Is Worldtradecenter safe?

Pros

Cons

Is Worldtradecenter Safe or Scam?

Introduction

The Worldtradecenter (WTC) positions itself as a prominent player in the forex market, claiming to offer a wide range of trading instruments and attractive trading conditions. However, the rise of online trading has also brought about a surge in fraudulent activities, making it crucial for traders to carefully evaluate the legitimacy of their chosen brokers. In this article, we will explore whether Worldtradecenter is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, customer feedback, platform performance, and overall risk assessment. Our investigation is based on a thorough review of multiple online sources, including user reviews and regulatory warnings, to provide a comprehensive analysis of the brokers credibility.

Regulation and Legitimacy

A brokers regulatory status is a critical factor in determining its safety. Regulation ensures that brokers adhere to strict standards, providing traders with a level of protection and recourse in case of disputes. Unfortunately, Worldtradecenter operates without valid regulation, which is a significant red flag for potential investors. The broker has been flagged by the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC) for operating without authorization, indicating that it is not compliant with regulatory standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

| CySEC | N/A | Cyprus | Blacklisted |

The absence of regulatory oversight means that Worldtradecenter does not provide the necessary protections for client funds, such as segregated accounts or negative balance protection. Traders may find themselves vulnerable to fraud and manipulation, as there is no governing body to hold the broker accountable for its actions. The lack of regulation and the existence of warnings from reputable authorities strongly suggest that Worldtradecenter is not a safe option for traders.

Company Background Investigation

Worldtradecenter claims to be based in Cyprus, yet the details regarding its ownership structure and history remain vague. The company is purportedly managed by WTC Group Limited, but there is little information available about its founding members or the management team‘s qualifications. This lack of transparency raises concerns about the firm’s legitimacy.

Furthermore, the absence of a functional official website further complicates the investigation into its background. Many unregulated brokers often operate through shell companies, making it challenging to trace their actual locations or verify their claims. The lack of information regarding the companys history and ownership structure is alarming, as legitimate brokers typically provide detailed disclosures about their operations. Therefore, the overall opacity surrounding Worldtradecenter amplifies the skepticism regarding its safety and reliability.

Trading Conditions Analysis

When evaluating a brokers trading conditions, it is essential to consider its fee structures, spreads, and overall trading environment. Worldtradecenter advertises competitive spreads and high leverage options, which are enticing for traders. However, the broker's fee structure raises several concerns.

Traders are often lured in with low initial deposit requirements, typically around $250, but the fine print reveals potential hidden fees and unfavorable withdrawal conditions. For instance, the broker imposes a withdrawal fee of at least $30 and charges a hefty $99 inactivity fee after one month of no trading activity. Such practices are common among scam brokers, as they create barriers to accessing funds.

| Fee Type | Worldtradecenter | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | 4.1 pips | 1-2 pips |

| Commission Structure | None disclosed | Varies |

| Overnight Interest Range | Not specified | Varies |

The high spreads, particularly on major currency pairs, significantly impact traders profitability. Moreover, the lack of a clear commission structure and the ambiguity surrounding overnight interest rates suggest that traders may be subjected to unforeseen costs, further compromising their trading experience. Overall, these factors indicate that Worldtradecenter may not provide the favorable trading conditions it claims.

Client Funds Security

The safety of client funds is paramount when selecting a broker. Worldtradecenter lacks essential security measures that are typically offered by regulated brokers. Without segregation of client funds, there is no guarantee that traders' investments are protected in the event of the broker's insolvency. Furthermore, the absence of negative balance protection means that traders can lose more than their initial investments, leading to significant financial risks.

The lack of investor protection schemes, such as those provided by the FCA or CySEC, raises serious concerns. In the event of a dispute or financial failure, traders may have no recourse to recover their funds. The historical context of Worldtradecenter being flagged by regulatory authorities for fraudulent activities only exacerbates these concerns, highlighting the potential risks associated with trading with this broker.

Customer Experience and Complaints

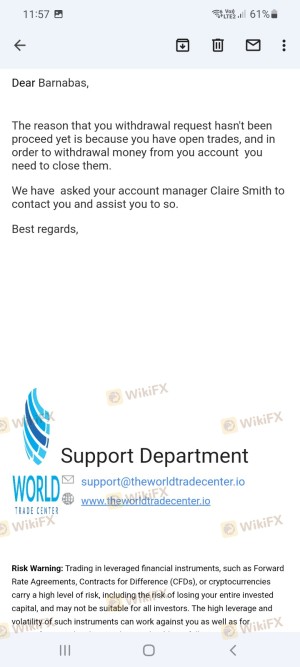

Customer feedback is a valuable resource for assessing a broker's reliability. Reviews for Worldtradecenter reveal a mixture of experiences, but a significant portion of feedback is negative. Common complaints include difficulties in withdrawing funds, aggressive sales tactics, and unresponsive customer support.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Sales Practices | High | Poor |

| Lack of Support | Medium | Poor |

Many users report being locked out of their accounts when attempting to withdraw funds, a tactic often employed by scam brokers to retain clients' money. Additionally, there are claims of high-pressure sales tactics, where clients are urged to deposit more funds under the guise of promising higher returns. These issues are compounded by the broker's unresponsive customer support, which leaves clients feeling abandoned and frustrated.

One notable case involves a client who successfully withdrew small amounts initially but was later locked out of their account when attempting to access larger sums. This pattern of behavior aligns with tactics commonly seen in fraudulent operations, suggesting that Worldtradecenter may not prioritize customer satisfaction or ethical trading practices.

Platform and Trade Execution

The trading platform is a critical component of the trading experience. Worldtradecenter claims to offer the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and robust trading features. However, user feedback indicates that the platform may experience stability issues, leading to delayed executions and high slippage.

Traders have reported instances of orders being executed at unfavorable prices, raising suspicions of potential market manipulation. Moreover, the lack of transparency regarding order execution policies further complicates the assessment of the broker's reliability. A trustworthy broker should provide clear information about order execution practices and any potential risks associated with trading.

Risk Assessment

Engaging with Worldtradecenter presents numerous risks that potential traders should consider. The absence of regulation, coupled with a history of complaints and negative feedback, suggests a high-risk trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | No segregation of funds |

| Withdrawal Risk | High | Difficulties in accessing funds |

| Trading Conditions Risk | Medium | Unfavorable spreads and fees |

To mitigate these risks, potential traders should conduct thorough research before engaging with any broker. It is advisable to seek alternatives that are regulated and have a proven track record of customer satisfaction and transparent practices.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Worldtradecenter is not a safe trading option. The lack of regulation, combined with numerous complaints regarding withdrawal issues and aggressive sales tactics, raises significant red flags. Traders should exercise extreme caution when considering this broker, as the risks associated with trading with an unregulated entity can lead to substantial financial losses.

For those seeking reliable trading options, it is recommended to explore well-regulated brokers that prioritize client safety and transparency. Brokers such as OANDA, IG, and Forex.com offer robust regulatory oversight and favorable trading conditions, making them suitable alternatives for traders looking to enter the forex market. Ultimately, ensuring the safety of your investments should be the top priority when selecting a trading partner.

Is Worldtradecenter a scam, or is it legit?

The latest exposure and evaluation content of Worldtradecenter brokers.

Worldtradecenter Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Worldtradecenter latest industry rating score is 1.50, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.50 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.