Is Vlado safe?

Pros

Cons

Is Vlado A Scam?

Introduction

Vlado is a relatively new player in the forex market, having been established in December 2021. Positioned as a broker offering various trading services, it claims to provide access to a wide range of financial instruments, including forex, cryptocurrencies, and commodities. As the forex market continues to expand, traders are increasingly faced with a multitude of options, making it crucial to evaluate the legitimacy and reliability of brokers like Vlado. This evaluation is essential to protect their investments and ensure a safe trading environment. In this article, we will conduct a thorough investigation into Vlado's regulatory status, company background, trading conditions, customer safety measures, client experiences, and overall risk assessment. Our analysis is based on multiple sources, including expert reviews, regulatory databases, and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a vital component that informs traders about the level of oversight and protection they can expect. A well-regulated broker is typically subject to strict compliance standards, which helps safeguard client funds and ensure fair trading practices. In the case of Vlado, the broker claims to be regulated by the Australian Securities and Investments Commission (ASIC) and the Money Services Business (MSB) in Canada. However, investigations reveal that these claims lack substantiation.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| ASIC | 001295039 | Australia | Not Found |

| MSB | M22965628 | Canada | Not a Forex Regulator |

The ASIC does not list Vlado as a licensed entity, and although the MSB has registered Vlado, it does not regulate forex brokers or issue licenses for forex trading. This lack of legitimate regulatory oversight raises significant concerns about the safety of funds and the overall trustworthiness of the broker. The absence of a credible regulatory framework places Vlado in a high-risk category, making it essential for potential clients to exercise extreme caution.

Company Background Investigation

Understanding a broker's history and ownership structure is crucial for assessing its reliability. Vlado Limited claims to operate from the United Kingdom and has an office in Dubai. However, its actual operational history is murky, with little to no transparency regarding its management team or ownership. The company's website lacks detailed information about its founders and key personnel, which can be a red flag for potential investors.

Moreover, the absence of a solid track record or established reputation in the industry further complicates the picture. Reliable brokers typically have a history of compliance with regulatory standards and transparent operations. In contrast, Vlado's claims of being a regulated entity appear to be misleading, as corroborating evidence from regulatory bodies is non-existent. This lack of transparency and accountability raises questions about the broker's intentions and operational integrity.

Trading Conditions Analysis

Vlado offers various trading conditions that may initially seem appealing to potential clients. However, a closer examination reveals several areas that warrant concern. The broker advertises competitive spreads and a leverage ratio of up to 1:500, which can be enticing for traders looking to maximize their profits. However, such high leverage also significantly increases the risk of substantial losses.

| Fee Type | Vlado | Industry Average |

|---|---|---|

| Spread for Major Pairs | 1.0 pips | 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Rates | Varies | Varies |

While the spreads appear competitive, the lack of a transparent commission structure raises questions about hidden fees that may be imposed on traders. Additionally, the broker's policies regarding overnight interest rates are not clearly outlined, which could lead to unexpected charges for traders holding positions overnight. Overall, the trading conditions at Vlado may not be as favorable as they initially seem, necessitating careful scrutiny by potential clients.

Client Funds Security

The safety of client funds is paramount when choosing a forex broker. In the case of Vlado, the broker does not provide adequate information regarding its client fund protection measures. There is no mention of segregated accounts or investor protection schemes, which are standard practices among reputable brokers.

Without these safeguards, client funds may be at risk, especially in the event of the broker facing financial difficulties or insolvency. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, a risk that should not be taken lightly. Historically, brokers operating without regulatory oversight have faced numerous complaints regarding fund mismanagement and withdrawal issues, further highlighting the importance of due diligence when considering Vlado.

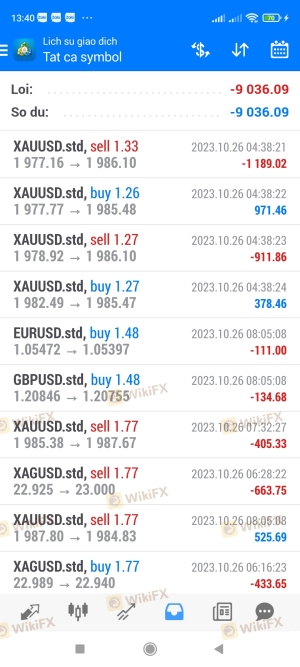

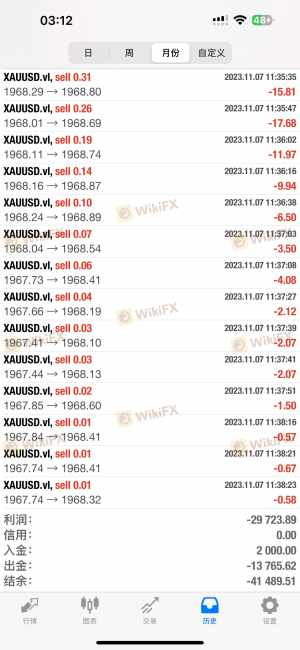

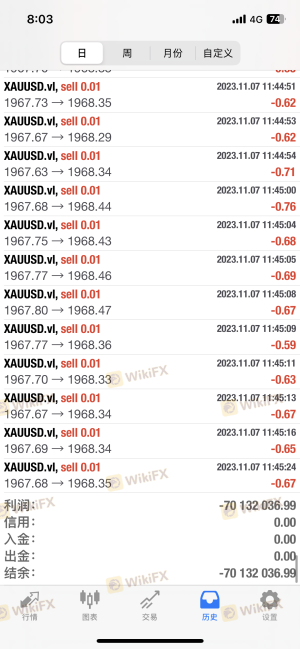

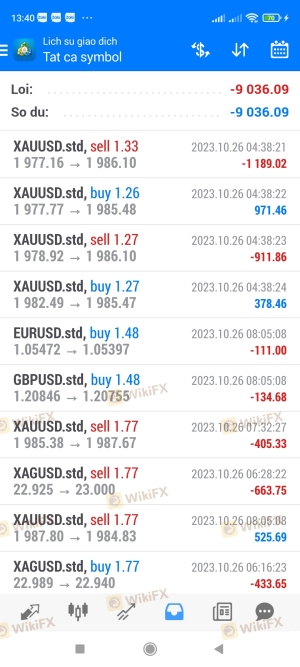

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability and service quality. In the case of Vlado, numerous user reviews and complaints have surfaced, painting a concerning picture of the broker's operational practices. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and unclear communication regarding account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Support | Medium | Lacks Availability |

| Transparency Concerns | High | No Clear Answers |

Two notable cases involve clients who reported being unable to withdraw their funds after repeated attempts. In one instance, a trader claimed to have invested $17,000 but faced delays and unresponsiveness from the broker. Such experiences are alarming and suggest systemic issues within Vlado's operations.

Platform and Trade Execution

The trading platform offered by Vlado is based on the widely used MetaTrader 4 (MT4), which is known for its robust features and user-friendly interface. However, the overall performance and execution quality remain critical factors for traders. Reports from users indicate that while the platform is functional, there are concerns about order execution quality, including instances of slippage and order rejections.

Moreover, the lack of transparency regarding the broker's execution policies raises questions about potential manipulations. Traders should be cautious when using platforms that do not provide clear information about how orders are processed and executed.

Risk Assessment

Engaging with Vlado entails several risks that potential clients must consider. The absence of credible regulation, combined with a lack of transparency and a history of customer complaints, places Vlado in a high-risk category.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Unregulated and lacks oversight |

| Fund Safety | High | No segregation or protection measures |

| Customer Support | Medium | Reports of slow and inadequate support |

To mitigate these risks, potential clients should conduct thorough research and consider trading with well-regulated brokers that offer clear fund protection policies and reliable customer support.

Conclusion and Recommendations

In conclusion, the evidence suggests that Vlado may not be a safe choice for forex trading. The broker's lack of legitimate regulatory oversight, combined with numerous customer complaints and questionable operational practices, raises significant red flags. Traders should exercise extreme caution and consider alternative options that provide robust regulatory frameworks and transparent operations.

For those seeking reliable trading platforms, it is advisable to explore brokers that are well-regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer better protections for client funds and a more transparent trading environment, ultimately providing a safer trading experience.

Is Vlado a scam, or is it legit?

The latest exposure and evaluation content of Vlado brokers.

Vlado Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vlado latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.