Is Paramount Markets safe?

Pros

Cons

Is Paramount Safe or a Scam?

Introduction

In the ever-evolving landscape of the foreign exchange (forex) market, brokers play a pivotal role in facilitating trades and providing necessary tools for traders. Paramount, a broker that has garnered attention in recent years, positions itself as a key player in this space. However, as the forex market is rife with both reputable and dubious entities, it is crucial for traders to meticulously evaluate the safety and legitimacy of any broker they consider working with. This article aims to investigate whether Paramount is a safe option for traders or if it operates as a scam. Our analysis will be grounded in a thorough examination of regulatory compliance, company background, trading conditions, customer experiences, and risk assessments, using information gathered from reputable financial sources and regulatory bodies.

Regulation and Legitimacy

The regulatory status of a forex broker is paramount in determining its trustworthiness. A well-regulated broker is more likely to adhere to strict operational standards, ensuring the safety of client funds and fair trading practices. In the case of Paramount, it has been identified that the broker lacks regulation by any top-tier financial authority. This absence of oversight raises significant concerns regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulatory oversight means that Paramount does not have to comply with stringent requirements that protect traders, such as maintaining segregated accounts or providing compensation schemes in the event of insolvency. Moreover, brokers operating without regulation often lack transparency, making it difficult for traders to seek recourse in disputes. The historical compliance of Paramount is also questionable, as it has not demonstrated a commitment to regulatory norms, further amplifying concerns about its operational integrity.

Company Background Investigation

Understanding the background of a broker is essential in assessing its reliability. Paramount claims to have been established in the United Arab Emirates, yet specific details about its ownership and management structure remain elusive. This lack of transparency can be alarming for potential clients, as it raises questions about accountability and operational practices.

The management team‘s professional experience is another crucial factor. A broker led by seasoned professionals with a strong track record in finance and trading is typically more trustworthy. Unfortunately, Paramount does not provide substantial information about its team, which could indicate a lack of expertise in managing a forex brokerage. Furthermore, the company’s information disclosure level appears to be insufficient, making it challenging for traders to make informed decisions based on comprehensive data.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer can significantly impact a trader's experience. Paramount presents itself with competitive features, yet there are notable concerns regarding its fee structure and trading costs.

| Fee Type | Paramount | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (1.6 pips) | 1.0 - 1.5 pips |

| Commission Model | Varies by account | Generally low or none |

| Overnight Interest Range | High | Variable |

While Paramount advertises a minimum spread of 1.6 pips on major currency pairs, this is higher than the industry average, indicating that traders may incur additional costs when trading with this broker. Furthermore, the commission structure is unclear, which could lead to unexpected charges. High overnight interest rates can also deter traders, especially those who engage in long-term positions. These factors collectively suggest that the trading conditions at Paramount may not be as favorable as they seem, raising further questions about its overall reliability.

Customer Funds Security

The safety of customer funds is of utmost importance in the forex trading environment. Paramount has been criticized for its lack of adequate security measures to protect client deposits.

The absence of segregated accounts means that client funds may not be kept separate from the broker's operational funds, increasing the risk of loss in the event of financial difficulties. Furthermore, Paramount does not offer any investor protection schemes, leaving clients vulnerable should the broker become insolvent.

Historically, unregulated brokers like Paramount have faced issues related to fund security, including allegations of misappropriation and fraud. Therefore, potential clients should exercise extreme caution when considering this broker, as the risks associated with fund safety are significantly elevated.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability and service quality. An analysis of user experiences with Paramount reveals a mixed bag of reviews, with a notable number of complaints regarding withdrawal delays and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Often delayed |

| Customer Support | Medium | Poor response time |

Common complaints include difficulties in processing withdrawals, which is a significant red flag for any broker. Users have reported waiting weeks or even months to access their funds, leading to frustration and financial strain. Additionally, the quality of customer support has been criticized, with many clients experiencing long wait times or inadequate assistance.

These issues highlight a concerning trend that suggests Paramount may not prioritize customer satisfaction or operational transparency, further reinforcing the notion that traders should be wary of engaging with this broker.

Platform and Trade Execution

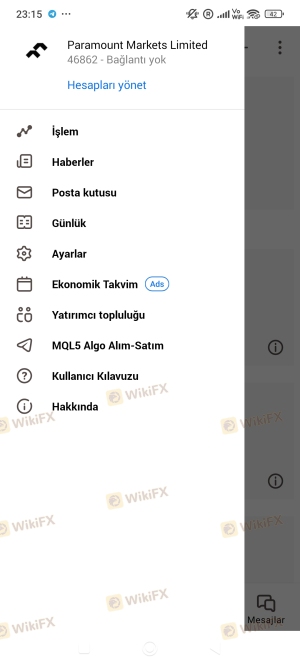

A broker's trading platform is crucial for the trading experience, impacting execution speed, reliability, and overall user satisfaction. Paramount claims to offer a robust trading platform; however, user reviews indicate mixed experiences regarding its performance.

Traders have reported instances of slippage and delays in order execution, which can be detrimental in the fast-paced forex market. Additionally, there are no clear indications of platform manipulation, but the overall reliability of the platform remains uncertain given the lack of transparency surrounding its operational practices.

Risk Assessment

Engaging with Paramount comes with a variety of risks that traders should carefully consider.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases potential for loss. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | Medium | Poor response to client inquiries and complaints. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers with a proven track record of reliability and customer service.

Conclusion and Recommendations

Based on the comprehensive analysis presented, it is evident that Paramount raises several red flags concerning its safety and legitimacy. The absence of regulation, coupled with significant complaints regarding fund security and customer service, suggests that Paramount may not be a trustworthy option for traders.

For those considering entering the forex market, it is advisable to seek out brokers that are well-regulated and have a strong reputation for customer satisfaction. Reputable alternatives include brokers regulated by top-tier authorities such as the FCA or ASIC, which provide a safer trading environment and better protection for client funds. In conclusion, while Paramount may present itself as a viable trading option, the potential risks and lack of transparency warrant serious caution.

Is Paramount Markets a scam, or is it legit?

The latest exposure and evaluation content of Paramount Markets brokers.

Paramount Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Paramount Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.