Is TradeFills safe?

Business

License

Is TradeFills A Scam?

Introduction

TradeFills is a relatively new player in the forex market, having been established in 2022. Based in Saint Vincent and the Grenadines, it positions itself as an online broker offering access to a diverse range of financial instruments, including forex, stocks, commodities, and cryptocurrencies. With promises of high leverage and low minimum deposits, TradeFills aims to attract both novice and experienced traders. However, the influx of unregulated brokers in the forex space raises significant concerns about their legitimacy and safety.

For traders, it is crucial to thoroughly assess any broker before committing funds, as the lack of oversight can lead to potential scams and loss of capital. This article investigates whether TradeFills is a safe option for trading or if it poses significant risks to its clients. We will analyze its regulatory status, company background, trading conditions, customer safety measures, client experiences, platform performance, and associated risks, ultimately providing a comprehensive evaluation of the broker.

Regulation and Legitimacy

TradeFills operates under the jurisdiction of Saint Vincent and the Grenadines, which is known for its lenient regulatory environment. It is registered with the Saint Vincent and the Grenadines Financial Services Authority (SVG FSA), but it lacks a valid forex trading license. The absence of stringent regulatory oversight raises red flags regarding the safety of funds and the legitimacy of the broker.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| SVG FSA | 26568 BC 2021 | Saint Vincent and the Grenadines | Unregulated |

The quality of regulation is paramount in determining the safety of a broker. Licensed brokers are subject to strict compliance measures, ensuring the protection of client funds and promoting fair trading practices. In contrast, TradeFills status as an unregulated entity means that it operates without accountability, leaving clients vulnerable to potential fraud and mismanagement. Historical compliance issues with offshore brokers like TradeFills further underscore the need for caution when dealing with them.

Company Background Investigation

TradeFills is owned by TradeFills Limited, a company incorporated in Saint Vincent and the Grenadines. The firm claims to offer a range of trading services, but its short history raises concerns about its credibility. A lack of transparency in the companys ownership structure and operational history makes it difficult for potential clients to ascertain its reliability.

The management team behind TradeFills is not prominently featured on its website, which is often a red flag for investors. A strong management team with relevant experience is crucial for a broker‘s success and integrity. Without this information, traders are left to speculate about the qualifications and competence of those running the operations. The company’s overall transparency and information disclosure levels are notably low, further complicating the decision-making process for potential clients.

Trading Conditions Analysis

TradeFills offers competitive trading conditions, including a low minimum deposit requirement of just $5 and leverage of up to 1:1000. However, such high leverage can be a double-edged sword, increasing both potential profits and losses. Understanding the fee structure is essential for evaluating the overall cost of trading with TradeFills.

| Fee Type | TradeFills | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | 1.4 pips | 1.0 - 2.0 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 0-3% | 0-2% |

While the broker claims to offer competitive spreads, the reality is that these rates can vary significantly based on market conditions and account types. Furthermore, the commission structure is not clearly defined, leading to potential unexpected costs for traders. Such ambiguities in pricing can be concerning, especially for those who are new to trading and may not fully understand the implications of these fees.

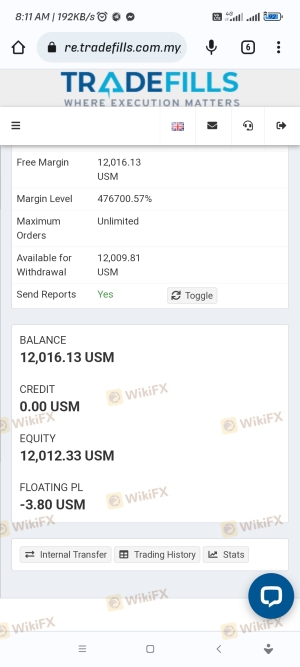

Client Funds Safety

The safety of client funds is a critical aspect of any trading platform. TradeFills claims to implement various security measures, but the lack of regulation raises questions about the effectiveness of these protections. The broker does not provide clear information regarding the segregation of client funds, which is essential for ensuring that traders' capital is protected in the event of financial difficulties faced by the broker.

Additionally, the absence of investor compensation schemes means that clients have no recourse if the broker were to become insolvent. Historical issues with fund safety in unregulated environments further emphasize the risks associated with trading with TradeFills. Clients should be acutely aware of these vulnerabilities and consider whether they are willing to risk their capital with a broker that lacks robust safety measures.

Customer Experience and Complaints

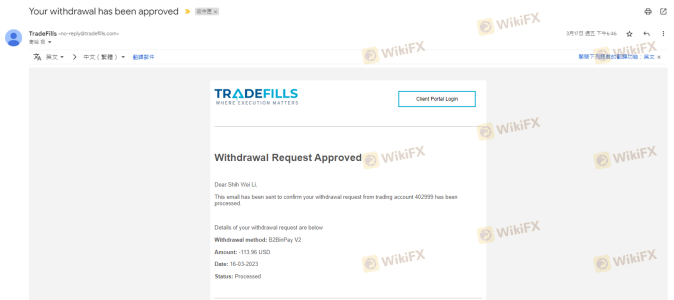

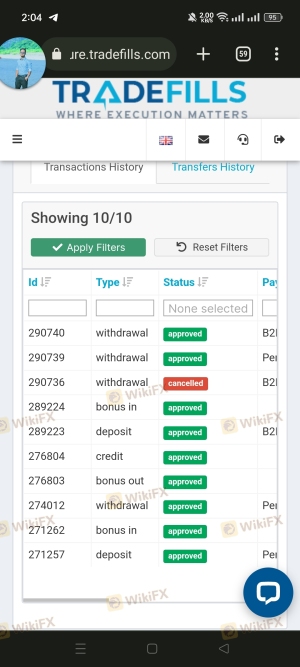

Customer feedback is a vital indicator of a brokers reliability and service quality. Reviews and complaints about TradeFills suggest a pattern of dissatisfaction among clients. Many users report difficulties in withdrawing funds, which is a common complaint associated with unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Delayed or Ignored |

| Customer Service | Medium | Poor Communication |

| Account Closure | High | Unresponsive |

One typical case involved a trader who requested a withdrawal after achieving profits, only to find their account frozen without explanation. Such incidents are alarming and suggest potential fraudulent practices. The overall sentiment among users indicates a lack of trust in the broker, which is a significant concern for anyone considering trading with TradeFills.

Platform and Trade Execution

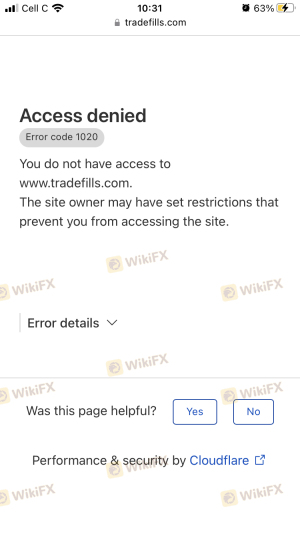

The trading platform offered by TradeFills is MetaTrader 4 (MT4), which is widely recognized for its user-friendly interface and robust features. However, the quality of execution is paramount for a successful trading experience. Reports of slippage, rejected orders, and execution delays have surfaced, raising doubts about the brokers reliability in this regard.

Traders have expressed concerns about the integrity of the trading environment, with some alleging signs of manipulation. Such practices can severely impact a trader's ability to operate effectively, making it crucial to assess the execution quality before committing funds.

Risk Assessment

Trading with TradeFills carries inherent risks due to its unregulated status and the associated concerns highlighted throughout this review. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Lack of oversight raises potential for fraud. |

| Fund Safety Risk | High | Absence of investor protection mechanisms. |

| Withdrawal Risk | High | Complaints about withdrawal issues are prevalent. |

| Execution Risk | Medium | Reports of slippage and order rejections exist. |

To mitigate these risks, traders should conduct thorough research and consider using regulated brokers that provide better security and oversight. Additionally, implementing effective risk management strategies is essential when trading with high leverage.

Conclusion and Recommendations

In conclusion, the evidence suggests that TradeFills is not a safe option for trading. Its unregulated status, lack of transparency, and numerous customer complaints raise significant red flags. While the broker may offer attractive trading conditions, the potential risks associated with trading through an unregulated entity far outweigh the benefits.

For traders seeking a secure trading environment, it is advisable to consider alternatives that are regulated by reputable authorities. Brokers such as IG, OANDA, or Forex.com offer robust regulatory frameworks and better client protection. Always ensure to conduct comprehensive research and choose brokers with a proven track record of safety and reliability to safeguard your investments.

Is TradeFills a scam, or is it legit?

The latest exposure and evaluation content of TradeFills brokers.

TradeFills Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TradeFills latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.