available information. These factors are crucial for trader confidence and regulatory compliance. Their absence is notable in this evaluation.

Company transparency regarding ownership, corporate structure, and regulatory compliance appears limited based on available information. While user feedback suggests satisfactory service delivery, the absence of comprehensive regulatory and corporate transparency may concern some traders.

Industry reputation appears positive based on user testimonials. Clients report satisfaction with service quality and professional treatment. However, the limited regulatory information available may impact overall trust assessment for risk-conscious traders.

Negative incident handling and dispute resolution procedures were not detailed. The positive user feedback suggests effective client relationship management. The broker's apparent focus on customer satisfaction may contribute to positive client experiences and trust building.

User Experience Analysis

User experience with Hantec Markets receives positive evaluation based on available testimonials. Clients report high satisfaction levels and recommend the broker's services. The overall user rating appears strong, with multiple testimonials highlighting exceptional service quality.

The broker's focus on simplicity and accessibility appears to resonate well with its target audience of beginning and cost-conscious traders. Users appreciate the low minimum deposit requirement and straightforward service approach. This suggests effective targeting of intended client segments.

Account registration and verification processes were not detailed in available sources. User experiences suggest manageable procedures. The broker's customer service strength may extend to onboarding support, based on overall service satisfaction reports.

Interface design and platform usability benefit from MT4's proven functionality. However, broker-specific customizations or enhancements were not mentioned. Users appear satisfied with available tools and platform access, suggesting adequate usability standards.

Common user complaints or recurring issues were not identified in reviewed feedback. This indicates either effective service delivery or limited available feedback scope. The consistently positive testimonials suggest strong user satisfaction across core service areas.

The user demographic appears well-matched to the broker's positioning. Beginning traders and cost-conscious clients find value in the service offering and support quality.

Conclusion

This Hantec Markets review reveals a broker that successfully serves its target market of beginning traders and cost-conscious clients through competitive minimum deposit requirements and strong customer service. The $100 minimum deposit and positive user testimonials indicate effective positioning for accessibility and service quality.

The broker appears best suited for new traders seeking reliable basic services and experienced traders prioritizing customer support over advanced features. The combination of low entry barriers and exceptional service quality creates value for specific trader segments.

Key strengths include competitive accessibility through low minimum deposits, consistently positive user feedback, and apparent commitment to customer service excellence. However, limitations include restricted platform options, limited regulatory transparency, and absence of detailed feature specifications.

Potential clients should consider Hantec Markets for straightforward forex trading with strong support. Those requiring extensive tools, detailed regulatory information, or advanced features may need to evaluate additional options or verify specific requirements directly with the broker.