Regarding the legitimacy of GO Markets forex brokers, it provides ASIC, CYSEC, FSA and WikiBit, (also has a graphic survey regarding security).

Is GO Markets safe?

Pros

Cons

Is GO Markets markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

GO MARKETS PTY LTD

Effective Date: Change Record

2004-03-10Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 7 447 COLLINS ST MELBOURNE VIC 3000 AUSTRALIAPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Market Making License (MM) 20

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

RegulatedLicense Type:

Market Making License (MM)

Licensed Entity:

Go Markets Ltd

Effective Date:

2017-04-25Email Address of Licensed Institution:

compliance@gomarkets.euSharing Status:

No SharingWebsite of Licensed Institution:

www.gomarkets.eu, www.gomarkets.com/en-euExpiration Time:

--Address of Licensed Institution:

Σπύρου Κυπριανού 38, Κτήριο CCS, 2ος όροφος, Γραφείο 201, Κάτω Πολεμίδια, 4154 Λεμεσός, ΚύπροςPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

FSA Derivatives Trading License (EP)

The Seychelles Financial Services Authority

The Seychelles Financial Services Authority

Current Status:

RegulatedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Go Markets International Ltd

Effective Date:

--Email Address of Licensed Institution:

compliance@gomarket.scSharing Status:

No SharingWebsite of Licensed Institution:

https://www.int.gomarkets.com/Expiration Time:

--Address of Licensed Institution:

IMAD Complex, Office 12, 3rd Floor, Ile du Port, Mahe, SeychellesPhone Number of Licensed Institution:

+248 4671903Licensed Institution Certified Documents:

Is GO Markets A Scam?

Introduction

GO Markets, established in 2006, positions itself as a prominent player in the online forex and CFD trading landscape. With its headquarters in Australia and regulatory oversight from multiple jurisdictions, GO Markets aims to provide traders with access to a wide array of financial instruments, including forex, commodities, indices, and share CFDs. However, the forex market is fraught with risks, and traders need to exercise caution when selecting a broker. The potential for scams and fraudulent activities is a reality in the trading world, making it imperative for traders to conduct thorough research before committing their funds.

In this article, we will investigate the legitimacy of GO Markets by examining its regulatory status, company background, trading conditions, customer fund safety, and overall client experiences. Our assessment is based on a comprehensive review of available data, including regulatory filings, customer reviews, and industry analyses, ensuring a balanced and objective evaluation.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and legitimacy of a forex broker. GO Markets is regulated by several reputable authorities, which helps ensure that it adheres to strict financial standards and practices. The following table summarizes the key regulatory information for GO Markets:

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| ASIC | 254963 | Australia | Verified |

| CySEC | 322/17 | Cyprus | Verified |

| FSA | SD 043 | Seychelles | Verified |

| FSC | GB 19024896 | Mauritius | Verified |

The Australian Securities and Investments Commission (ASIC) is known for its stringent regulatory framework, making it a tier-1 regulator. This means that GO Markets must comply with rigorous standards concerning financial stability, transparency, and consumer protection. Additionally, the Cyprus Securities and Exchange Commission (CySEC) offers investor compensation schemes, providing further assurance to clients. The presence of multiple regulatory licenses indicates that GO Markets operates within a well-regulated environment, which is a positive sign for potential traders.

Historically, GO Markets has maintained a clean compliance record, with no significant regulatory sanctions or complaints reported. This track record enhances its credibility as a legitimate forex broker.

Company Background Investigation

GO Markets has a rich history since its inception in 2006. Initially focused on providing CFD trading services, the company has expanded its offerings to include a diverse range of financial instruments. The ownership structure of GO Markets is transparent, with the company registered as GO Markets Pty Ltd in Australia.

The management team at GO Markets comprises experienced professionals with extensive backgrounds in finance and trading. This expertise is crucial for ensuring that the broker adheres to industry standards and provides quality service to its clients. The company has also received multiple awards for its customer service and educational resources, further demonstrating its commitment to client satisfaction.

Transparency is a core value for GO Markets, as evidenced by its clear communication regarding fees, trading conditions, and regulatory compliance. The broker provides comprehensive information on its website, allowing traders to make informed decisions.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions is essential. GO Markets offers two primary account types: the Standard Account and the Go Plus+ Account. The overall fee structure is competitive, with spreads starting from 0.0 pips for the Go Plus+ Account and 0.8 pips for the Standard Account.

The following table compares the core trading costs associated with GO Markets:

| Cost Type | GO Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.0 - 1.0 pips | 1.0 - 2.0 pips |

| Commission Model | $2.50 per side (Go Plus+) | $3.0 - $5.0 per side |

| Overnight Interest Range | Varies | Varies |

The fee structure at GO Markets is designed to cater to both casual and active traders. However, it is worth noting that the commission charged on the Go Plus+ Account may be higher than some competitors, depending on the trading volume. Traders should carefully evaluate their trading strategies and expected volumes to determine which account type aligns with their needs.

While the overall trading costs are competitive, some users have reported inconsistencies in spreads during high volatility periods. Therefore, potential traders should consider the implications of these fees on their trading strategies.

Customer Fund Safety

The safety of customer funds is paramount when selecting a forex broker. GO Markets employs several measures to ensure the security of client funds. Client funds are held in segregated accounts, ensuring that they are kept separate from the broker's operational funds. This practice minimizes the risk of loss in the event of the broker's insolvency.

Additionally, GO Markets offers negative balance protection, meaning that clients cannot lose more than their deposited amount. This policy is particularly important for traders using high leverage, as it mitigates the risk of substantial financial loss.

Historically, GO Markets has not faced significant issues related to fund safety, and there have been no major controversies reported. This solid track record enhances its reputation as a trustworthy broker.

Customer Experience and Complaints

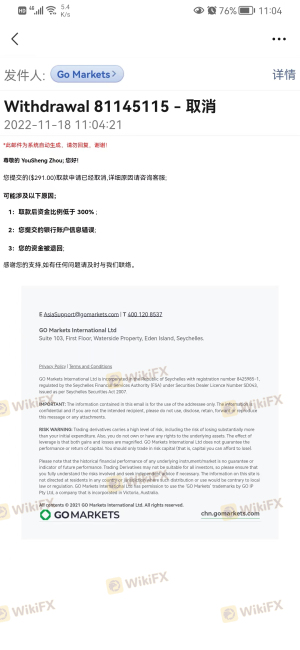

Customer feedback is a valuable indicator of a broker's reliability and service quality. GO Markets has received a mix of reviews, with many clients praising its user-friendly trading platforms, competitive spreads, and responsive customer support. However, some common complaints have emerged, particularly concerning withdrawal processing times and occasional platform stability issues.

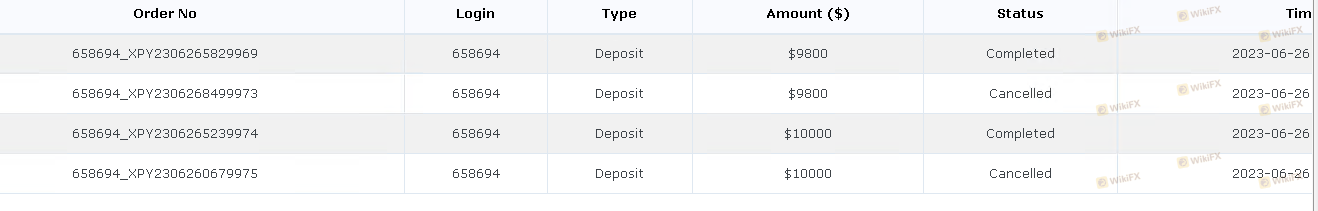

The following table outlines the primary types of complaints received about GO Markets and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | Moderate | Generally responsive, but some delays reported |

| Platform Stability Issues | Moderate | Ongoing improvements noted |

| Customer Support Response | Low | Generally positive feedback |

For instance, some users reported delays in withdrawal processing, particularly during peak trading periods. While GO Markets has responded to these complaints by improving its processes, it is essential for potential clients to be aware of these issues.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. GO Markets offers several platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both of which are widely recognized for their reliability and advanced trading features. Users have reported high levels of satisfaction with the platforms, citing their user-friendly interfaces and extensive charting capabilities.

However, there have been some reports of slippage during high volatility periods, which can impact trade execution quality. Traders should be aware of these potential issues, especially when trading during major market events.

Risk Assessment

Using GO Markets comes with certain risks, as is the case with any forex broker. The following table summarizes the key risk areas associated with trading with GO Markets:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Low | Well-regulated by multiple authorities |

| Financial Risk | Medium | Potential for losses due to market volatility |

| Operational Risk | Medium | Platform stability issues reported |

| Withdrawal Risk | Medium | Some delays in processing withdrawals |

To mitigate these risks, traders should conduct thorough research, utilize risk management strategies, and remain informed about market conditions.

Conclusion and Recommendations

In conclusion, based on the evidence gathered, GO Markets appears to be a legitimate and well-regulated forex broker. Its multiple regulatory licenses, transparent fee structure, and commitment to customer fund safety indicate that it operates within a secure framework. While there are some areas for improvement, particularly in withdrawal processing and platform stability, the overall user experience remains positive.

For traders considering GO Markets, it is advisable to start with a demo account to familiarize themselves with the platform and trading conditions. Additionally, those who are new to trading should ensure they understand the risks involved and utilize appropriate risk management strategies.

If you are looking for alternative options, consider brokers with similar regulatory standings and robust customer support, such as IG Markets or CMC Markets, to ensure a secure trading experience.

Is GO Markets a scam, or is it legit?

The latest exposure and evaluation content of GO Markets brokers.

GO Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

GO Markets latest industry rating score is 8.98, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 8.98 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.