Regarding the legitimacy of Tifia forex brokers, it provides VFSC and WikiBit, .

Is Tifia safe?

Pros

Cons

Is Tifia markets regulated?

The regulatory license is the strongest proof.

VFSC Forex Trading License (EP)

Vanuatu Financial Services Commission

Vanuatu Financial Services Commission

Current Status:

RevokedLicense Type:

Forex Trading License (EP)

Licensed Entity:

Tifia Markets Limited

Effective Date:

2021-01-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

Silicon Avenue, 40 Cybercity 2nd Floor, Suite 207, The Catalyst, 40 Cybercity 72201 Ebene, Mauritius, Govant Building, BP 1276 Port Vila, The Republic of VanuatuPhone Number of Licensed Institution:

--Licensed Institution Certified Documents:

Is Tifia A Scam?

Introduction

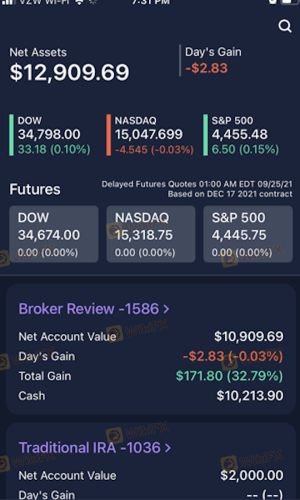

Tifia is an online forex and CFD broker that has been operating since 2011, primarily targeting markets in Asia and Africa. With its headquarters in Vanuatu and regulatory oversight from the Vanuatu Financial Services Commission (VFSC) and the Mauritius Financial Services Commission (FSC), Tifia positions itself as a competitive player in the forex market. However, the rapid growth of online trading has led to a surge in both legitimate and fraudulent brokers, making it essential for traders to conduct thorough evaluations before committing their funds. This article aims to investigate whether Tifia is a safe trading option or a potential scam. Our evaluation framework includes an analysis of regulatory compliance, company background, trading conditions, customer fund security, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors influencing its credibility. Tifia is regulated by the VFSC and FSC, providing some level of assurance regarding its operations. However, it is important to note that both of these regulatory bodies are considered offshore regulators, which typically offer less stringent oversight compared to first-tier regulators such as the FCA or ASIC.

| Regulatory Body | License Number | Regulatory Area | Verification Status |

|---|---|---|---|

| Vanuatu VFSC | 40209 | Vanuatu | Active |

| Mauritius FSC | FS-41 | Mauritius | Active |

While Tifia holds valid licenses, the quality of regulation raises concerns. The VFSC has faced criticism for its lax regulatory framework, which can lead to inadequate investor protection. Moreover, there are reports of the VFSC revoking licenses from brokers that fail to comply with its standards. Therefore, while Tifia is technically regulated, the effectiveness of this regulation is questionable. Traders need to weigh these factors carefully, as the regulatory environment significantly impacts the safety of their investments.

Company Background Investigation

Tifia Markets Limited, the parent company of Tifia, was founded in 2011 and has since expanded its reach to over 130,000 traders globally. The company claims to prioritize transparency and security, offering segregated accounts for client funds to ensure their safety. However, the management team‘s experience and background are less publicized, which raises questions about the company’s operational integrity.

The lack of detailed information about the management team can hinder traders' ability to assess the broker's reliability. Transparency in ownership and management is crucial for establishing trust, especially in an industry where many brokers have been accused of fraud. Furthermore, Tifia does not provide extensive information regarding its corporate structure, which could be a red flag for potential clients.

Trading Conditions Analysis

Tifia offers a variety of trading accounts, including the Start (Micro), ECN Classic, and ECN Pro accounts. The minimum deposit required to open an account is relatively low, starting at just $10. However, traders should be aware of the fee structures associated with these accounts.

| Fee Type | Tifia | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 2.2 pips (Start) | 1.0 - 1.5 pips |

| Commission Model | $8 per lot (ECN Pro) | $5 - $10 per lot |

| Overnight Interest Range | Variable, depending on the pair | Variable |

While Tifias spreads might seem competitive at first glance, they are higher than the industry average for certain account types. Additionally, the commission structure on the ECN Pro account may not be appealing for all traders, particularly those who engage in high-frequency trading. It is essential for traders to carefully evaluate these costs, as they can significantly impact overall profitability.

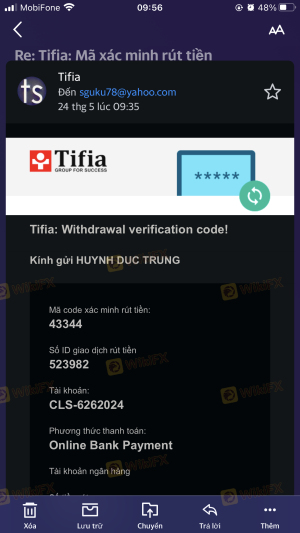

Customer Fund Security

The safety of client funds is a paramount concern for any trader. Tifia claims to implement several measures to safeguard client assets, including segregated accounts and negative balance protection. Segregated accounts are essential in ensuring that client funds are kept separate from the companys operational funds, which is a standard practice among reputable brokers.

However, the effectiveness of these measures is contingent upon the company's adherence to regulatory requirements. Historical incidents involving Tifia and fund security issues have raised alarms among traders, with some reporting difficulties in withdrawing funds. Such concerns necessitate a thorough evaluation of Tifias practices regarding fund security.

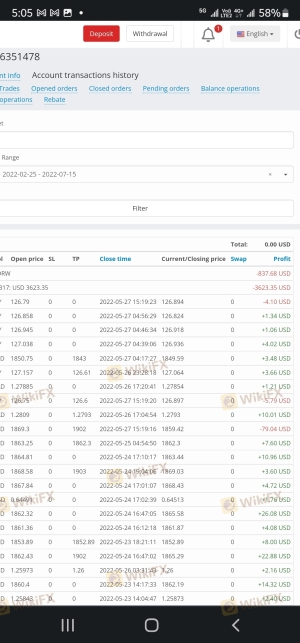

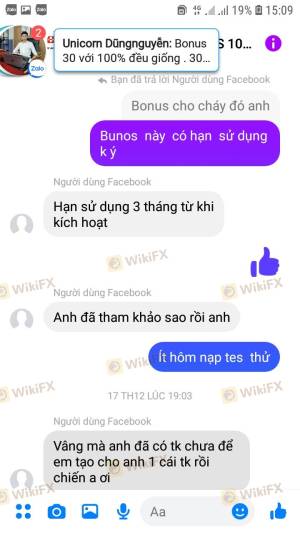

Customer Experience and Complaints

Customer feedback is an invaluable resource for assessing a brokers reliability. Reviews of Tifia reveal a mixed bag of experiences. While some users praise the platform's ease of use and quick execution times, others have reported significant issues, particularly concerning withdrawal processes.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response times |

| Poor Customer Support | Medium | Inconsistent quality |

| High Spreads | Low | Standard explanations |

Typical complaints include delays in processing withdrawals and inadequate customer support. For instance, one user reported waiting weeks for a withdrawal request to be fulfilled, which raises concerns about the broker's operational efficiency. It is crucial for potential traders to consider these experiences when assessing whether Tifia is a safe option.

Platform and Trade Execution

Tifia offers trading through the widely-used MetaTrader 4 and MetaTrader 5 platforms, which are known for their user-friendly interfaces and robust analytical tools. However, the quality of order execution is a critical aspect that can impact trading success.

Reports suggest that while Tifia generally provides quick execution speeds, there have been instances of slippage and order rejections. Such occurrences can be detrimental, especially during volatile market conditions. Traders should be wary of any signs of platform manipulation or inconsistent execution quality, as these could indicate deeper issues within the broker's operational framework.

Risk Assessment

Using Tifia for trading involves several risks that traders should be aware of. The combination of offshore regulation, mixed customer feedback, and historical complaints regarding fund withdrawals raises the overall risk profile of this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Offshore regulation may lack protections |

| Operational Risk | Medium | Complaints regarding withdrawal delays |

| Execution Risk | Medium | Potential slippage and order rejections |

To mitigate these risks, traders are advised to start with a small investment and thoroughly monitor their trading activities. Additionally, it may be beneficial to diversify trading accounts across multiple brokers to reduce exposure to any single entity.

Conclusion and Recommendations

In conclusion, while Tifia presents itself as a legitimate broker, several factors indicate that traders should exercise caution. The combination of offshore regulation, mixed customer experiences, and potential issues with fund withdrawals suggests that Tifia may not be the safest option for all traders.

For those considering trading with Tifia, it is crucial to weigh the risks against the potential benefits. New traders or those with limited experience may find the broker's low minimum deposit appealing, but they should remain vigilant about the safety of their funds.

If you are looking for safer alternatives, consider brokers with stronger regulatory oversight, such as those regulated by the FCA or ASIC. These brokers typically offer better investor protection and a more transparent operational framework.

Ultimately, the question "Is Tifia safe?" remains open-ended, and potential traders are encouraged to conduct their own research and consider their risk tolerance before proceeding.

Is Tifia a scam, or is it legit?

The latest exposure and evaluation content of Tifia brokers.

Tifia Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tifia latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.