Is savebroker safe?

Business

License

Is Savebroker A Scam?

Introduction

Savebroker is a relatively new entrant in the forex market, having been established in 2022. It positions itself as a broker offering a wide range of trading products and services, including forex, CFDs, and cryptocurrencies. However, the rapid growth of online trading has also led to an increase in scams and fraudulent schemes, making it crucial for traders to carefully evaluate the legitimacy of brokers before committing their funds. This article aims to provide an objective assessment of Savebroker, exploring its regulatory status, company background, trading conditions, customer experiences, and overall safety. Our analysis is based on various online sources, user reviews, and regulatory information to determine whether Savebroker is indeed safe or a potential scam.

Regulation and Legitimacy

One of the most critical factors when assessing any forex broker is its regulatory status. A regulated broker is typically subject to oversight by a recognized financial authority, which helps ensure the safety of client funds and adherence to industry standards. In the case of Savebroker, it has been reported that the broker operates without any licenses from reputable financial regulatory authorities.

Here is a summary of the regulatory information regarding Savebroker:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unregulated |

The lack of regulation is a significant red flag, as it indicates that Savebroker is not subject to any oversight or compliance requirements. This absence of regulatory protection means that traders may have limited recourse in cases of disputes or financial mismanagement. Moreover, the broker claims to be headquartered in St. Vincent and the Grenadines, a location known for having less stringent regulatory frameworks. This raises further concerns about the broker's legitimacy and commitment to safeguarding client interests.

Company Background Investigation

Savebroker is operated by Savebroker Ltd, which claims to be registered in Belgium. However, there are inconsistencies regarding the company's history and ownership structure. The brokers website lacks transparency in disclosing key information about its management team and corporate governance, which is essential for building trust with potential clients.

The absence of a well-established track record raises questions about the broker's reliability. A company with a history of successful operations and a transparent management team is generally more trustworthy. In contrast, Savebroker's relatively new presence in the market, combined with the lack of detailed information about its ownership and management, contributes to the perception that it may not be a safe option for traders.

Furthermore, the company's claims about its services and offerings lack substantial evidence, making it difficult for potential clients to ascertain the credibility of its operations. This opacity in information disclosure is a common trait among many unregulated brokers, further indicating that Savebroker may not be safe.

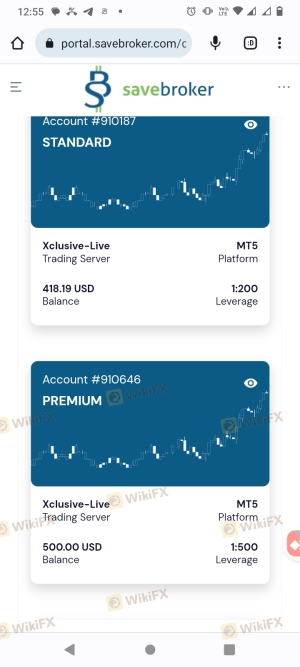

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions, including fees and spreads, is essential. Savebroker offers various account types, each with different minimum deposit requirements and trading costs. However, several reviews indicate that the broker's fees and spreads are not competitive compared to industry standards.

Heres a comparison of core trading costs associated with Savebroker:

| Fee Type | Savebroker | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | $3-$6 | $2-$5 |

| Overnight Interest Range | Not disclosed | Varies widely |

The spreads offered by Savebroker, particularly for major currency pairs, are notably higher than the industry average. Additionally, the commission structure lacks transparency, with some reviews mentioning hidden fees that could further erode traders' profits. This lack of clarity in the fee structure raises concerns about the overall cost of trading with Savebroker, making it imperative for potential clients to thoroughly assess whether they can afford the associated costs.

Customer Funds Security

The security of customer funds is paramount when choosing a forex broker. Regulated brokers are typically required to implement stringent measures to protect client deposits, including segregated accounts and investor protection schemes. In the case of Savebroker, the absence of regulation raises significant concerns regarding the safety of client funds.

Savebroker does not provide clear information about its fund security measures, such as whether it utilizes segregated accounts to protect client deposits. Furthermore, there are no indications of any investor protection mechanisms in place, leaving clients vulnerable in the event of financial mismanagement.

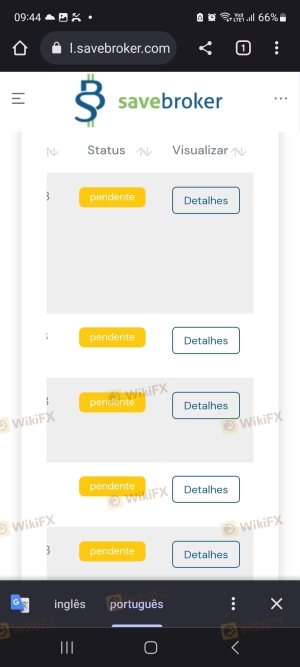

Historical complaints from users have also highlighted issues related to fund withdrawals, with many claiming that they faced difficulties accessing their money after depositing. These complaints further underscore the risks associated with trading with an unregulated broker like Savebroker, leading to the conclusion that Savebroker is likely not safe for traders concerned about the security of their funds.

Customer Experience and Complaints

Customer feedback is an essential aspect of evaluating a broker's reliability. Reviews of Savebroker paint a concerning picture, with numerous complaints regarding poor customer service, high fees, and difficulties in withdrawing funds.

Heres a summary of the main complaint types and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Average |

| Customer Service Quality | High | Poor |

Many users have reported being unable to withdraw their funds, a common tactic employed by fraudulent brokers to retain client deposits. Additionally, the quality of customer support has been criticized, with clients noting that their queries often go unanswered or are met with vague responses.

For example, one user reported submitting a withdrawal request that went unanswered for weeks, leading to frustration and financial loss. Such experiences suggest that Savebroker may not prioritize customer satisfaction, further indicating that it may not be a trustworthy option for traders.

Platform and Trade Execution

The trading platform offered by Savebroker is a crucial element for traders, as it affects the overall trading experience. Reviews indicate that while Savebroker claims to provide a user-friendly platform, there are concerns regarding its performance and reliability.

Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes. The lack of transparency regarding the platform's technology and operational stability raises further concerns about its reliability.

Moreover, the absence of a demo account option makes it challenging for potential clients to evaluate the platform's performance before committing real funds. This lack of a trial period could lead to traders facing unexpected challenges when trading live, reinforcing the notion that Savebroker may not be safe.

Risk Assessment

Engaging with any forex broker involves inherent risks, particularly when the broker is unregulated. Savebroker presents several risk factors that potential clients should consider before proceeding.

Heres a summary of the key risk areas associated with Savebroker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated, with no oversight |

| Financial Risk | High | Lack of fund security measures |

| Customer Service Risk | Medium | Poor response to client complaints |

| Operational Risk | High | Issues with order execution |

To mitigate these risks, potential clients should conduct thorough research, read user reviews, and consider trading with regulated brokers that offer more robust protections and transparent operations.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Savebroker is not a safe option for traders. The lack of regulation, combined with numerous complaints regarding fund withdrawals, high fees, and poor customer service, raises significant red flags.

For traders seeking a reliable and trustworthy trading environment, it is advisable to consider alternative brokers that are regulated and have a proven track record of positive customer experiences. Some reputable alternatives include brokers regulated by top-tier authorities such as the FCA, ASIC, or NFA, which offer enhanced security measures and better trading conditions.

In summary, while Savebroker may present itself as an attractive option for trading, the risks and concerns associated with it far outweigh any potential benefits. Therefore, it is recommended that traders exercise caution and seek out safer, more reputable alternatives in the forex market.

Is savebroker a scam, or is it legit?

The latest exposure and evaluation content of savebroker brokers.

savebroker Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

savebroker latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.