Regarding the legitimacy of Standard Bank forex brokers, it provides FSCA and WikiBit, (also has a graphic survey regarding security).

Is Standard Bank safe?

Business

License

Is Standard Bank markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

SBG Securities (Pty) Ltd

Effective Date:

2007-10-16Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

9TH FLOORSTANDARD BANK CENTRE5 SIMMONDS STREET2001Phone Number of Licensed Institution:

011 5471183Licensed Institution Certified Documents:

Is Standard Safe or Scam?

Introduction

Standard is a forex broker established in South Africa in 2019, positioning itself to cater to traders in various regions including the UAE, Angola, and Australia. As the forex market continues to evolve, traders must exercise caution when selecting a broker, as the risk of scams and fraudulent activities remains prevalent. Evaluating a broker's credibility involves scrutinizing their regulatory status, company background, trading conditions, and customer experiences. This article employs a comprehensive investigative approach, utilizing data from reputable financial sources to assess whether Standard is safe or a potential scam.

Regulation and Legitimacy

The regulatory environment is a crucial factor when determining the safety of a forex broker. Standard is regulated by the Financial Sector Conduct Authority (FSCA) in South Africa, which is responsible for overseeing financial institutions in the region. Regulatory oversight is vital, as it ensures that brokers adhere to strict operational standards, promoting transparency and protecting investors' interests.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 26691 | South Africa | Verified |

Despite being regulated, Standard's FSCA status has been flagged as "exceeded," indicating potential concerns regarding its operational practices. Regulatory bodies like the FSCA are essential for maintaining market integrity, and their oversight can significantly impact a broker's credibility. A broker with a solid regulatory framework is typically viewed as safer, while those with dubious regulatory status may pose higher risks to traders.

Company Background Investigation

Standard was founded by SBG Securities (Pty) Ltd, which has been operational for several years. The company has established itself in the market, but a thorough examination of its ownership structure and management team is warranted. The management team comprises individuals with backgrounds in finance and securities, contributing to the broker's operational capabilities.

Transparency is another critical aspect of evaluating a broker's reliability. Standard provides basic information about its services and regulatory compliance, yet some users have expressed concerns regarding the depth of information available. A lack of comprehensive disclosures can lead to mistrust among potential clients, making it imperative for traders to seek brokers that offer clear and detailed information about their operations and management.

Trading Conditions Analysis

Understanding the trading conditions offered by Standard is vital for prospective clients. The broker provides various trading products, including shares, warrants, and contracts for difference (CFDs). However, the overall fee structure and any unusual charges must be carefully analyzed to assess the broker's competitiveness and fairness.

| Fee Type | Standard | Industry Average |

|---|---|---|

| Spread for Major Pairs | Not disclosed | 1.0 - 2.0 pips |

| Commission Model | Not specified | Varies by broker |

| Overnight Interest Range | Not specified | 2.5% - 5.0% |

While the absence of detailed fee information raises concerns, it is essential to compare these conditions against industry standards. A broker that lacks transparency in its fee structure may not be acting in the best interests of its clients, leading to potential financial pitfalls for traders.

Client Fund Safety

The safety of client funds is paramount when assessing whether Standard is safe. The broker claims to implement various measures to safeguard clients funds, including segregating client accounts and adhering to local regulatory requirements. However, the effectiveness of these measures needs thorough evaluation.

Investors should inquire about the existence of investor protection schemes and negative balance protection policies. These safeguards can provide additional layers of security for traders in the event of unforeseen market fluctuations or broker insolvency. Historical issues concerning fund safety can also tarnish a broker's reputation, thus it is essential to investigate any past incidents involving Standard.

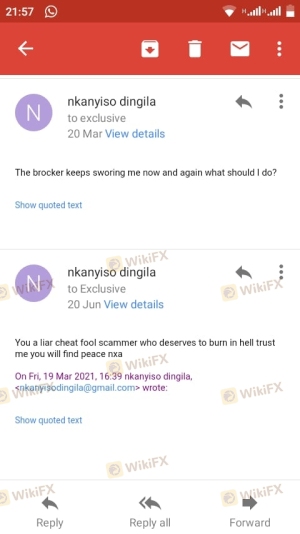

Customer Experience and Complaints

Customer feedback plays a significant role in evaluating a brokers reliability. Reviews of Standard reveal mixed experiences among users. While some clients report satisfactory service, others have raised complaints regarding withdrawal processes and customer support responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Inconsistent |

Typical complaints often revolve around difficulties in withdrawing funds and delays in customer support responses. For instance, users have reported being asked for additional deposits before they could access their funds. Such practices can be indicative of underlying issues within the brokers operational framework, suggesting that potential clients should exercise caution.

Platform and Trade Execution

The trading platform offered by Standard is another critical aspect to consider. A robust and reliable trading platform is essential for executing trades efficiently. Users have described the platform as user-friendly, with features that cater to both novice and experienced traders. However, the quality of order execution, including slippage and rejection rates, must also be evaluated.

Traders have reported instances of slippage during volatile market conditions, which can impact trading performance. While some slippage is normal in forex trading, excessive slippage or frequent order rejections can indicate potential manipulation or inefficiencies within the broker's trading infrastructure.

Risk Assessment

Using Standard as a forex broker entails certain risks. Understanding these risks is essential for traders to make informed decisions.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | Medium | Exceeded status with FSCA |

| Fund Safety | High | Concerns over past complaints |

| Customer Support | Medium | Inconsistent response times |

Traders should be aware of the potential risks associated with using Standard, particularly regarding regulatory compliance and fund safety. To mitigate these risks, it is advisable to conduct thorough research and consider starting with a smaller investment to gauge the broker's reliability.

Conclusion and Recommendations

In conclusion, while Standard is regulated by the FSCA, its "exceeded" status raises red flags regarding its operational practices. Complaints about withdrawal issues and inconsistent customer support further contribute to concerns about its reliability. Therefore, traders should approach Standard with caution and consider alternative brokers with a stronger reputation for transparency and customer service.

For traders seeking safer options, it may be beneficial to explore brokers that are regulated by top-tier authorities, offer clear and competitive trading conditions, and have a proven track record of positive customer experiences. Ultimately, conducting thorough research and due diligence is crucial in determining whether Standard is safe or a potential scam.

Is Standard Bank a scam, or is it legit?

The latest exposure and evaluation content of Standard Bank brokers.

Standard Bank Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Standard Bank latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.