Regarding the legitimacy of SUPAY forex brokers, it provides ASIC and WikiBit, .

Is SUPAY safe?

Pros

Cons

Is SUPAY markets regulated?

The regulatory license is the strongest proof.

ASIC Market Making License (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

RevokedLicense Type:

Market Making License (MM)

Licensed Entity:

ALIPAY (AUSTRALIA) PTY LTD

Effective Date:

2012-11-08Email Address of Licensed Institution:

matthew.lee@worldfirst.comSharing Status:

No SharingWebsite of Licensed Institution:

www.supay.comExpiration Time:

--Address of Licensed Institution:

--Phone Number of Licensed Institution:

0434880860Licensed Institution Certified Documents:

Is Supay Safe or Scam?

Introduction

Supay is a foreign exchange broker that positions itself within the competitive landscape of online trading, primarily catering to clients seeking currency exchange and remittance services. As the forex market continues to expand, traders are increasingly faced with a plethora of brokers, making it essential for them to conduct thorough evaluations to avoid potential scams. This article aims to provide a comprehensive analysis of Supay, assessing its legitimacy and safety for investors. Our investigation incorporates a mix of qualitative assessments and quantitative data, drawing from various reputable sources, including customer reviews, regulatory information, and financial performance metrics.

Regulation and Legitimacy

One of the foremost considerations when determining if Supay is safe involves its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds and promote transparency. Unfortunately, Supay operates without adequate regulatory oversight, raising significant concerns about its legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | N/A | Australia | Unregulated |

The absence of a valid license from a reputable regulatory body, such as the Australian Securities and Investments Commission (ASIC), is a major red flag. Although Supay claims to be compliant with regulations, its lack of a verifiable license means that traders have little recourse if issues arise. Furthermore, the historical compliance of brokers is critical; unregulated brokers often have a history of poor performance and customer complaints, which can lead to financial losses for traders.

Company Background Investigation

Supay was established in 2005 and has since positioned itself as a currency exchange and remittance service provider, primarily focusing on the Australian market. However, the ownership structure and management team behind Supay remain unclear, which further complicates its credibility. Transparency in ownership and management is crucial for any financial institution, as it allows investors to gauge the experience and qualifications of those handling their funds.

The companys website offers limited information regarding its management team, which raises questions about its operational integrity. A lack of transparency can often indicate underlying issues, such as potential mismanagement or even fraudulent activities. Given these concerns, it's essential for potential clients to be cautious and perform due diligence before engaging with Supay.

Trading Conditions Analysis

When evaluating whether Supay is safe, one must also consider its trading conditions. The overall fee structure and trading costs can significantly impact a trader's profitability. Supays fee structure is not clearly defined, leading to potential hidden costs that could catch traders off guard.

| Fee Type | Supay | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Reports indicate that clients have experienced unexpected fees and charges, particularly during the withdrawal process. Such practices are common among unregulated brokers, who may impose excessive fees to deter clients from withdrawing their funds. This lack of clarity in fees is a significant concern for potential investors, as it can lead to unexpected financial burdens.

Client Fund Safety

Client fund safety is paramount in assessing whether Supay is safe. The broker claims to implement various security measures to protect client funds, but the absence of regulatory oversight raises doubts about the effectiveness of these measures.

Traders should be particularly wary of how their funds are managed. Segregated accounts and investor protection policies are vital components of a secure trading environment. However, reports of withdrawal issues and unresponsive customer service suggest that Supay may not provide adequate protection for client funds. Historical incidents involving fund mismanagement or loss can further exacerbate these concerns.

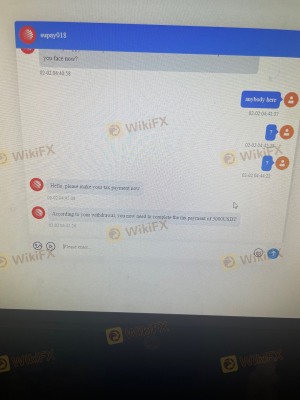

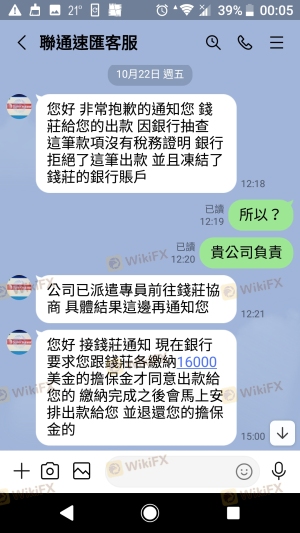

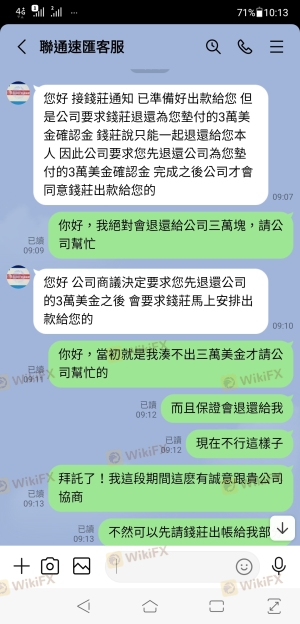

Customer Experience and Complaints

Analyzing customer feedback is crucial in determining if Supay is safe. Numerous reports from users indicate a pattern of complaints, primarily revolving around withdrawal difficulties and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

For instance, some clients have reported being unable to withdraw their funds after being asked to pay additional taxes or fees. These types of complaints are indicative of potential scam practices, where brokers create hurdles to prevent clients from accessing their funds. The lack of effective communication from Supays support team further compounds these issues, leading to frustration among clients.

Platform and Execution

The performance of a trading platform is another critical factor in assessing whether Supay is safe. A reliable platform should offer stability, quick execution times, and a user-friendly interface. However, reports suggest that Supay's platform may suffer from performance issues, including slow execution and occasional downtimes.

The quality of order execution is paramount; traders expect their orders to be executed at the prices they see. However, instances of slippage and rejections have been reported, which can severely impact trading outcomes. Such issues are often symptomatic of underlying operational problems within the broker, raising further questions about their reliability.

Risk Assessment

In summary, the risks associated with using Supay are substantial.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status poses significant risks. |

| Financial Risk | High | Hidden fees and withdrawal issues can lead to losses. |

| Operational Risk | Medium | Platform performance issues may affect trading outcomes. |

Given these risks, potential traders should consider alternative options. Engaging with unregulated brokers like Supay can expose traders to significant financial loss and operational challenges.

Conclusion and Recommendations

In conclusion, the evidence suggests that Supay exhibits several characteristics commonly associated with scam brokers. The lack of regulation, unclear fee structures, and numerous customer complaints raise serious concerns about the safety and reliability of this broker.

For traders seeking a secure trading environment, it is advisable to consider regulated brokers with positive reviews and a proven track record. Alternatives such as brokers regulated by ASIC or FCA can provide a safer trading experience, ensuring that client funds are protected and that the broker adheres to industry standards.

In light of the findings, it is prudent for traders to exercise caution and conduct thorough research before engaging with Supay. The potential risks far outweigh the benefits, making it essential for traders to prioritize their safety and financial well-being.

Is SUPAY a scam, or is it legit?

The latest exposure and evaluation content of SUPAY brokers.

SUPAY Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUPAY latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.