TradeFills 2025 Review: Everything You Need to Know

Executive Summary

TradeFills has become a notable player in the forex brokerage industry. Users consistently praise its fast and fluid trade execution alongside excellent customer service. According to multiple user reviews on Trustpilot, the broker delivers on its core promises of providing a seamless trading experience with competitive conditions.

The broker's key features include leverage up to 1:1000 and spreads starting from zero pips. This makes it particularly attractive to active traders seeking optimal trading conditions. TradeFills offers many account types designed to cater to different trading preferences and risk appetites, while maintaining very thin spreads across its offerings.

This comprehensive tradefills review focuses on traders who prioritize high leverage opportunities and rapid trade execution. The broker's reputation among its user base suggests strong performance in operational efficiency and customer satisfaction. However, potential clients should carefully consider the regulatory framework and their individual trading requirements before making a decision.

Based on available information and user feedback, TradeFills appears well-positioned for traders seeking a reliable broker with competitive trading conditions and responsive customer support.

Important Disclaimer

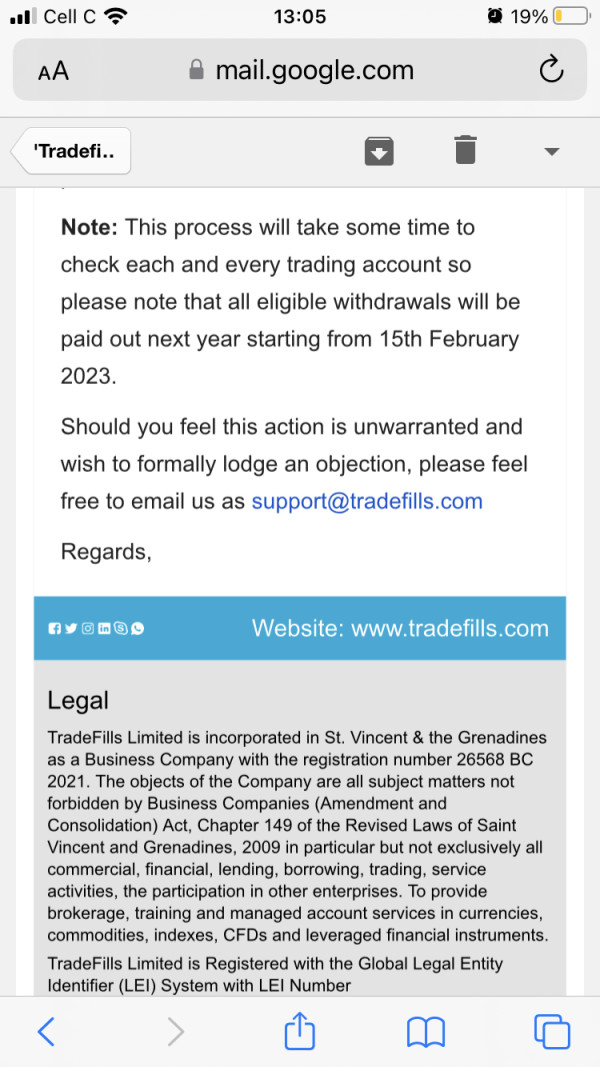

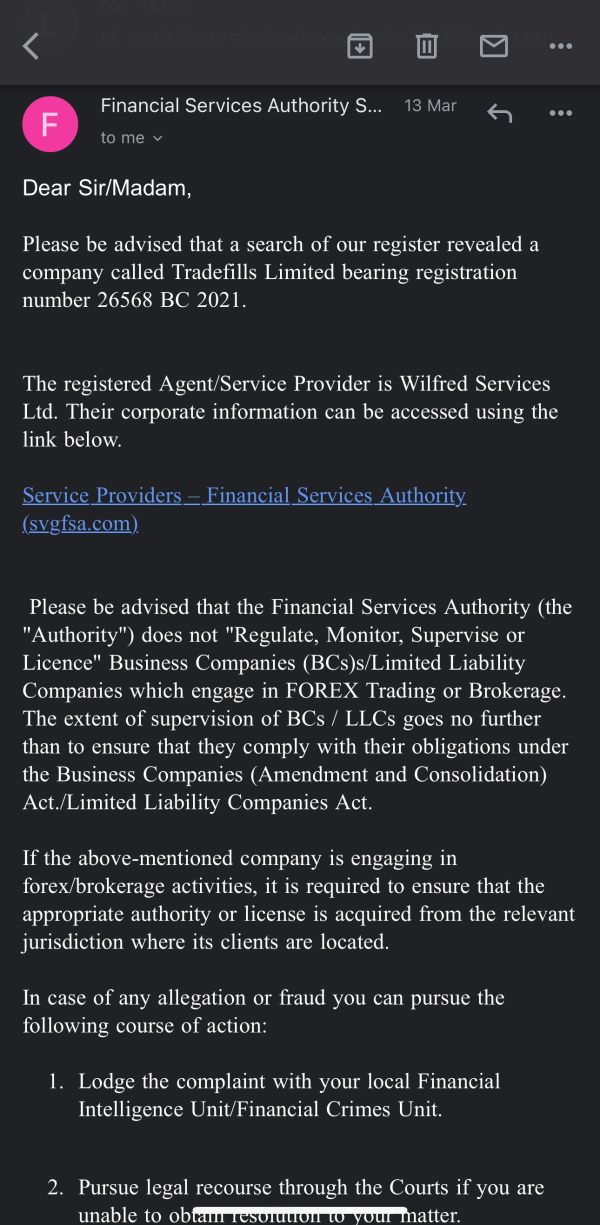

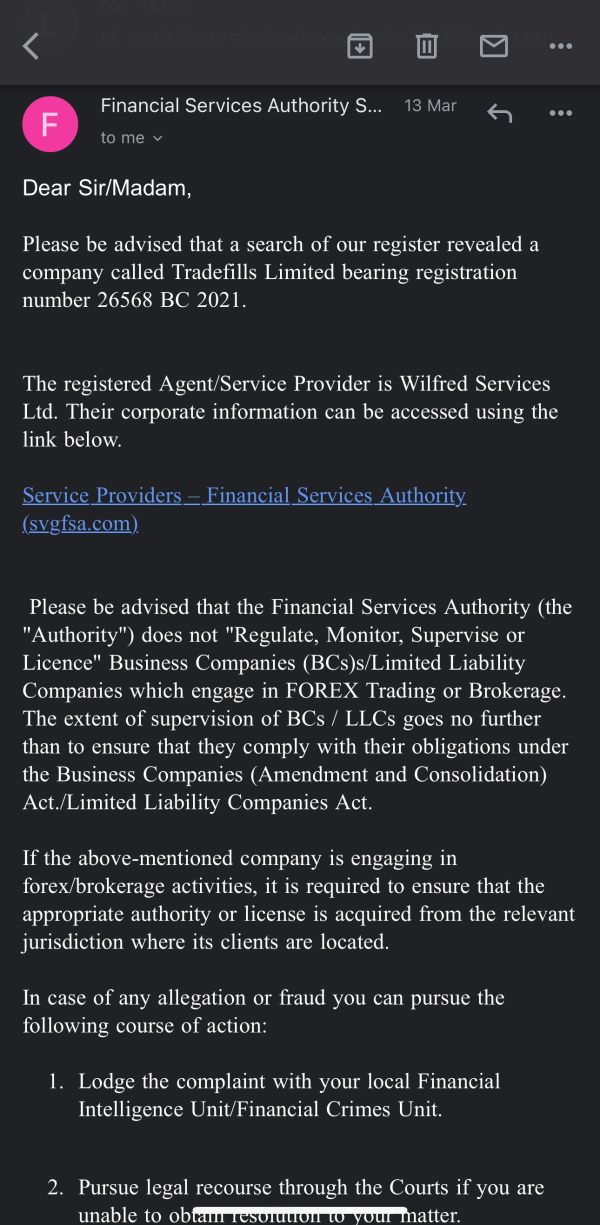

TradeFills operates under registration in Saint Vincent and the Grenadines. This may present varying regulatory standards compared to more established financial jurisdictions. Potential clients should be aware that regulatory oversight in this jurisdiction may differ significantly from major financial centers.

This review is based on publicly available information, user feedback data, and market analysis available at the time of writing. Trading involves substantial risk. Individuals should conduct their own due diligence before engaging with any broker. The information presented here should not be considered as investment advice or a recommendation to trade with any specific broker.

Overall Rating Framework

Broker Overview

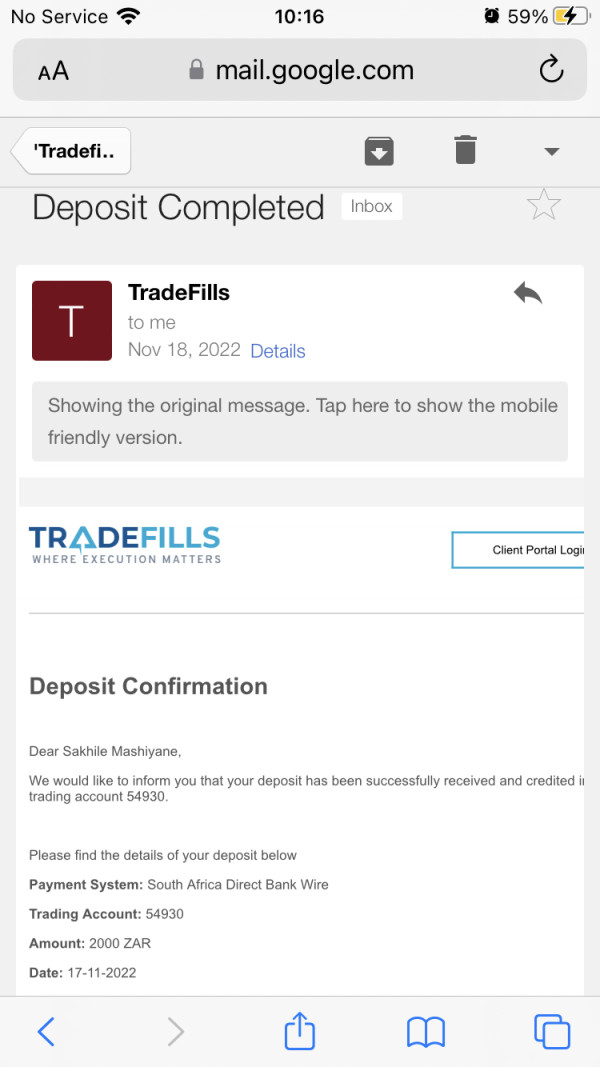

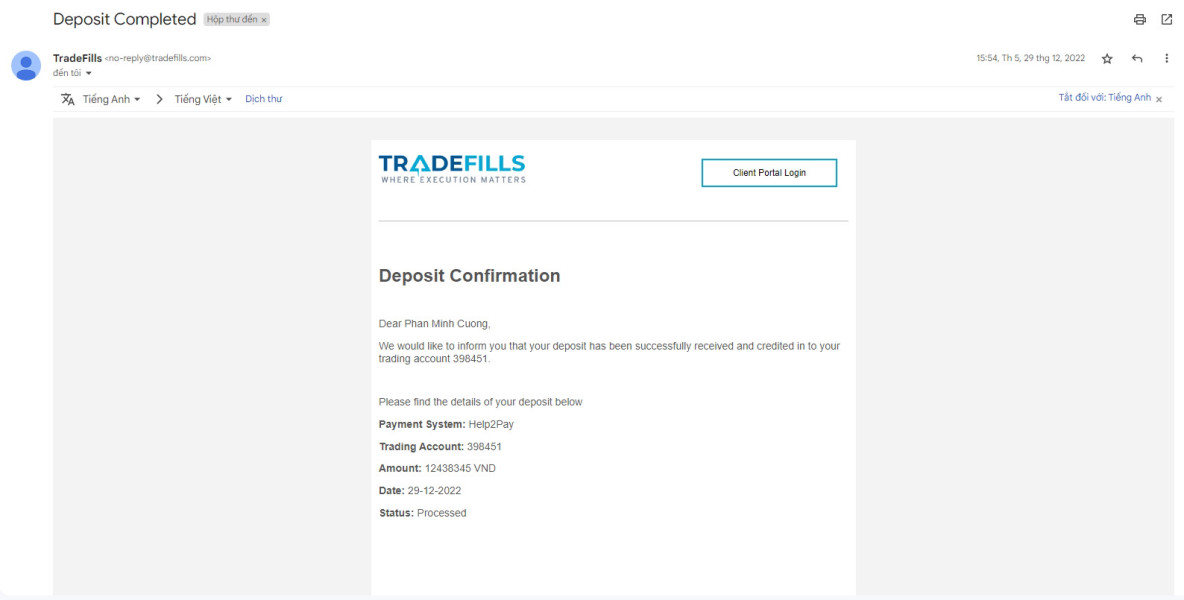

TradeFills emerged in the forex brokerage landscape in 2022. The company positioned itself as an ECN broker dedicated to providing efficient trading services to global traders. The company has built its foundation on delivering competitive trading conditions while maintaining a focus on execution quality and customer satisfaction.

Operating from its registered base in Saint Vincent and the Grenadines, TradeFills has developed a business model centered around providing access to international financial markets through advanced trading technology. The broker's relatively recent establishment in 2022 reflects the evolving nature of the forex industry. New entrants continue to challenge established players through innovative service offerings.

The broker supports both MetaTrader 4 and MetaTrader 5 trading platforms. This enables users to access a comprehensive range of trading instruments including forex pairs, precious metals, stocks, and indices. This diverse asset selection allows traders to implement various strategies and diversification approaches within a single trading account. Due to its registration jurisdiction, specific regulatory oversight details require individual assessment by potential clients. This makes this tradefills review particularly important for understanding the broker's operational framework.

Regulatory Jurisdiction: TradeFills operates under registration in Saint Vincent and the Grenadines. Specific regulatory authority information has not been detailed in available sources. This requires traders to conduct independent verification of oversight mechanisms.

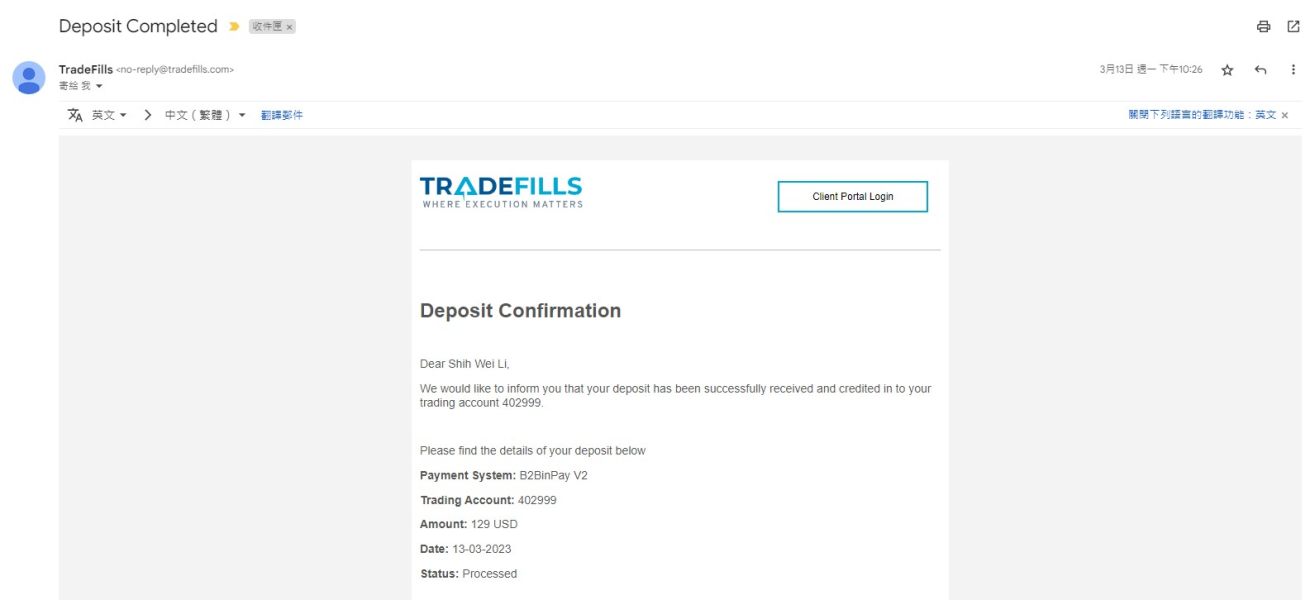

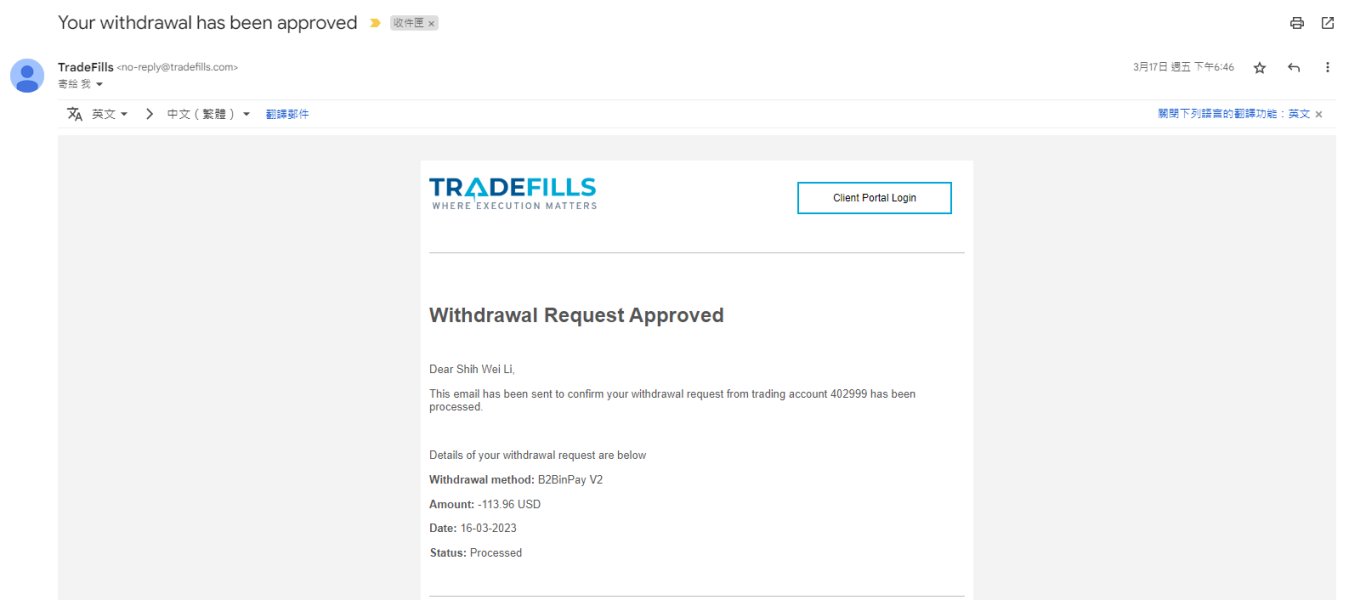

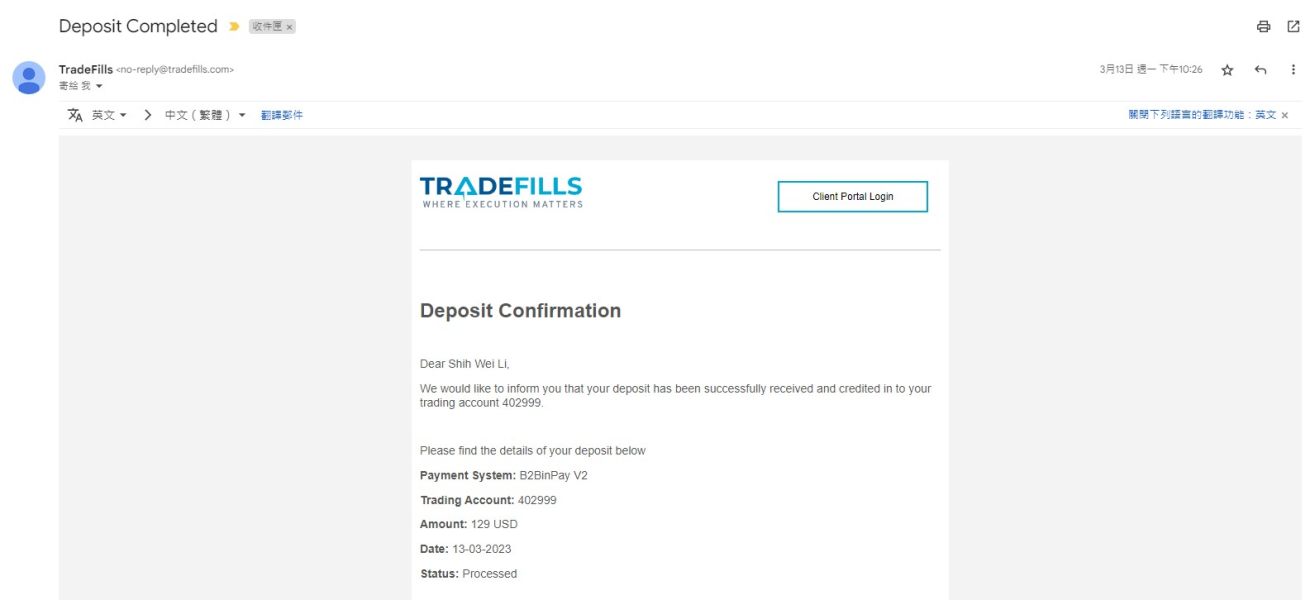

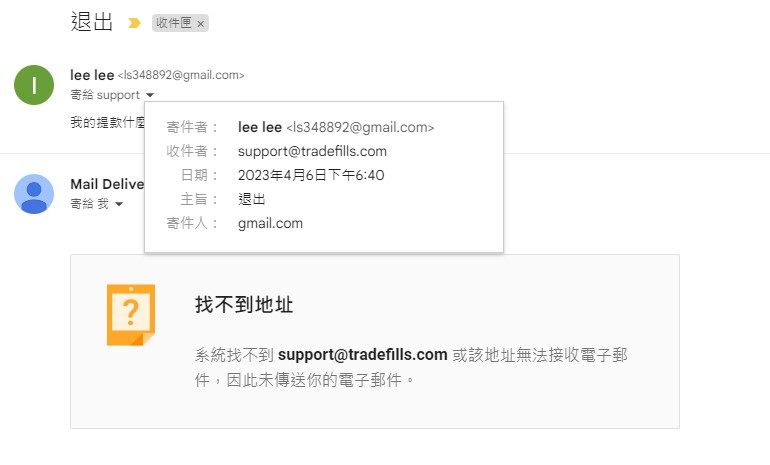

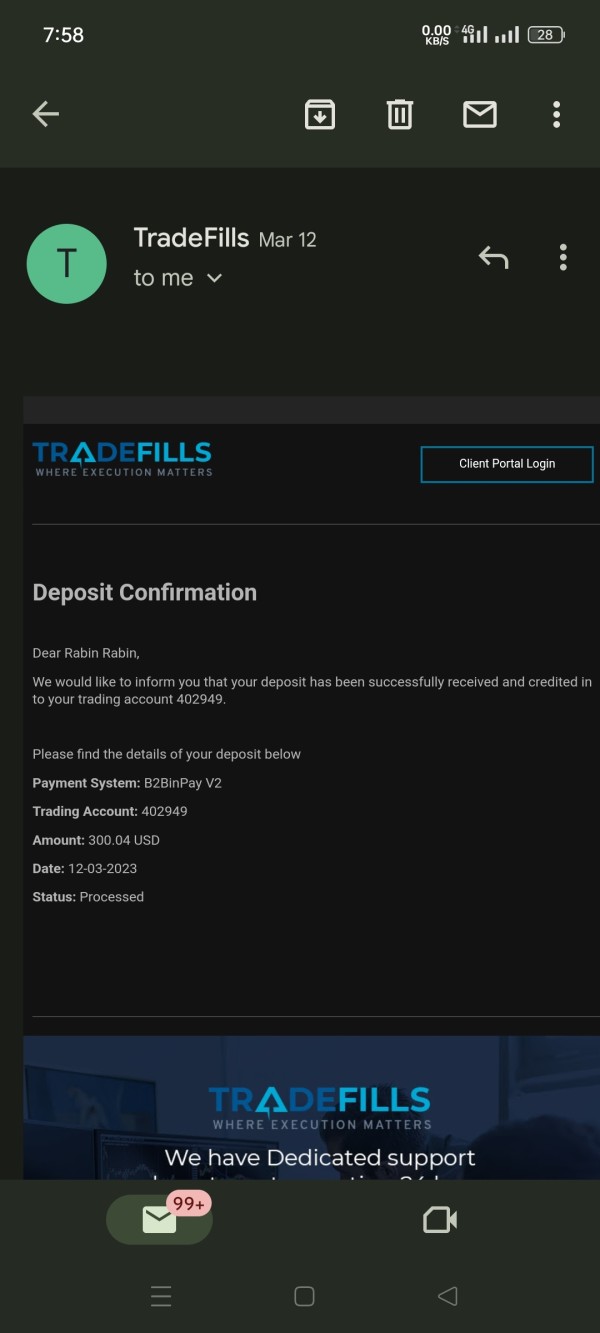

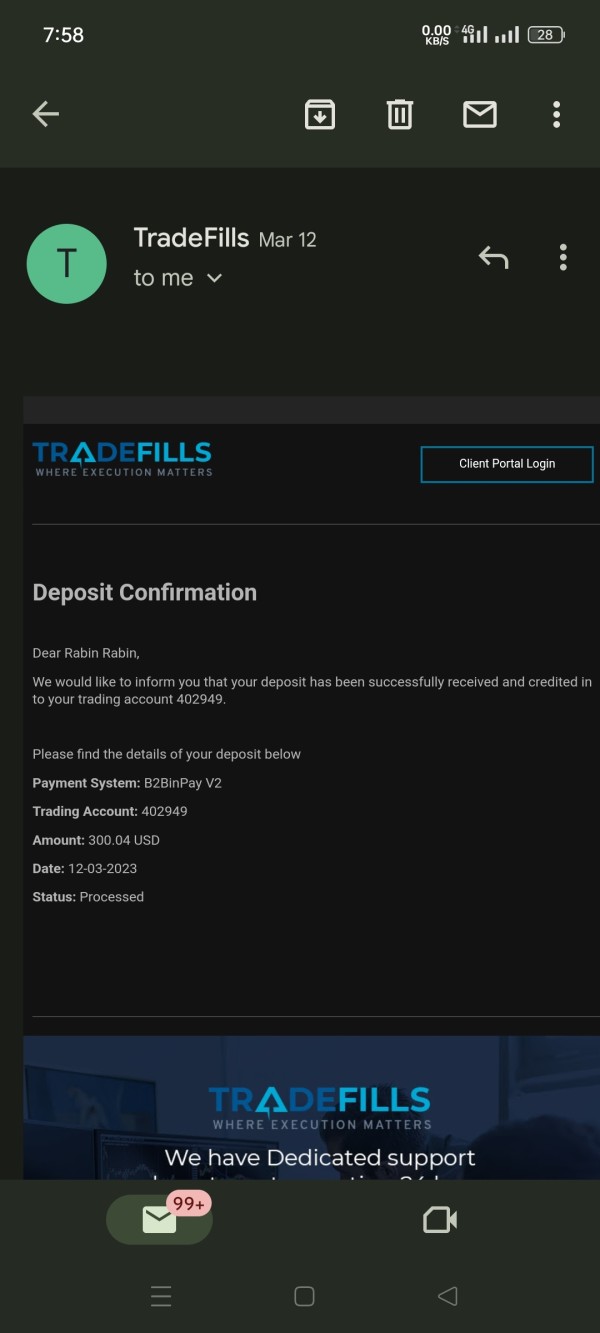

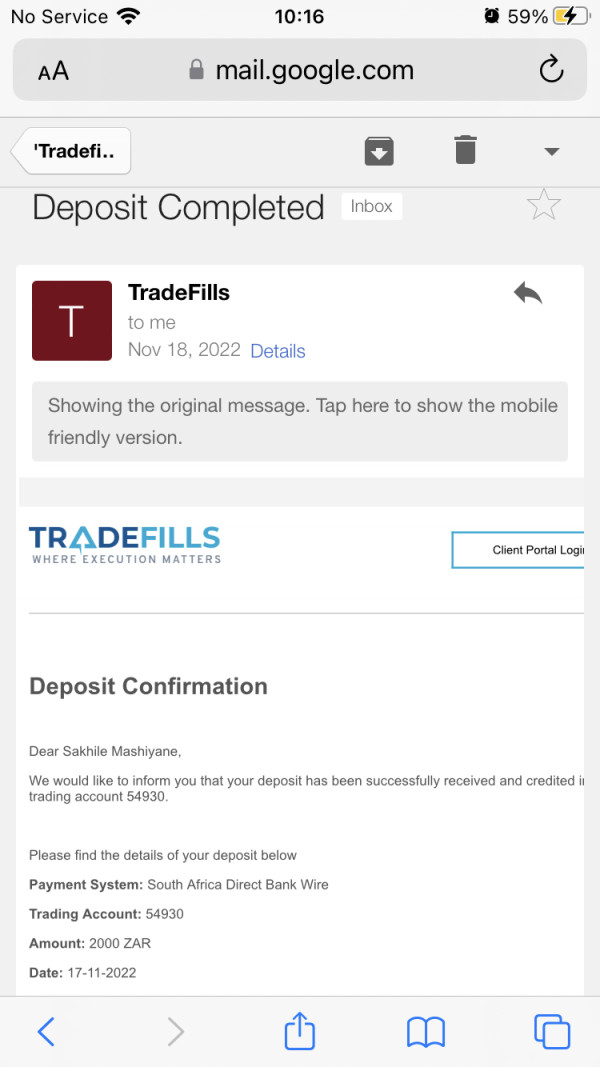

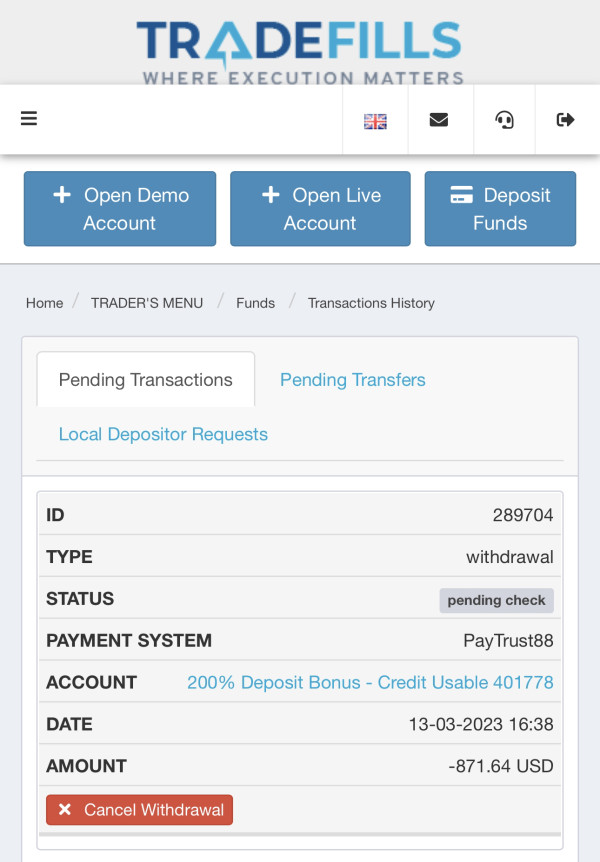

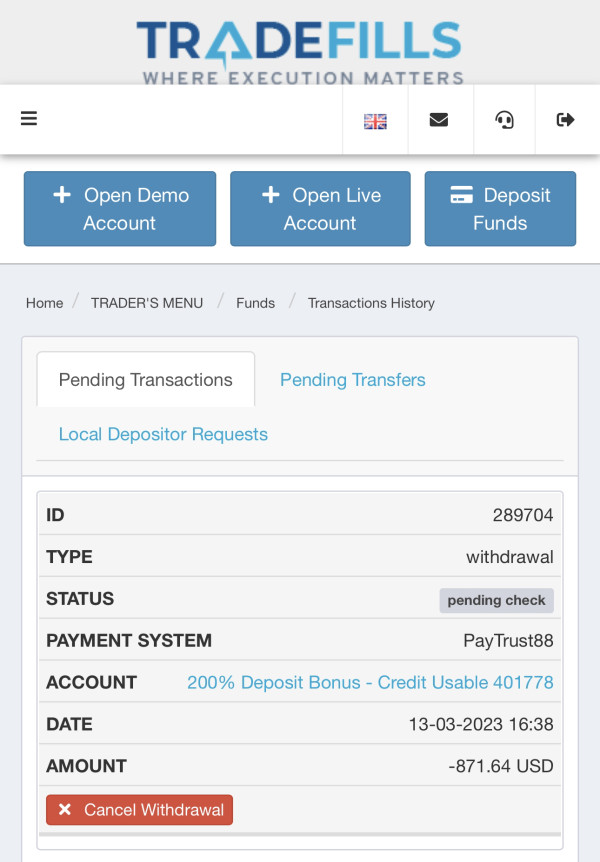

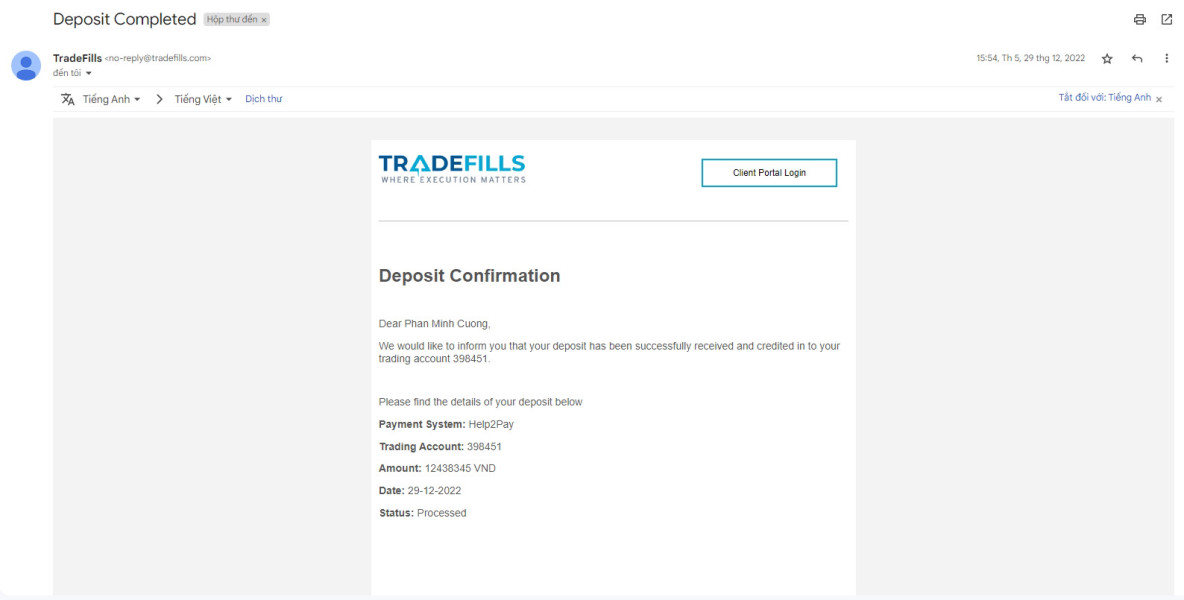

Deposit and Withdrawal Methods: Information regarding specific deposit and withdrawal methods has not been detailed in available materials. This necessitates direct inquiry with the broker for comprehensive payment processing details.

Minimum Deposit Requirements: Minimum deposit requirements have not been specified in available information sources. This suggests potential flexibility in account opening amounts or requiring direct broker consultation.

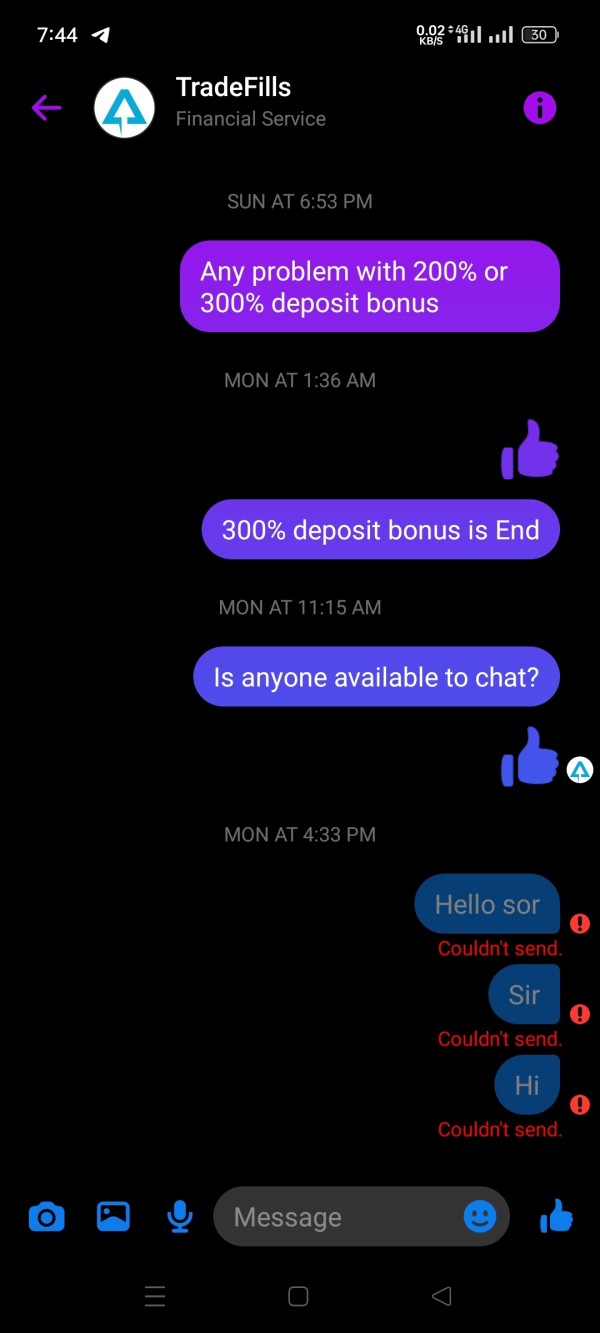

Bonus and Promotional Offers: Current promotional activities and bonus structures have not been detailed in available information. This indicates either absence of such programs or need for direct broker inquiry.

Available Trading Assets: The broker provides access to multiple asset classes including foreign exchange pairs, precious metals, individual stocks, and market indices. This offers traders diversification opportunities across different market sectors.

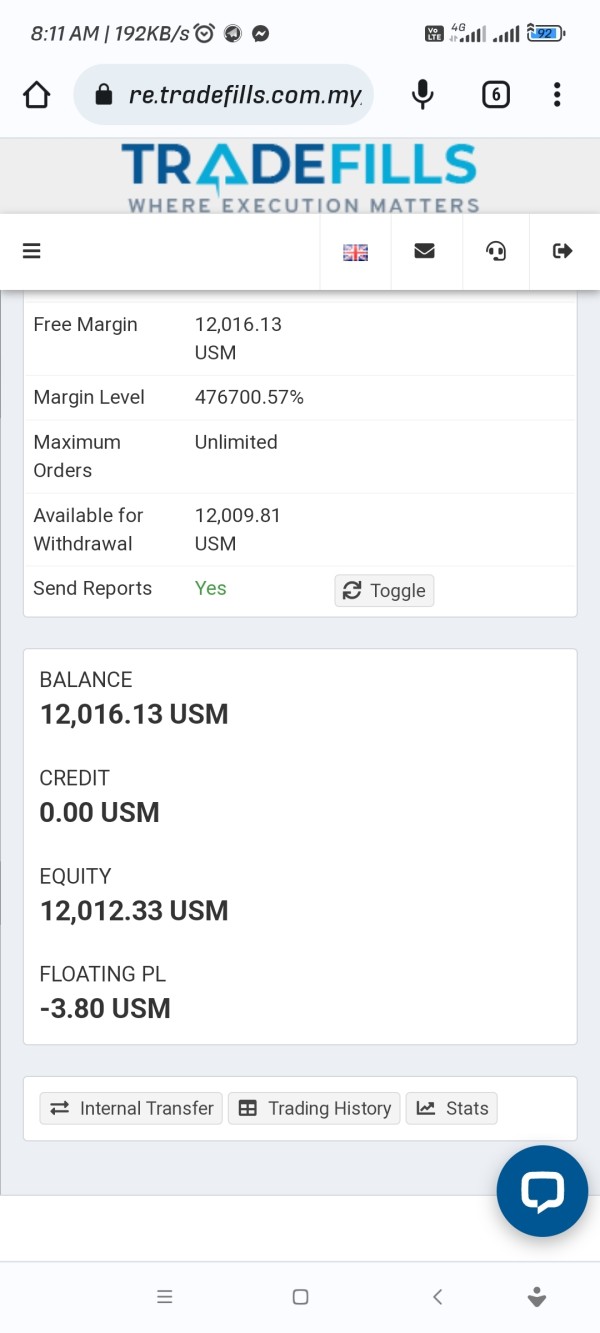

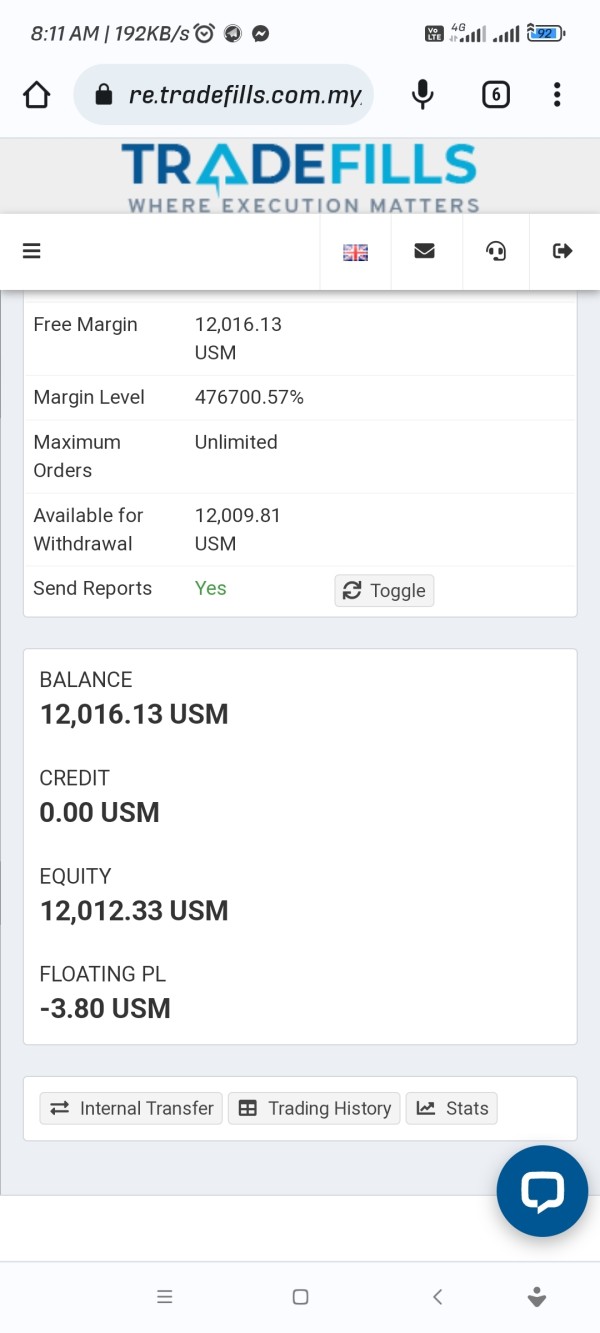

Cost Structure: TradeFills advertises spreads starting from zero pips. However, commission structures and additional trading costs have not been comprehensively detailed. Traders should carefully review complete fee schedules before account activation.

Leverage Ratios: The broker offers leverage up to 1:1000. This caters to traders seeking significant position sizing capabilities relative to account capital.

Platform Options: Clients can choose between MetaTrader 4 and MetaTrader 5 platforms for their trading activities. This provides access to advanced charting and automated trading capabilities.

Geographic Restrictions: Specific geographic limitations or restricted territories have not been detailed in available information sources.

Customer Service Languages: Available customer service language options have not been specified in current information materials.

This tradefills review highlights the importance of direct broker communication for clarifying specific operational details not covered in publicly available materials.

Detailed Rating Analysis

Account Conditions Analysis

TradeFills offers multiple account types designed to accommodate various trading styles and experience levels. However, specific details regarding minimum deposit requirements remain unspecified in available materials. The broker's account structure appears flexible, with users reporting positive experiences regarding account setup and management processes.

The absence of detailed minimum deposit information suggests either competitive entry requirements or customized account opening procedures based on individual circumstances. Users have indicated that the account opening process flows smoothly. They report straightforward verification procedures that don't create unnecessary barriers to market access.

Account functionality appears comprehensive, with users gaining access to the full range of trading instruments and platform features regardless of account type selection. The broker's approach to account conditions emphasizes accessibility while maintaining professional service standards that appeal to both novice and experienced traders.

Special account features and premium service tiers have not been detailed in available information. However, the variety of account types suggests differentiated service levels. This tradefills review indicates that potential clients should engage directly with the broker to understand specific account benefits and requirements that align with their trading objectives and capital allocation plans.

TradeFills provides access to both MetaTrader 4 and MetaTrader 5 platforms. This offers traders comprehensive analytical tools and automated trading capabilities. These industry-standard platforms include extensive charting packages, technical indicators, and expert advisor functionality that supports sophisticated trading strategies.

Users have access to market analysis resources, news feeds, and real-time data streams that enhance decision-making capabilities. The platform integration appears seamless. Traders report reliable access to research materials and market information that supports informed trading decisions.

Educational resource availability has not been specifically detailed in available materials. This suggests that traders may need to supplement platform tools with external educational content. However, the robust nature of MT4 and MT5 platforms provides inherent learning opportunities through their comprehensive feature sets.

Automated trading support enables users to implement algorithmic strategies and utilize signal services effectively. The platform stability and tool accessibility contribute to positive user experiences. Traders appreciate the comprehensive functionality available through these established trading environments.

Customer Service and Support Analysis

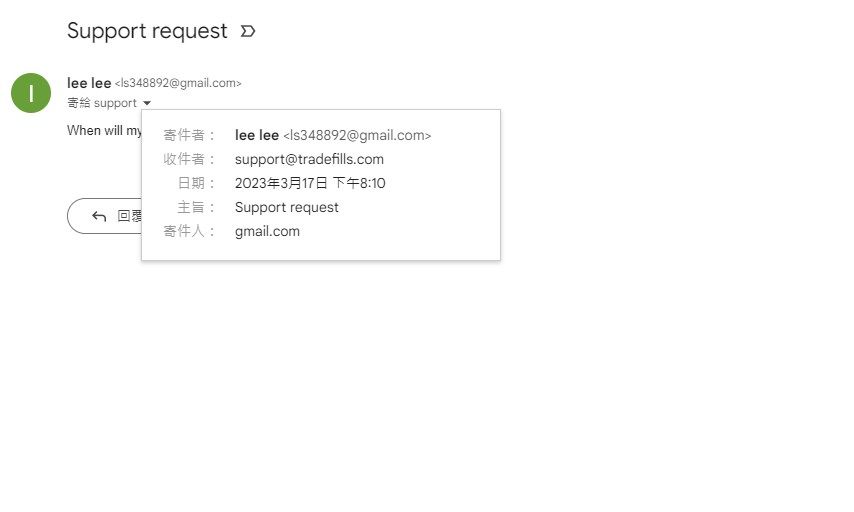

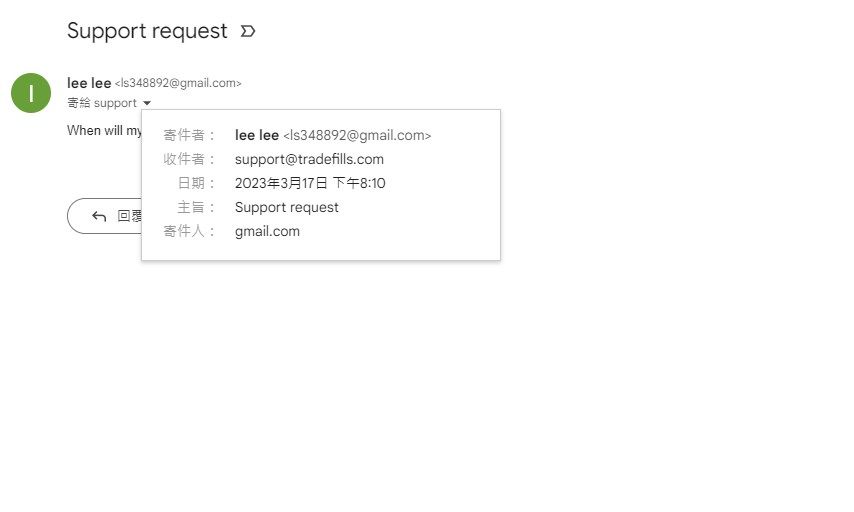

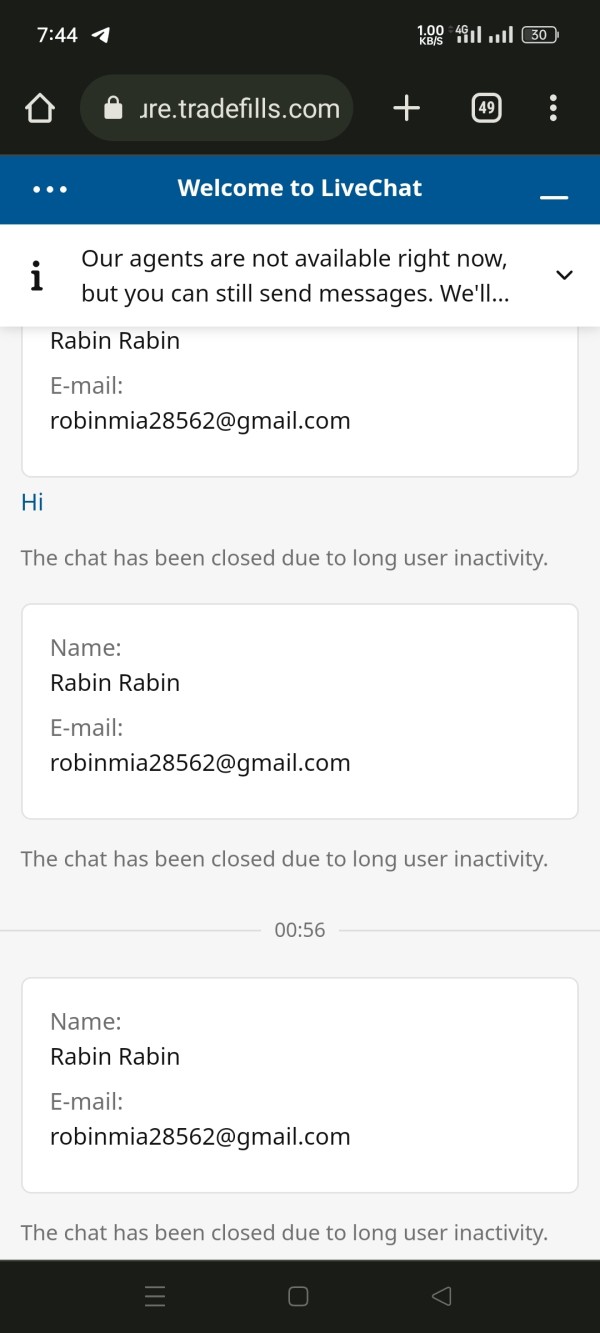

TradeFills has earned strong user praise for customer service quality. Multiple feedback sources highlight responsive support and effective problem resolution. The broker appears to maintain multiple communication channels including phone, email, and live chat options for client assistance.

User feedback consistently emphasizes quick response times and knowledgeable support staff capable of addressing both technical and account-related inquiries. The service quality has contributed significantly to overall user satisfaction. Clients report smooth communication experiences and efficient issue resolution.

Customer satisfaction levels appear consistently high based on available feedback. This suggests well-trained support staff and effective service protocols. The broker's commitment to customer service excellence appears genuine, with users noting the professional and helpful nature of support interactions.

Multilingual support capabilities and specific service hours have not been detailed in available materials. However, the positive user feedback suggests adequate coverage for the broker's client base. The strong customer service performance represents a significant competitive advantage in the broker selection process.

Trading Experience Analysis

User feedback consistently highlights TradeFills' superior trade execution speed and platform reliability. Traders report smooth operation even during volatile market conditions. The technical infrastructure appears robust, supporting consistent order processing without significant slippage or requote issues.

Platform stability receives particular praise from users, who note reliable access and consistent performance across different trading sessions. The execution quality maintains high standards. Users experience minimal technical disruptions that could impact trading outcomes.

The comprehensive functionality of MT4 and MT5 platforms enhances the overall trading experience. This provides access to advanced charting tools, technical indicators, and automated trading capabilities. Users appreciate the familiar interface and extensive customization options available through these established platforms.

Mobile trading experience details have not been specifically addressed in available materials. However, the standard MT4/MT5 mobile applications would provide expected functionality. The positive user feedback regarding overall tradefills review experiences suggests satisfactory access across different devices and trading environments.

Trust and Reliability Analysis

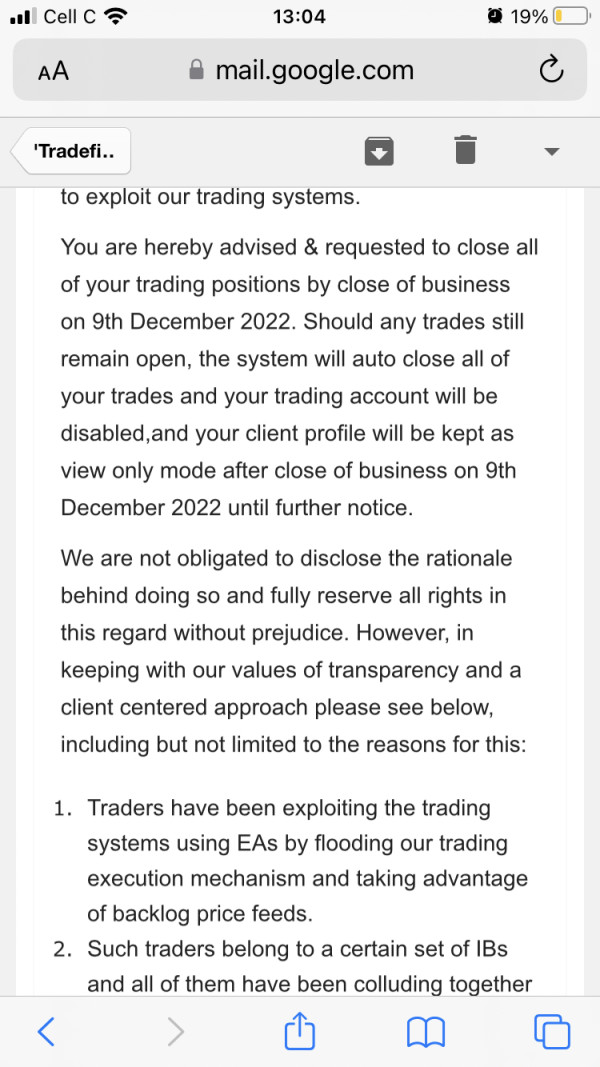

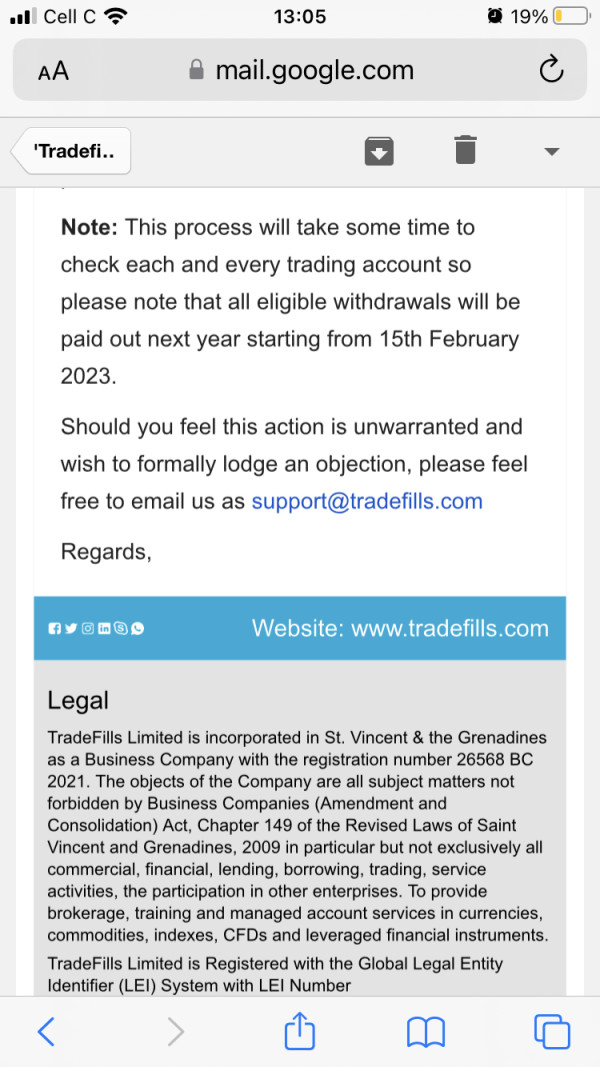

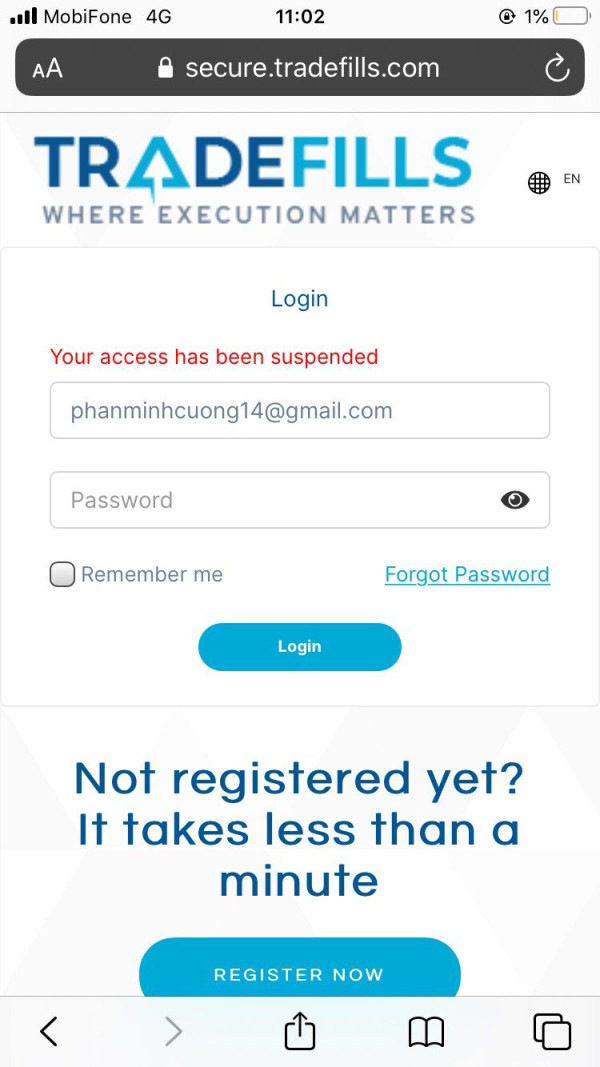

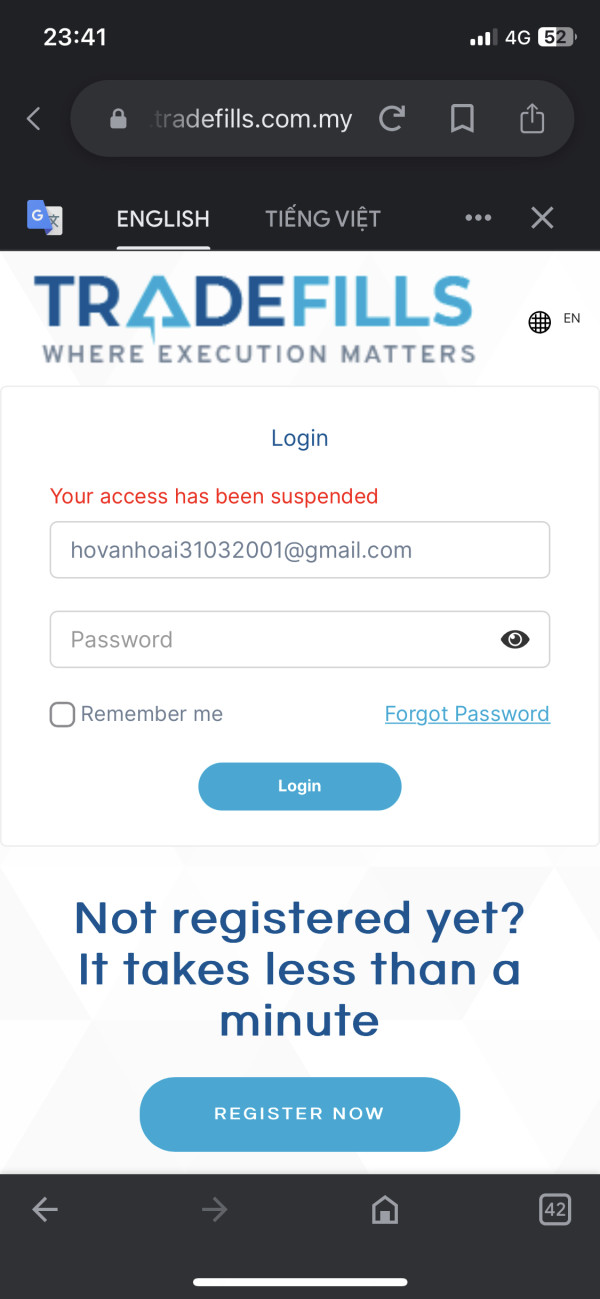

TradeFills operates under registration in Saint Vincent and the Grenadines. This presents considerations regarding regulatory oversight compared to more established financial jurisdictions. The regulatory framework in this jurisdiction may offer less comprehensive investor protection compared to major financial centers.

Fund security measures and client money protection protocols have not been detailed in available information. This requires individual assessment by potential clients. The absence of specific safety mechanism details represents a consideration for traders prioritizing regulatory oversight and fund protection.

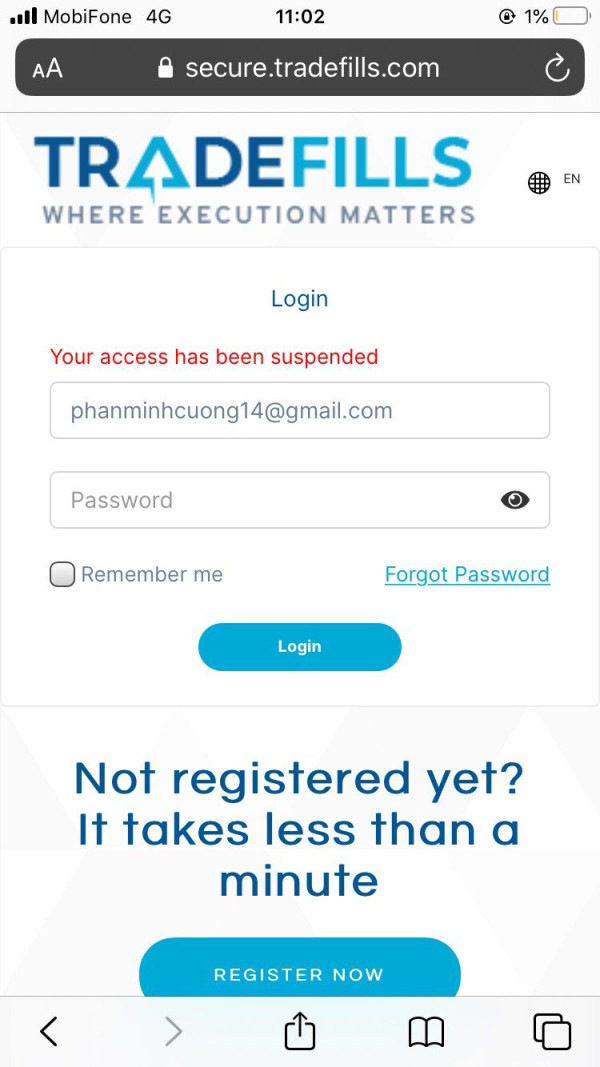

Company transparency regarding operational details remains limited in publicly available materials. This suggests the need for direct engagement to understand business practices and risk management procedures. The relatively recent establishment in 2022 means long-term track record information remains limited.

No significant negative incidents have been reported in available sources. However, the limited operational history means reputation establishment continues to develop. Traders should carefully evaluate regulatory considerations and fund safety measures based on their individual risk tolerance and protection requirements.

User Experience Analysis

Overall user satisfaction appears consistently positive based on available feedback. Traders express general approval of TradeFills' service delivery and operational reliability. The broker has successfully created a user environment that meets expectations for trading functionality and support quality.

Interface design and navigation receive positive user feedback. Traders report intuitive platform operation and straightforward account management processes. The user-friendly approach extends across different platform features and account functions.

Registration and verification processes have not been comprehensively detailed. However, user feedback suggests efficient onboarding procedures that don't create unnecessary delays. The streamlined approach appears to balance security requirements with user convenience effectively.

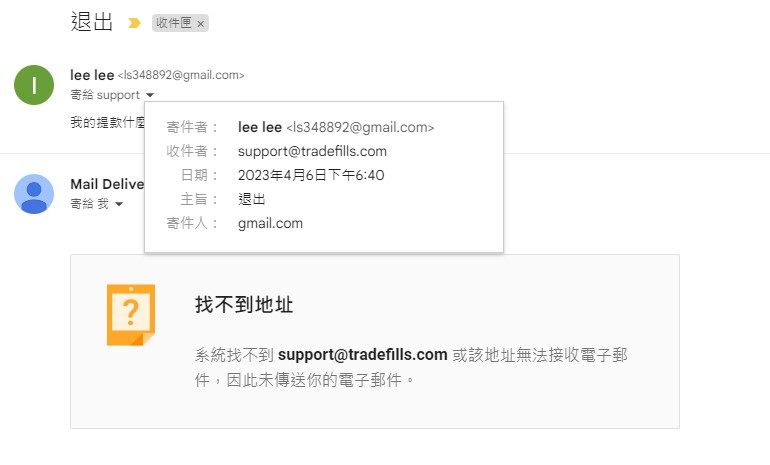

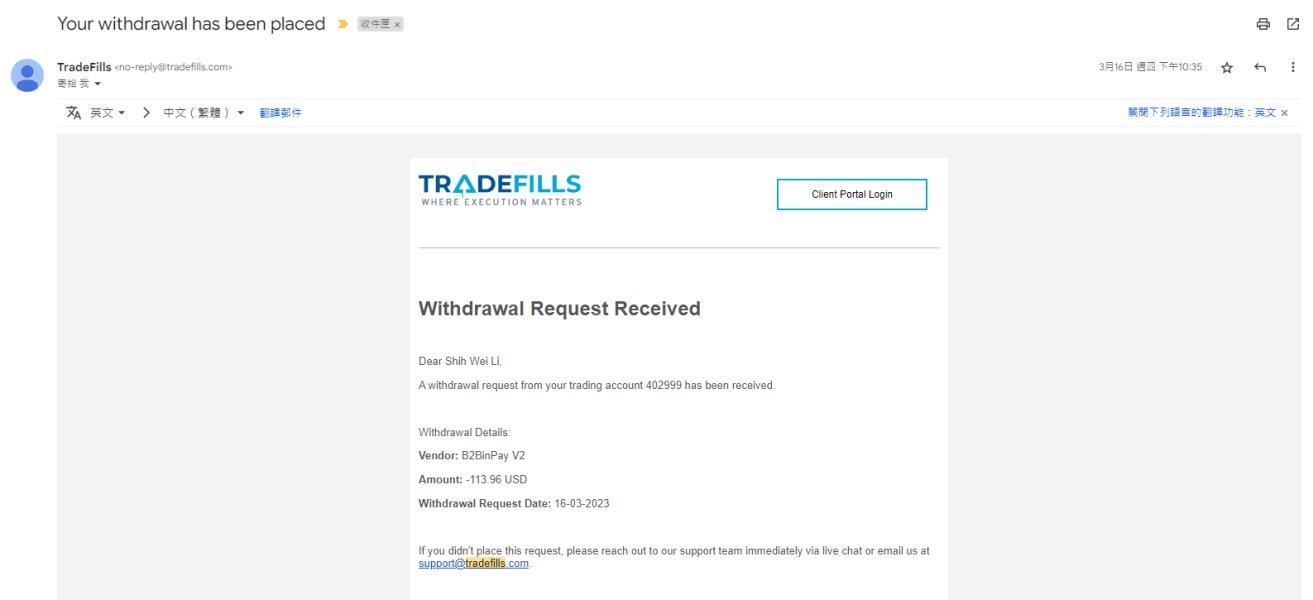

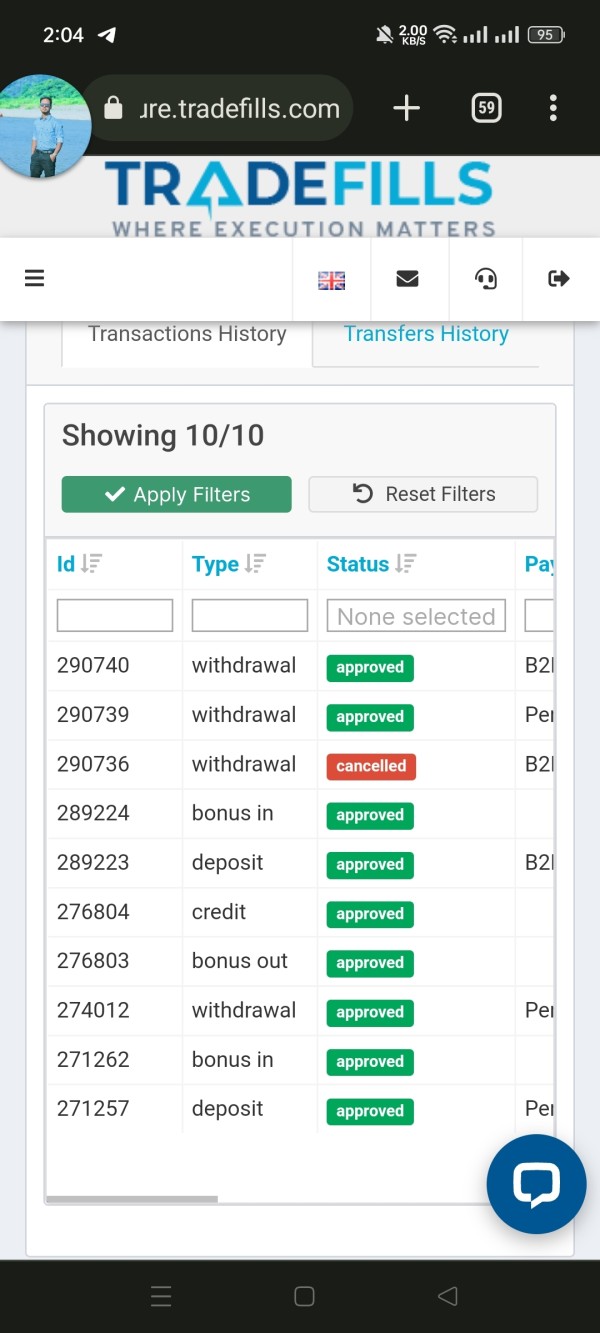

Withdrawal convenience and processing speeds have received positive mentions from users. This indicates reliable payment processing systems. The absence of significant user complaints in available materials suggests satisfactory operational standards across different service areas.

The broker appears well-suited for active traders and those seeking high leverage opportunities. User profiles suggest satisfaction among risk-tolerant market participants who value execution quality and responsive service.

Conclusion

TradeFills presents itself as a noteworthy option in the forex brokerage space. It particularly appeals to traders who prioritize high leverage capabilities and rapid trade execution. The broker's strengths lie in its competitive trading conditions, excellent customer service, and reliable platform performance that consistently receives positive user feedback.

The broker appears most suitable for active traders and those with higher risk tolerance who can appreciate the benefits of significant leverage ratios and tight spreads. However, potential clients should carefully consider the regulatory framework and conduct thorough due diligence regarding fund safety measures.

Primary advantages include zero-pip spreads, leverage up to 1:1000, responsive customer service, and smooth trade execution. The main considerations involve limited regulatory oversight information and the need for greater transparency regarding operational safeguards and business practices.