Is XAtrade safe?

Business

License

Is XAtrade Safe or a Scam?

Introduction

XAtrade has positioned itself as a player in the Forex market, primarily targeting traders in the Chinese market. As with any financial service, especially in the volatile world of Forex trading, it is crucial for traders to thoroughly evaluate the legitimacy and safety of their chosen broker. The Forex market is notorious for its lack of regulation, which can lead to the proliferation of unscrupulous brokers. Therefore, traders must exercise caution and conduct comprehensive research before committing their funds. This article utilizes a structured framework to assess the safety and reliability of XAtrade, including regulatory status, company background, trading conditions, customer experiences, and overall risk assessment.

Regulation and Legitimacy

The regulatory environment is a core factor in determining whether a broker like XAtrade is safe to trade with. Regulation serves as a safeguard for traders, ensuring that brokers adhere to certain standards of conduct and financial practices. Unfortunately, XAtrade appears to operate with minimal regulatory oversight, which raises concerns about its legitimacy.

| Regulatory Authority | License Number | Regulated Region | Verification Status |

|---|---|---|---|

| None | N/A | United Kingdom | Not Verified |

The absence of a regulatory license is concerning. A lack of regulation can expose traders to potential risks such as fraud, mismanagement of funds, and unfair trading practices. Furthermore, a history of compliance issues can further erode trust in a broker. The lack of a robust regulatory framework for XAtrade suggests a higher risk profile, making it essential for potential users to consider these factors before engaging with the platform.

Company Background Investigation

XAtrade was established with a focus on providing Forex trading services, but its history and ownership structure remain somewhat opaque. The company is registered in the United Kingdom, yet it lacks significant transparency regarding its ownership and operational history. In an industry where trust is paramount, the absence of clear information about the management team and their qualifications can be a red flag.

The management team‘s background is crucial in assessing the broker’s credibility. Traders should look for a team with a proven track record in finance and a commitment to ethical practices. However, XAtrade's lack of public information makes it difficult to evaluate these aspects. Transparency in operational practices and management experience is vital for building trust with clients, and XAtrade's shortcomings in this area could be a cause for concern.

Trading Conditions Analysis

Trading conditions, including fees and spreads, are vital in determining a broker's overall value proposition. XAtrade offers various trading accounts, but its fee structure appears to be less competitive than industry standards.

| Fee Type | XAtrade | Industry Average |

|---|---|---|

| Spread for Major Pairs | Variable | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | 0.5% | 0.5% - 1.0% |

The spread for major currency pairs can be a critical factor for traders. While XAtrade does not charge a commission, the variable spreads can significantly impact trading costs. Additionally, the overnight interest rates are on par with industry averages, but the lack of clarity regarding other hidden fees may lead to unexpected costs. Traders should be particularly cautious of any unusual fees that could erode their profits.

Customer Fund Safety

The safety of customer funds is paramount when evaluating whether XAtrade is safe. A reputable broker should implement robust measures to protect client funds, including segregated accounts and investor protection schemes. Unfortunately, XAtrade's policies regarding fund safety are not well-documented, leading to potential concerns.

Traders must inquire whether XAtrade uses segregated accounts to keep client funds separate from its operational funds. This practice is essential in safeguarding client assets in the event of financial difficulties faced by the broker. Furthermore, the absence of any investor protection mechanisms or compensation schemes can leave traders vulnerable to losses.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reliability. A thorough analysis of user experiences with XAtrade reveals a mixed bag of reviews, with some users reporting satisfactory experiences while others express significant concerns.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Unresponsive |

| Poor Customer Support | Medium | Slow to respond |

| Misleading Information | High | Unresolved |

Common complaints include difficulties in withdrawing funds and inadequate customer support. The severity of these issues cannot be understated, as they directly impact a trader's ability to access their money. In particular, withdrawal issues are a major red flag that could indicate deeper operational problems. Traders should carefully consider these factors when evaluating whether XAtrade is safe for their trading activities.

Platform and Trade Execution

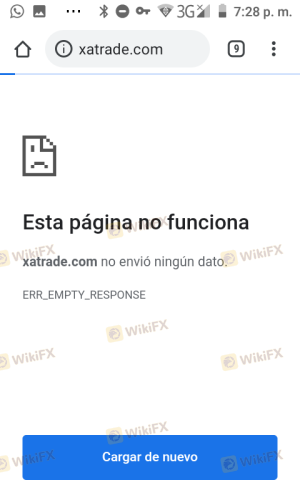

The performance of a trading platform can significantly influence a trader's experience. XAtrades platform has received mixed reviews regarding its stability and user-friendliness. Efficient execution of trades is critical, especially in a fast-paced environment like Forex trading.

Traders have reported instances of slippage and rejected orders, which can be detrimental to trading strategies. Any indication of platform manipulation or poor execution quality raises concerns about the broker's integrity. A reliable broker should ensure that trades are executed promptly and fairly, without any undue interference.

Risk Assessment

Using XAtrade comes with inherent risks that traders must be aware of. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | No significant regulation |

| Fund Safety | High | Lack of transparency in policies |

| Customer Support | Medium | Reports of slow response times |

| Platform Reliability | Medium | Issues with execution quality |

To mitigate these risks, traders should consider using smaller amounts of capital until they are confident in the broker's reliability. Additionally, seeking out user reviews and feedback can provide further insight into the broker's practices.

Conclusion and Recommendations

In conclusion, the evidence suggests that XAtrade exhibits several characteristics that warrant caution. The lack of regulation, combined with a history of customer complaints and concerns about fund safety, raises significant red flags. While some users report positive experiences, the overall risk profile of XAtrade leans towards the high side.

For traders seeking a reliable Forex broker, it may be prudent to consider alternatives with stronger regulatory oversight and better customer feedback. Brokers such as AvaTrade or Forex.com offer more robust regulatory frameworks and a history of positive customer experiences. Ultimately, the decision to engage with XAtrade should be made with careful consideration of the associated risks and a clear understanding of the broker's practices.

In light of these findings, the question remains: Is XAtrade safe? The answer leans towards caution, and potential traders should proceed with vigilance.

Is XAtrade a scam, or is it legit?

The latest exposure and evaluation content of XAtrade brokers.

XAtrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

XAtrade latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.