Is RUI LONG safe?

Pros

Cons

Is Rui Long Safe or a Scam?

Introduction

Rui Long is an online forex broker that has garnered attention in the trading community, particularly within the Chinese market. With the rise of digital trading platforms, it is essential for traders to carefully assess the legitimacy and reliability of brokers before committing their funds. The forex market, while offering significant opportunities, is also fraught with risks, including the potential for scams and fraudulent activities. Therefore, traders must conduct thorough due diligence on brokers to ensure their safety. This article aims to evaluate whether Rui Long is a safe trading option or if it raises red flags of a potential scam. Our investigation draws from various sources, including user reviews, regulatory information, and expert analyses, to provide a comprehensive assessment of Rui Long.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical indicator of its legitimacy. A regulated broker is typically subject to stringent oversight, which helps protect traders' interests. In the case of Rui Long, there are significant concerns regarding its regulatory compliance. According to various reports, Rui Long operates without a valid license from recognized financial authorities, which is a serious red flag for potential investors.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | Not Available | United States | Suspicious Clone |

| ASIC | Not Available | Australia | Not Registered |

| FCA | Not Available | United Kingdom | Not Registered |

The absence of a valid license from reputable regulatory bodies such as the NFA, ASIC, or FCA raises concerns about the broker's credibility. Without regulatory oversight, traders may find it difficult to seek recourse in the event of disputes or issues with fund withdrawals. Furthermore, historical compliance issues and the lack of transparency regarding Rui Long's operations further exacerbate these concerns.

Company Background Investigation

Rui Long presents itself as an international forex broker, but its company background is shrouded in ambiguity. The lack of clear information about its ownership structure and the management team raises questions about its operational transparency. Reports indicate that Rui Long is associated with a group of similar-sounding entities, which may suggest a pattern of cloning or fraudulent practices.

Additionally, the company's history appears to be relatively short, with limited information available about its establishment and growth trajectory. This lack of historical data makes it challenging to assess its stability and reliability in the competitive forex market. Moreover, the absence of detailed disclosures about the management team and their qualifications raises further suspicions about the broker's legitimacy.

Trading Conditions Analysis

Evaluating the trading conditions of a broker is crucial for understanding its cost structure and potential profitability for traders. Rui Long's fees and trading conditions have been a topic of concern among users. Reports suggest that the broker employs a complex fee structure that may include hidden charges, which can significantly impact trading outcomes.

| Fee Type | Rui Long | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Low |

The spreads offered by Rui Long appear to be higher than the industry average, which could deter potential traders. Additionally, the absence of a transparent commission structure raises concerns about the overall cost of trading with this broker. Traders should be wary of any unusual fees that may not be clearly communicated, as these can erode profits and lead to negative trading experiences.

Client Fund Safety

The safety of client funds is paramount when evaluating a forex broker. Rui Long's measures for securing client funds have come under scrutiny. Reports indicate that the broker does not implement adequate segregation of client accounts, which is a standard practice among reputable brokers. Without proper segregation, traders risk losing their funds in the event of the broker's insolvency.

Furthermore, there is no evidence that Rui Long participates in any investor protection schemes, which typically safeguard traders' funds up to a certain limit. The lack of such protections raises alarms about the safety of investments made with Rui Long. Historical disputes related to fund withdrawals and accusations of fund mismanagement further highlight the risks associated with this broker.

Customer Experience and Complaints

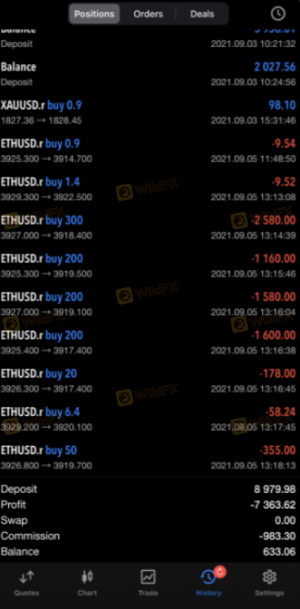

Customer feedback is a valuable resource for assessing a broker's reliability. In the case of Rui Long, numerous user reviews indicate a pattern of dissatisfaction. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and a lack of transparency regarding trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Fair |

| Transparency Concerns | High | Poor |

Several users have reported being unable to withdraw their funds, leading to accusations that Rui Long operates as a scam. The company's response to these complaints has been inadequate, with many users feeling ignored or dismissed. These patterns of complaints raise significant concerns about the broker's commitment to customer satisfaction and ethical business practices.

Platform and Trade Execution

The performance of a trading platform is crucial for a seamless trading experience. Rui Long claims to offer a robust trading platform; however, user experiences suggest otherwise. Many traders have reported issues with platform stability, including frequent outages and slow execution speeds.

Concerns about order execution quality, including slippage and order rejections, have also been raised. These issues can severely impact traders' ability to execute their strategies effectively, leading to potential losses. Additionally, there are allegations of platform manipulation, which further erodes trust in Rui Long's trading environment.

Risk Assessment

Trading with Rui Long presents several risks that potential investors should consider. The absence of regulation, combined with a lack of transparency and numerous customer complaints, creates a high-risk environment for traders.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No valid licenses from reputable authorities. |

| Financial Risk | High | Lack of fund protection measures. |

| Operational Risk | Medium | Platform stability issues reported. |

To mitigate these risks, traders should exercise extreme caution when considering investments with Rui Long. It is advisable to conduct thorough research, utilize demo accounts for testing, and consider alternative brokers with established reputations and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Rui Long raises significant concerns regarding its legitimacy and safety. The lack of regulation, coupled with numerous customer complaints and questionable trading conditions, indicates that traders should approach this broker with caution.

For those considering forex trading, it is essential to prioritize brokers that are regulated and have a proven track record of transparency and customer satisfaction. If you are looking for safer alternatives, consider established brokers such as IG, OANDA, or Forex.com, which are known for their regulatory compliance and strong customer support. Ultimately, ensuring the safety of your investments should be the top priority when choosing a forex broker.

In summary, Is Rui Long safe? The evidence points to a high level of risk, and potential traders should be wary of engaging with this broker.

Is RUI LONG a scam, or is it legit?

The latest exposure and evaluation content of RUI LONG brokers.

RUI LONG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RUI LONG latest industry rating score is 1.61, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.61 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.