Funding Pips 2025 Review: Everything You Need to Know

Executive Summary

This Funding Pips review looks at one of the new prop trading platforms that has become very popular in 2025. Funding Pips Services Ltd started in 2022 and has made itself a strong competitor in the proprietary trading space, with users calling it "the best propfirm in the world." The platform is special because it has low-fee account structures and can process funds instantly. It supports multiple payment options to make access easier for more traders. Funding Pips ranks as the third most-visited prop trading platform in the world in 2025. The platform mainly targets individual investors who want opportunities in forex trading. It operates through the MT5 trading environment and focuses mostly on forex assets. The platform offers maximum overall loss limits of 10% with daily loss restrictions of 5%. User feedback always highlights the platform's professional support and convenient trading conditions. This makes it an attractive option for traders who want to use proprietary capital in forex markets.

Important Notice

Funding Pips operates under Funding Pips Services Ltd, with registration in Comoros while keeping headquarters in Dubai, UAE. Traders should know about potential regulatory differences across various jurisdictions and make sure they follow local trading regulations. This review is based on available user feedback, platform analysis, and publicly accessible information as of 2025. The content here is for informational purposes only and does not constitute investment advice. Traders should do their own research and consider their risk tolerance before engaging with any prop trading platform. Regulatory information was not detailed in available sources, which may impact the overall assessment of the platform's compliance framework.

Rating Framework

Broker Overview

Funding Pips appeared in the prop trading landscape in 2022 as Funding Pips Services Ltd. The company established its operational headquarters in Dubai, UAE, while maintaining registration in Comoros. The company has quickly gained recognition in the proprietary trading sector. It achieved the distinction of being the third most-visited prop trading platform globally by 2025. This remarkable growth shows the platform's ability to attract and retain traders through its competitive offerings and user-focused approach. The platform operates as a specialized prop trading firm, providing capital access opportunities specifically designed for forex traders who want to use external funding for their trading activities.

The platform's business model centers on providing traders with access to proprietary capital through a structured evaluation process. This allows successful participants to trade with much larger amounts than their personal capital would permit. Funding Pips uses the MetaTrader 5 platform as its primary trading environment. This offers traders access to a familiar and robust trading interface. The asset focus stays concentrated on forex markets, providing traders with complete coverage of major, minor, and exotic currency pairs. According to available sources, specific regulatory information was not detailed, which represents an area where traders should seek additional clarification directly from the platform.

Regulatory Framework: Specific regulatory information was not detailed in available sources. The company operates under Funding Pips Services Ltd with registration in Comoros and headquarters in Dubai, UAE.

Deposit and Withdrawal Options: The platform supports multiple payment options with instant processing capabilities. This ensures traders have convenient access to their funds across various payment methods and multi-currency support.

Minimum Deposit Requirements: Specific minimum deposit information was not detailed in available sources. This requires direct inquiry with the platform for current requirements.

Promotional Offers: Current bonus and promotional information was not specified in available sources. The platform emphasizes its low-fee account structure as a primary value proposition.

Available Trading Assets: The platform focuses primarily on forex trading. It offers a complete range of currency pairs from major pairs like EUR/USD and GBP/USD to exotic combinations, providing traders with diverse market exposure opportunities.

Cost Structure: Funding Pips positions itself as offering "best accounts in very low fees." Specific spread and commission details were not provided in available sources, requiring direct verification for current pricing.

Leverage Options: Specific leverage ratios were not detailed in available sources. This requires direct inquiry with the platform for current leverage offerings.

Platform Technology: The platform operates exclusively on MetaTrader 5. This provides traders with advanced charting capabilities, technical indicators, and professional trading tools.

Geographic Restrictions: Information regarding specific geographic limitations was not detailed in available sources.

Customer Support Languages: Specific language support information was not provided in available sources. User feedback suggests effective communication capabilities.

This Funding Pips review reveals a platform that prioritizes accessibility and user convenience while maintaining competitive trading conditions for forex-focused prop trading activities.

Comprehensive Rating Analysis

Account Conditions Analysis (Score: 8/10)

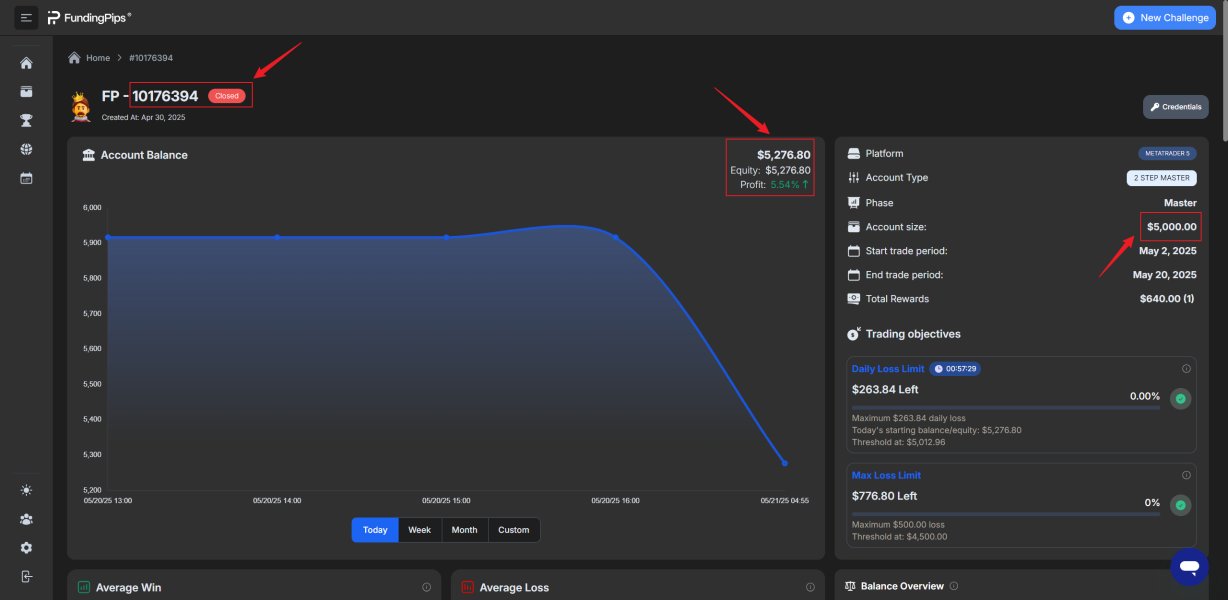

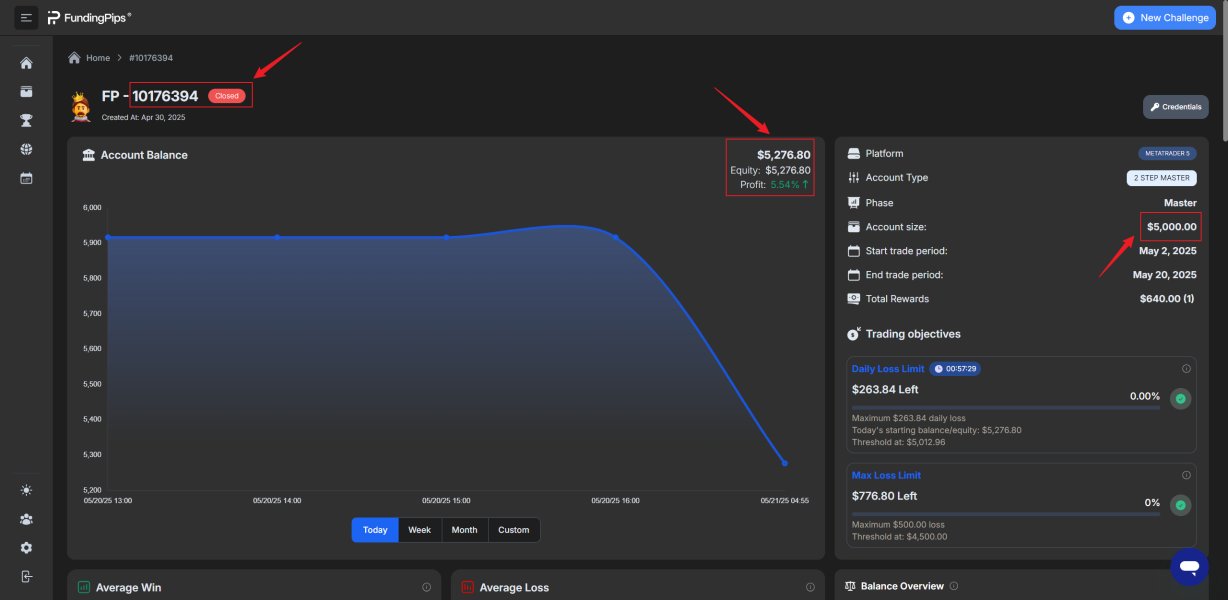

Funding Pips shows strong performance in account conditions. It establishes clear risk management parameters with a maximum overall loss limit of 10% and daily loss restrictions of 5%. These risk parameters align with industry standards while providing traders with reasonable flexibility for their trading strategies. The platform's emphasis on "best accounts in very low fees" represents a significant competitive advantage, especially for traders sensitive to cost structures in prop trading environments. User feedback consistently highlights satisfaction with account terms. This suggests that the platform successfully balances trader interests with risk management requirements.

The account opening process receives positive user testimonials, with traders reporting smooth onboarding experiences. According to user reviews, the platform maintains professional standards throughout the account setup process, contributing to overall user satisfaction. While specific information about account types and Islamic account availability was not detailed in available sources, the positive user feedback suggests that Funding Pips accommodates diverse trader needs effectively. The combination of competitive fees, clear risk parameters, and positive user experiences supports the strong rating in this category. Additional transparency regarding specific account features would further enhance the offering.

The platform's tools and resources center around the MetaTrader 5 environment. This provides traders with access to professional-grade trading technology. MT5 offers complete charting capabilities, technical indicators, and analytical tools that support sophisticated trading strategies. The platform's focus on forex markets ensures that available tools are optimized for currency trading. The concentration on a single asset class may limit appeal for traders seeking broader market exposure.

User feedback indicates satisfaction with the MT5 integration, praising the platform's convenience and functionality. However, the platform explicitly prohibits Expert Advisors, which may limit appeal for algorithmic traders or those relying on automated trading strategies. This restriction represents a notable limitation in the tools and resources category. Educational resources and research materials were not detailed in available sources, suggesting potential areas for platform enhancement. The solid but not exceptional rating reflects the strong MT5 integration balanced against limitations in automation support and unclear educational offerings.

Customer Service and Support Analysis (Score: 8/10)

Customer service emerges as a significant strength for Funding Pips. User testimonials consistently praise the support team's professionalism and responsiveness. One verified user specifically thanked the platform "for the support and professionalism you've shown throughout my experience," indicating high-quality service delivery. The positive feedback suggests that customer service representatives possess adequate knowledge and maintain professional standards when addressing trader inquiries and concerns.

While specific customer service channels, response times, and multilingual support capabilities were not detailed in available sources, the overwhelming positive user sentiment indicates effective support infrastructure. The platform appears to prioritize customer satisfaction, as evidenced by users expressing gratitude for the support received. However, the lack of detailed information about service availability, response time metrics, and support channel options prevents a perfect rating. The strong user testimonials and evident commitment to customer satisfaction support the high rating while acknowledging areas where additional transparency would be beneficial.

Trading Experience Analysis (Score: 7/10)

The trading experience on Funding Pips receives generally positive feedback from users. Users give particular praise for the MT5 platform integration and overall functionality. Users report satisfaction with platform stability and trading conditions, suggesting reliable execution and minimal technical disruptions. The forex-focused approach allows the platform to optimize the trading environment specifically for currency markets. This potentially provides enhanced execution quality for forex transactions.

User testimonials indicate positive experiences with liquidity and trading conditions. Specific technical performance metrics such as execution speeds, slippage rates, or server uptime were not detailed in available sources. The platform's instant fund processing capability enhances the overall trading experience by ensuring quick access to capital. However, the prohibition of Expert Advisors may limit the trading experience for algorithmic traders. Mobile trading experience information was not specified in available sources. This Funding Pips review notes that while user feedback is predominantly positive, the lack of detailed technical specifications and the EA restriction contribute to a solid but not exceptional rating in this category.

Trust and Reliability Analysis (Score: 6/10)

Trust and reliability represent areas where Funding Pips faces challenges due to limited regulatory transparency in available sources. While the platform operates under Funding Pips Services Ltd with registration in Comoros and headquarters in Dubai, specific regulatory oversight information was not detailed. This lack of regulatory clarity may concern traders who prioritize regulatory protection and oversight in their platform selection process.

However, the platform's achievement as the third most-visited prop trading platform globally in 2025 suggests strong industry recognition and user trust. Positive user testimonials, including claims that it's "the best propfirm in the world," indicate high user satisfaction and confidence in the platform's operations. The rapid growth since its 2022 establishment demonstrates market acceptance, though regulatory transparency remains a concern. Fund safety measures and company financial transparency were not detailed in available sources, limiting the ability to fully assess reliability factors. The moderate rating reflects the balance between positive user experiences and limited regulatory information.

User Experience Analysis (Score: 8/10)

User experience represents a clear strength for Funding Pips. The platform receives consistently positive feedback from traders across various aspects of platform interaction. Users describe the platform as convenient and efficient, with particular praise for the MT5 integration and overall functionality. The registration and verification processes receive positive mentions, suggesting streamlined onboarding procedures that minimize friction for new users.

The platform's achievement of being ranked as the third most-visited prop trading platform globally indicates strong user engagement and satisfaction. User testimonials consistently express high satisfaction levels, with one trader stating it's "the best propfirm in the world" after six months of experience. The combination of low fees, instant fund processing, and professional support contributes to positive user experiences. However, specific information about user interface design details, mobile experience, and common user complaints was not provided in available sources. The strong rating reflects overwhelmingly positive user feedback while acknowledging areas where additional detailed information would provide a more complete assessment.

Conclusion

This complete Funding Pips review reveals a promising prop trading platform that has achieved remarkable growth and user satisfaction since its 2022 establishment. The platform excels in providing competitive account conditions with low fees, professional customer support, and a reliable MT5 trading environment focused on forex markets. User testimonials consistently praise the platform's professionalism and convenience, contributing to its recognition as the third most-visited prop trading platform globally.

Funding Pips appears particularly well-suited for individual forex traders seeking access to proprietary capital through a user-friendly platform with competitive terms. The combination of reasonable risk parameters, instant fund processing, and strong customer support creates an attractive proposition for this target audience. However, potential users should note limitations including the prohibition of Expert Advisors and limited regulatory transparency in available information. Overall, Funding Pips demonstrates strong potential as a prop trading solution, particularly for forex-focused traders prioritizing competitive fees and professional support.