Is TUF Markets safe?

Business

License

Is TUF Markets Safe or Scam?

Introduction

TUF Markets is a forex broker that has been active in the trading industry, primarily targeting the Chinese market. As traders increasingly seek opportunities in the forex market, the importance of choosing a reliable broker cannot be overstated. The rise of online trading has unfortunately also led to a proliferation of scams and unregulated entities, making it essential for traders to perform thorough due diligence before committing their funds. In this article, we will explore the safety and legitimacy of TUF Markets by examining its regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk profile. Our investigation is based on a comprehensive review of multiple sources, including regulatory databases, user reviews, and industry reports.

Regulation and Legitimacy

Regulation is a critical aspect of any forex broker's credibility. A regulated broker is subject to oversight by financial authorities, which helps ensure that they adhere to strict operational standards and protect client funds. TUF Markets claims to operate under the regulatory framework of the United Kingdom; however, reports indicate that it may be operating as a clone of a legitimate entity without proper licensing. This raises significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | N/A | United States | Suspicious Clone |

The lack of a valid license from a reputable authority such as the Financial Conduct Authority (FCA) or the Commodity Futures Trading Commission (CFTC) is alarming. Without proper regulation, traders may have limited recourse in the event of disputes or financial losses, leading to a higher risk of fraud. Furthermore, the history of compliance for TUF Markets is questionable, with multiple complaints suggesting that it operates in a manner that could be considered deceptive or fraudulent.

Company Background Investigation

TUF Markets Limited has been in operation for over a decade, claiming to provide access to various financial markets. However, the opacity surrounding its ownership structure and management team raises red flags. The company appears to be linked to a series of similar entities that have been flagged for fraudulent activities. This association with a broader pattern of scams is troubling.

The management team lacks transparency, with limited information available on their backgrounds and professional expertise. This lack of clarity can often indicate a lack of accountability, which is crucial for a financial services provider. Furthermore, the company's disclosure practices are inadequate, making it difficult for potential clients to assess the risks involved in trading with TUF Markets.

Trading Conditions Analysis

When evaluating a broker, the overall cost structure is a key factor that traders must consider. TUF Markets claims to offer competitive spreads and low trading costs, but specific details are often vague or absent. This lack of clarity can lead to unexpected costs for traders.

| Fee Type | TUF Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1-2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | 3-5% |

The absence of detailed information about spreads and commissions is concerning. Traders should be wary of brokers that do not provide clear and comprehensive fee structures, as this can indicate hidden charges or unfavorable trading conditions. The potential for high costs can significantly impact a trader's profitability, making it essential to fully understand the fee landscape before proceeding.

Client Fund Safety

The safety of client funds is paramount when selecting a forex broker. TUF Markets claims to implement various safety measures, including fund segregation and negative balance protection. However, the effectiveness of these measures is questionable given the broker's regulatory status.

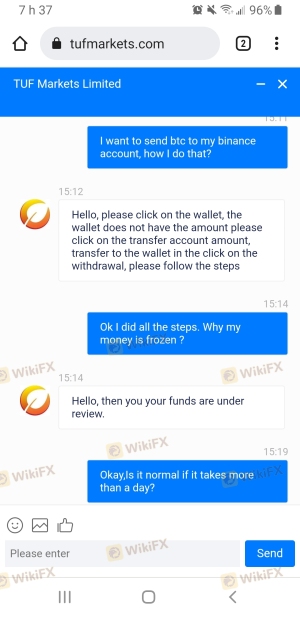

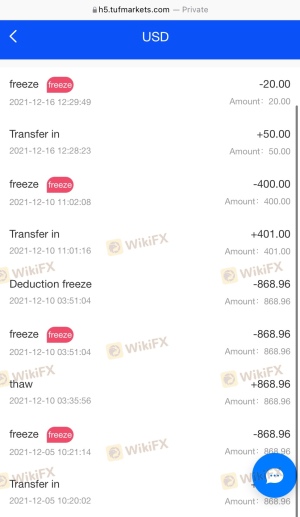

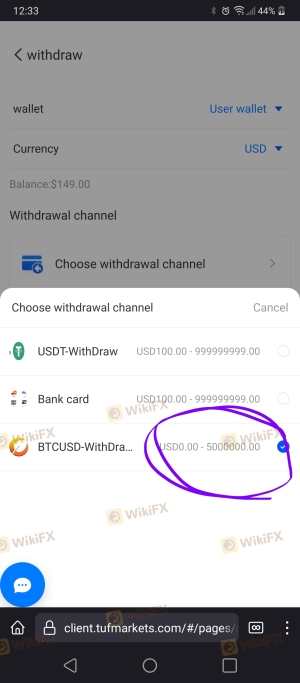

Traders should investigate whether TUF Markets maintains client funds in segregated accounts with reputable banks. Additionally, the absence of an investor compensation scheme raises concerns about the safety of client deposits. Historical issues related to fund security, including complaints about withdrawal difficulties and alleged fraudulent practices, further underscore the need for caution when dealing with this broker.

Customer Experience and Complaints

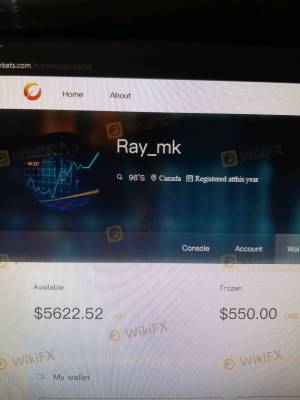

Customer feedback is a vital indicator of a broker's reliability. Reviews of TUF Markets reveal a mixed bag of experiences, with numerous complaints about withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Average |

| Misleading Information | High | Poor |

Common complaint patterns suggest that clients often struggle to access their funds after making deposits. Additionally, the quality of customer support appears to be lacking, with many users reporting long wait times and unhelpful responses. Such issues can significantly impact a trader's experience and trust in the platform.

Platform and Execution

The performance of the trading platform is another critical factor to consider. TUF Markets offers access to the popular MetaTrader 5 platform, which is known for its robust features and user-friendly interface. However, concerns have been raised regarding the execution quality, including instances of slippage and order rejections.

Traders should be vigilant for any signs of platform manipulation, as these can indicate a lack of integrity on the part of the broker. A reliable broker should ensure that trades are executed fairly and transparently, without undue interference.

Risk Assessment

Using TUF Markets involves a range of risks that potential clients should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | Medium | Unclear fee structure can lead to unexpected costs. |

| Operational Risk | High | Complaints about withdrawal issues and poor support. |

Given the high-risk factors associated with trading through TUF Markets, traders should consider implementing risk mitigation strategies, such as trading with lower amounts or exploring alternative brokers with stronger regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that TUF Markets exhibits several characteristics commonly associated with untrustworthy brokers. The lack of robust regulation, combined with numerous complaints about fund safety and customer service, raises significant concerns about the platform's reliability.

For traders seeking a safe trading environment, it is advisable to consider alternative brokers that are well-regulated and have a proven track record of positive customer experiences. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which offer greater security and transparency for their clients.

To summarize, is TUF Markets safe? The current evidence points to potential risks and a lack of trustworthiness, making it prudent for traders to exercise caution and seek alternatives.

Is TUF Markets a scam, or is it legit?

The latest exposure and evaluation content of TUF Markets brokers.

TUF Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TUF Markets latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.