Is Trader-capital safe?

Pros

Cons

Is Trader Capital A Scam?

Introduction

Trader Capital positions itself as a forex broker in the competitive online trading landscape, aiming to attract traders with promises of high leverage and a variety of trading instruments. However, the increasing prevalence of scams in the forex market necessitates that traders exercise caution and conduct thorough evaluations before committing their funds. In this article, we will investigate the legitimacy of Trader Capital by analyzing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our assessment will rely on a combination of qualitative analysis and quantitative data drawn from various trusted sources.

Regulation and Legitimacy

Regulation is a cornerstone of trust in the forex trading industry, as it provides a framework for accountability and investor protection. Trader Capital claims to operate from the UK but lacks any regulatory license from reputable bodies such as the Financial Conduct Authority (FCA). This absence of oversight raises significant concerns about the safety of funds and the legitimacy of trading practices.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Registered |

The lack of regulation from a recognized authority like the FCA means that Trader Capital does not have to adhere to stringent financial standards, which can protect traders from fraud and mismanagement. Furthermore, the broker's claims about being based in London are contradicted by its unverified status, suggesting that it may be operating from an offshore location, which is often associated with higher risks and less accountability.

Company Background Investigation

Trader Capital's history and ownership structure are shrouded in ambiguity, which is another red flag for potential investors. There is limited publicly available information regarding the company's formation, management team, or operational practices. A transparent broker typically provides clear details about its founders and executive team, including their qualifications and experience in the financial industry. However, the lack of such information raises questions about the company's legitimacy and operational integrity.

Moreover, the absence of a physical address or verifiable contact information further obscures the broker's credibility. Without transparency about the company's ownership and management, it becomes challenging for traders to assess the reliability of Trader Capital, making it imperative to consider the risks of trading with an unverified broker.

Trading Conditions Analysis

Trader Capital presents a variety of trading conditions, but these must be scrutinized for potential pitfalls. The broker offers a minimum deposit requirement of $200 and leverages up to 1:500, which is attractive but often associated with higher risk. The overall cost structure, including spreads and commissions, is essential for traders to understand, as hidden fees can erode profits.

| Fee Type | Trader Capital | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 0.4 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | N/A | 1-2% |

While the spreads offered by Trader Capital appear competitive, the lack of a detailed breakdown of fees and commissions raises concerns about transparency. Additionally, the absence of segregation of client funds and investor protection mechanisms could result in significant financial losses in the event of the broker's insolvency.

Client Fund Security

The safety of client funds is a critical consideration when evaluating any forex broker. Trader Capital does not offer segregated accounts, meaning that client funds may be pooled with the broker's operational funds, increasing the risk of loss. Furthermore, there is no indication of any investor protection policies, such as negative balance protection, which could leave traders vulnerable to significant financial risks.

Historically, unregulated brokers like Trader Capital have faced allegations of misappropriating client funds or failing to honor withdrawal requests. This lack of security measures and the absence of a regulatory framework significantly compromise the safety of funds held with Trader Capital.

Customer Experience and Complaints

Customer feedback is invaluable in assessing the reliability of a broker. Reviews and testimonials about Trader Capital indicate a troubling pattern of complaints, primarily concerning withdrawal difficulties and unresponsive customer service. Many users have reported that after depositing funds, they encountered challenges in accessing their money, raising alarms about the broker's operational integrity.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unresponsive Support | Medium | Poor |

Several clients have shared their experiences of being unable to withdraw funds, with some alleging that their accounts were frozen without explanation. These complaints underscore the importance of due diligence before engaging with Trader Capital, as they reflect a broader trend often seen with unregulated brokers.

Platform and Trade Execution

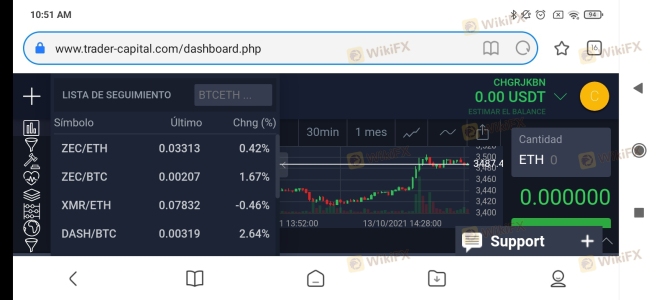

The performance of a trading platform is crucial for a successful trading experience. Trader Capital offers a web-based platform, but user reviews suggest that it may lack the sophistication and reliability expected from established brokers. Issues such as slow execution times, slippage, and occasional downtime have been reported, which can adversely affect trading outcomes.

Furthermore, the absence of advanced trading features and tools raises concerns about the platform's overall functionality. Traders should be wary of platforms that do not provide robust trading capabilities, as they may hinder effective trading strategies.

Risk Assessment

Using Trader Capital involves several inherent risks due to its unregulated status and questionable operational practices. Traders should be aware of the following risk categories:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No oversight from recognized regulatory bodies. |

| Fund Safety Risk | High | Lack of segregation and protection mechanisms. |

| Operational Risk | Medium | Reports of withdrawal issues and poor support. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and avoid investing significant capital with unverified entities like Trader Capital.

Conclusion and Recommendations

In conclusion, Trader Capital raises significant concerns regarding its legitimacy and safety. The absence of regulation, coupled with a lack of transparency and a troubling history of customer complaints, suggests that this broker may not be a safe choice for traders. The risks associated with trading through Trader Capital are considerable, and potential investors should exercise extreme caution.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA, ASIC, or CySEC. These brokers typically offer greater transparency, enhanced fund security, and a more robust trading environment. By prioritizing safety and regulatory compliance, traders can protect their investments and enhance their trading experience.

Is Trader-capital a scam, or is it legit?

The latest exposure and evaluation content of Trader-capital brokers.

Trader-capital Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trader-capital latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.