Is Nation FX safe?

Pros

Cons

Is Nation FX A Scam?

Introduction

Nation FX is a forex broker that has emerged in the competitive landscape of online trading, offering a variety of financial instruments, including forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders must exercise caution when selecting a broker, as the industry is rife with both legitimate firms and potential scams. This article aims to provide a comprehensive assessment of Nation FX, evaluating its regulatory compliance, company background, trading conditions, client fund security, customer experiences, platform performance, and overall risk. The evaluation is based on a thorough review of multiple sources, including user feedback, expert analyses, and regulatory data.

Regulation and Legitimacy

The regulatory status of a broker is paramount in determining its legitimacy and the safety of clients' funds. Nation FX claims to operate under the auspices of several regulatory bodies, including the Australian Securities and Investments Commission (ASIC) and the Mwali International Services Authority (MISA). However, the effectiveness and reliability of these regulations can vary significantly.

| Regulatory Body | License Number | Jurisdiction | Verification Status |

|---|---|---|---|

| ASIC | 001304800 | Australia | Active |

| MISA | T 2023257 | Mwali | Active |

| SVG FSA | 1485 | St. Vincent | Active |

While ASIC is known for its stringent regulatory standards, the other jurisdictions, particularly St. Vincent and the Grenadines (SVG), have a reputation for less rigorous oversight. The SVG Financial Services Authority does not regulate forex brokers, which raises significant concerns about the safety of client funds deposited with Nation FX. Furthermore, the lack of segregated accounts and negative balance protection, which are common features in well-regulated environments, further diminishes the trustworthiness of this broker.

Company Background Investigation

Nation FX is reportedly operated by Nation FX LLC, which is registered in St. Vincent and the Grenadines. The company claims to have expanded its services to traders in over 180 countries since its inception, but specific details about its history and ownership structure remain vague. The management teams qualifications and professional backgrounds are not readily available, which raises questions about the broker's transparency.

The absence of publicly accessible information regarding the company's leadership and operational history is a significant red flag. Transparent brokers typically disclose their management teams credentials and relevant experience, which helps build trust with potential clients. In Nation FX's case, the lack of such information may indicate a desire to obscure potential issues or a lack of accountability.

Trading Conditions Analysis

Nation FX offers a range of trading conditions that can be appealing to traders, including competitive leverage and a variety of trading instruments. However, the overall fee structure raises concerns. The broker's spreads and commissions are often higher than industry averages, which can significantly impact trading profitability.

| Fee Type | Nation FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 4.1 pips | 1.0 - 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spreads offered by Nation FX, particularly for major currency pairs, are substantially higher than those typically seen in the industry. This discrepancy suggests that trading with Nation FX may be less profitable compared to other brokers. Additionally, the lack of transparency regarding overnight interest rates and other potential fees is concerning for traders seeking to understand their total cost of trading.

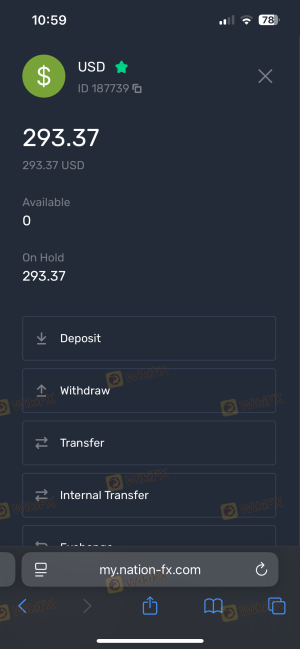

Client Fund Security

The safety of client funds is a critical concern when evaluating any broker. Nation FX claims to implement various security measures; however, the lack of segregated accounts and investor protection schemes poses significant risks. In regulated environments, funds are typically held in separate accounts, ensuring that client money is protected in the event of the broker's insolvency.

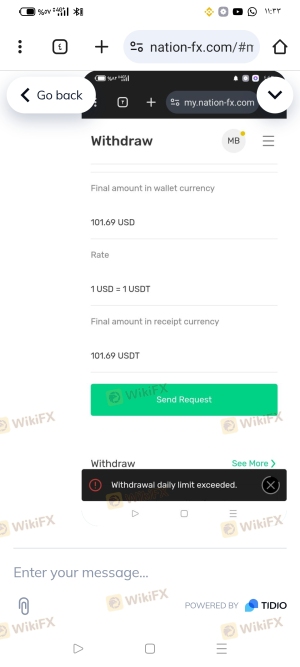

Historically, there have been complaints regarding fund withdrawals and difficulties in accessing capital, which raises alarms about the brokers financial practices. Without robust protections in place, clients may find themselves vulnerable to potential losses.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Nation FX reflect a mixed bag of experiences, with several users reporting significant issues, particularly concerning fund withdrawals and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Slow |

| High Spreads | Medium | Acknowledged |

Common complaints include difficulties in withdrawing funds and a lack of timely responses from customer support. For instance, one trader reported being locked out of their account with a substantial balance and faced delays in receiving assistance. Such experiences highlight potential operational weaknesses and raise concerns about the broker's commitment to customer service.

Platform and Execution

Nation FX utilizes the MetaTrader 4 (MT4) platform, a popular choice among traders for its user-friendly interface and advanced charting capabilities. However, the absence of expert advisors (EAs) and automated trading features limits the platform's appeal for many traders.

The execution quality and order fulfillment rates are also crucial for a trading platform. Reports of slippage and rejected orders can significantly affect trading performance. While there have been no widespread allegations of platform manipulation, the high spreads and execution delays reported by some users suggest potential inefficiencies in trade execution.

Risk Assessment

Using Nation FX involves several risks that potential clients should consider carefully. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Operates under weak regulations in SVG. |

| Fund Safety | High | Lack of segregated accounts and protections. |

| Trading Costs | Medium | Higher spreads and commissions than average. |

| Customer Support | Medium | Frequent complaints about responsiveness. |

To mitigate these risks, traders should conduct thorough research and consider using brokers with established regulatory frameworks and better customer support records.

Conclusion and Recommendations

In conclusion, while Nation FX presents itself as a legitimate forex broker, significant concerns regarding its regulatory status, transparency, and customer experiences raise red flags. The lack of robust regulatory oversight, combined with high trading costs and troubling customer feedback, suggests that potential clients should proceed with caution.

For traders seeking a more secure and reliable trading environment, it is advisable to consider established brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. Alternatives like FP Markets or XM may offer more favorable trading conditions and stronger customer protections. Ultimately, due diligence and careful evaluation are essential when choosing a broker in the forex market.

Is Nation FX a scam, or is it legit?

The latest exposure and evaluation content of Nation FX brokers.

Nation FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Nation FX latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.