Is SIG Susquehanna safe?

Pros

Cons

Is SIG Susquehanna Safe or Scam?

Introduction

SIG Susquehanna, also known as Susquehanna International Group, LLP, is a prominent player in the global quantitative trading landscape. Established in 1987, the firm has built a reputation for its expertise in trading various financial instruments, including equities, options, fixed income, and foreign exchange. As a proprietary trading firm, SIG Susquehanna operates with its own capital, engaging in high-frequency trading and market-making activities. Given the complexities and risks associated with trading in the forex market, it is crucial for traders to carefully evaluate the credibility and safety of their chosen brokers. This article aims to provide a comprehensive analysis of SIG Susquehanna, assessing its safety and legitimacy based on regulatory status, company background, trading conditions, and customer experiences. The investigation draws on multiple sources, including regulatory databases, customer reviews, and industry reports, to deliver an objective evaluation of whether SIG Susquehanna is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its safety for traders. Regulation provides a framework for oversight, ensuring that brokers adhere to specific standards designed to protect investors. In the case of SIG Susquehanna, the firm operates without any significant regulatory oversight.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

The absence of regulation raises concerns about investor protection and the quality of services offered. Regulatory bodies typically enforce rules that govern trading practices, capital requirements, and client fund protection. Without these safeguards, clients may face higher risks, including potential fraud or mismanagement of funds. Historically, SIG Susquehanna has faced scrutiny for its trading practices, but it has not been subject to significant regulatory penalties in recent years. However, the lack of a regulatory framework leaves traders vulnerable to potential issues, which is a significant factor to consider when evaluating whether SIG Susquehanna is safe.

Company Background Investigation

SIG Susquehanna was founded in 1987 by a group of entrepreneurs with a focus on quantitative trading and market-making. Over the years, the firm has grown to become one of the largest proprietary trading companies globally, with a presence in multiple financial markets. The ownership structure of SIG Susquehanna is private, and it operates as a limited liability partnership.

The management team at SIG Susquehanna consists of experienced professionals with backgrounds in finance, trading, and quantitative analysis. Their expertise contributes to the firm‘s strategic decision-making and operational efficiency. However, the transparency of the company’s operations and its willingness to disclose information to clients remains a concern. While the firm does provide some information about its services and trading practices, the lack of comprehensive disclosures can lead to uncertainties regarding its operations.

In summary, while SIG Susquehanna has a strong reputation in the trading community, the absence of regulatory oversight and limited transparency raises questions about its overall safety and reliability.

Trading Conditions Analysis

When assessing the trading conditions offered by SIG Susquehanna, it's essential to consider the overall fee structure and any potential hidden costs. The firm provides a range of trading services, but the lack of transparency regarding fees can be concerning for traders.

| Fee Type | SIG Susquehanna | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1-2 pips |

| Commission Structure | N/A | $0-$10 per trade |

| Overnight Interest Range | Variable | 0.5%-2% |

The fees associated with trading at SIG Susquehanna can vary significantly based on the type of account and trading volume. While the firm offers competitive spreads on major currency pairs, the lack of a clear commission structure can be problematic for traders looking to understand their overall trading costs. Furthermore, the absence of a demo account limits traders' ability to familiarize themselves with the platform and its fee structure before committing real funds.

Overall, while SIG Susquehanna provides access to diverse trading instruments, the potential for hidden costs and lack of clarity in its fee structure raises concerns about whether it is safe for traders to engage with this broker.

Client Fund Security

The security of client funds is paramount in the forex trading environment. Traders need to be assured that their investments are protected and that the broker has measures in place to safeguard their capital. SIG Susquehanna does not provide detailed information about its fund security measures, which is a significant red flag.

The firm does not appear to offer segregated accounts for client funds, which is a standard practice among regulated brokers. Segregation of client funds ensures that traders' money is kept separate from the broker's operating capital, providing an additional layer of protection in case of financial difficulties. Furthermore, there is no indication that SIG Susquehanna offers investor protection schemes or negative balance protection, which can be crucial for safeguarding traders in volatile market conditions.

Historically, the firm has not faced significant issues regarding fund security, but the lack of transparency and established protective measures raises concerns about the safety of clients' investments. Therefore, traders must carefully consider these factors when evaluating whether SIG Susquehanna is safe for their trading activities.

Customer Experience and Complaints

Customer feedback is an essential aspect of assessing a forex broker's reliability. Analyzing user experiences can reveal potential issues and the level of service provided by the broker. Reviews of SIG Susquehanna indicate a mixed reception, with some clients praising the firm's trading technology and execution speed, while others express concerns about customer support and transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Lack of Transparency | High | Slow Response |

| Customer Support Issues | Medium | Average |

| Fee Discrepancies | Medium | Unresolved |

A common complaint among users relates to the lack of transparency regarding fees and trading conditions, which can lead to confusion and dissatisfaction. Additionally, some clients have reported slow response times from customer support, particularly when addressing issues related to account management or trading discrepancies.

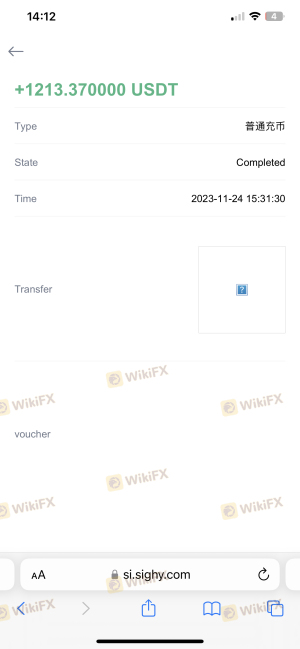

For example, one trader reported experiencing difficulties in withdrawing funds, citing a lack of clear communication from the support team. Another user mentioned that while the trading platform was robust, the lack of guidance and educational resources made it challenging to navigate effectively. These complaints highlight potential areas of concern for traders considering whether SIG Susquehanna is safe.

Platform and Execution

The performance and reliability of a trading platform are critical components of a successful trading experience. SIG Susquehanna offers a trading platform that is generally well-regarded for its speed and execution quality. However, there are concerns regarding the potential for slippage and order rejections, which can impact traders' profitability.

Traders have reported instances of slippage during high volatility periods, which can lead to unfavorable trade executions. Additionally, while the platform is designed for institutional clients, retail traders may find it less user-friendly, lacking the intuitive features offered by other brokers.

Overall, while the platform is capable of handling a high volume of trades, traders should remain cautious and consider the potential risks associated with execution quality when assessing whether SIG Susquehanna is safe.

Risk Assessment

Evaluating the risks associated with trading through SIG Susquehanna is essential for potential clients. The absence of regulatory oversight, combined with limited transparency regarding fees and fund security, presents several risks for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight can lead to potential fraud. |

| Transparency Risk | Medium | Unclear fee structures may result in unexpected costs. |

| Fund Security Risk | High | Absence of segregated accounts increases vulnerability. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with SIG Susquehanna. This includes understanding the fee structure, ensuring they are comfortable with the platform's execution quality, and being aware of the lack of regulatory protections.

Conclusion and Recommendations

In conclusion, while SIG Susquehanna is a well-established firm with a significant presence in the trading community, several factors raise concerns about its overall safety. The lack of regulatory oversight, combined with limited transparency regarding fees and fund security, suggests that traders should exercise caution.

For those considering trading with SIG Susquehanna, it is advisable to thoroughly assess personal risk tolerance and to explore alternative brokers that offer more robust regulatory protections and clearer fee structures. Brokers such as IG Group and OANDA are examples of firms with established regulatory frameworks and better transparency, making them safer options for traders.

Ultimately, while SIG Susquehanna may provide access to diverse trading opportunities, the potential risks associated with its lack of regulation and transparency warrant careful consideration before proceeding.

Is SIG Susquehanna a scam, or is it legit?

The latest exposure and evaluation content of SIG Susquehanna brokers.

SIG Susquehanna Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SIG Susquehanna latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.