Tradeview Markets 2025 Review: Everything You Need to Know

Executive Summary

This tradeview markets review examines a forex and CFD trading platform that has been operating since 2004. Tradeview Markets operates from the Cayman Islands and offers competitive trading conditions with zero spreads and commission-free trading on certain account types. The platform gives traders access to over 1,000 trading instruments across multiple asset classes through professional trading platforms including MetaTrader 4, MetaTrader 5, and cTrader.

The broker targets retail investors who want low-cost trading solutions and traders who need high leverage capabilities up to 1:500. With a minimum deposit requirement of just $100 USD, Tradeview Markets makes itself accessible to many different types of traders. The platform delivers execution speeds of less than 1 millisecond and offers eight different trading platforms to accommodate various trading styles and preferences.

However, our analysis shows mixed results regarding regulatory transparency and safety measures. While the broker has maintained operations for nearly two decades, specific regulatory information remains unclear in available documentation. User feedback on platforms like Trustpilot indicates generally positive experiences with customer support, though the overall safety rating stands at a moderate 7/10.

Important Disclaimer

Regional Variations: Tradeview Markets operates across multiple jurisdictions, and specific regulatory protections may vary significantly depending on your location. Users in different regions may encounter different legal frameworks and investor protection schemes. The regulatory status and licensing information for this broker requires verification based on your specific geographical location.

Review Methodology: This evaluation is based on publicly available information, user feedback from various platforms, and industry reports. We have not conducted direct testing of the trading platforms or services. All data presented reflects information available as of the review date and should be independently verified before making any trading decisions.

Rating Framework

Broker Overview

Tradeview Markets was established in 2004 and operates from its headquarters in the Cayman Islands, with additional presence in New York, United States. The company has built its reputation over nearly two decades as a provider of forex and CFD trading services, focusing on delivering competitive spreads and professional-grade trading platforms to retail and institutional clients.

The broker's business model centers on providing direct market access through multiple trading platforms while maintaining cost-effective trading conditions. Tradeview Markets emphasizes technological innovation and customer service excellence, positioning itself as a premium broker for serious traders who demand high-quality execution and comprehensive market access.

This tradeview markets review reveals that the platform supports trading across major asset classes including foreign exchange, contracts for difference, and other derivative instruments. The broker offers both commission-free accounts and ECN accounts, allowing traders to choose the pricing structure that best suits their trading strategy and volume requirements. With access to over 1,000 trading instruments and support for automated trading through Expert Advisors and signal services, Tradeview Markets caters to both manual and algorithmic trading approaches.

Regulatory Jurisdiction: Specific regulatory information for Tradeview Markets was not detailed in available documentation. The broker operates from the Cayman Islands, though comprehensive regulatory status requires independent verification.

Deposit and Withdrawal Methods: The platform supports multiple funding options including bank transfers, credit cards, cryptocurrency payments, electronic banking solutions, and local deposit methods. This variety accommodates traders from different geographical regions and payment preferences.

Minimum Deposit Requirements: Tradeview Markets sets a minimum deposit threshold of $100 USD, making the platform accessible to retail traders with modest starting capital.

Bonuses and Promotions: Current promotional offerings and bonus programs were not specified in available information and would require direct inquiry with the broker.

Available Trading Assets: The broker provides access to over 1,000 trading instruments spanning multiple asset classes. This extensive selection includes major, minor, and exotic currency pairs, as well as various CFD products covering different market sectors.

Cost Structure: Trading costs feature competitive spreads starting from 0 pips with 0% commission fees on certain account types. This pricing structure positions Tradeview Markets competitively within the retail forex market, particularly appealing to high-frequency traders and scalpers who prioritize low transaction costs.

Leverage Options: Maximum leverage reaches up to 1:500, providing significant buying power for traders. However, leverage availability may vary based on account type, trading instrument, and regulatory requirements in the trader's jurisdiction.

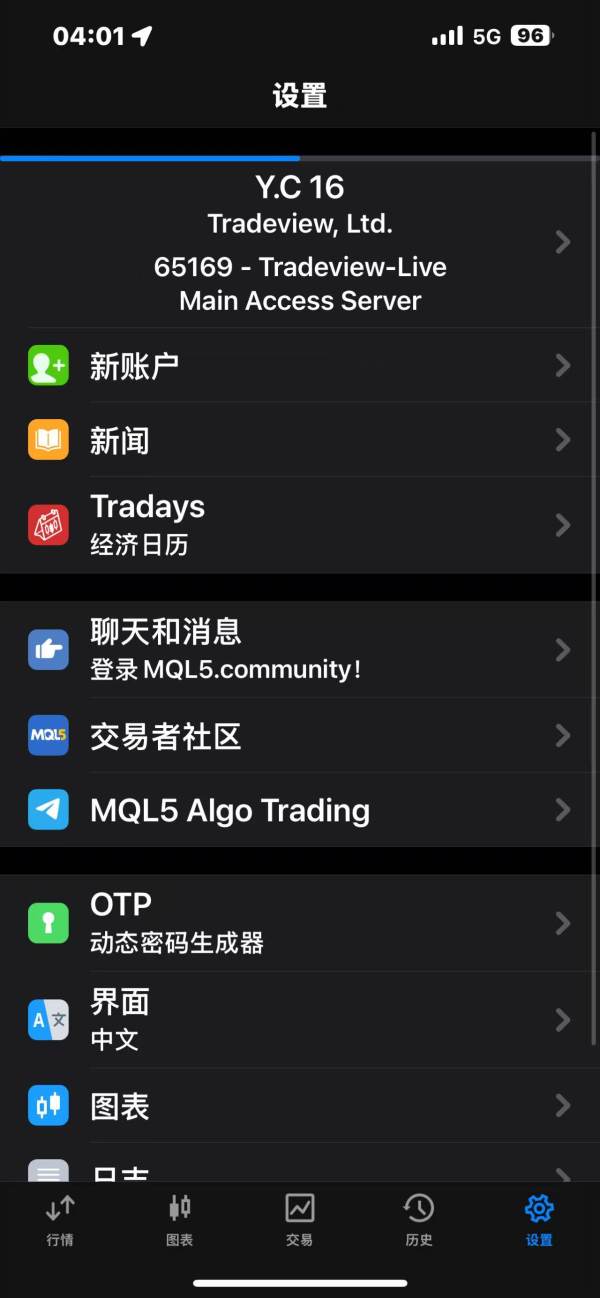

Platform Selection: The broker supports three major trading platforms: MetaTrader 4, MetaTrader 5, and cTrader. This selection covers the preferences of most retail traders while providing access to advanced charting tools, automated trading capabilities, and comprehensive market analysis features.

Geographic Restrictions: Specific geographic limitations were not detailed in available documentation and should be confirmed based on individual circumstances.

Customer Service Languages: The range of supported languages for customer service was not specified in available materials.

Detailed Rating Analysis

Account Conditions Analysis (8/10)

Tradeview Markets demonstrates strong performance in account conditions by offering flexible options that cater to different trading styles and experience levels. The broker provides both commission-free accounts and ECN accounts, allowing traders to select the pricing model that aligns with their trading frequency and strategy. The commission-free accounts appeal to casual traders and those who prefer predictable costs, while ECN accounts serve active traders seeking direct market access and potentially tighter spreads.

The minimum deposit requirement of $100 USD represents a reasonable entry point that balances accessibility with serious trading intent. This threshold is competitive within the retail forex market and allows new traders to begin with manageable capital while still accessing professional-grade trading conditions. The account opening process, while not detailed in available documentation, appears streamlined based on user feedback patterns.

Account holders benefit from access to multiple trading platforms and the full range of available instruments regardless of account type. The broker also offers Islamic accounts, accommodating traders who require Sharia-compliant trading conditions. However, specific details about account tiers, VIP programs, or graduated benefits based on deposit levels were not clearly outlined in available information.

This tradeview markets review notes that the broker's account structure emphasizes simplicity and accessibility rather than complex tiered systems. While this approach benefits most traders, some may prefer more sophisticated account hierarchies with progressive benefits and exclusive features for larger deposits.

The platform excels in providing comprehensive trading tools and resources, with over 1,000 trading instruments representing one of the most extensive selections in the retail forex market. This broad instrument coverage spans major currency pairs, exotic currencies, precious metals, energy commodities, and various CFD products across global markets. Such diversity enables traders to implement sophisticated portfolio strategies and capitalize on opportunities across multiple asset classes.

Tradeview Markets supports automated trading through Expert Advisors and signal services, catering to algorithmic traders and those who prefer systematic trading approaches. The platform's compatibility with MetaTrader 4, MetaTrader 5, and cTrader ensures access to robust charting packages, technical indicators, and analytical tools that professional traders demand. Each platform offers unique advantages, with MT4 providing widespread compatibility, MT5 offering advanced features and additional asset classes, and cTrader delivering superior user interface design and order management capabilities.

The broker's technological infrastructure supports high-frequency trading with execution speeds of less than 1 millisecond, enabling scalping strategies and latency-sensitive trading approaches. However, specific information about research resources, market analysis, educational materials, and trading signals was not detailed in available documentation. This represents a potential gap for traders who rely heavily on broker-provided research and educational content to inform their trading decisions.

Customer Service and Support Analysis (8/10)

Customer service represents a notable strength for Tradeview Markets, with user feedback on Trustpilot and other review platforms consistently highlighting positive experiences with the support team. Traders frequently praise the responsiveness, professionalism, and problem-solving capabilities of customer service representatives. The support team demonstrates technical competence in addressing platform-related issues and account management queries.

The broker provides multiple communication channels including telephone support, email correspondence, and online chat functionality. This multi-channel approach ensures traders can reach support through their preferred communication method and receive assistance during critical trading situations. Response times appear competitive based on user feedback, though specific service level agreements and guaranteed response timeframes were not detailed in available documentation.

User testimonials indicate that support staff possess strong technical knowledge and can effectively assist with platform navigation, account setup, and trading-related questions. The quality of support appears consistent across different communication channels, suggesting comprehensive staff training and standardized service protocols. However, information about 24/7 availability, multilingual support capabilities, and dedicated account management for higher-tier clients was not specified in available materials.

The positive customer service reputation contributes significantly to overall user satisfaction and helps differentiate Tradeview Markets in a competitive broker landscape where support quality often varies significantly between providers.

Trading Experience Analysis (8/10)

The trading experience with Tradeview Markets centers on fast execution speeds and stable platform performance. With execution times of less than 1 millisecond, the broker demonstrates strong technological infrastructure that supports various trading styles including scalping and high-frequency strategies. This performance level meets the expectations of professional traders who require minimal latency and reliable order processing.

Platform stability appears robust based on user feedback, with traders reporting consistent access to markets and minimal technical disruptions. The availability of three major trading platforms provides flexibility for traders with different preferences and technical requirements. MetaTrader platforms offer familiar interfaces for experienced forex traders, while cTrader provides advanced features for those seeking more sophisticated order management and charting capabilities.

The broker's spread competitiveness, starting from 0 pips, creates favorable trading conditions particularly for short-term strategies and high-volume trading. Combined with zero commission fees on certain account types, the cost structure supports active trading approaches. However, specific information about slippage rates, requote frequency, and order rejection rates was not available in the documentation reviewed.

This tradeview markets review finds that the overall trading environment supports both manual and automated trading strategies effectively. The platform's support for Expert Advisors and algorithmic trading systems expands opportunities for systematic trading approaches, while the multiple platform options accommodate different user preferences and technical requirements.

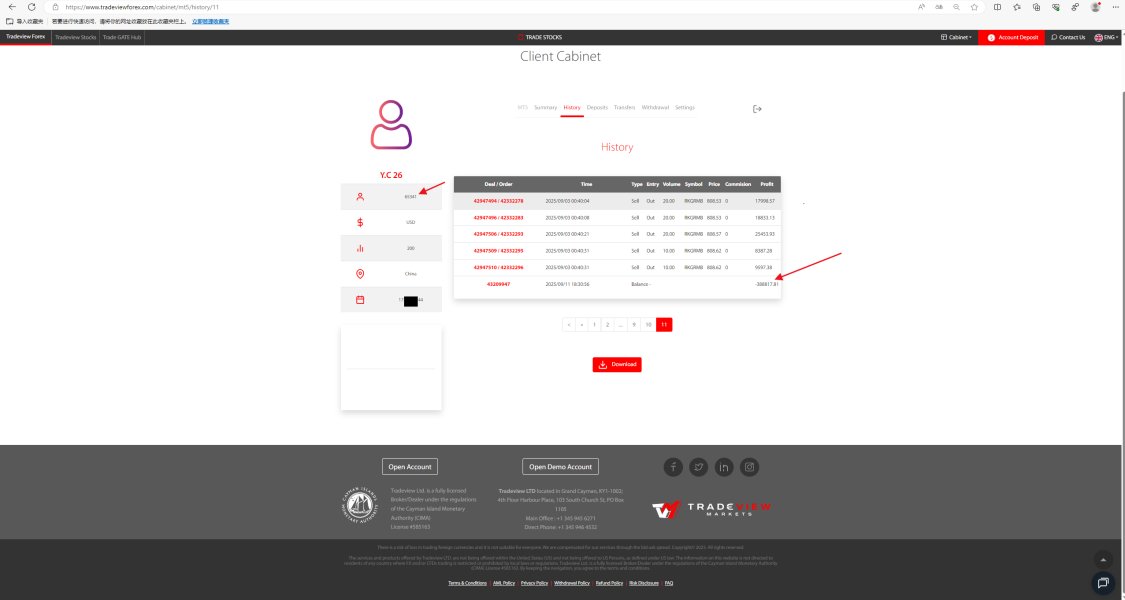

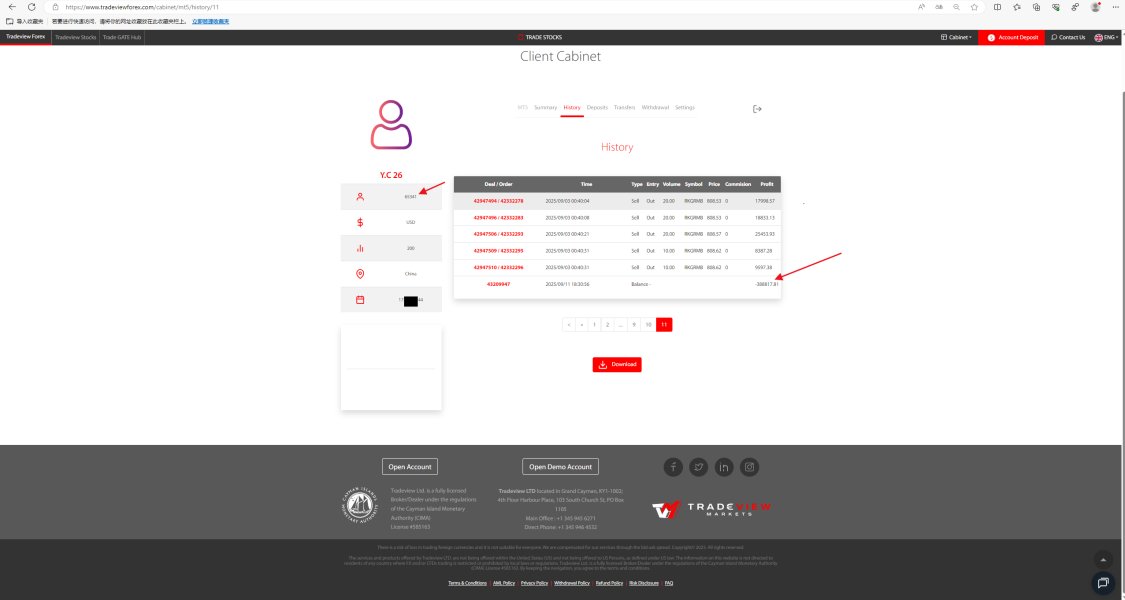

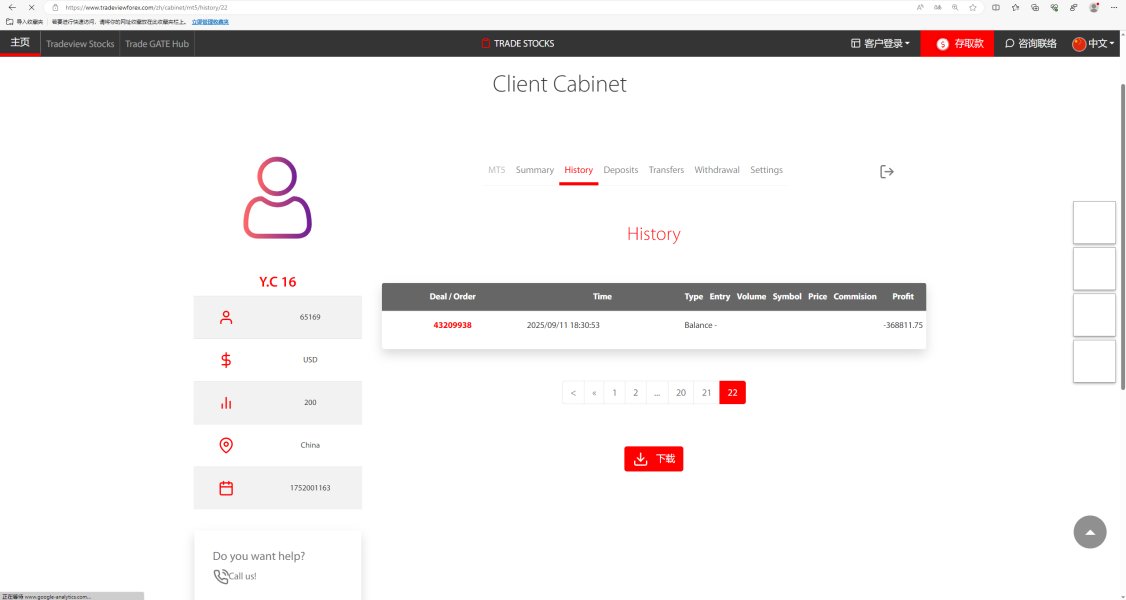

Trust and Safety Analysis (6/10)

Trust and safety represent areas where Tradeview Markets shows mixed results. While the broker has maintained operations since 2004, demonstrating longevity in a competitive market, specific regulatory information and licensing details were not clearly presented in available documentation. This lack of transparency regarding regulatory oversight creates uncertainty about investor protection measures and dispute resolution mechanisms.

The safety rating of 7/10 suggests moderate confidence levels, though this assessment would benefit from more detailed regulatory disclosure. Established brokers typically provide clear information about their regulatory status, segregated client fund arrangements, and investor compensation schemes. The absence of such details in readily available documentation raises questions about transparency standards.

The broker's long operational history provides some reassurance about business stability and market presence. Companies that survive nearly two decades in the competitive forex market typically demonstrate sound business practices and adequate risk management. However, longevity alone does not substitute for comprehensive regulatory oversight and transparent business practices.

User feedback does not indicate significant concerns about fund safety or withdrawal issues, suggesting that day-to-day operations meet basic security expectations. Nevertheless, the lack of detailed regulatory information limits the ability to fully assess investor protection measures and recommend the broker for risk-averse traders who prioritize maximum regulatory oversight.

User Experience Analysis (8/10)

Overall user experience with Tradeview Markets receives positive feedback from the trading community. Users consistently praise the support team's professionalism and effectiveness in resolving issues. The combination of competitive trading conditions, multiple platform options, and responsive customer service creates a generally satisfactory user experience for most trader profiles.

The platform's interface design and usability benefit from offering established trading platforms rather than proprietary solutions. MetaTrader and cTrader platforms provide familiar environments for experienced traders while offering sufficient functionality for newcomers to develop their skills. This approach reduces learning curves and technical adoption barriers.

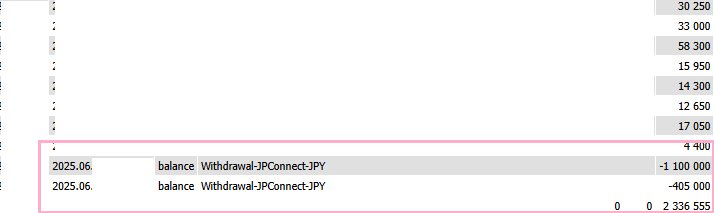

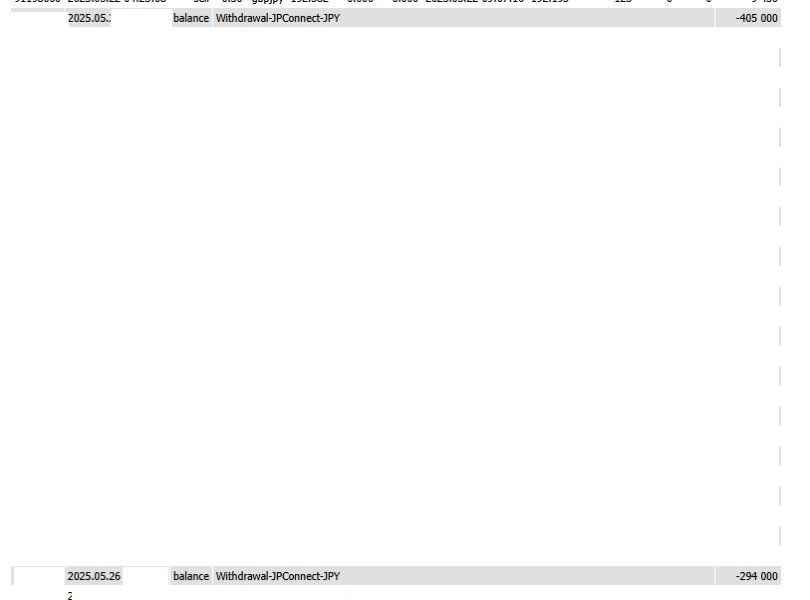

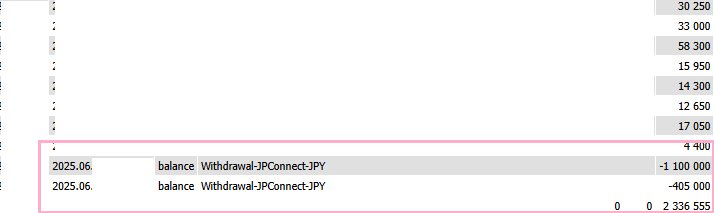

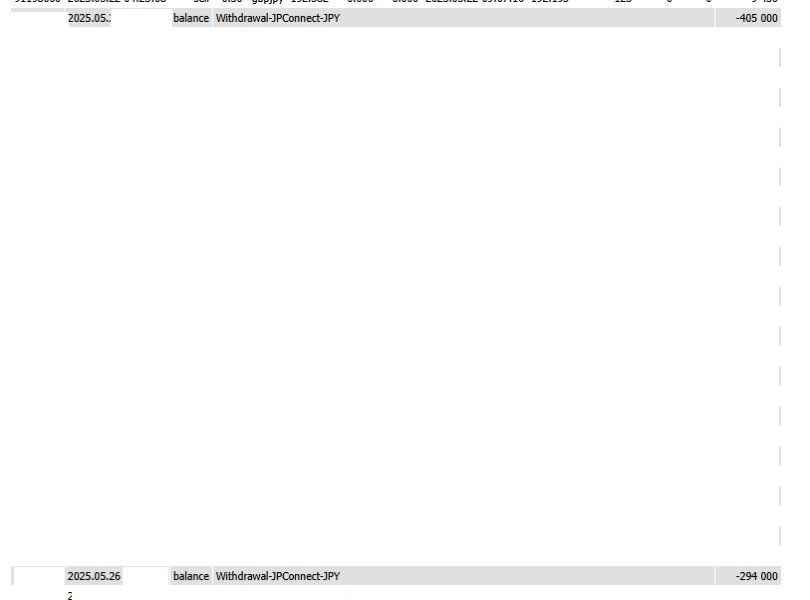

The variety of deposit and withdrawal methods accommodates users from different geographic regions and with varying payment preferences. The inclusion of cryptocurrency options reflects modern payment trends and appeals to tech-savvy traders. However, specific processing times, fees, and minimum withdrawal amounts were not detailed in available documentation.

User feedback suggests that the registration and account verification processes are reasonably straightforward, though specific timelines and documentation requirements were not outlined. The $100 minimum deposit threshold strikes an appropriate balance between accessibility and serious trading intent, making the platform approachable for retail traders while maintaining professional standards.

Areas for potential improvement include enhanced educational resources, more detailed regulatory disclosure, and expanded research offerings to support trader development and decision-making processes.

Conclusion

This tradeview markets review reveals a broker that offers competitive trading conditions and solid customer service while showing areas for improvement in regulatory transparency. Tradeview Markets appeals primarily to cost-conscious traders seeking low spreads, zero commissions, and access to professional trading platforms. The extensive instrument selection and fast execution speeds support various trading strategies effectively.

The broker best serves retail investors who prioritize competitive pricing and responsive customer support over maximum regulatory oversight. Active traders and those employing automated strategies will find the platform's technological capabilities and cost structure particularly attractive. However, risk-averse traders who prioritize comprehensive regulatory protection may prefer brokers with more transparent regulatory disclosure.

Strengths include competitive cost structures, extensive instrument selection, fast execution speeds, and positive customer service feedback. Weaknesses center on limited regulatory transparency and insufficient educational resources. Overall, Tradeview Markets represents a solid choice for experienced traders who value cost efficiency and platform performance over extensive research and educational support.