Is Tenoris FX safe?

Pros

Cons

Is Tenoris FX Safe or Scam?

Introduction

Tenoris FX is a forex broker that positions itself as a provider of various financial instruments, including CFDs on forex, commodities, and cryptocurrencies. As the forex market continues to grow, traders are increasingly faced with a multitude of options, making it essential to carefully evaluate the credibility and safety of brokers like Tenoris FX. This article aims to provide an objective analysis of Tenoris FX, focusing on its regulatory status, company background, trading conditions, and customer experiences. By employing a comprehensive evaluation framework, this investigation seeks to answer the critical question: Is Tenoris FX safe?

Regulation and Legitimacy

When assessing the safety of a forex broker, regulatory oversight is paramount. Regulatory bodies ensure that brokers adhere to strict guidelines that protect investors and maintain market integrity. Unfortunately, Tenoris FX operates without proper regulation from recognized financial authorities.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Regulated |

The absence of a regulatory license raises significant concerns regarding Tenoris FX's legitimacy. Regulatory bodies such as the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) provide essential protections for traders. Without these safeguards, investors may be vulnerable to potential fraud or mismanagement. Historical compliance issues and a lack of transparency further exacerbate the risks associated with trading with unregulated brokers. In light of this information, it is crucial for potential investors to consider the implications of trading with Tenoris FX.

Company Background Investigation

Tenoris FX's company history and ownership structure are critical components in evaluating its trustworthiness. The broker claims to be registered in Saint Vincent and the Grenadines, but details regarding its establishment and ownership remain vague. The lack of publicly available information about its management team and their professional backgrounds raises additional red flags.

A transparent company typically provides information about its founders and key executives, along with their qualifications and experience in the financial sector. However, Tenoris FX does not offer such disclosures, which can lead to skepticism about its operational integrity. Furthermore, the absence of an identifiable physical address and contact information diminishes the broker's credibility. With these factors in mind, it is prudent for traders to question the reliability of Tenoris FX as a trading partner.

Trading Conditions Analysis

Understanding the trading conditions offered by Tenoris FX is essential for assessing its overall value proposition. The broker claims to provide competitive spreads and a variety of account types, but the absence of regulation raises concerns over the transparency of its pricing structure.

| Fee Type | Tenoris FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (from 0.0 pips) | 1.0 - 2.0 pips |

| Commission Model | $3 - $10 per lot | $5 - $15 per lot |

| Overnight Interest Range | Not disclosed | Varies widely |

While Tenoris FX advertises low spreads starting from 0.0 pips, traders should approach such claims with caution. Unregulated brokers often employ hidden fees or unfavorable conditions that can significantly impact trading profitability. Additionally, the lack of clarity regarding overnight interest rates raises questions about the broker's transparency. Traders must conduct thorough research to understand the actual costs associated with trading on the Tenoris FX platform.

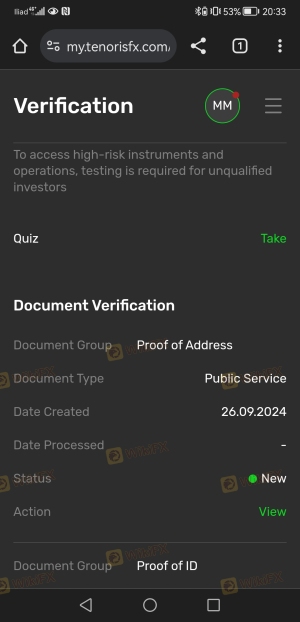

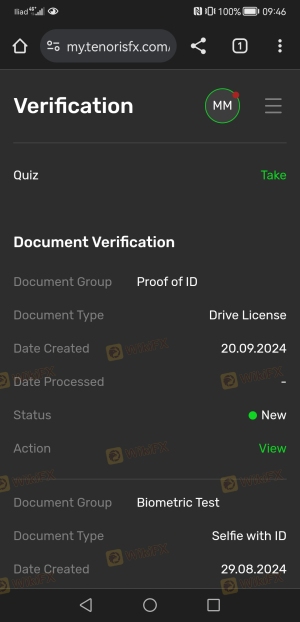

Client Funds Security

The safety of client funds is a top priority for any trader. Tenoris FX's approach to fund security is concerning, particularly given its lack of regulatory oversight. Regulated brokers are typically required to maintain segregated accounts for client funds, ensuring that these assets are protected in the event of bankruptcy or financial mismanagement.

Tenoris FX does not provide specific information about its fund safety measures, such as whether client funds are kept in segregated accounts or if there are any investor protection policies in place. This lack of transparency is alarming, especially considering that unregulated brokers can easily misappropriate client funds without facing legal consequences. Historical incidents involving unregulated brokers highlight the potential for significant losses, further emphasizing the importance of carefully evaluating Tenoris FX's safety measures.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Tenoris FX reveal a concerning pattern of complaints, particularly regarding withdrawal issues and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support Issues | Medium | Poor |

| Misleading Information | High | Poor |

Many users have reported difficulties in withdrawing their funds, with delays lasting weeks or even months. Additionally, complaints about unresponsive customer service further exacerbate the negative sentiment surrounding Tenoris FX. In some cases, customers have described experiences where they felt pressured to invest more money, raising concerns about aggressive sales tactics. These recurring issues suggest that potential investors should approach Tenoris FX with caution, as the overall customer experience appears to indicate significant risks.

Platform and Execution

The performance and reliability of the trading platform are critical factors for traders. Tenoris FX offers the popular MetaTrader 5 (MT5) platform, which is generally well-regarded for its functionality and user experience. However, the quality of order execution and potential issues such as slippage or order rejections warrant closer examination.

Users have reported experiencing slippage during volatile market conditions, which is not uncommon in forex trading. However, if slippage occurs frequently or disproportionately against traders, it could indicate potential manipulation or poor execution practices. The absence of regulatory oversight further complicates the situation, as traders lack recourse if they experience execution issues.

Risk Assessment

Evaluating the risks associated with trading on Tenoris FX is essential for informed decision-making. The lack of regulation, combined with negative customer feedback and transparency issues, presents a concerning risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No oversight increases fraud potential. |

| Fund Safety Risk | High | Lack of segregation and transparency. |

| Execution Risk | Medium | Potential slippage and poor execution. |

To mitigate these risks, traders should consider using only regulated brokers with established reputations. Conducting thorough research and maintaining a cautious approach can help protect investments and minimize potential losses.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tenoris FX may not be a safe trading option. The lack of regulatory oversight, coupled with numerous customer complaints and transparency issues, raises significant concerns about the broker's legitimacy. Potential investors should exercise extreme caution and consider alternative options with established regulatory frameworks and positive reputations.

For traders seeking reliable alternatives, it is advisable to explore brokers that are regulated by reputable authorities, such as the FCA or ASIC. These brokers typically offer a higher level of investor protection and transparency, making them safer choices in the volatile forex market. Ultimately, ensuring the safety of your investments should always be the top priority when selecting a forex broker.

Is Tenoris FX a scam, or is it legit?

The latest exposure and evaluation content of Tenoris FX brokers.

Tenoris FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Tenoris FX latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.